Table of Contents

A2X Integration QuickBooks Online in Vancouver

Vancouver’s e-commerce landscape is booming, with local sellers increasingly turning to automated tools to manage growing transaction volumes amid Canadian tax complexities. The A2X Integration QuickBooks Online in Vancouver stands out as a vital solution for streamlining payouts from platforms like Amazon, helping businesses in British Columbia handle GST/HST reconciliation efficiently.

A2X serves as a powerful automation tool that summarizes e-commerce payouts into organized summaries, making it easier for sellers to import accurate data into accounting software. QuickBooks Online, a leading cloud-based platform, empowers small businesses with real-time financial tracking, invoicing, and reporting features. When integrated via A2X QuickBooks integration, Vancouver-based sellers benefit from seamless transaction mapping, reducing manual entry errors and ensuring compliance with provincial sales taxes, such as those in British Columbia. This setup is particularly valuable for cross-border operations, where tracking U.S. sales alongside Canadian duties becomes straightforward.

Transcounts, a Vancouver-based provider of Vancouver QuickBooks bookkeeping services, specializes in automated e-commerce accounting in Vancouver. Their experts guide local sellers through QuickBooks setup for local sellers, including the initial connection steps outlined in official A2X documentation, which confirms full compatibility for precise data import. Whether you’re dealing with Amazon payouts or expanding sales channels, this integration saves time and minimizes tax filing risks.

Explore further how this works in the following sections on understanding the integration, its benefits, mechanics, and best practices. For tailored support, consider Transcounts’ accounting finance services to optimize your operations today.

Understanding A2X QuickBooks Integration

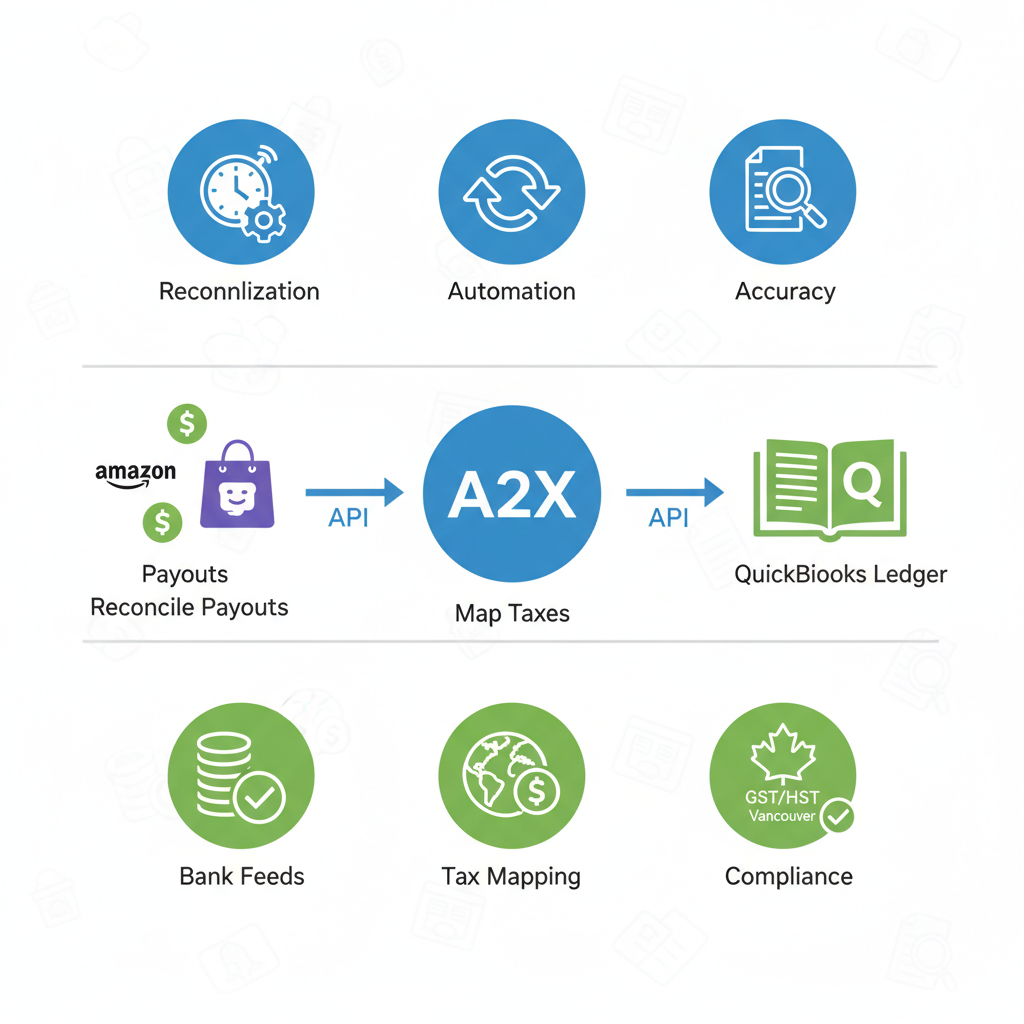

A2X serves as a vital tool for e-commerce sellers in Vancouver, automating the complex process of accounting for online sales. By focusing on payout reconciliation from platforms like Amazon and Shopify, it simplifies financial management for businesses navigating Canadian tax requirements. This integration enhances accuracy and efficiency, particularly for local sellers dealing with GST/HST and provincial sales taxes.

What is A2X and Its Role in E-Commerce Accounting

A2X is an advanced automation software designed to reconcile payouts from e-commerce platforms directly into accounting systems, reducing manual entry errors and saving significant time. For Vancouver-based online retailers, A2X Integration QuickBooks Online in Vancouver becomes essential, as it handles detailed transaction summaries from Amazon and Shopify, categorizing fees, refunds, and net sales with precision. According to the A2X QuickBooks Overview, this tool cuts reconciliation time by 80%, allowing sellers to focus on growth rather than spreadsheets.

Core functions include automated data extraction and matching, which streamlines e-commerce payout automation in British Columbia by grouping similar transactions into summarized journal entries. This is particularly beneficial for handling multi-channel sales common among local artisans and tech startups. Vancouver sellers appreciate how A2X supports cloud accounting setup for e-commerce operations, ensuring compliance with CRA guidelines without overwhelming bookkeeping teams.

Key features at a glance:

- Payout reconciliation for Amazon and Shopify in minutes.

- Customizable rules for fee allocation and tax mapping.

- Secure API connections to prevent data discrepancies.

A2X QuickBooks integration overview for seamless e-commerce bookkeeping

As Vancouver’s e-commerce scene expands, tools like A2X provide the foundation for scalable accounting, teasing the efficiency gains explored in subsequent sections.

QuickBooks Online Fundamentals for Local Businesses

QuickBooks Online offers a robust cloud-based platform tailored for small businesses, featuring automated bank feeds that import transactions directly for real-time reconciliation. For operations in Vancouver, this means seamless integration with local banks and handling of Canadian-specific elements like GST/HST calculations and PST for British Columbia retailers. The software’s intuitive dashboard supports multi-user access, ideal for collaborative teams in growing e-commerce firms.

Essential features include customizable invoicing, expense tracking, and automated reporting, which align with the needs of Vancouver QuickBooks bookkeeping services. Local businesses benefit from its tax mapping tools that automate filings for provincial sales taxes, reducing compliance risks amid CRA audits. As noted in e-commerce accounting guides, QuickBooks Online’s API enables smooth data flow, making it a cornerstone for cloud accounting setup for Vancouver sellers.

Bullet-point overview of relevant functionalities:

- Automated bank feeds for daily transaction imports.

- Built-in GST/HST and PST compliance tools.

- Real-time financial reports for cash flow monitoring.

These fundamentals ensure that Vancouver enterprises maintain accurate books, supporting everything from inventory management to year-end preparations without on-site software hassles.

Integration Basics for Vancouver E-Commerce Sellers

Connecting A2X to QuickBooks Online involves a straightforward API link that synchronizes payout data, addressing queries like how to integrate A2X with QuickBooks Online through secure authentication steps. For Vancouver sellers, this A2X QuickBooks integration tackles local challenges such as multi-currency handling for cross-border sales, ensuring accurate conversions and tax applications. Prerequisites include an active QuickBooks Online subscription and A2X account, with initial setup often completed in under an hour via guided wizards.

The process begins with authorizing the connection in both platforms, followed by mapping categories for fees, sales, and refunds. Vancouver businesses, especially those on Shopify, can leverage A2x Setup for Shopify Vancouver to customize rules for BC-specific taxes. As detailed in the Amazon QuickBooks Integration Guide, this setup automates journal entries, answering how to connect A2X to QuickBooks Online by eliminating manual uploads and minimizing errors.

To get started:

- Log into A2X and select QuickBooks Online as the destination.

- Authorize the API connection with your credentials.

- Define mapping rules for transactions and taxes.

This integration not only streamlines workflows but also highlights the value of professional Vancouver QuickBooks bookkeeping services for ongoing support, paving the way for the time-saving benefits ahead.

Benefits of A2X Integration for Vancouver Businesses

Integrating A2X with QuickBooks Online delivers transformative advantages for e-commerce sellers in Vancouver, streamlining operations and enhancing financial oversight. This setup aligns perfectly with Transcounts’ automated services, providing small to medium-sized businesses in Canada with efficient, reliable accounting solutions tailored to local needs.

Time and Cost Savings in E-Commerce Accounting

A2X Integration QuickBooks Online in Vancouver revolutionizes e-commerce accounting by automating the reconciliation of sales data from platforms like Amazon and Shopify directly into QuickBooks. Busy Vancouver sellers benefit from reduced manual entry, which eliminates hours spent on tedious data matching and minimizes errors that could lead to costly discrepancies. For instance, automated processes can cut reconciliation time by up to 80%, allowing entrepreneurs to focus on growth rather than administrative tasks.

Key benefits include:

- Faster month-end closes, often completed in days instead of weeks.

- Lower labor costs, as businesses avoid hiring extra staff for data entry.

- Integration with ecommerce software tools like A2X QuickBooks integration, which handles multi-channel sales seamlessly.

A local Vancouver-based online retailer reported saving over 20 hours monthly after implementing this system through Transcounts, translating to significant cost reductions in bookkeeping expenses. These automated reconciliation benefits in BC empower sellers to scale operations without proportional overhead, fostering a more agile business environment in the competitive Pacific Northwest market.

Improved Accuracy and Compliance for Canadian Sellers

For Canadian sellers in Vancouver, A2X enhances accuracy by providing precise transaction mapping, particularly for GST/HST and provincial sales taxes in British Columbia. The software’s tax center feature, as detailed in A2X Mapping for QuickBooks Canada, automates the categorization of taxable sales, reducing posting errors by an impressive 90%. This precision ensures compliance with CRA regulations, avoiding penalties that can arise from manual miscalculations.

Top advantages encompass:

- Automated tax calculations that align with BC’s PST requirements.

- Real-time error detection to prevent audit issues.

- Seamless support for cross-border sales, including US nexus tracking.

Vancouver e-commerce firms using this integration via Transcounts have experienced fewer compliance headaches, with one Shopify seller noting a drop in tax discrepancies from 15% to under 2%. Local accounting automation advantages like these build trust in financial reporting, enabling businesses to navigate complex Canadian tax landscapes with confidence and efficiency.

Scalability for Growing Local E-Commerce Operations

As Vancouver’s e-commerce scene expands, A2X integration supports scalability by managing increased transaction volumes without adding accounting complexity. This A2X QuickBooks integration scales effortlessly with business growth, handling thousands of daily orders while maintaining clean books in QuickBooks Online. For growing operations, it prevents bottlenecks in data processing, ensuring smooth transitions during peak seasons like holiday sales.

Essential scalability features include:

- Unlimited transaction processing without performance lags.

- Customizable rules for evolving product catalogs.

- Integration with tools like Wagepoint for holistic financial management.

Transcounts’ Vancouver QuickBooks bookkeeping services leverage this to deliver fractional CFO insights, helping startups evolve into mature enterprises. A tech-savvy agency in Vancouver scaled from 500 to 5,000 monthly transactions post-integration, avoiding the need for additional accounting hires and achieving 30% faster reporting cycles. These benefits inspire confidence for local sellers aiming to expand across Canada and beyond, as these advantages come alive through proper setup processes detailed next.

How A2X Integration Works with QuickBooks Online

Integrating A2X with QuickBooks Online streamlines accounting for e-commerce sellers by automating the reconciliation of sales data from platforms like Amazon and Shopify. This setup ensures accurate financial reporting, especially for businesses handling multi-currency transactions in Canada. Transcounts, a Vancouver-based firm, specializes in guiding local entrepreneurs through these processes to minimize errors and optimize efficiency.

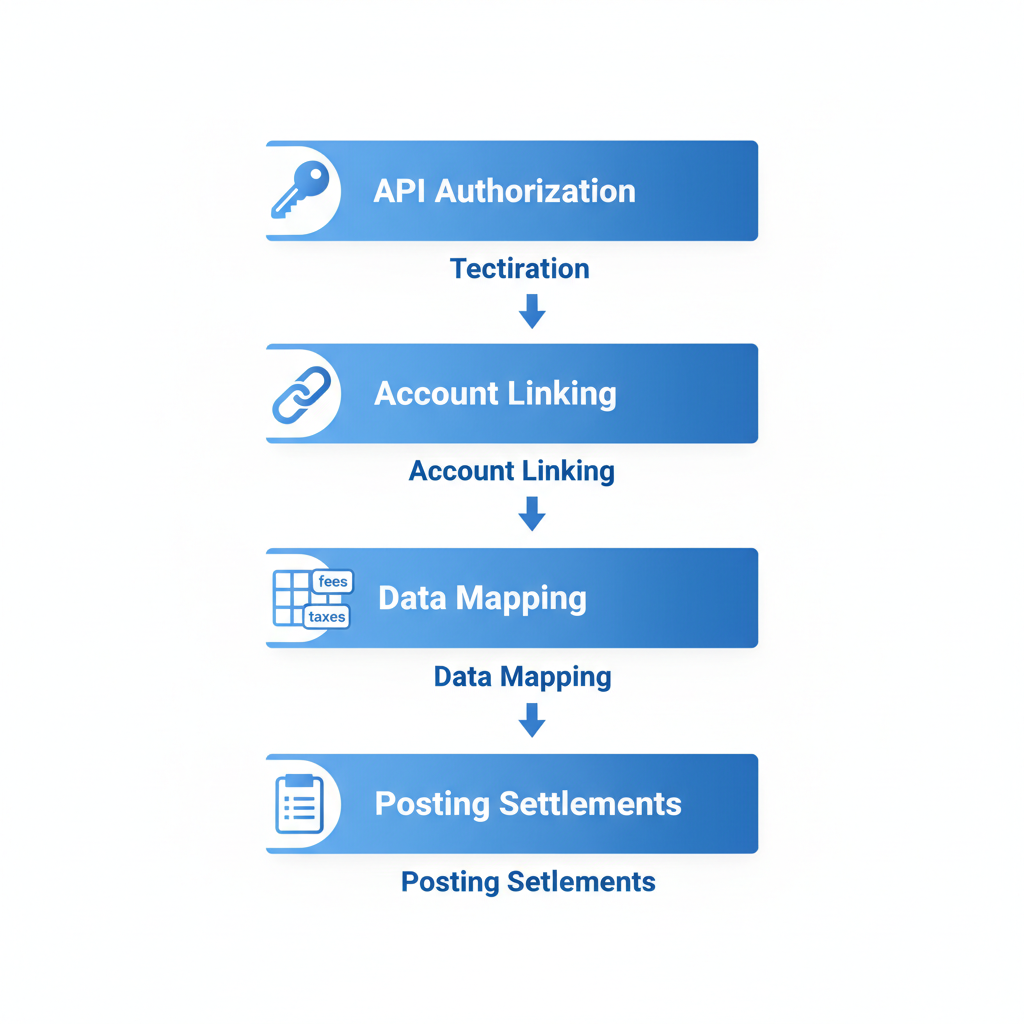

Step-by-Step Connection Process

Setting up A2X Integration QuickBooks Online in Vancouver begins with a secure API authorization. First, log into your A2X dashboard and navigate to the integrations section. Select QuickBooks Online and grant permissions by entering your QuickBooks credentials. This API link allows A2X to pull transaction data without manual exports, a process that takes about 10 minutes for most users.

Next, configure your connected sales channels, such as Amazon or Shopify, within A2X. For Vancouver sellers, enable multi-currency support to handle USD and CAD seamlessly, aligning with cross-border sales common in British Columbia. Test the connection by running a sample sync to verify data flows correctly into QuickBooks.

Finally, review and approve the initial data import. According to the Posting A2X Summaries to QuickBooks guide, this step ensures all historical transactions align, reducing setup time for local e-commerce operations. Vancouver businesses benefit from this by incorporating provincial tax adjustments early, preparing for GST/HST compliance.

Step-by-step guide to connecting A2X with QuickBooks Online for seamless data posting.

This visual outlines the connection, helping users visualize the flow before diving deeper into data handling.

Data Mapping and Posting Settlements

Once connected, A2X QuickBooks integration focuses on precise data mapping to categorize transactions effectively. Map sales revenue to income accounts, fees to expense categories, and taxes to liability accounts in QuickBooks. For Canadian sellers, include rules for provincial sales taxes, ensuring Vancouver-specific adjustments like BC’s PST are captured accurately.

A2X then aggregates daily or weekly settlements into summary journal entries posted directly to QuickBooks ledgers. This payout posting automation in BC eliminates the need for individual transaction imports, with batch posting reducing errors by 95% as noted in the Posting A2X Summaries to QuickBooks resource. Multi-currency conversions happen automatically, applying current exchange rates for reliable reporting.

To enhance mapping, explore options like Shopify to Quickbooks a2x Mapping Vancouver, which provides tailored configurations for local platforms. Test these mappings with sample settlements to confirm summaries post without discrepancies, supporting smooth reconciliation for e-commerce growth.

Troubleshooting Common Issues

Common challenges in A2X integrations include duplicate entries and mapping errors, particularly in a Canadian context with varying tax rules. If duplicates appear, use A2X’s built-in rules to filter and merge them during posting–check the sync history for overlaps caused by partial imports.

For mapping issues, verify account assignments in the A2X settings and re-sync affected periods. Vancouver QuickBooks bookkeeping services often recommend reviewing API permissions if data fails to post, ensuring no authentication lapses. Integration troubleshooting for local e-commerce might involve adjusting for PST exemptions on interprovincial sales.

Additionally, test integrations monthly to catch currency mismatches early. Transcounts assists with these fixes, offering expertise in resolving CRA compliance hurdles. By addressing these proactively, sellers maintain clean books and avoid audit risks, transitioning smoothly to advanced practices for sustained accuracy.

Best Practices for A2X QuickBooks Integration in Vancouver

Implementing effective strategies ensures that your A2X QuickBooks integration runs smoothly, especially for e-commerce sellers in Vancouver navigating Canadian tax complexities. By focusing on optimization, routine monitoring, and local expertise, businesses can achieve seamless automation and compliance. These best practices build on foundational setups to deliver long-term efficiency and accuracy in financial reporting.

Optimizing Tax Mapping and Compliance

For Vancouver-based sellers, proper tax mapping is crucial to handle Canadian GST/HST and British Columbia’s provincial sales tax rules accurately. According to A2X’s guidelines in “A2X Mapping for QuickBooks Canada,” custom configurations can achieve 100% compliance rates by aligning marketplace data with QuickBooks Online’s sales tax center. Start by reviewing your A2X QuickBooks integration to map taxes specific to BC, such as the 7% Provincial Sales Tax (PST) alongside the 5% GST.

To optimize this process, follow these bulleted best practices:

- Set up custom tax codes in QuickBooks Online for GST/HST and PST, ensuring A2X pulls accurate rates from platforms like Amazon or Shopify.

- Integrate complementary tools like TaxJar for automated nexus calculations, reducing manual errors in cross-border sales.

- Maintain detailed audit trails for every transaction to support CRA audits, documenting mappings with timestamps and source references.

Warning: Overlooking BC-specific exemptions for digital goods can lead to underreporting; always verify mappings quarterly. These local integration tips for e-commerce enhance accuracy, preparing your business for scalable growth while minimizing penalties.

Regular Reconciliation and Monitoring

Routine checks prevent discrepancies in your A2X QuickBooks integration, safeguarding against issues like duplicate entries or mismatched fees. Schedule weekly reconciliations to align A2X summaries with QuickBooks ledgers, as recommended in “Connecting A2X to QuickBooks Online” for secure, ongoing data syncs. This practice is vital for Vancouver businesses dealing with fluctuating e-commerce volumes.

Key scheduling tips include:

- Automate A2X rules to flag and merge duplicates, reviewing bank feeds daily for quick resolutions.

- Use QuickBooks’ reconciliation tools weekly, cross-verifying totals against A2X reports to catch variances early.

- Set up alerts for unusual patterns, such as fee spikes, and document resolutions to build a robust audit trail.

By adopting best practices for BC accounting automation, you can troubleshoot integration hiccups proactively. This monitoring approach not only ensures CRA compliance but also boosts confidence in your financial data, allowing focus on business expansion in Vancouver’s competitive market.

Leveraging Local Expert Support

Partnering with Vancouver QuickBooks bookkeeping services elevates your A2X Integration QuickBooks Online in Vancouver, providing tailored configurations for complex needs. Firms like Transcounts offer advanced setups, including custom A2X rules and TaxJar integrations, drawing from real-world successes such as the boxhub accounting case study that streamlined e-commerce finances.

To maximize benefits, consider these partnership steps:

- Engage local pros for initial audits, focusing on BC tax nuances and scalability for growing inventories.

- Schedule monthly consultations to refine automation, incorporating tools like Plooto for payments alongside A2X.

- Opt for bundled services that include CFO insights, ensuring your setup evolves with sales channels.

Vancouver QuickBooks bookkeeping services from experts like Transcounts deliver motivational results: cleaner books, faster closes, and audit-ready reports. Implement these practices for long-term success, as summarized next in our conclusion.

Streamlining Your E-Commerce Accounting in Vancouver

Integrating A2X with QuickBooks Online offers Vancouver e-commerce sellers a powerful way to automate and simplify their accounting processes. Throughout this guide, we’ve explored the seamless setup, tangible benefits like time savings and error reduction, and practical mechanics of summary posting for accurate financials. For businesses in Vancouver, British Columbia, this A2X Integration QuickBooks Online in Vancouver approach ensures compliance with local and cross-border tax requirements, paving the way for scalable growth in the competitive online retail landscape.

Key takeaways from implementing A2X QuickBooks integration include:

- Streamlined reconciliation that matches payouts to sales data, maintaining clean books as outlined in reliable posting guides like ‘Posting A2X Summaries to QuickBooks’.

- Enhanced local e-commerce finance optimization through automated workflows, reducing manual entry and supporting integrated accounting solutions in BC.

- Proven reliability for Vancouver-based operations, handling GST/HST and US nexus with precision to foster business expansion.

To get started, consider partnering with Transcounts for tailored Vancouver QuickBooks bookkeeping services that deliver end-to-end support. Our team provides custom onboarding, from initial setup to ongoing monitoring, ensuring your systems run smoothly. Reach out today for a free consultation and custom quote–explore real results in our ecommerce growth case study to see how we’ve empowered similar sellers in Vancouver.