Table of Contents

Streamlining Accounts Payable for Vancouver Businesses

In Vancouver’s fast-paced business environment, where high operational costs and GST/HST compliance add pressure, Accounts Payable Outsourcing in Vancouver emerges as a vital solution. Local startups and e-commerce sellers often struggle with manual invoice processing, leading to errors and cash flow delays that hinder growth in British Columbia’s tech ecosystem.

Accounts payable outsourcing involves external experts managing invoice reconciliation, approvals, and timely vendor payments, freeing businesses to focus on core activities. For SMEs handling cross-border trade, accounts payable services in Vancouver reduce processing time by 60% through automation, as seen in Canadian practices. Transcounts integrates QuickBooks and Xero for seamless AP management for local firms, complemented by Accounts Receivable Management Vancouver to optimize cash flow. Outsourced bookkeeping in Vancouver ensures compliance and efficiency amid surging transactions.

This guide explores these services, local factors, and steps to get started, helping your firm thrive with external finance handling in BC.

Vancouver Business Finance Landscape

Vancouver’s vibrant economy blends tech startups, e-commerce ventures, and nonprofits, creating a dynamic landscape for business finance. With rapid growth in the Lower Mainland, many companies face mounting accounts payable challenges. Accounts Payable Outsourcing in Vancouver emerges as a key solution, helping firms manage high transaction volumes amid GST/HST compliance and cross-border trade pressures. This approach streamlines operations for diverse sectors, from downtown innovators to suburban retailers.

High-density areas like Yaletown and Downtown Core often grapple with manual processing delays and error rates exceeding 15 percent in vendor payments. These pain points disrupt cash flow and expose businesses to penalties on remittances. Bill Pay Services for Small Business Vancouver address these issues by automating approvals and integrations, reducing errors while ensuring timely payments. Opportunities arise as 70 percent of Vancouver SMEs plan to outsource AP by 2025, per industry trends, fostering efficiency in local AP efficiency solutions.

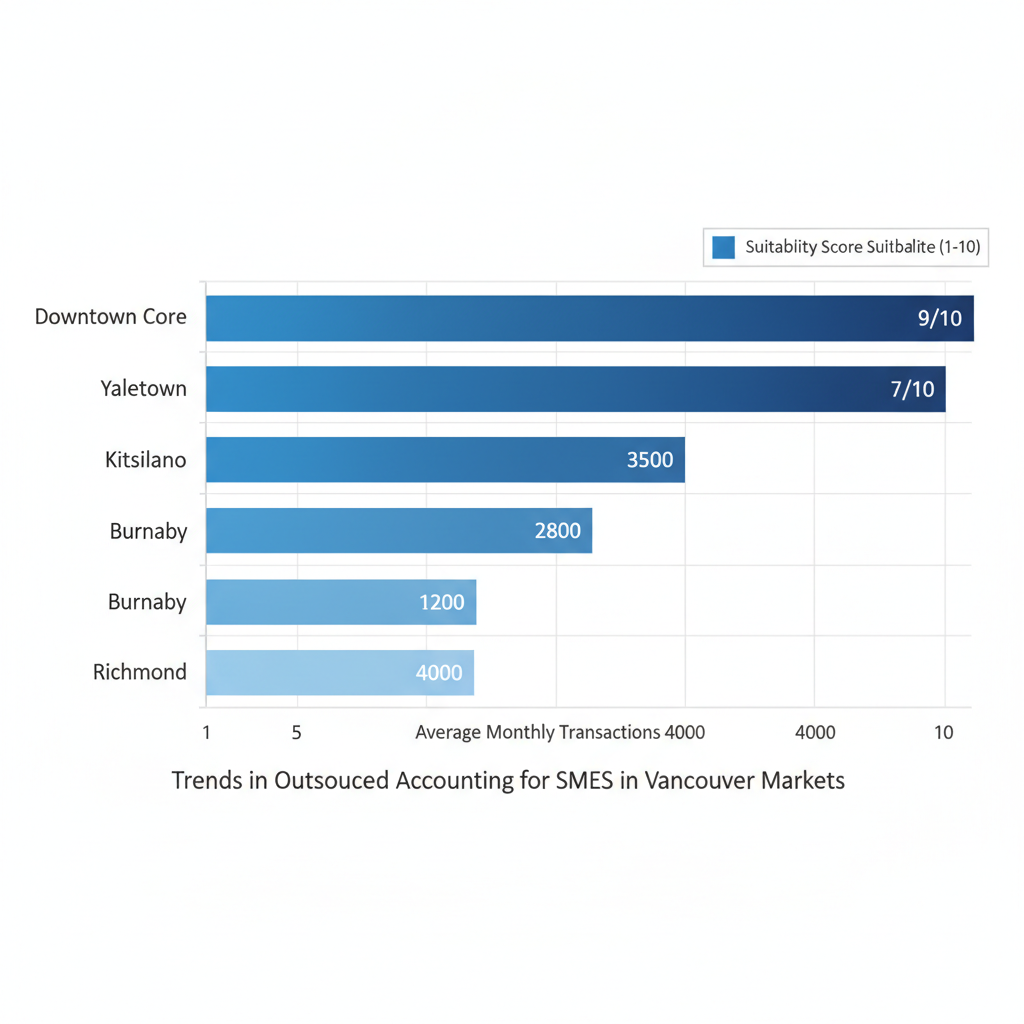

Vancouver’s urban spread influences outsourcing needs, with factors like business density, average monthly transactions, and proximity to providers determining suitability. Areas with high SME concentrations and complex volumes benefit most from specialized accounts payable services in Vancouver, supporting tech adoption and compliance.

| Area | Business Density (SMEs per sq km) | Avg. Monthly Transactions | Outsourcing Suitability Score (1-10) |

|---|---|---|---|

| Downtown Core | High (450+ SMEs) | 1500-3000 | 9/10 (Ideal for high-volume e-commerce) |

| Yaletown | Very High (500+ startups) | 2000-4000 | 10/10 (Tech hub with QuickBooks integration needs) |

| Kitsilano | Medium (250 SMEs) | 800-1500 | 7/10 (Suitable for retail and nonprofits) |

| Burnaby | High (400+) | 1200-2500 | 8/10 (Suburban access for cross-border trade) |

| Richmond | Medium-High (350+ e-commerce) | 1000-2200 | 9/10 (Proximity to US border for sales tax support) |

Data sourced from BC Business Registry and Transcounts client insights; Suitability based on transaction complexity, tech adoption, and proximity to service providers. This comparison highlights how Yaletown’s tech focus scores highest, while Kitsilano suits smaller operations. Vendor payment delegation in BC becomes more viable in high-suitability zones, enabling scalable growth without in-house overhead.

Interpreting these scores reveals Vancouver’s geographic diversity shapes outsourcing strategies. For instance, Richmond’s e-commerce boom demands robust sales tax support, making it a strong contender despite moderate density. Transcounts extends coverage across these neighborhoods, adapting to local dynamics for seamless integration.

AP outsourcing suitability by Vancouver area projected for 2025

These projections underscore the rising demand for outsourced bookkeeping in Vancouver, where integrated finance solutions align AP with broader goals like cash forecasting. Businesses in varied districts gain from Transcounts’ technology-driven model, ensuring compliance and efficiency tailored to their profiles.

Transcounts AP Services in Vancouver

For Vancouver businesses navigating the demands of growth, Transcounts offers specialized accounts payable outsourcing in Vancouver. This service streamlines financial operations, allowing local startups and e-commerce firms to focus on core activities while ensuring accurate and timely payments.

Transcounts provides comprehensive accounts payable services in Vancouver, designed to handle high-volume transactions from online sales. Key offerings include:

- Bill entry and invoice management: Securely capturing and organizing supplier invoices to prevent duplicates and delays.

- Vendor verification and management for BC businesses: Thorough checks to confirm legitimate vendors, reducing fraud risks in the local market.

- Multi-approval routing: Custom workflows that route bills through designated approvers, ensuring compliance with internal policies.

- Automated payments via Plooto: Efficient electronic transfers that align with CRA guidelines for remittances, as outlined in standard Accounts Payable Canada processes.

- Reconciliation and reporting: Monthly bank reconciliations that track payments and resolve discrepancies, supporting Vancouver-specific sales tax volumes from e-commerce.

These services incorporate AP workflow automation locally, minimizing manual errors and accelerating processing times. For e-commerce clients, Transcounts handles sales tax nexus complexities, integrating seamlessly with platforms like Shopify to automate tax calculations and filings.

Integrations with leading tools such as QuickBooks and Xero enable real-time data syncing, allowing Vancouver’s remote workers to access dashboards from anywhere. The 100% online model ensures 24-hour response times via dedicated success managers, with secure cloud infrastructure protecting sensitive financial data.

Scalability is a cornerstone, with fixed monthly fees based on transaction volumes–ideal for SMEs expanding in Vancouver’s tech scene. Bundling with outsourced bookkeeping in Vancouver provides end-to-end finance support. To explore how to outsource accounting Vancouver, businesses benefit from predictable costs starting at affordable rates for up to 100 transactions.

Clients experience significant time savings, reduced errors by up to 90%, and improved cash flow visibility, empowering informed decisions for growth in British Columbia’s dynamic economy.

Key Considerations for AP Outsourcing in Vancouver

Vancouver businesses exploring Accounts Payable Outsourcing in Vancouver must weigh several critical factors to ensure seamless operations amid Canada’s dynamic finance landscape. From regulatory adherence to technological fit, these elements guide effective delegation of AP tasks.

- Compliance with BC Taxes: Handling GST/HST and provincial sales taxes requires expertise in local compliance outsourcing. For instance, a Vancouver tech firm must navigate nexus rules for cross-border sales. Partnering with providers offering tax filing services Vancouver ensures accurate remittances and audit-ready documentation, mitigating penalties.

- Integration Challenges: Outsourced bookkeeping in Vancouver often involves QuickBooks or Xero compatibility for inventory reporting. Evaluate how BC finance delegation aligns with your systems to avoid disruptions, with typical processing times of 24-48 hours.

- Cost Structures and Provider Reliability: Accounts payable services in Vancouver vary, but fixed-fee models like Transcounts’ offer transparency based on transaction volume. Pros include 90% error reduction per industry benchmarks; cons involve data security risks demanding robust SLAs.

- Pros: Cost savings and faster processing.

- Cons: Potential integration hurdles and dependency on provider uptime.

To prepare, assess your volume and seek quotes for tailored monthly fees, balancing savings against reliability for sustainable growth.

Initiating AP Outsourcing with Transcounts

Starting accounts payable outsourcing in Vancouver can transform your business operations, especially for startups seeking efficient financial workflows. Transcounts offers a streamlined 30-day setup, beginning with a dedicated success manager to guide you through AP initiation locally. This Vancouver finance onboarding ensures customized solutions tailored to your needs, like handling high-volume e-commerce transactions.

The process unfolds in clear steps:

- Initial Consultation: Contact your success manager for a free assessment of transaction volume, determining transparent pricing based on monthly activity.

- Assessment and Planning: Evaluate current systems to align with Transcounts’ tools, including secure data transfer protocols for compliance.

- Data Migration: Transfer historical invoices and vendor data securely, often bundling with bookkeeping services Vancouver for integrated financial management.

- Tool Integration: Set up cloud platforms like QuickBooks or Xero, with A2X for e-commerce clients to automate sales reconciliations.

- Launch and Testing: Go live with workflows, ensuring virtual bookkeeping for startups in Vancouver runs smoothly.

For a Vancouver-based e-commerce startup, this meant seamless integration, processing their first invoices under 24 hours post-setup. Emphasize security throughout, using encrypted protocols to protect sensitive data. Expect full integration within 30 days, answering how long invoice processing takes in accounts payable services in Vancouver.

Ready to optimize? Schedule your consultation today for outsourced bookkeeping in Vancouver that scales with your growth.

Five-step onboarding process for AP outsourcing with Transcounts

Optimizing Finance with AP Outsourcing

Accounts Payable Outsourcing in Vancouver empowers businesses with efficiency gains, seamless compliance, and scalable support from Transcounts, driving growth in BC’s competitive market. Local AP optimization delivers time savings on invoice processing and e-commerce integrations, while fixed-fee predictability shields against broader payroll taxes impact Canada. Vancouver finance streamlining through accounts payable services in Vancouver and outsourced bookkeeping in Vancouver ensures faster month-end closes and enhanced cash visibility. Contact Transcounts for tailored quotes today–outsourcing adoption is rising 40% in Canada, positioning Vancouver firms for success.

Resources

Accounts Payable Outsourcing VancouverAccounts Receivable Management VancouverBill Pay Services for Small Business Vancouver