Table of Contents

Mastering Cash Flow Forecasting in Vancouver, BC

Vancouver’s vibrant economy, driven by seasonal tourism and booming tech startups, presents unique cash flow challenges for small businesses. High operational costs and variable revenues make cash flow forecasting in Vancouver, BC, essential for survival and growth. This practice involves projecting inflows and outflows to anticipate shortfalls and seize opportunities amid rising interest rates and supply chain disruptions.

For BC small businesses, accurate financial planning in Vancouver helps navigate complexities like the 7% Provincial Sales Tax (PST). Tools like QuickBooks enable real-time data integration for reliable cash flow management in Vancouver, supporting informed decisions that boost resilience.

Transcounts specializes in financial forecasting services in BC, offering expert cash flow projection for BC businesses using QuickBooks and Xero. Our KPI Dashboard for Small Business Vancouver provides actionable insights. This guide explores local challenges, our tailored solutions, and proven strategies to stabilize your finances.

Vancouver’s Business Landscape and Cash Flow Challenges

Vancouver’s business scene thrives on a mix of tech innovation, tourism vibrancy, and retail resilience, positioning it as a key economic hub in British Columbia. The city’s tech boom in areas like Yaletown attracts startups, while downtown tourism drives seasonal revenues for hospitality businesses. However, high living costs and economic policies strain operations, making cash flow forecasting in Vancouver, BC, essential for sustainability. According to the BDC 2025 economic outlook, BC’s projected GDP growth of 2.1% underscores the need for adaptive financial strategies amid rising expenses.

Small businesses and startups often grapple with cash flow pain points such as volatile seasonal revenues from tourism fluctuations and high overheads like rental costs in prime districts. BC-specific taxes, including PST on imports as noted in the BC Budget 2025 fiscal plan, add complexity, delaying profitability. Effective cash flow management in Vancouver requires addressing delayed client payments and inventory holding costs, particularly for e-commerce retailers in East Vancouver facing supply chain disruptions. These challenges highlight the demand for tailored Vancouver cash projection techniques to ensure steady operations.

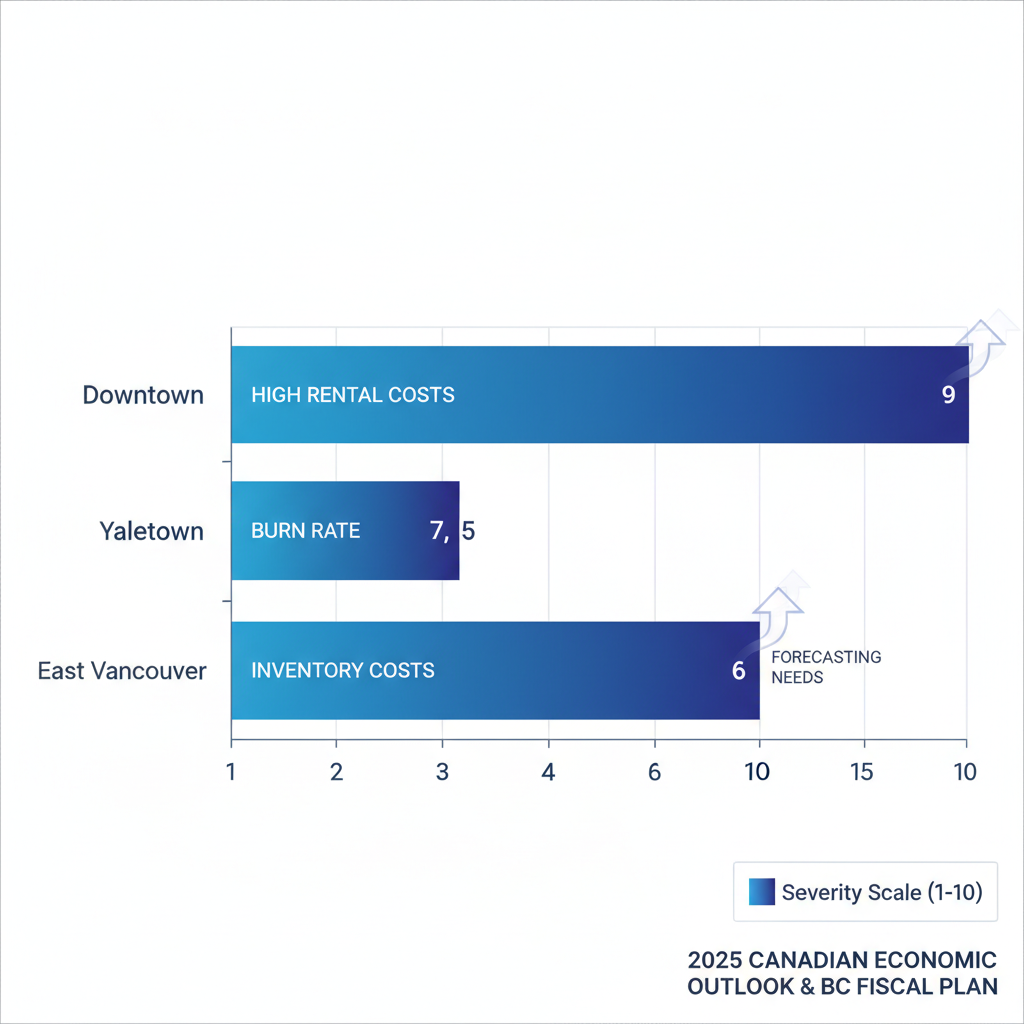

Vancouver’s diverse districts present unique hurdles, from downtown’s tourism-driven volatility to Yaletown’s funding cycles and East Vancouver’s retail mixes. The following table compares these cash flow challenges across key areas, emphasizing forecasting needs for small businesses and startups. Data sourced from BDC 2025 economic outlook for BC businesses and local stats from Vancouver Economic Commission reports.

| Vancouver Area | Common Cash Flow Challenges | Key Forecasting Needs |

|---|---|---|

| Downtown Vancouver | High rental costs and tourism seasonality lead to volatile revenues. Delayed client payments from international trade; high fixed expenses. | Scenario planning for peak/off-peak months; integration with tourism data. |

| Yaletown Tech Hub | Rapid startup growth with investor funding cycles. Burn rate management; irregular funding inflows. | Burn rate projections; VC milestone alignments. |

| East Vancouver Retail | E-commerce and local sales mix with supply chain disruptions. Inventory holding costs; PST on imports. | Inventory turnover forecasts; tax impact modeling. |

This comparison reveals how Downtown businesses benefit from seasonal models to buffer tourism dips, while Yaletown startups need burn rate projections aligned with VC milestones. East Vancouver retailers require inventory forecasts incorporating tax impacts for smoother cash flows. Such insights drive the value of financial forecasting services in BC, where firms like Transcounts offer local expertise in BC financial planning essentials, including scenario planning and tax modeling to mitigate risks.

For instance, a Yaletown tech startup might use these projections to time funding rounds amid irregular inflows, avoiding cash shortages during growth phases. Transcounts’ tailored approaches, drawing on Vancouver-specific data, empower businesses to navigate these district-unique pressures. Implementing small business accounting tips vancouver, such as regular reconciliations and KPI dashboards, further enhances visibility and decision-making. This strategic focus not only stabilizes operations but also supports scalable growth in a competitive landscape.

Cash flow challenges visualization for Vancouver business districts

Building on these visualizations, businesses can prioritize high-severity areas like Downtown’s volatility, integrating advanced tools for proactive management and long-term resilience.

Available Cash Flow Forecasting Services in Vancouver

Vancouver businesses, especially startups and SMEs in sectors like e-commerce, often seek reliable cash flow forecasting in Vancouver, BC, to navigate seasonal fluctuations and growth challenges. These services provide essential projections that integrate with daily operations, ensuring financial stability amid BC’s dynamic economy.

Core cash flow forecasting services available locally include comprehensive forecasting, ongoing management, and tax-integrated projections tailored for Canadian regulations. Drawing from established steps like those outlined by BDC Canada, professionals guide businesses through sales estimation, expense tracking, and scenario planning to create realistic forecasts. For cash flow management in Vancouver, options range from standalone consulting to bundled packages that combine forecasting with bookkeeping and advisory support. Fractional CFO engagements stand out, offering KPI dashboards and variance analysis without full-time costs–benefits like up to 70% savings on traditional hires, as noted in part-time CFO resources, make them ideal for local firms.

Transcounts leads with its 100% online model, delivering financial forecasting services in BC through seamless integrations with tools like QuickBooks. Their fixed-fee structure scales with transaction volume, starting affordably for small operations and including custom quotes for complex needs. Key features encompass:

- Automated cash flow projections with real-time dashboards

- Tax-compliant reporting for GST/HST and provincial sales taxes

- Variance analysis to adjust strategies mid-month

Bundled options pair forecasting with Month End Close Services Vancouver, streamlining reviews, while standalone focuses on advisory for targeted insights like Vancouver projection consulting.

This online accessibility suits Vancouver clients perfectly, eliminating in-person needs while adapting to BC-specific rules. A local e-commerce owner shared, “Transcounts’ BC cash flow advisory turned our projections into actionable growth tools–predictable finances boosted our scaling confidence.” From remote tech startups to urban nonprofits, these services ensure inclusive support across industries.

Key Local Factors Influencing Cash Flow in BC

In Vancouver’s dynamic business landscape, cash flow forecasting in Vancouver, BC requires careful attention to provincial taxes and regulations. Businesses face BC PST and GST, which can significantly alter projections if not accounted for properly. For instance, tech startups often overlook these taxes during rapid scaling, leading to unexpected cash shortfalls. Transcounts integrates these local tax nuances into its financial forecasting services in BC, ensuring accurate BC-specific cash projections that minimize compliance risks and optimize liquidity.

Economic conditions in Vancouver further influence cash flow management. Inflation rates, currently hovering around 3-4% in the region, erode purchasing power and squeeze margins for small businesses. Rising labor costs, driven by BC’s minimum wage increases and competitive tech sector salaries, add pressure on operational budgets. Nonprofits, in particular, must navigate funding volatility amid these factors, while startups balance growth investments against Vancouver regulatory planning demands. These elements highlight the need for tailored strategies to maintain stable cash positions.

To address local compliance, Transcounts leverages tools like TaxJar integration with QuickBooks, which automates BC sales tax calculations for seamless forecasting. This supports cash flow management in Vancouver by reducing manual errors and providing real-time insights. For nonprofits and startups, cash flow management tips non-profits vancouver emphasize budgeting for seasonal donations and grant cycles. Professional services, starting at fixed monthly fees based on transaction volume, deliver these efficiencies without high upfront costs, empowering businesses to focus on growth.

Steps to Begin Cash Flow Forecasting with Transcounts

Starting cash flow forecasting in Vancouver, BC, can transform how your business manages finances, especially for startups navigating tight budgets. Transcounts offers a streamlined onboarding process designed for BC operations, typically completed within 30 days. Begin by scheduling a free consultation through our website to discuss your needs. Next, upload essential documents like bank statements, invoices, and prior financials via our secure portal. Our team handles integration with tools like QuickBooks or Xero, ensuring seamless data flow for accurate projections.

The core process involves data integration for historical trends, followed by creating an initial 12-month forecast tailored to your revenue volume. Costs for financial forecasting services in BC start at fixed monthly fees of $500 for businesses under $100K annual revenue, scaling to $1,500 for larger operations, with custom quotes available. This approach, inspired by proven projection steps, includes variance analysis and scenario planning to enhance cash flow management in Vancouver. As part of broader services, consider accounts payable outsourcing vancouver to optimize outflows alongside forecasting.

For Vancouver startups, focus on startup cash planning in Vancouver by prioritizing seasonal adjustments like tourism fluctuations. Our BC forecast initiation tips include monthly reviews to spot issues early and leveraging automation for efficiency. Contact Transcounts today to kickstart your forecasting journey and gain predictable financial visibility.

Five-step vertical process for initiating cash flow forecasting services

Achieve Financial Stability Through Vancouver Cash Flow Expertise

In Vancouver’s dynamic business environment, embracing cash flow forecasting in Vancouver, BC, empowers SMEs with superior planning, precise cost control, and seamless compliance. Transcounts delivers innovative financial forecasting services in BC through our online model, fractional CFO expertise, and rapid onboarding, including specialized ecommerce fractional controller vancouver for growing e-tailers. Contact Transcounts today to secure Vancouver financial security.

With BC growth projections from BDC’s 2025 outlook highlighting robust opportunities, proactive cash flow management in Vancouver positions your business for sustainable success and expansion.

Resources

Cash Flow Forecasting Vancouver BCKPI Dashboard for Small Business VancouverMonth End Close Services Vancouver