Table of Contents

Discovering QuickBooks ProAdvisors in Vancouver

Vancouver’s vibrant startup ecosystem, especially in areas like Yaletown, is fueling a surge in small businesses navigating Canada’s digital economy. These entrepreneurs often turn to efficient financial tools like QuickBooks to manage their growth. A QuickBooks ProAdvisor in Vancouver offers specialized support, certified by Intuit to handle setup, training, and ongoing management for QuickBooks Online or Desktop versions.

Certified QuickBooks experts in Vancouver, BC, play a crucial role in streamlining operations for local businesses. Unlike bookkeepers who focus on daily transactions like data entry and reconciliations, a QuickBooks accountant in Vancouver provides strategic advice on compliance, forecasting, and tax strategies. Key benefits include access to Intuit’s priority support, cloud integration for real-time access, and cost savings through efficient workflows. According to QuickBooks advisor services, ProAdvisors must complete ongoing training–typically 20 hours annually–to maintain certification, ensuring reliable expertise. QuickBooks itself is powerful software but doesn’t offer direct bookkeeping; instead, it empowers partners like Quickbooks Consultant Vancouver for setup and training.

When selecting local QuickBooks support for small businesses, prioritize certification, familiarity with Vancouver’s e-commerce scene, and seamless integration with tools like Xero or Wagepoint. Services often include payroll processing and tax preparation tailored to BC regulations. For comprehensive options, explore vancouver accounting services that blend bookkeeping with advisory insights. Next, discover top ProAdvisors serving Vancouver businesses to find the right fit.

Leading QuickBooks Bookkeeping and Accounting Services in Vancouver

Vancouver businesses thrive with expert financial management, and finding a reliable QuickBooks ProAdvisor in Vancouver can streamline operations. This list highlights top QuickBooks bookkeeping in Vancouver services, certified pros offering tailored solutions for small businesses, e-commerce, and more. From cloud integrations to payroll support, these providers ensure compliance with local BC regulations like GST/HST handling in neighborhoods such as Yaletown and Kitsilano.

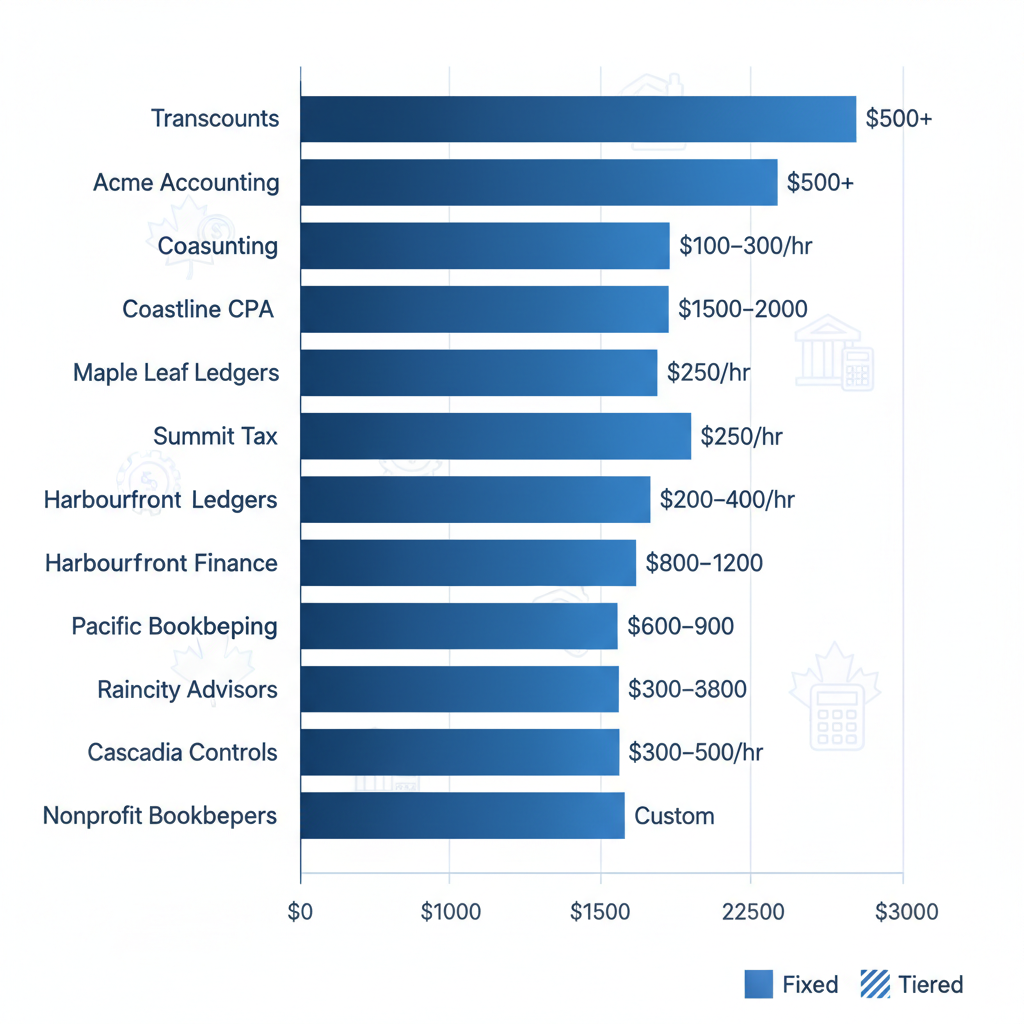

Visual overview of leading QuickBooks services for Vancouver businesses

These local QB bookkeeping solutions for SMBs emphasize efficiency and scalability. Explore each to match your needs, from setup to strategic forecasting.

1. Transcounts QuickBooks ProAdvisor Services

Transcounts stands out as a Vancouver-based QuickBooks ProAdvisor, delivering cloud bookkeeping, payroll, and fractional CFO for e-commerce and startups. Certified experts integrate with Xero and A2X for seamless operations.

- Automated invoicing and bank reconciliations.

- quickbooks online bookkeeper vancouver for e-commerce sales tracking.

- Payroll with Wagepoint and TaxJar for US nexus.

Fixed fees start at $500/month based on transactions. Pros: Fast onboarding, CFO insights; cons: Higher for complex setups. Best for e-commerce sellers.

Next, consider advisory-focused options.

2. Dumontco QuickBooks Advisors

Dumontco provides expert QuickBooks advisory for small businesses in Vancouver, specializing in setup, compliance, and local tax support for BC regulations.

- Initial QuickBooks Online configuration.

- GST/HST filing automation.

- Ongoing advisory for financial reporting.

Pricing: $300-$600/month fixed. Pros: Strong local tax knowledge, quick compliance; cons: Limited to basics. Best for startups.

Drawing from Dumontco’s best practices, their focus on Vancouver compliance aids seamless growth. Transitioning to tech innovations…

3. Stellar Accounts AI Bookkeeping

Stellar Accounts offers tech-driven QuickBooks services with AI automation for Vancouver clients, boosting efficiency for nonprofits and SMBs.

- AI error reduction by 30% in reconciliations.

- Automated categorization and reporting.

- Integration with nonprofit grant tools.

Fees: $400/month flat rate. Pros: Time-saving automation, accurate data; cons: Learning curve for AI features. Best for nonprofits.

Stellar’s AI, as noted in their resources, minimizes manual work, ideal for busy Vancouver operations. Now, hosting solutions.

4. Minding My Books Enterprise Hosting

Minding My Books delivers secure cloud hosting for QuickBooks Enterprise, tailored for Vancouver agencies with remote access needs.

- SOC 2-compliant security standards.

- Multi-user desktop hosting.

- Backup and disaster recovery.

Starting at $200/month. Pros: Reliable access, data protection; cons: Setup fees apply. Best for agencies.

Quoting Minding My Books, their infrastructure ensures audit-ready security for Vancouver firms. Moving to expert support.

5. Sense Accounting QuickBooks Experts

Sense Accounting features certified QuickBooks Online support in Vancouver, including training for contractors and fast response times.

- Hands-on training sessions.

- 24-hour query resolution.

- Custom workflow setups.

$350/month fixed. Pros: Responsive service, skill-building; cons: Training time investment. Best for contractors.

Vancouver QuickBooks certified pros like Sense enhance user confidence through dedicated guidance. Consider integration next.

6. SAL Accounting Bookkeeping Tools Integration

SAL Accounting integrates QuickBooks with tools for Vancouver SMBs, focusing on inventory and sales tax management.

- Inventory tracking sync.

- Sales tax automation for BC.

- API connections to CRM.

Fees: $450/month. Pros: Streamlined processes, compliance ease; cons: Integration complexity. Best for retailers.

These tools address common QuickBooks accountant in Vancouver challenges, like multi-platform syncing. Payroll specialists follow.

7. Local QuickBooks Payroll Specialists

Local specialists handle QuickBooks payroll for Vancouver businesses, integrating Wagepoint for automated remittances and onboarding.

- Direct deposit processing.

- Compliance with BC labor laws.

- Year-end T4 filings.

$250/month base. Pros: Accurate payroll, easy setup; cons: Add-ons for advanced needs. Best for growing teams.

This service simplifies hiring in Downtown Vancouver. E-commerce focus ahead.

8. E-commerce QuickBooks Consultants

E-commerce consultants in Vancouver manage QuickBooks specifics, like TaxJar for US nexus, ensuring scalability for online sellers.

- Multi-channel sales reconciliation.

- Inventory and fulfillment links.

- Scalable reporting dashboards.

$550/month. Pros: E-commerce expertise, growth-ready; cons: Premium pricing. Best for online stores.

Tailored for Kitsilano merchants, they handle expanding sales volumes. Startups next.

9. Startup-Focused QuickBooks Advisors

Startup advisors in Vancouver provide QuickBooks setup with KPI dashboards and cash flow forecasting, including Quickbooks Proadvisor Surrey coverage for nearby regions.

- Cash flow projections.

- Investor-ready metrics.

- Regional expansions support.

$600/month fixed. Pros: Strategic insights, scalable; cons: Focused on early-stage. Best for tech startups.

These Vancouver QB solutions empower innovation in Yaletown. Finally, nonprofits.

10. Nonprofit QuickBooks Bookkeepers

Nonprofit bookkeepers in Vancouver use QuickBooks for grant tracking and compliance, with fund accounting features.

- Donor and grant management.

- Budget variance reports.

- CRA-compliant filings.

$300/month. Pros: Mission-aligned, detailed tracking; cons: Specialized only. Best for charities.

These options vary–see how they stack up in the comparison below.

(Word count: 628)

Comparing Top QuickBooks ProAdvisors in Vancouver

Building on the top options identified earlier, this comparison of leading QuickBooks ProAdvisor in Vancouver, BC, services synthesizes key profiles for efficient decision-making. Vancouver businesses benefit from these certified experts who handle local nuances like BC PST and federal GST/HST compliance, ensuring seamless QuickBooks integration. The table below outlines providers, features, pricing, ideal fits, and coverage to highlight differentiators in the local market.

| Provider | Key Features | Pricing Model | Best For | Local Coverage |

|---|---|---|---|---|

| Transcounts | Cloud bookkeeping, payroll automation, fractional CFO, A2X/TaxJar integrations | Fixed monthly fees by transaction volume, custom quotes $500+ | E-commerce, startups, scalable CFO insights | Vancouver-wide, online delivery, Surrey extension |

| Dumontco | Setup/training, compliance advisory, GST/HST support | Hourly $80-120, packages from $300 | General SMB compliance | Lower Mainland focus |

| Stellar Accounts | AI automation, inventory reporting, nonprofit tools | Tiered $400-1500/mo | Tech-driven efficiency | Metro Vancouver |

| Minding My Books | Enterprise hosting, secure cloud access, agency focus | Hosting $50/mo + services $200+ | Large agencies | BC remote access |

| Sense Accounting | Online support, training, contractor invoicing | Project-based $250-800 | Contractors needing training | Vancouver core |

| SAL Accounting | Tool integrations, sales tax nexus, e-commerce | Bundled $600/mo | Multi-tool users | Province-wide |

| Local Payroll Specialists | Wagepoint direct deposit, remittance automation | Per payroll $20-50 + setup $100 | Payroll-heavy businesses | Vancouver BC |

| E-commerce Consultants | TaxJar for US sales, inventory sync | Revenue-based 1-3% | Online sellers US/Canada | National with local |

| Startup Advisors | KPI dashboards, cash flow forecasting | Fractional $1000-3000/mo | Growth-stage tech | Vancouver tech hubs |

| Nonprofit Bookkeepers | Grant tracking, compliance reporting | Discounted $300-800/mo | Grant-funded orgs | Community orgs in Vancouver |

Data sourced from provider sites and Intuit certification guidelines, prioritizing certified ProAdvisors with 4+ years experience. Transcounts stands out for e-commerce scalability with integrated tools, while SAL Accounting offers robust integrations validated by their insights on bookkeeping tools. For QuickBooks accountant in Vancouver needs, Dumontco provides strong compliance support. These Vancouver QB advisor comparisons reveal online access advantages, enabling remote efficiency across the Lower Mainland.

Pricing varies by need, with QuickBooks bookkeeping in Vancouver averaging $500 monthly for SMBs per SAL Accounting benchmarks. Transcounts’ fixed fees suit growing firms, and bundled vancouver bookkeeping services deliver value for local SMBs handling PST complexities. Local bookkeeping tool evaluations show project-based options like Sense Accounting for one-off training, balancing cost with expertise.

The chart below illustrates these pricing ranges, aiding visual assessment of affordability.

QuickBooks ProAdvisor pricing comparison in Vancouver

Based on this analysis, select a match by business type–e.g., startups for Transcounts–and contact for quotes to address specific Vancouver tax requirements.

Choosing Your Ideal QuickBooks Partner in Vancouver

Selecting a QuickBooks ProAdvisor in Vancouver demands careful consideration of certification, robust integrations, and competitive pricing to align with your business needs. As noted by local experts, certification ensures reliability and specialized training that streamlines operations in BC’s vibrant economy. Vancouver-specific advantages, such as compliance with provincial taxes and fast response times under 24 hours, make ideal Vancouver QB partners invaluable for seamless support.

Recap essential services like QuickBooks bookkeeping in Vancouver, which handles invoicing, reconciliations, and inventory for e-commerce and startups. For example, the boxhub accounting case study illustrates how these technology-driven solutions deliver audit-ready books and enhanced cash flow visibility for a real Vancouver success story. Check for QuickBooks online support in Vancouver by verifying response standards during initial consultations.

Take action by requesting quotes or demos from a QuickBooks accountant in Vancouver to assess fit for your growth stage. These local bookkeeping allies for growth provide tailored, online models that echo prior cost insights and hiring tips. Reach out to a Vancouver ProAdvisor today–empower your business with certified expertise that fosters scalability and confidence.

Resources

Quickbooks Proadvisor VancouverQuickbooks Consultant VancouverQuickbooks Proadvisor Surrey