Table of Contents

Navigating Shopify Tax Setup for Canadian and US Sales in Vancouver

For Vancouver-based e-commerce sellers, mastering Shopify tax setup for Canadian and US sales in Vancouver is crucial to avoid hefty penalties and ensure smooth operations. Local businesses often face unique challenges like balancing provincial taxes with cross-border rules, making accurate configuration a secure financial foundation much like building a sturdy bridge over regulatory gaps.

Key taxes include GST at 5% federally, PST at 7% in British Columbia as per Shopify’s guide, and varying HST rates across provinces. For US sales, sellers must navigate nexus thresholds–connection points triggering tax obligations in specific states. Common pitfalls for cross-border Shopify taxation involve underestimating shopify sales tax canada requirements, leading to compliance risks that can cost thousands in fines. Proper shopify gst hst setup automates these, streamlining Vancouver e-commerce tax compliance.

Transcounts, a local expert, integrates with QuickBooks and Xero for seamless tax reporting and bookkeeping and offers ecommerce bookkeeping services vancouver bc.

Upcoming sections explore provincial rates, automation tools, and best practices for hassle-free setup.

Tax Landscape Overview for Shopify Sellers in Vancouver

Navigating the Shopify tax setup for Canadian and US sales in Vancouver requires understanding the layered tax system that impacts e-commerce operations. For sellers in Vancouver, this Vancouver Shopify taxation overview starts with federal and provincial obligations, ensuring compliance while optimizing for cross-border growth.

GST serves as the 5% federal tax collected on most taxable supplies across Canada. In provinces like British Columbia, sellers add a separate 7% PST, creating a combined rate of 12% on applicable goods. Other regions use HST, such as Ontario’s 13% blended rate. Per Shopify, BC’s combined rate is 12%, highlighting key differences in shopify sales tax canada configurations. Bullet points for quick reference:

- GST: Universal 5% on sales over $30,000 annually

- HST: Varies (e.g., 13% Ontario, 15% Atlantic provinces)

- PST in BC: 7% on tangible personal property

For cross-border e-commerce, Canadian Shopify sellers shipping to the US must consider nexus rules. Thresholds include $100,000 in sales or 200 transactions per state, triggering collection of state sales tax. Shopify’s automatic tax calculation features simplify shopify gst hst setup and US compliance. Export rules exempt GST/HST on goods shipped outside Canada, but CRA guidelines emphasize accurate tracking for digital and physical exports. BC cross-border tax rules add complexity for Vancouver-based operations, like urban shipping hubs influencing nexus.

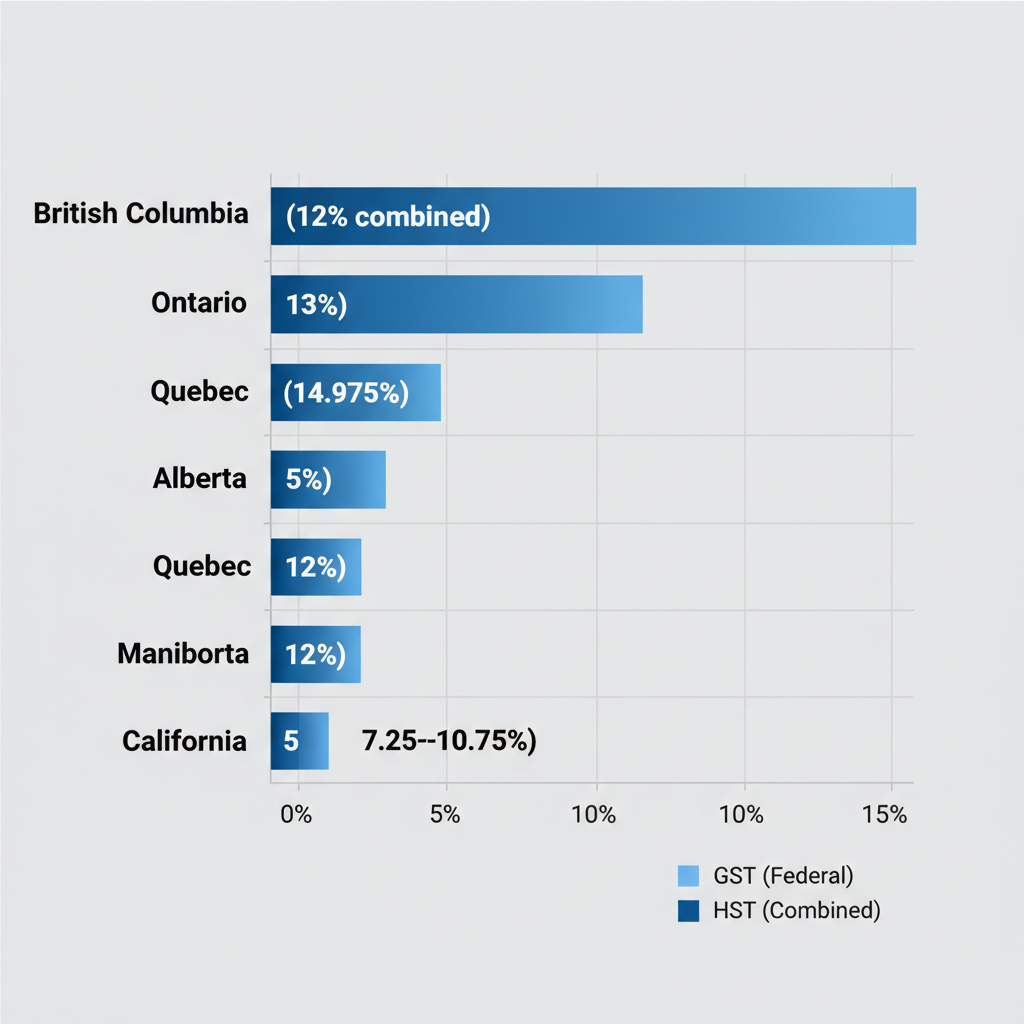

Regional tax variations affect Shopify configurations, with canada sales tax rates differing by province. The table below compares key rates, focusing on BC for Vancouver sellers while noting US examples.

| Province | GST Rate | HST Rate | PST Rate | Combined Rate for BC Example |

|---|---|---|---|---|

| British Columbia | 5% (federal) | N/A | 7% | 12% |

| Ontario | 5% (federal) | 8% (combined as HST) | N/A | 13% |

| Quebec | 5% (federal) | 9.975% (QST as HST equivalent) | N/A | 14.975% |

| Alberta | 5% (federal) | N/A | N/A | 5% |

| Manitoba | 5% (federal) | 7% (combined as HST) | 7% | 12% |

| US (Nexus Example – California) | N/A | N/A | 7.25% base | Varies by state (up to 10.75%) |

Data sourced from CRA and Shopify references; update annually for accuracy. BC’s structure offers straightforward separation of GST and PST, benefiting Vancouver sellers with clear Shopify integrations over blended HST provinces. This setup empowers local businesses, like a Vancouver coffee shop selling artisanal beans online, to manage taxes efficiently amid urban logistics.

Provincial sales tax rates comparison for Shopify sellers in Canada

Understanding these elements provides a solid foundation for compliance in Vancouver’s dynamic e-commerce scene.

Configuring Tax Calculations in Shopify for Vancouver Sellers

For Vancouver e-commerce sellers handling sales across Canada and the US, proper Shopify tax setup for Canadian and US sales in Vancouver is essential to automate compliance and avoid penalties. Begin by logging into your Shopify admin dashboard. Navigate to Settings in the left sidebar, then select Taxes and duties. Here, you can enable tax calculations tailored to your operations in British Columbia.

Enabling Taxes for Canada

To configure shopify gst hst setup, toggle on ‘Collect sales tax’ following Shopify’s guide for Canada tax management. Select Canada as your country, then choose British Columbia to activate automatic GST at 5% and HST where applicable. For PST, enable it specifically for BC at 7% on taxable goods, ensuring Vancouver tax automation in Shopify handles provincial rates correctly. This BC Shopify rate configuration integrates seamlessly with your store’s checkout, calculating taxes based on customer location. Next, review default rates and adjust any custom exemptions for non-taxable items like certain digital services.

Step-by-step Shopify tax setup for Vancouver-based e-commerce sellers

Setting Up US and Cross-Border Taxes

For US sales from British Columbia, add states where you have nexus, such as those with economic thresholds from online sales. In the same Taxes and duties section, select United States and choose relevant states to enable shopify sales tax canada automation extended to US jurisdictions. Shopify will compute rates dynamically based on shipping addresses.

Advanced Integrations and Tips

Enhance accuracy with apps like TaxJar for nexus tracking and automated filing, as recommended in TaxCloud’s best practices. For tax reconciliation, consider a2x setup for shopify vancouver. Always test calculations on a sample order to verify settings before going live.

British Columbia Tax Specifics for Shopify in Vancouver

Vancouver-based Shopify sellers must navigate unique tax obligations in British Columbia to ensure compliance with both Canadian and potential US requirements. The Shopify tax setup for Canadian and US sales in Vancouver involves configuring rates for GST, PST, and cross-border implications, tailored to local e-commerce needs.

British Columbia applies a 7% Provincial Sales Tax (PST) on tangible personal property and certain services sold through Shopify, distinct from the federal 5% Goods and Services Tax (GST). For shopify sales tax canada setups, physical goods like apparel trigger both taxes at checkout, while digital downloads often face only GST. Downtown Vancouver merchants, for instance, commonly apply these rates via Shopify’s tax settings to avoid undercharging local customers, aligning with CRA guidelines for accurate reporting.

Exemptions play a key role in shopify gst hst setup, particularly for exports shipped outside Canada, where no PST applies and GST may be zero-rated. Vancouver BC tax exemptions also cover specific services like software development, but sellers must verify eligibility to prevent errors. On the US side, urban nexus in Vancouver can trigger obligations if sales exceed $100,000 annually, as noted in sales tax guides–requiring state filings for platforms like Shopify.

Common pitfalls include overlooking PST on installation services, which can lead to audits and penalties. For local Shopify PST rules, early registration is essential.

Provincial registration occurs through the My PST portal, with guidance available via BC PST Registration for Ecommerce Surrey. This step ensures timely remittances and supports seamless growth for Vancouver sellers.

Initial Steps for Shopify Tax Compliance in Vancouver

Embarking on Shopify tax setup for Canadian and US sales in Vancouver requires a structured approach to ensure compliance from the start. These Vancouver compliance starters guide beginners through initial Shopify tax steps, addressing common hurdles for e-commerce sellers in British Columbia.

- Register for GST/HST with the CRA: If your annual taxable sales exceed $30,000, mandatory registration is required under Canadian Revenue Agency guidelines. For shopify sales tax canada, complete the online form at cra-arc.gc.ca, providing business details like your BN. This step establishes your tax account numbers for remittances. Expect processing within 10-14 days. (48 words)

- Enable and Configure Taxes in Shopify: Post-registration, log into your Shopify admin and navigate to Settings > Taxes and duties. Activate automatic tax calculations for Canada, setting British Columbia rates at 5% GST and 7% PST. For US sales, select nexus states like Washington. Test the shopify gst hst setup by creating sample orders; Shopify recommends verifying calculations against CRA rates to avoid discrepancies. Add cross-border elements, including Sales Tax Nexus Help for Amazon Sellers Vancouver for US nexus insights, ensuring accurate thresholds for Vancouver-based operations. Run multiple test transactions to confirm exemptions and totals align–crucial for preventing audit issues. (72 words)

- Apply Tax Overrides and Exemptions: Use Shopify’s override feature for specific customer scenarios, like zero-rating exports or applying PST waivers. Input custom rates via product settings to handle exemptions seamlessly. (28 words)

- Seek Professional Support: For ongoing accuracy, consult Transcounts’ experts in Vancouver to streamline your setup and avoid costly errors. Their tailored services provide peace of mind. (27 words)

Achieving Seamless Tax Compliance for Your Vancouver Shopify Store

Mastering Shopify tax setup for Canadian and US sales in Vancouver ensures smooth operations amid complex GST/HST/PST rules. Recapping essentials, secure registration, precise shopify gst hst setup, and thorough testing form the foundation of shopify sales tax canada compliance, while automation streamlines cross-border filings.

These Vancouver tax best practices yield benefits like error reduction and time savings–as noted in industry guides, annual reviews prevent 80% of errors–empowering ongoing Shopify compliance.

Take action today:

- Conduct quarterly audits to stay audit-ready.

- Integrate automation tools for real-time accuracy.

- Partner with Transcounts for bundled e-commerce services in British Columbia, following e-commerce bookkeeping best practices to sustain precision and growth.

Shopify Tax Setup Canada Us VancouverSales Tax Nexus Help for Amazon Sellers VancouverBC PST Registration for Ecommerce Surrey