Table of Contents

Essential Bookkeeping for Ecommerce in Surrey, British Columbia

Running an ecommerce business in Surrey, British Columbia, presents unique financial hurdles like handling cross-border sales taxes, tracking inventory across channels, and reconciling Shopify transactions. An experienced Ecommerce Bookkeeper in Surrey, British Columbia, becomes essential for maintaining accurate records amid these demands, ensuring seamless online store financial management in Surrey BC.

Transcounts stands out as a leading provider of Shopify bookkeeping services in Surrey, offering 100% online delivery powered by QuickBooks and Xero. These platforms provide cloud integration and scalability, ideal for Canadian ecommerce per BDC insights on low-cost accounting options. With fixed monthly fees based on transaction volume and over 100 clients across Canada and the US, Transcounts delivers Canadian bookkeeping services tailored to local needs, including provincial sales tax compliance for Ecommerce accounting in Surrey, British Columbia.

This guide explores local ecommerce finance solutions, from service costs and software choices to getting started steps. Busy Surrey sellers can empower their growth by contacting Transcounts for a personalized quote today.

Overview of the Ecommerce Bookkeeper in Surrey, British Columbia’s Landscape

Surrey, British Columbia, has emerged as a vibrant hub for ecommerce, fueled by tech startups and online sellers capitalizing on the region’s proximity to major ports and urban markets. Local businesses face unique challenges in managing sales tax across provinces and integrating inventory with platforms like Shopify. An Ecommerce Bookkeeper in Surrey, British Columbia plays a crucial role in streamlining these operations, ensuring compliance with BC regulations while supporting growth in digital sales.

Typical services in this landscape include end-to-end inventory reporting, sales tax reconciliation for GST/HST, and automated payroll processing. Providers often focus on Shopify bookkeeping services in Surrey to handle order data and multi-channel sales. Popular software like QuickBooks and Xero dominate due to their robust ecommerce features, such as bank reconciliations and real-time financial dashboards tailored for BC online sales accounting. These tools help track high-volume transactions common among local online retailers, answering questions like the best bookkeeping software for ecommerce in BC by offering seamless integrations and provincial tax automation.

When evaluating ecommerce accounting in Surrey, British Columbia, businesses should consider expertise in cross-border compliance, pricing transparency, and technology adoption. The competitive scene includes specialized firms alongside generalists, with expansions into nearby areas like Ecommerce Bookkeeping Richmond BC highlighting regional scalability.

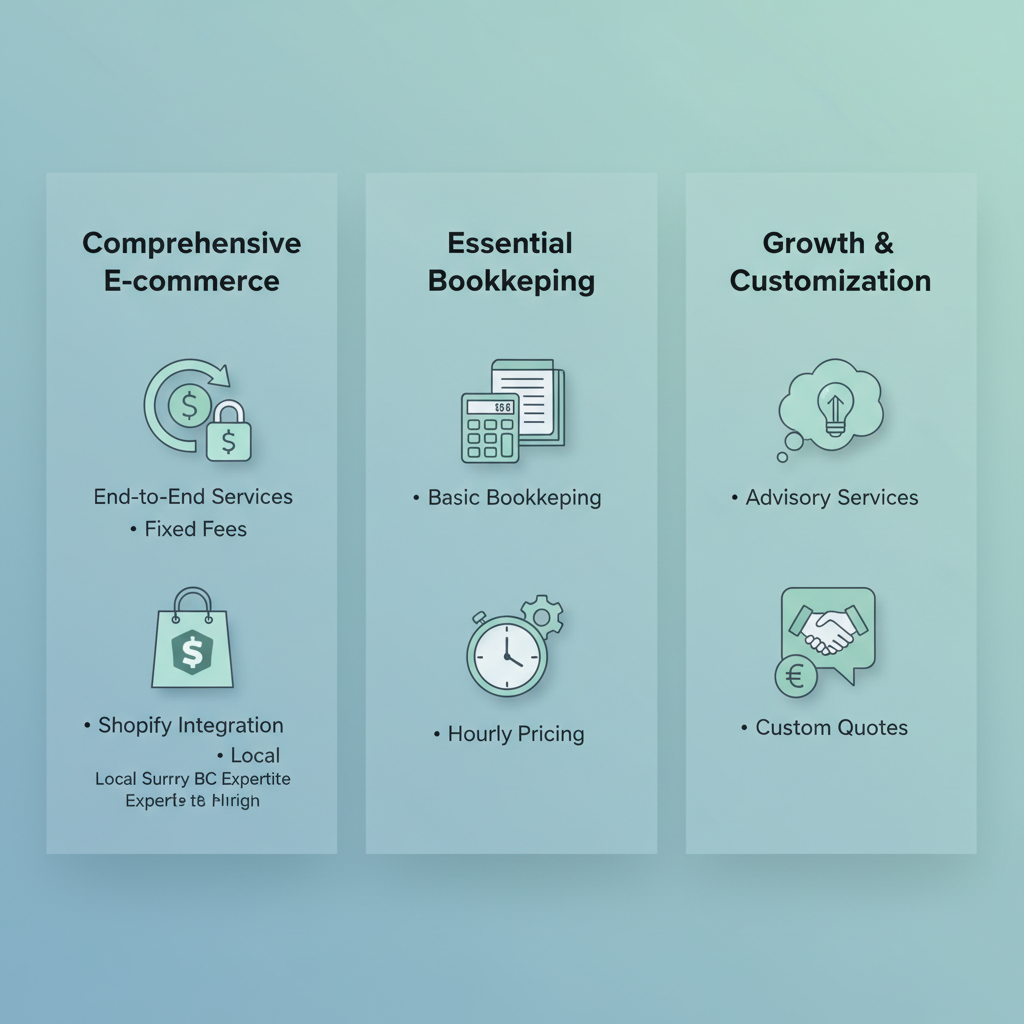

The following table compares key local providers in Surrey and nearby areas based on services, pricing, and integrations to help ecommerce owners evaluate options:

| Provider | Core Services | Pricing Model | Key Integrations | Local Focus |

|---|---|---|---|---|

| Transcounts | End-to-end bookkeeping, payroll, tax compliance, fractional CFO | Fixed monthly fees based on transaction volume | QuickBooks, Xero, Shopify, A2X | Surrey BC and cross-border Canada/US expertise |

| Local Competitor A (e.g., Maje Accounting) | Basic bookkeeping, tax filing | Hourly or project-based | QuickBooks, limited ecommerce tools | General Surrey focus |

| Local Competitor B (e.g., Accedge) | Accounting and advisory | Custom quotes | Xero, standard integrations | BC-wide with Surrey coverage |

This comparison reveals Transcounts’ edge in ecommerce-specific tools and fixed pricing, contrasting with competitors’ more variable models and limited integrations, as noted from provider sites and BDC resources. Maje Accounting offers basic tax support but lacks deep Shopify ties, while Accedge provides advisory without strong ecommerce focus, underscoring gaps in specialized Surrey ecommerce financial tracking.

Comparison of top ecommerce bookkeeping providers in Surrey, BC

Transcounts stands out with its fixed-fee approach and Shopify expertise, ideal for Surrey sellers navigating BC online sales accounting complexities.

Available Ecommerce Bookkeeping Services in Surrey

For online sellers in Surrey, British Columbia, finding a reliable Ecommerce Bookkeeper in Surrey, British Columbia can simplify the complexities of managing digital sales. Local providers offer tailored solutions that address the unique demands of ecommerce operations, ensuring compliance and efficiency. Transcounts stands out with its comprehensive Ecommerce Accounting Burnaby extensions that support nearby areas, making Shopify bookkeeping services in Surrey accessible and seamless.

Core ecommerce bookkeeping services available include:

- Invoicing and bank reconciliations to track sales from platforms like Shopify accurately.

- Year-end reporting and GST/HST handling, crucial for Surrey online store tax handling under Canadian regulations.

- Inventory management integrated with sales channels to prevent stock discrepancies in multi-channel setups, such as a Surrey-based clothing brand syncing Amazon and Etsy data.

Specialized offerings extend to payroll automation via Wagepoint for BC ecommerce payroll solutions, streamlining employee payments for growing teams. For businesses with US sales, tax nexus support helps navigate cross-border compliance without the headaches of manual filings. As highlighted in general accounting FAQs from firms like WIO, common services often lack deep ecommerce focus, but Transcounts differentiates with A2X for Shopify sync, reducing reconciliation time by up to 80%. SOM Accounting’s integration examples validate this tech-driven approach, emphasizing automated workflows for accurate financials.

Transcounts delivers these Ecommerce accounting in Surrey, British Columbia through a 100% online model with 24-hour response times and custom KPI dashboards. Bundled AP/AR services enhance efficiency, providing overwhelmed owners with peace of mind and scalable support tailored to local needs.

Key Local Factors for Ecommerce Bookkeeping in Surrey

When running an online store in Surrey, British Columbia, hiring an Ecommerce Bookkeeper in Surrey, British Columbia, becomes essential for navigating local financial nuances. Many owners worry about costs, but options like fixed monthly fees based on transaction volume offer predictability over hourly rates, which can vary from $50 to $150 per hour depending on complexity. This model suits growing ecommerce businesses, keeping expenses aligned with revenue.

Tax compliance adds another layer, with GST/HST at 5% federally, plus British Columbia’s provincial sales tax considerations for local sales. For cross-border operations, US sales tax nexus requires careful tracking to avoid penalties. Common ecommerce bookkeeping pitfalls include overlooking these rules, leading to audits or fines in Surrey BC tax optimization efforts. Providers experienced in Shopify bookkeeping services in Surrey ensure accurate filings and deductions.

Selecting a reliable partner involves these tips: 1) Check for certifications like CPA or QuickBooks ProAdvisor status; 2) Evaluate response times, aiming for under 24 hours; 3) Review client testimonials for local ecommerce cost management. Transcounts, with its Vancouver base, excels here, offering fixed fees, catch-up discounts up to 20%, and audit support tailored to BC regulations–ideal for startups seeking affordable Ecommerce accounting in Surrey, British Columbia.

Ultimately, prioritizing compliant, cost-effective services safeguards your business growth while minimizing surprises.

Steps to Begin Ecommerce Bookkeeping in Surrey

Starting as an Ecommerce Bookkeeper in Surrey, British Columbia, requires a structured approach to ensure your online business stays compliant and efficient. Local providers like SOM Accounting Services offer traditional setups, but for ecommerce sellers, specialized support accelerates the process. Begin by researching reliable options through online reviews on Google and verifying NAP consistency for credibility in the area.

Follow these five key steps to launch your Shopify bookkeeping services in Surrey:

- Research Providers: Search for Ecommerce accounting in Surrey, British Columbia, focusing on those experienced with platforms like Shopify. Check client testimonials and local directories to identify firms with strong reputations for handling sales tax and inventory tracking.

- Request Quotes: Contact shortlisted accountants for customized quotes based on your transaction volume. Inquire about fixed fees and integration capabilities to align with starting local ecommerce finances.

- Schedule Initial Consultation: Discuss your specific needs, such as GST/HST compliance and multi-channel sales. Explore ecommerce bookkeeping solutions that integrate seamlessly with your store for automated reconciliations.

- Onboard Documents: Upload financial records, bank statements, and sales data to the provider’s secure portal. This Surrey bookkeeping onboarding step ensures quick setup within days, unlike longer traditional processes.

- Implement and Monitor: Work with a dedicated success manager for software configuration and training. Transcounts completes this in 30 days, providing CFO-level insights tailored for Surrey ecommerce owners.

Five-step process to begin ecommerce bookkeeping in Surrey with Transcounts

For tips, prioritize providers offering cloud-based tools like QuickBooks for real-time visibility. Contact Transcounts today for a free consultation to streamline your setup and focus on growth.

Streamlining Your Ecommerce Finances in Surrey

As an Ecommerce Bookkeeper in Surrey, British Columbia, Transcounts addresses local challenges like complex sales tax and inventory tracking through tailored Shopify bookkeeping services in Surrey and comprehensive Ecommerce accounting in Surrey, British Columbia. Our integrations with tools recommended in the BDC’s accounting software guide ensure optimized Surrey ecommerce operations and robust BC financial growth strategies.

Experience the benefits of fixed fees, quick onboarding, and ecommerce tax savings bookkeeping for compliant growth. Contact Transcounts today for a free quote and unlock scalable CFO insights at affordable rates.

Resources

Ecommerce Bookkeeper Surrey BCEcommerce Accounting BurnabyEcommerce Bookkeeping Richmond BC