Table of Contents

Biweekly Payroll Processing Essentials in Surrey, BC

In the bustling business landscape of Surrey, BC, where e-commerce and tech startups thrive, managing biweekly payroll processing in Surrey, BC can present unique challenges for small businesses. This pay schedule, occurring every two weeks, demands precision to ensure timely direct deposits and remittances, aligning with provincial regulations and federal guidelines outlined in the CRA’s Employer’s Guide on Payroll Deductions and Remittances.

Transcounts, a Vancouver-based firm specializing in Payroll Services Surrey BC, offers seamless solutions through integration with QuickBooks and Wagepoint. Their online model automates local payroll automation for Surrey businesses, handling employee onboarding, statutory deductions, and GST/HST remittances with fixed monthly fees. For instance, a local tech startup with 10 employees can rely on this system for error-free biweekly payroll in Canada, freeing up time for growth.

The benefits are clear: predictable cash flow reduces financial stress, while consistent payments boost employee satisfaction and retention. As businesses navigate semi-monthly pay scheduling in British Columbia, Transcounts ensures compliance without complexity, setting the stage for deeper insights into Surrey’s specific needs.

Payroll Landscape for Businesses in Surrey, BC

Surrey, BC, hosts a vibrant mix of startups, contractors, and nonprofits in its expanding e-commerce and tech sectors. These businesses often rely on Quickbooks Payroll Surrey for seamless integration. Biweekly payroll processing in Surrey, BC, meets the needs of agencies managing contractor pay amid rapid growth. With payroll services in Surrey, BC, evolving to handle local demands, companies seek reliable options for efficient operations.

Biweekly payroll in Canada involves 26 pay periods annually, aligning with employee preferences for consistent income. This cycle supports cash flow predictability, especially for seasonal e-commerce firms. Under BC Employment Standards, employers must process deductions accurately, including CPP, EI, and income tax remittances to the CRA. Software integration streamlines these tasks, ensuring timely direct deposits and record-keeping.

Local challenges include statutory holidays like BC Day, which require prorated pay adjustments and can disrupt biweekly cycles for tech startups. Remittances must comply with provincial regulations, while e-commerce businesses face added complexity from sales tax nexus. Nonprofits often struggle with variable funding impacting pay schedules.

Surrey’s unique payroll hurdles, such as holiday effects on e-commerce workflows, demand adaptable solutions.

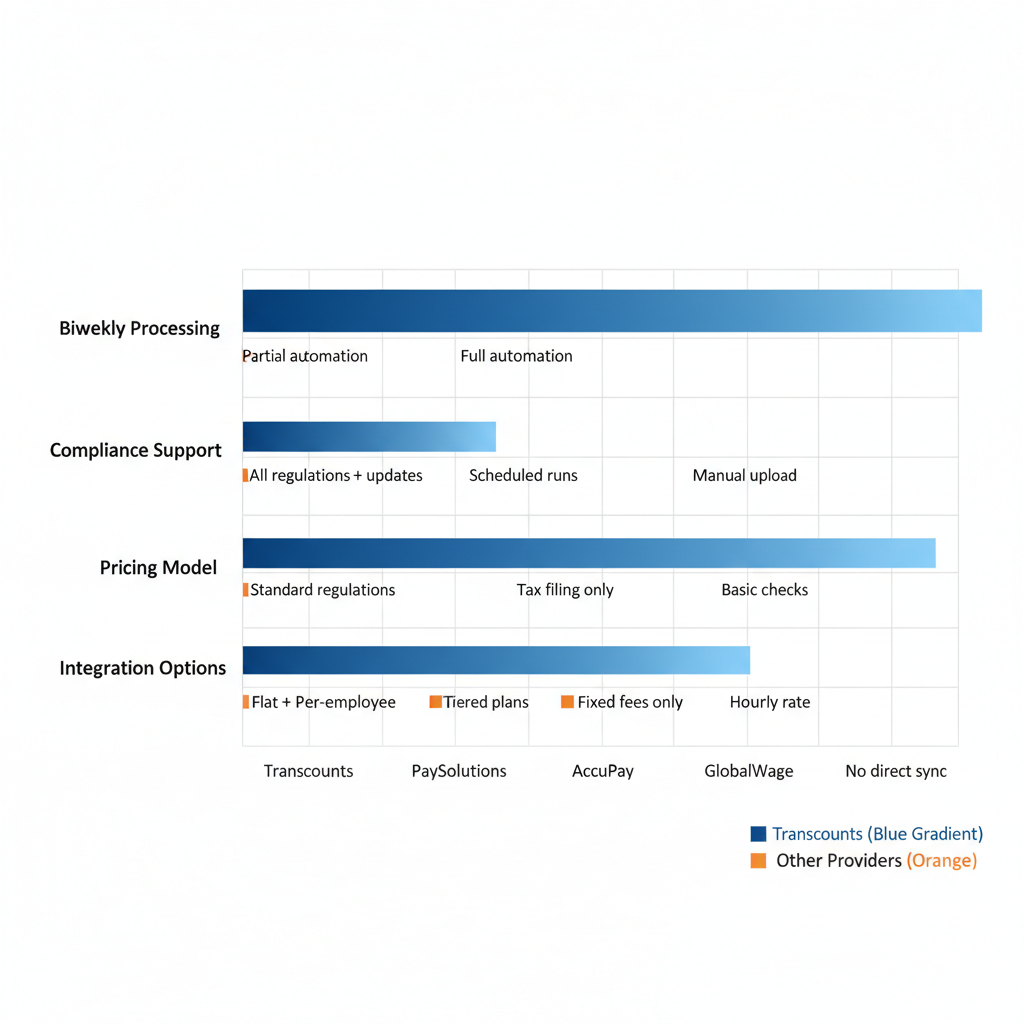

| Provider | Biweekly Processing | Compliance Support | Pricing Model | Integration Options |

|---|---|---|---|---|

| Transcounts | Full automation for 26 pay periods, direct deposits via Wagepoint | CRA/IRS compliant, statutory holiday adjustments | Fixed monthly fees based on transactions | QuickBooks, Xero, A2X, TaxJar |

| Payless Income Tax | Basic biweekly setup, manual remittances | GST/HST support, limited provincial | Per-employee or hourly | Limited to basic software |

| WIO Accounting | Standard biweekly handling, BC-focused compliance | BC regulations, sales tax nexus | Custom quotes, volume-based | QuickBooks primary |

| Local Freelancers | Variable, often inconsistent for holidays | Basic CRA filings, no advanced support | Project-based, unpredictable | Manual or basic tools |

This comparison, drawn from provider details and CRA guidelines, shows Transcounts leading in automation for Surrey tech firms. Unlike Payless Income Tax’s manual methods or WIO Accounting’s regional focus, Transcounts offers scalable biweekly payroll in Canada with robust integrations. Local freelancers provide flexibility but lack consistency for holiday adjustments.

Evaluating these options helps Surrey businesses select providers matching their volume and compliance needs. For instance, e-commerce operators benefit from advanced tools that automate remittances and ensure audit-ready books. This tech edge supports faster month-end closes, vital for growth-oriented firms.

Payroll providers feature comparison for Surrey, BC businesses

Transcounts stands out with its fixed-fee model, delivering efficient Surrey-area pay cycle management for small businesses facing these challenges.

Access to Biweekly Payroll Services in Surrey, BC

For businesses seeking efficient biweekly payroll processing in Surrey, BC, Transcounts offers comprehensive payroll services for businesses tailored to local needs. As a Vancouver-based firm with a 100% online model, Transcounts streamlines operations for small to medium enterprises, including e-commerce sellers and nonprofits. According to Rise People’s guide on pay periods, biweekly cycles reduce administrative burdens by aligning payments with consistent employee schedules, making it ideal for payroll services in Surrey, BC.

Transcounts’ biweekly payroll in Canada begins with seamless employee onboarding, followed by automated direct deposits every two weeks. The process includes:

- Secure data upload for new hires, ensuring compliance with BC employment standards.

- Automated calculation of deductions like CPP, EI, and provincial taxes.

- Timely remittance filing to CRA, with electronic submissions for accuracy.

This structured approach minimizes errors and saves time for busy Surrey teams.

Availability extends across Surrey and Greater Vancouver, with 24-hour response times via dedicated success managers. Remote businesses benefit from cloud-based access, eliminating the need for in-person visits and supporting Surrey biweekly pay automation from anywhere. Transcounts handles local BC requirements, such as payroll deductions for WorkSafeBC premiums, ensuring hassle-free operations.

Pricing follows a fixed-fee model based on transaction volume, offering predictability for startups. Integrations enhance efficiency:

- Wagepoint for direct deposits and employee self-service portals.

- QuickBooks for synchronized biweekly cycles and real-time reporting.

An e-commerce seller in Surrey, for instance, can automate remittances through these tools, cutting processing time by half while maintaining tax compliance via partnerships.

These Canadian payroll outsourcing in BC solutions scale with growth, providing CFO-level insights at accessible costs to support regional expansion.

Key Regulations for Biweekly Payroll in Surrey, BC

Navigating biweekly payroll processing in Surrey, BC requires understanding local rules to ensure smooth operations for businesses. With 26 pay periods annually, deductions for income tax, CPP, and EI must be evenly distributed per Canada Revenue Agency (CRA) guidelines from the Payroll Deductions Tables. This approach minimizes discrepancies and supports efficient payroll services in Surrey, BC, while aligning with biweekly payroll in Canada standards.

Key regulations include:

- Income Tax and Contributions: Calculate deductions using CRA tables for biweekly cycles, ensuring remittances by the 15th of the following month to avoid penalties.

- Statutory Holidays: Under BC Employment Standards, prorate pay for holidays falling mid-period or add premium pay for shifts on those days, like BC Day for a Surrey contractor.

- Sales Taxes: Remit GST/HST quarterly and provincial sales tax monthly, considering US sales nexus for e-commerce firms in Surrey.

Handling statutory holidays involves BC regulatory payroll adjustments, such as prorating a employee’s pay if the holiday splits a biweekly cycle. For tax implications, the payroll taxes impact on business requires timely remittances to maintain Surrey tax-compliant pay cycles. Common pitfalls, like holiday shifts disrupting cycles, can lead to non-compliance fines up to $500 per violation. Transcounts provides expert support for CRA notices and audit documentation, safeguarding your operations.

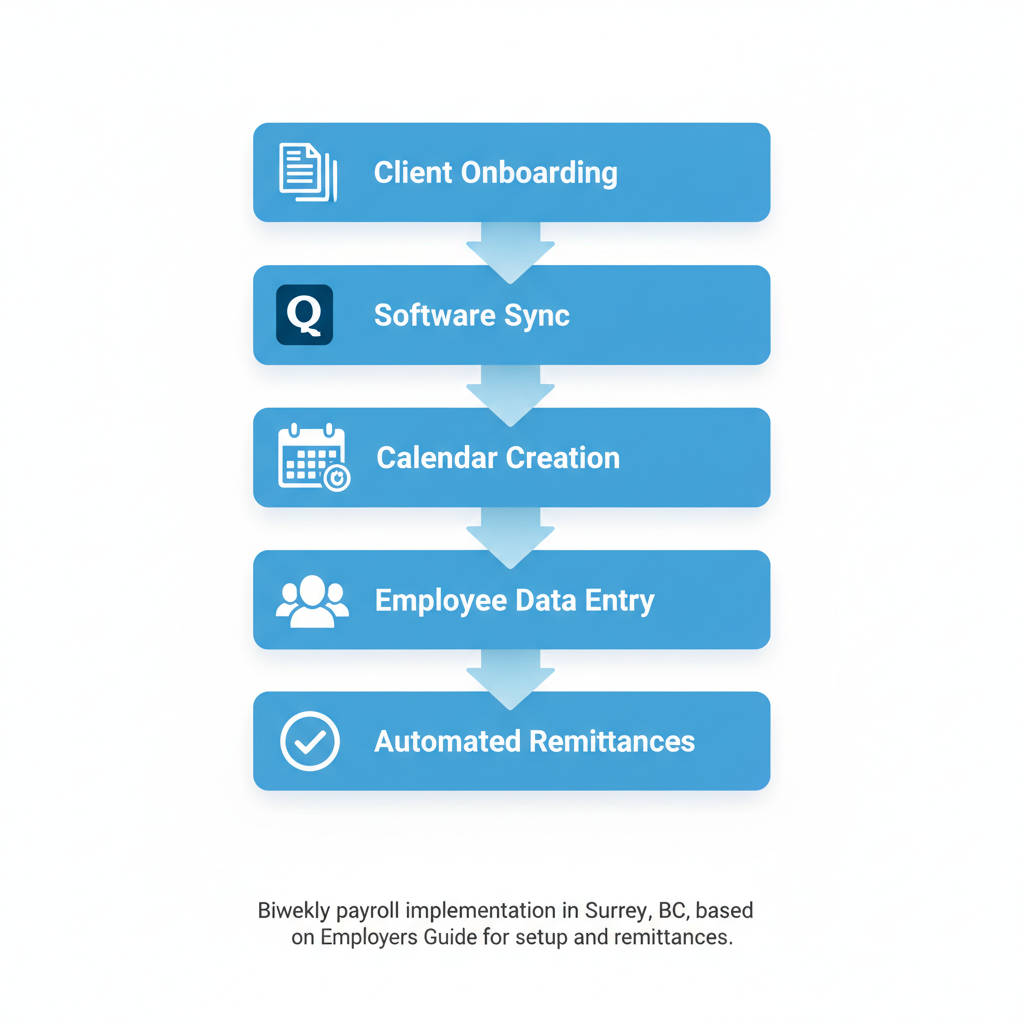

Steps to Implement Biweekly Payroll in Surrey, BC

Starting biweekly payroll processing in Surrey, BC, can streamline operations for local businesses like tech agencies syncing with QuickBooks. Transcounts offers a seamless transition to efficient payroll services in Surrey, BC, ensuring compliance with Canadian regulations. This Canadian biweekly setup guide outlines a straightforward path to get you up and running.

- Onboarding Phase (Days 1-30): Begin with client intake to gather your business details and employee information. Transcounts handles software synchronization, integrating platforms like QuickBooks or Xero for smooth data transfer. For existing books, explore catch-up options to reconcile past records quickly.

- Setup for Biweekly Cycles: Create a customized payroll calendar aligned with biweekly pay dates, factoring in holidays to avoid disruptions. Enter employee data, including tax withholdings per the CRA Employer’s Guide, which specifies deduction timelines for accurate remittances.

- Remittance and Compliance Handling: Automate CRA filings to remit deductions on time, reducing manual errors and penalties. This setup supports direct deposits and holiday pay adjustments seamlessly.

Transcounts provides dedicated success managers for ongoing support, with 24-hour response times to address queries. Discover outsourcing payroll benefits, including significant cost savings and expert compliance, making starting Surrey pay systems a smart choice for growth.

Steps to implement biweekly payroll in Surrey, BC

Optimize Your Payroll Operations in Surrey, BC

Embracing biweekly payroll processing in Surrey, BC, transforms business operations with 26 even pay periods, seamless holiday handling, and effortless remittances. Transcounts delivers these advantages through automation that helps streamline payroll process, reducing compliance risks for local firms. Our fixed-fee payroll services in Surrey, BC, integrate smoothly for enhanced Surrey payroll efficiency.

Biweekly payroll in Canada ensures consistent cash flow and employee satisfaction, as noted in expert guides on pay periods. Outsourcing to Transcounts avoids costly errors while optimizing BC pay strategies.

Ready to elevate your finances? Contact Transcounts today for onboarding and focus on growth with worry-free payroll.

Resources

Biweekly Payroll Processing SurreyQuickbooks Payroll SurreyPayroll Services Surrey BC