Table of Contents

Navigating Monthly Bookkeeping Services in Vancouver

In Vancouver’s dynamic economy, where tech startups and e-commerce thrive alongside diverse neighborhoods, maintaining accurate financial records is crucial for small businesses. Monthly Bookkeeping Services in Vancouver offer a lifeline, providing ongoing financial tracking for Vancouver businesses to navigate rapid growth and regulatory demands like GST/HST compliance.

These services involve transaction categorization, bank reconciliations, and monthly reporting to keep books audit-ready, ensuring predictable cash flow and adherence to CRA guidelines. Transcounts stands out with its 100% online model, integrating QuickBooks and Xero for seamless delivery and response times under 24 hours. Covering areas from Downtown to Burnaby and Richmond, bookkeeping services Vancouver feature fixed monthly fees based on transaction volume, making local monthly accounting support affordable and scalable–unlike traditional fixed-fee setups from providers like Sense Accounting.

Explore upcoming sections on tackling local challenges, comparing service options, and steps to get started with reliable small business bookkeeping in Vancouver.

Exploring Bookkeeping Needs Across Vancouver Neighborhoods

Vancouver’s diverse neighborhoods present varied demands for monthly bookkeeping services in Vancouver, where small businesses navigate everything from high-volume tech transactions in Downtown’s Yaletown hubs to contractor compliance in Burnaby. Bookkeeping services in Vancouver must adapt to these local dynamics, offering scalable solutions that align with urban density and economic specialties. Transcounts delivers uniform online support across these areas, ensuring small business bookkeeping in Vancouver remains efficient and cost-effective regardless of location.

Key challenges emerge in each neighborhood, such as Downtown’s fast-paced environment requiring rapid response times amid heavy transaction loads, or Surrey’s complexities with cross-border US-Canada sales that demand specialized tax handling. In Richmond, e-commerce sellers grapple with inventory tracking and automated reporting, while Kitsilano’s creative agencies and nonprofits seek flexible payroll integrations. Burnaby startups often prioritize quick onboarding to fuel growth. Transcounts addresses these through cloud-based tools like QuickBooks and Xero, backed by dedicated success managers for seamless neighborhood-specific financial management in Vancouver.

Vancouver’s geographic diversity influences bookkeeping choices, with urban cores favoring tech integrations and suburbs emphasizing affordability and compliance. The following table outlines these variations:

| Area | Service Availability | Cost Range (Monthly) | Specialties |

|---|---|---|---|

| Downtown Vancouver | Full cloud-based services including QuickBooks/Xero integration, 24/7 access; high availability from invoicing to year-end | $300-$800 based on transactions | Urban tech startups, high-volume transactions |

| Burnaby | Expanded coverage with same-day response for startups; rapid onboarding within 30 days | $250-$600 for small businesses | Contractor invoicing and compliance |

| Richmond | E-commerce focused with inventory reporting; automated AP/AR | $400-$900 for e-commerce | Inventory and sales tax automation |

| Kitsilano | Nonprofit and contractor specialists with payroll add-ons; fractional CFO consultations | $200-$500 for nonprofits | Creative agencies and nonprofits |

| Surrey | Cross-border US/Canada tax support for SMBs; GST/HST and provincial sales tax filing | $350-$700 with US nexus | Cross-province SMB scaling |

This comparison highlights how localized accounting solutions for BC businesses can vary, yet Transcounts maintains fixed fees based on revenue tiers, drawing from benchmarks like Enkel’s cost data for competitive pricing around $250-$800 monthly. A Burnaby startup shared, “We saved 20% on fees with their cloud setup,” underscoring the model’s edge over traditional providers like Hayson Accounting, where small business adoption rates exceed 70% in diverse areas.

Transcounts’ consistent delivery reduces location-based disparities, providing audit-ready books and integrations like A2X for e-commerce in Richmond or payroll for Kitsilano nonprofits. For Surrey’s cross-border needs, Bookkeeping Services Surrey BC offers tailored US nexus support, helping SMBs scale without added complexity. This approach fosters trust and scalability for Vancouver’s evolving economy.

Bookkeeping services comparison in key Vancouver areas

Such visuals reinforce how Transcounts empowers localized growth, from Downtown’s tech scene to Surrey’s international trade, ensuring reliable financial oversight for all.

Available Bookkeeping Options for Vancouver Businesses

Vancouver businesses can access reliable Monthly Bookkeeping Services in Vancouver through Transcounts, a cloud-based provider specializing in scalable solutions for startups, e-commerce sellers, and SMBs. These bookkeeping services in Vancouver emphasize efficiency with fixed monthly fees based on transaction volume, offering predictability compared to variable hourly rates seen in local benchmarks like Raisekhon. From Downtown offices to Richmond warehouses, Transcounts delivers end-to-end financial management to support growth in a competitive market.

Core offerings include automated bank feeds for real-time transaction monitoring, detailed expense tracking to categorize spending accurately, and year-end preparation for seamless tax filing. Packages are tiered by monthly transactions–starter for under 50, growth for 50-200, and enterprise for higher volumes–with custom quotes available for complex needs. For e-commerce, integrate A2X to reconcile Amazon sales directly, while bundling accounts payable and receivable streamlines invoicing and payments. All tiers cover GST/HST tracking, ensuring compliance for Canadian operations.

Small business bookkeeping in Vancouver benefits from tailored options like the Bookkeeper Burnaby Small Business package, which includes basic reconciliations and reporting for emerging firms. Add fractional CFO services for cash flow forecasting and KPI dashboards, ideal for agencies in Kitsilano automating payroll via Plooto or Wagepoint.

Integrations with QuickBooks and Xero enable seamless cloud access, while add-ons like TaxJar handle US sales tax nexus. Vancouver-tailored financial packages provide accessible accounting for local SMBs, with 30-day onboarding for quick setup.

Key Factors for Vancouver Bookkeeping Choices

Selecting bookkeeping services in Vancouver requires careful consideration of local regulations and business needs. With the city’s thriving startup scene, factors like CRA compliance and cost-effective options for e-commerce sellers stand out. Monthly Bookkeeping Services in Vancouver, such as those from Transcounts, provide tailored support to ease these challenges, ensuring startups in areas like Burnaby maintain accurate records without overwhelming expenses.

Switching bookkeepers is straightforward with Transcounts’ structured onboarding process, typically completed in under 30 days. This empathetic approach addresses common pain points, like disorganized past records, by offering catch-up bookkeeping discounts up to 20%. For businesses starting from scratch, initial clean-ups integrate seamlessly with cloud platforms like QuickBooks, minimizing disruptions and building a solid financial foundation right away.

Tax filing is included in all packages, covering GST/HST and BC’s provincial sales taxes, which is crucial for e-commerce navigating complexities like US nexus rules. Revenue-based package selection helps match services to your scale–basic for under $50K monthly revenue, premium for growing tech firms. Following small business accounting tips Vancouver can guide these choices effectively.

Local tie-ins shine through Transcounts’ secure cloud infrastructure and industry-specific processes for Vancouver’s tech and nonprofit sectors. Compared to benchmarks like PSI’s small business focus, Transcounts offers a 24-hour response advantage, empowering Vancouver-specific compliance strategies and local financial decision-making tips for sustainable growth.

Steps to Begin Your Vancouver Bookkeeping Journey

Starting monthly bookkeeping services in Vancouver can transform how small businesses manage their finances. For startups in Downtown or contractors in Burnaby, Transcounts offers a streamlined path to clean books and KPI dashboards. Whether you’re exploring bookkeeping services in Vancouver for the first time or seeking small business bookkeeping in Vancouver, the initiation of local accounting routines begins with simple actions.

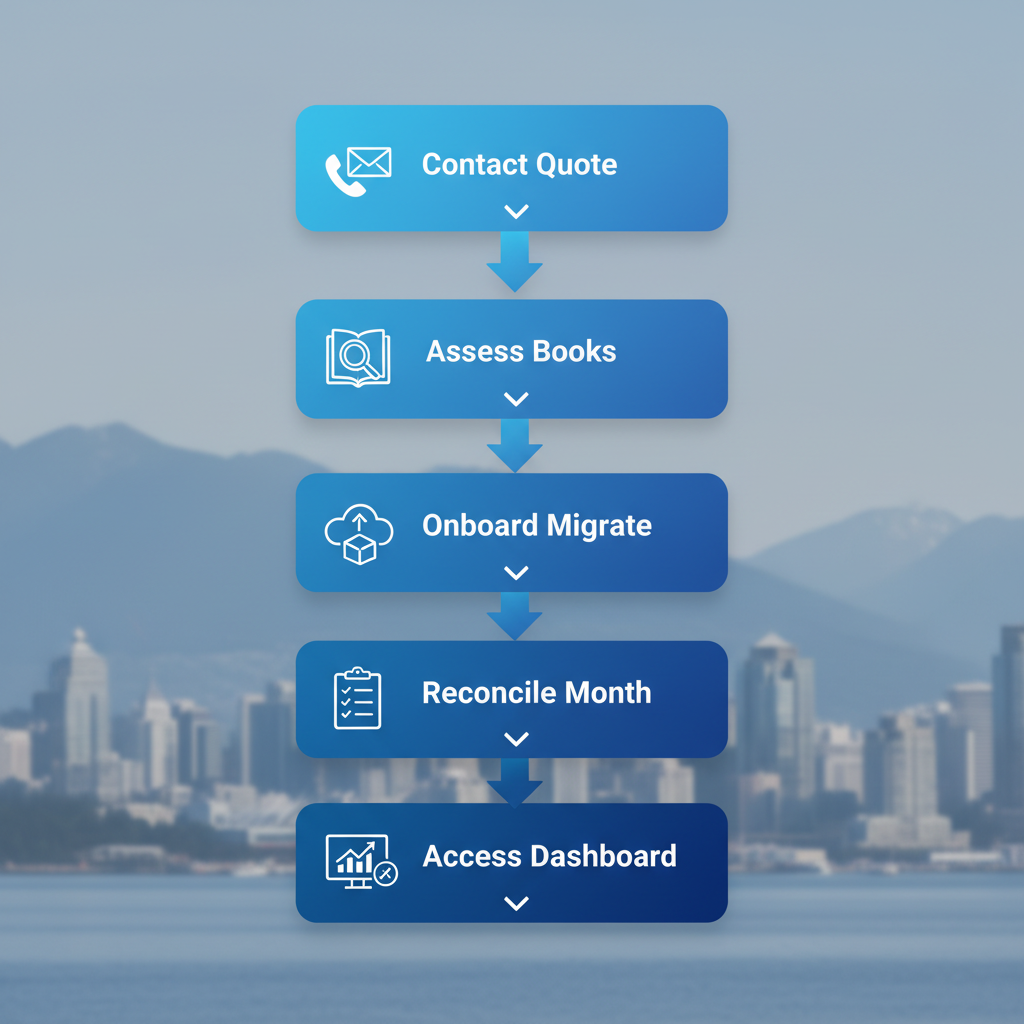

To kick off your Vancouver business setup processes, follow these numbered steps for efficient onboarding:

- Contact for a Quote: Visit the Transcounts website to request a free assessment. Share details about your transaction volume or revenue to receive a fixed monthly fee tailored to your needs.

- Book Assessment: Our team reviews your current books, identifying gaps or disorganized records. This quick evaluation, often completed in days, sets the foundation for smooth integration.

- 30-Day Onboarding: Unlike standard timelines from providers like Enkel, Transcounts accelerates setup. We migrate data from QuickBooks or Xero, automate workflows, and align with your operations–all within 30 days.

- First-Month Deliverables: Expect reconciled bank statements, categorized expenses, and initial financial reports. Most clients see results in the first month, gaining visibility into cash flow and KPIs.

For businesses with no prior bookkeeping, our catch-up services handle backlogs efficiently. When it comes to tax obligations, Transcounts includes tax filing accounting services Vancouver to manage CRA filings seamlessly. Prepare CRA documents for quicker setups in Richmond. Fractional controller options provide strategic oversight from day one.

Post-onboarding, enjoy long-term benefits like audit-ready books and predictable finances that support growth.

Steps to begin your Vancouver bookkeeping journey with Transcounts

Achieve Financial Clarity with Vancouver Bookkeeping

Embrace Monthly Bookkeeping Services in Vancouver to transform your small business bookkeeping in Vancouver. Transcounts delivers comprehensive solutions that ensure compliance, optimize cash flow, and fuel growth in vibrant neighborhoods like Kitsilano and Surrey, drawing on scalable trends from local experts.

Reap benefits like fixed fees, robust cloud security, and dedicated expert support, including quick onboarding and tax inclusions. Vancouver e-commerce and tech clients rave: “Transcounts streamlined our ecommerce bookkeeping services vancouver bc, boosting our ongoing local accounting success.” Partner with Transcounts today for a custom quote and sustained financial health in Vancouver.

Resources

Monthly Bookkeeping Services VancouverBookkeeping Services Surrey BCBookkeeper Burnaby Small Business