Table of Contents

Mastering Inventory Accounting for Shopify in Vancouver

Vancouver’s vibrant e-commerce scene, fueled by seasonal tourism and cross-border sales, demands precise Inventory Accounting for Shopify in Vancouver to thrive. Local sellers face unique pressures from fluctuating stock levels and compliance needs, making robust Shopify inventory management Canada essential for sustainable growth.

Inventory accounting involves tracking product costs, quantities, and valuations to ensure financial accuracy for Ecommerce inventory accounting in Vancouver. Transcounts, a Vancouver-based expert, integrates seamlessly with Shopify for automated reporting, enhancing built-in tools that reduce errors by up to 30% according to Shopify’s retail guidelines. Our ecommerce bookkeeping services vancouver bc address stock discrepancies and sales tax handling, using methods like FIFO for Shopify stock tracking for local sellers.

Common challenges include setting up beginning inventory and navigating Canadian tax rules, which can lead to costly audits if overlooked.

Upcoming sections explore Vancouver e-commerce valuation methods, our tailored services, and steps to get started, promising cleaner books and faster closes for your business.

Vancouver Ecommerce Landscape and Inventory Challenges

Vancouver’s e-commerce sector thrives with Shopify powering many local businesses, driven by a 20% year-over-year growth among sellers. This boom highlights the importance of Inventory Accounting for Shopify in Vancouver, where operators face unique pressures from international trade. As a key port city, the region sees rapid online sales expansion, yet maintaining accurate stock levels remains crucial for profitability and compliance.

Local Shopify users encounter several inventory hurdles that demand careful management. Port congestion at Vancouver’s terminals often causes supply chain delays, pushing back shipments and complicating beginning inventory calculations. Accurate starting stock valuation is essential, as errors can distort cost tracking and reduce margins by up to 10%, according to Shopify’s retail accounting insights. Multi-channel selling across platforms adds complexity, requiring robust Shopify inventory management in Canada to sync data seamlessly. Additionally, ecommerce inventory accounting in Vancouver must align with GST/HST reporting, where imprecise local Shopify stock valuation leads to compliance risks and audit headaches.

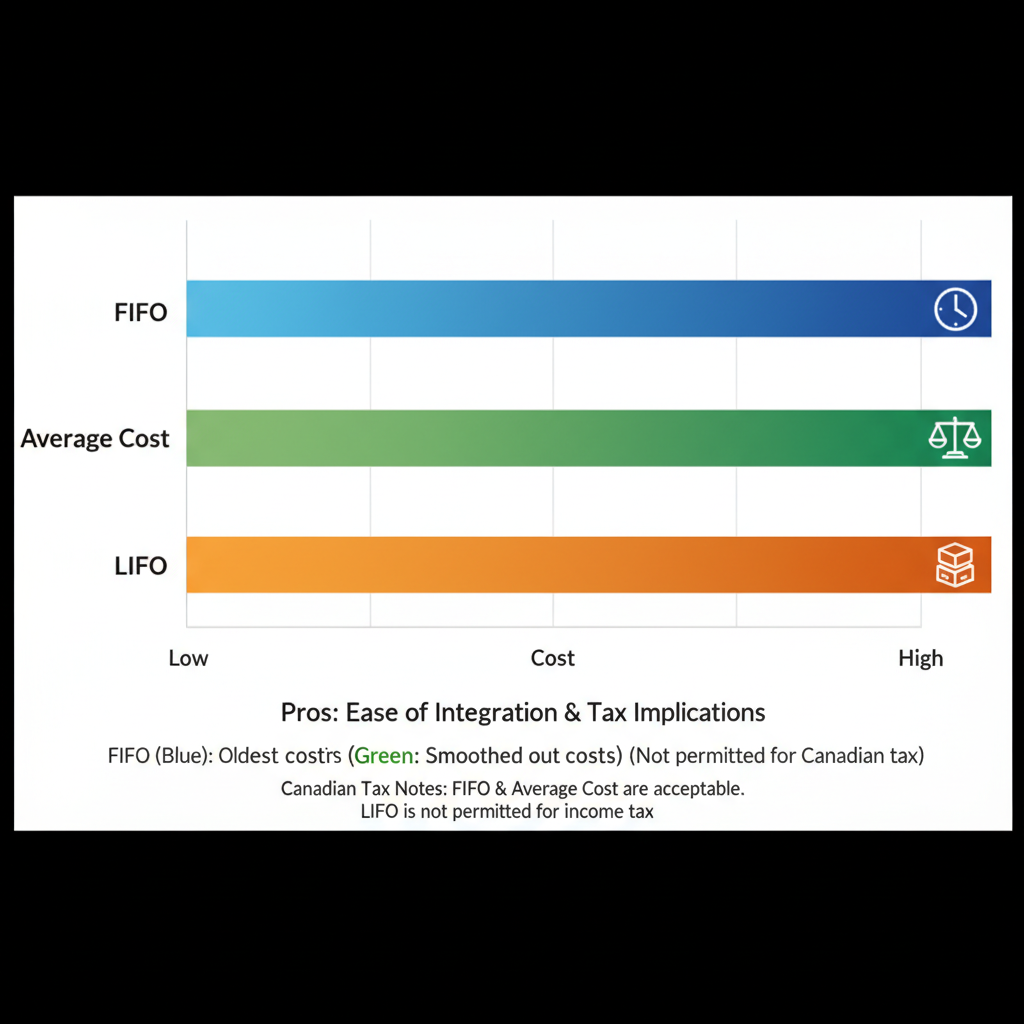

To navigate these, businesses turn to proven methods like FIFO, which suits imports by matching physical flow to accounting, or average costing for steady retail. Valuation choices directly affect profitability, especially in Canadian e-commerce cost tracking amid fluctuating import prices. Tools like SKU Margin Reporting Vancouver Ecommerce help analyze per-item margins, revealing how methods influence bottom lines. Transcounts automates this for error-free operations, easing the burden on Vancouver stores.

Choosing the right inventory method is vital in Vancouver, where 15% annual growth in online sales amplifies the need for CRA-compliant approaches that integrate smoothly with Shopify. These methods not only optimize costs but also simplify tax filings for import-heavy operations, supporting sustainable expansion.

| Method | Description | Best For Vancouver Shopify | Tax Implications in Canada | Ease of Shopify Integration |

|---|---|---|---|---|

| FIFO (First In, First Out) | Assumes oldest inventory sold first, ideal for perishable or trending goods. | Rising costs in volatile markets like Vancouver’s import scene. E-commerce with frequent stock turnover; matches actual flow for tourism-driven sales. | Aligns with CRA guidelines for cost of goods sold. | High – Native Shopify support via apps. |

| LIFO (Last In, First Out) | Assumes newest inventory sold first, useful for inflation hedging. | Higher costs in stable pricing environments. Bulk import stores; less common in Canada due to tax preferences. | May complicate CRA audits if not documented. | Medium – Requires custom apps. |

| Average Cost | Uses weighted average cost per item. | Balanced for steady Vancouver retail. General e-commerce; simplifies reporting for GST/HST. | CRA compliant and straightforward. | Easy – Built-in Shopify averaging tools. |

This comparison, drawn from Shopify’s inventory guides and CRA rules, underscores average cost as the top choice for most Vancouver e-commerce setups due to its simplicity and seamless integration. It minimizes audit risks while handling GST/HST effortlessly, ideal for businesses juggling port delays and multi-channel demands. FIFO works well for fast-turnover imports, but LIFO’s complexities often deter local adoption. Adopting these methods via automated tools like Transcounts’ solutions can boost efficiency, paving the way for reliable growth in the competitive scene.

Vancouver’s e-commerce pulse demands proactive inventory strategies to counter logistical snags, ensuring stores remain agile. By prioritizing compliant, Shopify-friendly methods, owners gain clearer financial visibility, setting the stage for scalable success.

Inventory accounting methods comparison for Vancouver Shopify stores

Understanding these dynamics helps local sellers calculate beginning inventory effectively–starting with physical counts plus prior purchases minus sales, adjusted for Vancouver-specific imports. This foundational step, validated by Shopify’s blog, empowers precise tracking and ties directly to broader service needs.

Transcounts Inventory Services for Vancouver Shopify Sellers

For Vancouver Shopify sellers navigating Inventory Accounting for Shopify in Vancouver, Transcounts offers specialized services that streamline operations in a dynamic e-commerce landscape. As a local firm with over 100 clients, we provide end-to-end bookkeeping tailored to the needs of Canadian online businesses, ensuring accurate tracking and compliance amid cross-border complexities.

Our comprehensive inventory services address key challenges for Shopify stores in Vancouver. We integrate directly with platforms like Shopify for real-time inventory sync, reducing manual errors and supporting Shopify inventory management in Canada through automated updates. Key offerings include:

- Automated tracking and reconciliation: a2x setup for shopify vancouver handles sales data import, matching payouts to orders with 99% accuracy, as built on Shopify’s core inventory management features.

- Inventory valuation and reporting: Detailed financial statements for stock levels, cost of goods sold, and adjustments, customized for Ecommerce inventory accounting in Vancouver.

- Tax compliance tools: Handling GST/HST remittances and provincial sales taxes, with support for U.S. nexus via integrations like TaxJar.

- Fixed-fee pricing: Transparent monthly rates based on transaction volume, starting at scalable plans for small to medium sellers.

These services deliver faster month-end closes and secure cloud access with 24-hour response times. For instance, a local tourism shop reduced reconciliation time by 50% through our local inventory automation, enabling focus on growth.

Transcounts’ Vancouver base ensures Vancouver Shopify reconciliation attuned to regional regulations, positioning us as your trusted partner for efficient, compliant e-commerce finance.

Key Local Considerations for Vancouver Shopify Inventory

Navigating Inventory Accounting for Shopify in Vancouver requires attention to unique local factors that impact e-commerce operations. Vancouver-based sellers must align their practices with Canadian regulations while managing cross-border complexities to avoid costly errors.

Here are key considerations:

- Tax Overview: Handle GST/HST remittance for inventory sales in British Columbia, ensuring accurate BC sales tax tracking. For US sales, BC sellers face nexus thresholds; exceeding $100,000 or 200 transactions annually triggers obligations. Explore us sales tax for bc shopify sellers vancouver for detailed guidance on compliance.

- Supply Chain Factors: Vancouver’s port delays from imports can disrupt stock levels, affecting Vancouver cross-border inventory. Local supply chain nuances, like Pacific Northwest logistics, demand buffer planning to maintain Ecommerce inventory accounting in Vancouver under Canadian valuation rules, such as FIFO or average cost.

- Best Practices: Implement Shopify inventory management Canada tools for real-time tracking, reducing errors by up to 30% through the eight techniques outlined in Shopify’s resources. Integrate CRA-aligned accounting to prevent overstocking and ensure audit-ready records.

Transcounts offers seamless tax add-ons, providing reassuring support for overwhelmed owners to optimize compliance and efficiency.

Getting Started with Shopify Inventory Accounting in Vancouver

Starting with Inventory Accounting for Shopify in Vancouver requires a structured approach to ensure compliance and efficiency for your ecommerce operations. Local sellers can leverage Shopify’s built-in tools alongside expert support from firms like Transcounts to streamline initial Shopify stock setup and ongoing tracking.

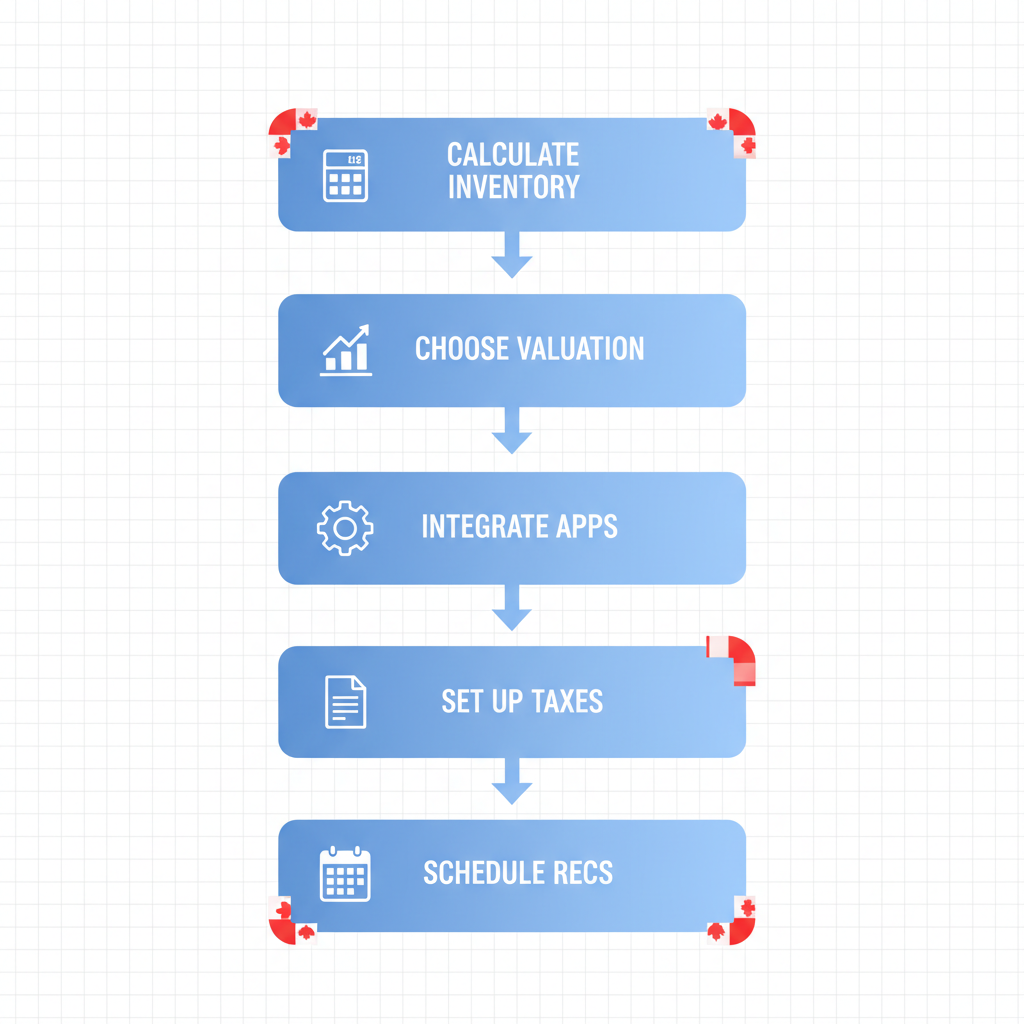

Follow these essential steps for Vancouver inventory onboarding:

- Calculate beginning inventory: Use Shopify’s inventory reports to tally current stock values. Apply the formula from Shopify’s Beginning Inventory guide: Beginning Inventory = Previous Ending Inventory + Purchases – Cost of Goods Sold. For Vancouver retailers, factor in seasonal items like winter apparel to establish accurate baselines.

- Choose a valuation method: Select average cost or FIFO for your Shopify inventory management in Canada. This choice impacts profitability; understanding Contribution Margin Vancouver helps optimize pricing and margins during valuation.

- Integrate automation apps: Connect tools like A2X or TradeGecko via Shopify’s app store for real-time updates, reducing manual errors in Ecommerce inventory accounting in Vancouver.

- Set up tax mappings: Configure GST/HST for Canada and sales tax nexus for US sales within Shopify settings to maintain compliance.

- Schedule monthly reconciliations: Review inventory against sales data regularly to catch discrepancies early.

Transcounts offers a 30-day onboarding process with catch-up discounts, making setup seamless for startups. This guided approach ensures accurate records and scalable growth.

Step-by-step Shopify inventory accounting process for Vancouver sellers

By following these steps, Vancouver ecommerce businesses achieve precise inventory control, minimizing losses and supporting informed financial decisions.

Optimizing Your Shopify Inventory Accounting in Vancouver

Mastering Inventory Accounting for Shopify in Vancouver ensures seamless operations amid local regulations. By recapping key methods like real-time tracking and automated reconciliation, alongside Shopify inventory management in Canada and Ecommerce inventory accounting in Vancouver, businesses achieve optimized local Shopify tracking and Vancouver e-commerce compliance. As Shopify’s inventory techniques blog notes, these eight proven strategies minimize losses through better forecasting.

The benefits include accurate inventory valuation and scalable growth support, enhanced by following ecommerce bookkeeping best practices. Partner with Vancouver experts at Transcounts for automated, audit-ready books tailored to your e-commerce needs.

Ready to elevate your operations? Schedule a consultation with Transcounts today for personalized guidance.

Resources

Inventory Accounting for Shopify VancouverSKU Margin Reporting Vancouver EcommerceContribution Margin Vancouver