Table of Contents

Navigating US Sales Tax for Shopify Sellers in Vancouver, BC

For Shopify sellers in Vancouver, BC, tackling US sales tax for Shopify sellers in Vancouver, BC presents a daunting challenge. Many local e-commerce entrepreneurs feel overwhelmed by cross-border sales tax requirements for BC e-commerce, especially as their US customer base grows. Non-compliance can lead to hefty fines–up to 25% of unpaid taxes–making it crucial to understand these rules early to avoid costly audits.

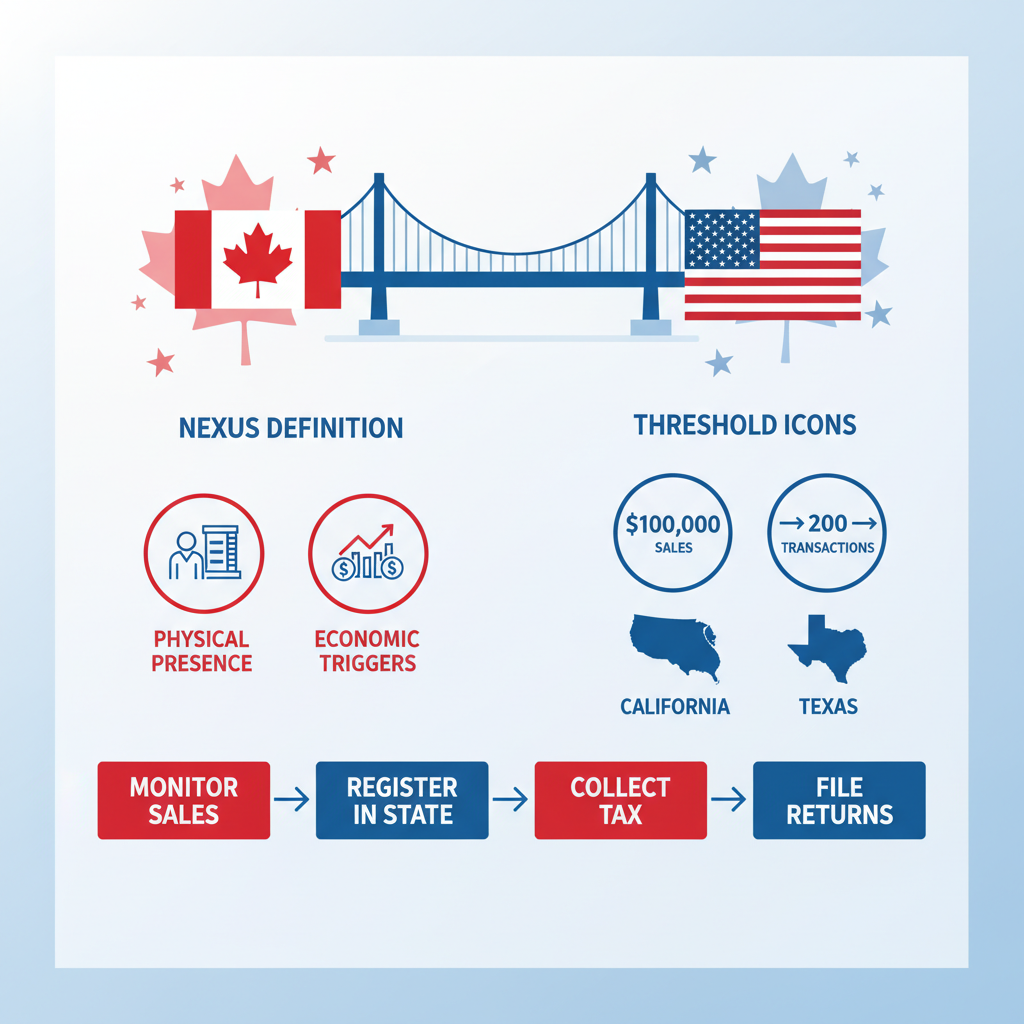

Vancouver-based stores selling physical or digital goods to US buyers must navigate US sales tax nexus for Canadian sellers, which triggers obligations when exceeding economic thresholds like $100,000 in sales or 200 transactions in a state, as outlined in guides for Canadian businesses. For instance, a BC Shopify store shipping apparel to California might hit nexus after a busy holiday season. Key obligations include registering in relevant states, collecting appropriate tax rates, and filing returns periodically. While handling Gst Hst PST for Ecommerce Vancouver remains familiar, Shopify US sales tax compliance adds layers of complexity for operations in the US market.

- Register for sales tax permits in states with nexus.

- Calculate and collect taxes based on buyer location.

- File returns and remit collected funds on time.

Manual tracking often leads to errors, underscoring the need for Vancouver Shopify tax automation solutions to ensure accurate Shopify US sales tax compliance.

US sales tax nexus overview for Vancouver-based e-commerce businesses

Specialized tools simplify these processes by automating nexus detection, rate calculations, and filings. This guide previews five essential apps: TaxJar for real-time compliance, Avalara for multi-state automation, A2X for Shopify integration, Vertex for advanced reporting, and Simply Accepted for returns handling–empowering sellers to focus on growth without tax worries.

LinkMyBooks: Streamlined Sales Tax Reconciliation for Shopify

LinkMyBooks offers precise reconciliation for US sales tax for Shopify sellers in Vancouver, BC, automating data sync from Shopify to accounting software with up to 99% accuracy in tax categorization, as noted in their blog.

Key Features

- Integrates with Shopify to pull orders and apply US state tax rates, supporting Shopify US sales tax compliance.

- Handles multi-channel reconciliation and Cross Border Ecommerce Sales Tax Vancouver for Vancouver cross-border tax syncing, including nexus alerts for Canadian sellers.

- Exports categorized data to QuickBooks or Xero, aiding BC e-commerce tax reconciliation and filing preparation.

- Tracks US sales tax nexus for Canadian sellers with automated mapping for states like California.

Pricing

Plans start at $19 per month, scaled by order volume.

Pros and Cons

Pros:

- Easy setup saves 80% of manual reconciliation time.

- High accuracy for moderate US sales.

Cons:

- Limited built-in advanced filing tools.

- Requires initial configuration for multi-state nexus.

Best for Vancouver sellers managing moderate US sales volumes, such as reconciling California transactions efficiently while addressing compliance challenges from Canada.

Numeral HQ: Advanced Tax Calculation for Cross-Border Sales

Numeral HQ stands out as a filing-focused app for Shopify US sales tax compliance, helping Canadian businesses automate cross-border tax obligations seamlessly.

Key features include real-time rate application at checkout for accurate US sales tax for Shopify sellers in Vancouver, BC; automated tax filing for BC stores across 45+ states with under 1 hour integration; nexus monitoring for US sales tax nexus for Canadian sellers, like Texas thresholds; and intuitive reporting dashboards for tracking liabilities and alerts.

Pricing starts at $29/month for basic plans, scaling with volume.

Pros:

- Full automation reduces manual errors

- Strong support for multi-state filings

- Complements canada sales tax handling for cross-border compliance, including USD/CAD conversions

Cons:

- Higher cost for advanced features

- Initial learning curve for dashboards

Best for growing Vancouver Shopify nexus management with high US sales volume, preventing over or under-taxing during e-commerce expansion.

TaxJar: Comprehensive US Sales Tax Platform

TaxJar stands out as a robust US sales tax nexus for Canadian sellers solution tailored for e-commerce platforms like Shopify. This US tax platform for BC e-commerce automates compliance challenges, ensuring Vancouver-based businesses avoid penalties from complex state regulations. For instance, it tracks economic nexus thresholds, such as $100,000 in sales triggering obligations in New York for Canadian entities selling to the US.

Key features include:

- Auto-nexus determination across 50+ states, reducing manual tracking errors by up to 90% as noted in Shopify app reviews.

- Real-time rate calculations and multi-channel support for seamless US sales tax for Shopify sellers in Vancouver, BC.

- Automated filing and remittance services, plus Shopify API integration for effortless data sync.

- Detailed analytics for tax reports, simplifying audits and insights.

Pricing starts at $19 per month for the core plan, focusing on Shopify US sales tax compliance basics.

Pros: Highly accurate nexus tools and easy integration cut compliance time; supports Vancouver seller tax tools effectively. Cons: Primarily US-focused, so additional fees for advanced filings can accumulate for growing operations.

Best for Vancouver starters navigating US sales tax nexus for Canadian sellers. Pairing TaxJar with ecommerce bookkeeping services vancouver bc ensures ongoing reconciliation and financial oversight for BC e-commerce growth, transitioning smoothly to enterprise-level needs.

Avalara: Enterprise-Grade Tax Compliance for E-Commerce

Avalara delivers robust enterprise tax solutions for BC sellers, specializing in US sales tax for Shopify sellers in Vancouver, BC. Its scalable platform integrates seamlessly with Shopify, helping businesses navigate complex nexus rules and ensure compliance as they grow.

Key features include:

- The AvaTax engine calculates precise sales tax rates across US jurisdictions, addressing US sales tax nexus for Canadian sellers.

- Automated registration and filing services simplify multi-state obligations, answering when Vancouver-based stores must collect US sales tax.

- Exemption management streamlines documentation for qualifying transactions.

- A dedicated Shopify app enables real-time analytics to determine tax duties.

- Global expansion tools support international compliance for scaling e-commerce operations.

Pricing starts from $50 per month, with custom enterprise plans.

Pros: Highly scalable, handling over 1 billion transactions annually per 2025 updates; ensures Shopify US sales tax compliance with 99.9% accuracy. Ideal for multi-state filing, like a Vancouver SaaS seller expanding to 10 US states.

Cons: Steep pricing for startups; setup complexity benefits from expert help, such as an ecommerce bookkeeper surrey bc in nearby Surrey, BC, to integrate with bookkeeping services.

Best for: Growing Vancouver e-commerce compliance platforms where businesses exceed economic thresholds in multiple states, balancing cost with advanced value for sustained expansion.

A2X: Tax-Ready Accounting Reconciliation

A2X serves as a powerful payout-to-books converter, streamlining Shopify US sales tax compliance for e-commerce operations. It transforms complex Shopify payouts into clean, categorized entries that integrate seamlessly with accounting software, supporting tax reconciliation for BC Shopify sellers handling cross-border sales.

Key features include:

- Payout summarization that aggregates daily transactions into monthly summaries, reducing manual entry for US sales tax nexus for Canadian sellers.

- Tax code mapping, such as assigning Texas sales tax rates directly in Xero during a2x setup for shopify vancouver for Vancouver-based stores.

- Multi-currency handling, converting USD earnings to CAD for accurate books in Vancouver accounting tax tools.

- Direct sync with QuickBooks or Xero, ensuring US sales tax data flows without discrepancies.

- Error reduction in filings, with LinkMyBooks noting 95%+ accuracy rates for compliant reporting.

Pricing starts at $19 per month for basic tiers, scaling to $99 for advanced multi-channel needs.

Pros include cleaner books and easy integration; cons involve limited tax-specific automations beyond reconciliation.

Best for US sales tax for Shopify sellers in Vancouver, BC, who prioritize accurate accounting and reduced compliance risks.

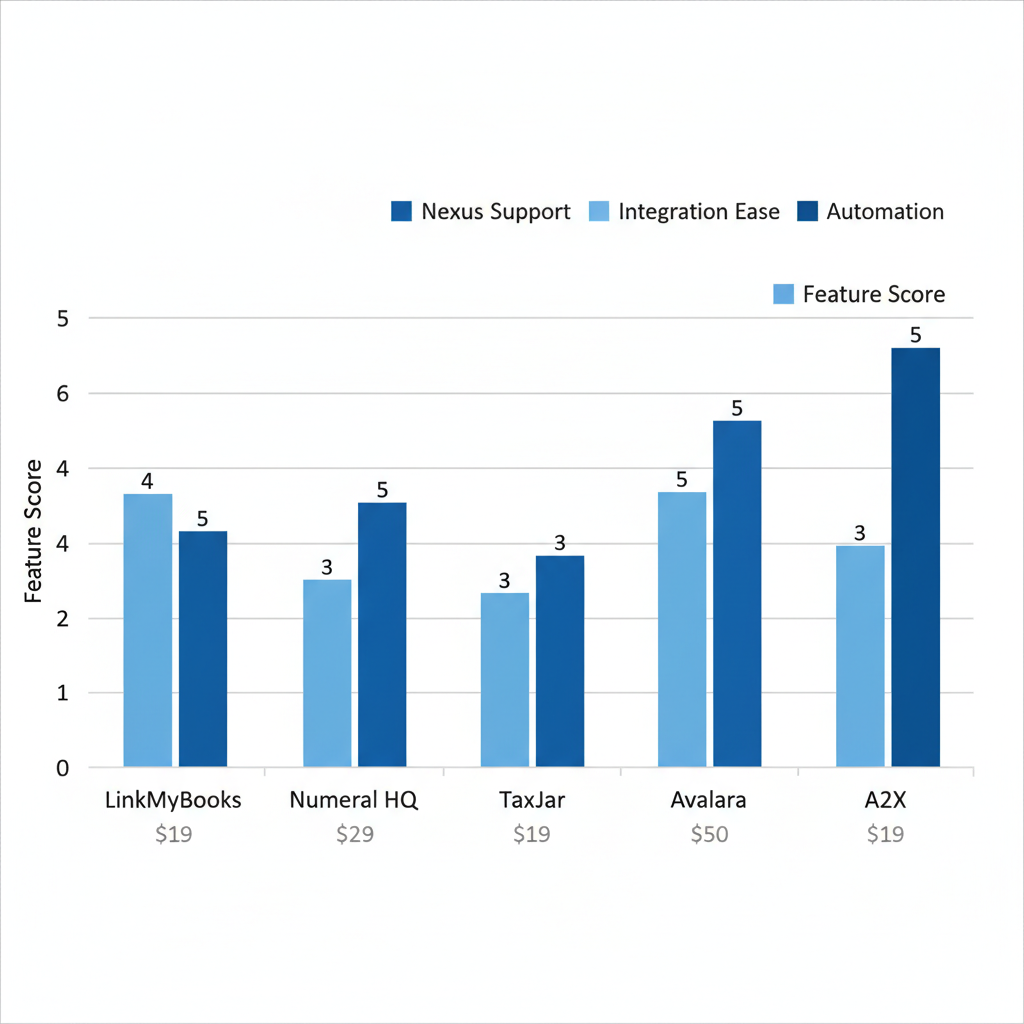

Comparing Top US Sales Tax Tools for Canadian Shopify Sellers

Navigating US sales tax for Shopify sellers in Vancouver, BC requires reliable tools that handle economic nexus thresholds, as outlined in the Commenda guide, where remote sellers must register once exceeding $100,000 in sales or 200 transactions per state annually. This table compares five top options across key features, pricing, nexus support, Shopify integration ease, and suitability for BC businesses, drawing on Webgility insights for integration ratings to simplify tool comparison for BC e-commerce taxes.

| Tool | Key Features | Pricing (Starting) | Nexus Support | Shopify Integration Ease | Best For BC Sellers |

|---|---|---|---|---|---|

| LinkMyBooks | Auto-reconciliation, tax mapping, Xero/QuickBooks export | $19/month | Basic nexus tracking | High | Moderate US sales reconciliation |

| Numeral HQ | Real-time calculations, auto-filing, dashboards | $29/month | Advanced multi-state nexus | Medium | High-volume filing automation |

| TaxJar | Nexus determination, filings, analytics | $19/month | Full US nexus monitoring | High | All-around compliance starters |

| Avalara | AvaTax engine, exemptions, global | $50/month | Enterprise nexus management | Medium | Scaling cross-border operations |

| A2X | Payout summarization, accounting sync | $19/month | Basic nexus via mapping | High | Accounting-focused tax prep |

Data sourced from official tool sites and referenced blogs, with focus on Canadian usability including USD/CAD support and Shopify Canada compatibility. In terms of US sales tax nexus for Canadian sellers, TaxJar excels with comprehensive monitoring across all states, making it ideal for beginners addressing economic nexus implications for BC businesses. Avalara stands out for scaling operations, offering advanced management that suits growing Vancouver seller compliance options, though at a higher cost. LinkMyBooks provides strong reconciliation at an affordable $19/month, perfect for moderate volumes, while Numeral HQ’s automation shines for high-volume filers but requires medium integration effort for Shopify US sales tax compliance. A2X focuses on accounting sync, aiding tax prep without deep nexus tools.

Feature and pricing comparison of US sales tax tools for ecommerce compliance

For Vancouver sellers, select based on sales volume: TaxJar for starters, Avalara for expansion. Consider automation needs versus reconciliation priorities to streamline compliance efficiently.

Mastering US Sales Tax Compliance from Vancouver

In navigating US sales tax for Shopify sellers in Vancouver, BC, the key lies in selecting robust automation tools that streamline nexus tracking, rate calculations, and filings. These solutions, from AvaTax to TaxJar, empower e-commerce businesses to handle economic thresholds efficiently while minimizing administrative burdens. By automating compliance, Vancouver sellers can focus on growth, reducing errors that often plague manual processes.

Common pitfalls demand attention to ensure seamless operations. For instance, overlooking US sales tax nexus for Canadian sellers can trigger unexpected liabilities; according to the Commenda guide, about 30% of businesses miss these triggers, leading to penalties up to 25% on unpaid taxes. Other mistakes include ignoring sales volume thresholds, relying on outdated rate tables, or attempting manual filing across 45 states, which invites costly errors and audits. To avoid these, start with free trials of recommended tools and consult tax experts for tailored setups.

For next steps in Shopify US sales tax compliance, integrate your chosen platform with e-commerce workflows and monitor nexus changes quarterly. Final tips for BC tax management include staying updated on cross-border rules and leveraging professional services like those from Transcounts for audit-ready support. Embrace proactive compliance to unlock the full potential of your Vancouver e-commerce venture, turning US market opportunities into sustainable success.

Mastering US Sales Tax Compliance from Vancouver

For Shopify sellers in Vancouver, BC, navigating US sales tax compliance is essential for seamless expansion into the American market. Tools like TaxJar, Avalara, and Quaderno streamline nexus tracking, automated filing, and error reduction, saving time and minimizing penalties. By integrating these solutions with platforms such as Shopify, businesses can efficiently manage thresholds, rates, and remittances, ensuring accurate compliance without manual hassle.

Common pitfalls underscore the need for vigilance in US sales tax nexus for Canadian sellers. According to the Commenda guide, about 30% of sellers overlook economic nexus triggers, leading to unexpected liabilities across states. Other frequent mistakes include:

- Ignoring sales volume thresholds, resulting in unmonitored tax collection obligations.

- Relying on manual calculations, which amplify errors and increase audit risks.

- Delaying registration after crossing nexus limits, exposing businesses to fines up to 25% of unpaid taxes.

To avoid these, prioritize automation to cut error rates by up to 90%, as supported by industry stats.

Next steps for Shopify US sales tax compliance involve starting with free trials of recommended tools to test integration ease. For complex setups in British Columbia, consult accounting experts like Transcounts for tailored guidance on nexus and filing. Implement these final tips for BC tax management to build a robust system.

In this Vancouver e-commerce compliance wrap-up, proactive adoption of sales tax tools empowers your growth. Stay ahead of obligations, reduce risks, and focus on scaling your US sales with confidence–your compliant foundation awaits.

Resources

Us Sales Tax for BC Shopify Sellers VancouverGst Hst PST for Ecommerce VancouverCross Border Ecommerce Sales Tax Vancouver