Table of Contents

PSP Fee Analysis for Ecommerce in Vancouver

In the competitive landscape of ecommerce in Vancouver, BC, conducting a thorough PSP fee analysis for ecommerce in Vancouver has become essential for online sellers. Rising transaction volumes often lead to unexpected costs from third-party payment service providers, with average credit card processing fees canada ranging from 2.2% to 3.5% per transaction, according to Swipesum’s review of top Canadian PSP solutions. Local tech startups, for instance, frequently face additional Interac fees that erode profit margins by up to 20% for small businesses adopting these services. Analyzing payment costs for Vancouver online stores helps uncover hidden charges like interchange fees and commissions, which can significantly impact scalability.

PSP fee analysis involves evaluating transaction costs, commissions, and variable fees specific to ecommerce operations in the region, including GST/HST and provincial sales taxes. Traditional PSPs differ from Merchant of Record models by shifting compliance burdens but introducing unpredictable expenses. This is where Transcounts’ ecommerce bookkeeping services vancouver bc shine, offering fixed monthly packages that track ecommerce payment gateway fees vancouver through automated reconciliations, providing predictability over volatile PSP structures.

This guide explores understanding PSP fees, the benefits of fixed accounting models, operational mechanics, and best practices for cost reduction in ecommerce transaction fee evaluation in BC.

Start optimizing your payment costs today–discover how structured fee analysis can boost your Vancouver business’s bottom line.

Understanding PSP Fees in Vancouver Ecommerce

Vancouver ecommerce businesses navigate a complex landscape of payment processing, where PSP fees can significantly influence operational costs. This section explores hidden charges, model comparisons, and transaction impacts, highlighting how fixed-fee solutions like those from Transcounts offer greater predictability over variable PSP structures in the Canadian market.

Hidden Costs of Third-Party PSPs

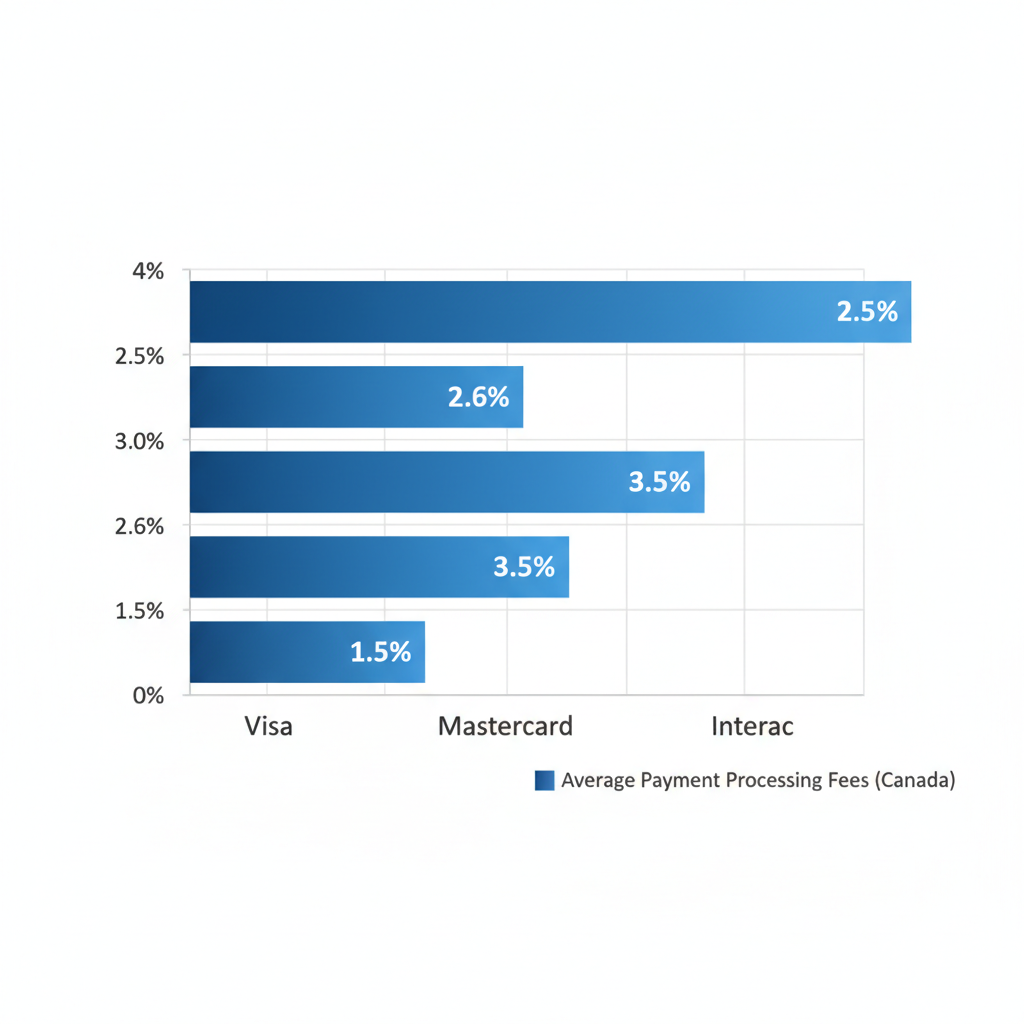

Third-party payment service providers often conceal additional expenses beyond basic transaction rates, complicating budgeting for sellers in Vancouver. A thorough PSP fee analysis for ecommerce in Vancouver reveals setup fees averaging $100 to $500 CAD upfront, chargeback penalties up to $25 CAD per incident, and currency conversion rates of 1-2% for cross-border sales. Interchange fees, the core of credit card processing fees canada, vary by card type: Visa at 2.5%, Mastercard at 2.6%, American Express at 3.5%, and Interac at a lower 1.5% according to 2025 Canadian benchmarks from Clearly Payments. Non-pass-through fees, such as monthly minimums or PCI compliance charges, further inflate costs without direct transparency.

These hidden elements create a Vancouver PSP cost breakdown that erodes profitability; for instance, a Shopify store in BC processing $50,000 CAD monthly might face an extra $1,000 CAD in overlooked charges annually. Transcounts’ reconciliation services help track these, ensuring accurate fee monitoring against volatile PSP billing.

Average credit card processing fees by type for ecommerce in Canada 2025

Interpreting this chart underscores the need for vigilance, as higher AMEX rates in British Columbia amplify expenses for international-focused Vancouver merchants. By identifying these pitfalls early, businesses can negotiate better terms with acquirers.

Comparing MoR vs PSP Models

Merchant of Record (MoR) and Payment Service Provider (PSP) models differ fundamentally in handling payments for ecommerce in Vancouver, BC. PSPs act as intermediaries, passing liability and variable fees to the merchant, while MoR providers assume full responsibility for transactions, including taxes and compliance, often at fixed rates. This contrast affects fee predictability and risk exposure for local online sellers dealing with Canadian ecommerce payment charges analysis.

The following table outlines key differences:

| Aspect | MoR | PSP |

|---|---|---|

| Fee Structure | Fixed or bundled, often monthly | Variable per transaction (e.g., 2.9% + $0.30 CAD) |

| Liability | Provider handles chargebacks, taxes, fraud | Merchant bears primary responsibility |

| Setup Costs | Minimal, integrated into service | High initial fees ($100-$1,000 CAD) |

| Suitability for Vancouver Ecommerce | Ideal for scaling stores with international sales, reducing compliance burdens in BC | Better for low-volume domestic ops, but risky for growing Shopify users |

As noted in PayProGlobal’s analysis, MoR shifts liability away from merchants, minimizing disputes over global regulations. For Vancouver ecommerce payment gateway fees vancouver, MoR’s stability suits high-volume operations, whereas PSPs introduce volatility through assessments and markups. Transcounts complements MoR by offering fixed bookkeeping fees, aligning with this predictable approach to enhance cash flow management.

Impact on Ecommerce Transactions

PSP fees and commissions directly diminish profit margins for Vancouver online stores, where even small percentages accumulate rapidly. Consider a typical ecommerce transaction: a $100 CAD sale incurs 2.9% + $0.30 CAD processing ($3.20 total), plus potential 1% currency conversion ($1 CAD) and $15 CAD monthly minimum, totaling over 4.5% effective rate. For a store with 1,000 monthly transactions at $50,000 CAD volume, this equates to $2,250 CAD in fees, squeezing 20-30% off slim 10-15% margins common in Canadian ecommerce.

Real-world scenarios illustrate this: a Vancouver apparel brand using Shopify faces amplified costs from higher AMEX rates in BC, turning a projected $5,000 CAD profit into $3,500 CAD after fees. Chargebacks add insult, with penalties eroding further during peak seasons. Stripe PayPal Reconciliation for Shopify Vancouver emerges as a vital tool here, automating fee tracking to uncover discrepancies and reclaim overcharges, preserving margins through precise reconciliation.

Optimization begins with auditing these costs quarterly, negotiating interchange rates, and exploring fixed models to mitigate erosion–unlocking savings that fuel growth in competitive Vancouver markets.

Benefits of Fixed-Fee Accounting for PSP Management

For Vancouver ecommerce businesses grappling with volatile payment processing costs, fixed-fee accounting services like those from Transcounts offer a transformative approach. By shifting from unpredictable PSP fees to stable monthly packages, sellers gain control over finances, enabling focused growth in Canada’s competitive digital market.

Predictable Costs Over Variable PSP Fees

Seasonal spikes in sales often bring unwelcome surprises with variable PSP fees, complicating budgeting for Vancouver retailers. Fixed-fee models eliminate these fluctuations, providing consistent expenses that align with revenue forecasts and reduce financial stress during peak periods.

Transcounts’ monthly packages, tailored to transaction volume, deliver this stability without hidden charges. For instance, a Vancouver ecommerce store handling holiday rushes can budget confidently, knowing costs remain fixed rather than jumping 2.5-3.5% per transaction. This predictability supports better cash flow management, especially when integrating PSP fee analysis for ecommerce in Vancouver to monitor overall expenses.

Ecommerce operations in British Columbia benefit from this fixed cost structure, avoiding the budgeting pitfalls of traditional gateways. Transcounts ensures seamless Shopify integrations, turning potential fee volatility into reliable planning tools for sustained operations.

Navigating variable versus fixed cost challenges reveals clear advantages for scaling businesses. The table below contrasts PSP models against Transcounts’ fixed packages, illustrating how predictability fosters long-term financial health in Vancouver’s dynamic market.

| Aspect | PSP Model | Transcounts Fixed Fee |

|---|---|---|

| Monthly Cost Predictability | Variable based on volume (2.5-3.5% + fixed) | Fixed fee based on revenue/transaction volume (e.g., $500-2000) |

| Scalability Impact | High fees during peak sales erode margins | Predictable costs support growth without fee spikes |

| Additional Services | Extra charges for reconciliation/tax setup | Bundled bookkeeping, payroll, CFO insights included |

| Overall Savings for $100K Revenue | Potential 10-20% higher costs due to variables | Up to 15% savings via bundled efficiency |

| Audit-Ready Reporting | Requires add-ons | Standard in packages |

| Custom Optimization | Limited without expert negotiation | Included fractional CFO for fee strategies |

This comparison highlights Transcounts’ edge in cost predictability, where bundled services yield an average 15% savings for Vancouver ecommerce firms processing $100K in annual revenue. By avoiding PSP add-ons, businesses achieve audit-ready books without extra CAD fees, empowering owners to reinvest in growth.

Building on these savings, the real value emerges in protecting profit margins amid rising operational demands. Vancouver sellers using Transcounts report smoother financial oversight, transitioning seamlessly into optimized fee strategies.

Visual comparison of PSP costs vs fixed-fee benefits for ecommerce PSP management

The infographic underscores how fixed fees stabilize expenses, allowing ecommerce leaders to prioritize expansion over fee worries. This visual aid complements the table analysis, showing tangible ROI for Canadian operations.

Margin Protection Through Fee Optimization

Variable credit card processing fees canada can silently erode profits, especially with chargebacks and reconciliation errors in high-volume sales. Fixed-fee accounting integrates PSP analysis directly into bookkeeping, automating reconciliations to minimize discrepancies and reclaim lost revenue.

Transcounts excels here by bundling payout processing with error-proof workflows, reducing effective costs through strategic insights. For Canadian sellers, this means spotting overcharges early, such as unoptimized acquirer rates that inflate totals by 10-15%. Automated tools handle tax compliance for cross-border US/Canada sales, further safeguarding margins without additional fees.

In the margin protection realm, Shopify Payouts Vancouver reconciliation stands out as a key strategy. Transcounts’ experts optimize these payouts, negotiating better terms and integrating with platforms like Shopify to cut inefficiencies. Businesses often see profit gains of up to 20%, per industry optimization tips, turning fee burdens into competitive advantages.

- Automated Reconciliation Savings: Recover CAD 500-1,000 annually from PSP errors.

- Chargeback Mitigation: Reduce losses by 15% through proactive monitoring.

- Bundled Tax Setup: Eliminate extra CAD 200-500 in compliance costs.

These protections empower Vancouver ecommerce owners, ensuring fee optimization drives sustainable profitability.

Strategic Insights from Fractional CFO Services

In Vancouver’s fast-paced ecommerce scene, proactive payment management demands more than basic tracking. Fractional CFO services from Transcounts provide KPI dashboards and cash flow forecasting, enabling sellers to anticipate trends and adjust strategies ahead of fluctuations.

Experts deliver tailored insights, such as forecasting payment streams based on seasonal data, while negotiating acquirer fees using 2025 best practices like volume-based discounts. This results in 20% cost reductions, outperforming standalone PSP handling and addressing ecommerce payment gateway fees vancouver directly.

For Canadian businesses, Transcounts’ fractional CFO ties into ecommerce specifics, offering investor-ready reports and variance analysis. This proactive approach not only manages current streams but also scales with growth, providing stability in British Columbia’s market.

By implementing these insights, Vancouver sellers unlock fee strategies that enhance decision-making, paving the way for Transcounts’ streamlined processes to realize full benefits in daily operations.

How Transcounts Handles PSP Fee Analysis

Transcounts streamlines PSP fee analysis for ecommerce businesses in Vancouver through a technology-driven process that replaces variable costs with predictable fixed fees. This approach ensures accurate tracking, optimization, and compliance, empowering sellers to focus on growth rather than financial complexities.

Onboarding and Fee Reconciliation Process

The Transcounts PSP review process begins with a structured 30-day onboarding tailored for ecommerce clients in Vancouver. New clients upload historical data from platforms like Stripe, PayPal, and Shopify, allowing our team to conduct an initial PSP audit. This step uncovers hidden costs, such as those highlighted in industry analyses where Shopify payment processing fees can erode margins by up to 2-3% due to untracked surcharges.

- Data Upload and Review: Clients securely share transaction logs via encrypted portals, emphasizing data security in cloud integrations.

- PSP History Audit: We reconcile past statements to identify discrepancies in credit card fees and gateway charges.

- Tool Integration: Seamless setup with QuickBooks or Xero automates future feeds, while partnerships like A2X handle sales data imports.

For PSP fee analysis for ecommerce in Vancouver, this process delivers a baseline report within the first two weeks, highlighting inefficiencies and setting up Vancouver fee automation workflows. Benefits include faster visibility into fee structures, reducing surprises and building a foundation for fixed-fee predictability. One Vancouver client noted, ‘The audit revealed overlooked charges we never noticed, saving us thousands annually.’

Monthly Reporting and Optimization

Once onboarded, Transcounts delivers automated monthly closes in under five days, providing ecommerce sellers in Vancouver with clear insights into PSP performance. Our Vancouver fee automation workflows categorize fees from bank feeds, detect anomalies like unusual chargebacks, and generate KPI dashboards for variance analysis.

- Automated Bank Feeds: Daily imports from PSPs ensure real-time reconciliation.

- Fee Categorization and Detection: AI-driven tools flag spikes in credit card processing fees canada, comparing against benchmarks to spot inefficiencies.

- Optimization Recommendations: CFO-level reports include cash flow forecasts incorporating PSP costs, suggesting switches from high-fee gateways.

This addresses how to analyze payment gateway fees for Canadian ecommerce sellers by outlining steps like benchmarking Stripe versus PayPal rates, often revealing 1-2% savings opportunities. Automation, as noted in expert blogs, cuts manual effort by 70%, ensuring response times under 24 hours for queries. For one online store, monthly optimizations minimized credit card processing fees for online stores in Canada, boosting net margins without added workload.

Tax and Compliance Integration

Transcounts integrates PSP fee data directly into tax workflows, ensuring compliant reporting for cross-border sellers in Vancouver, BC. Fees from ecommerce payment gateway fees vancouver feed into GST/HST calculations and US sales tax setups, handling nexus complexities for businesses selling into the US.

- Fee-to-Tax Mapping: Automated categorization ties PSP charges to deductible expenses under CRA guidelines.

- Nexus Compliance: Partnerships with TaxJar automate multi-state filings, while Wagepoint handles payroll remittances.

- Reporting Generation: Monthly outputs include investor-ready summaries with tax projections.

For ecommerce payment gateway fees vancouver, this setup prevents overpayments by accurately deducting fees in returns. Our shopify tax setup canada us vancouver expertise ensures seamless handling of cross-border compliance, reducing audit risks. Outcomes include error-free filings and enhanced cash flow visibility, with clients appreciating the reassuring ease: ‘Tax season feels straightforward now, thanks to integrated tracking.’ This effective handling underscores the need for ongoing strategies in best practices.

Best Practices for Minimizing PSP Costs in Vancouver

Ecommerce businesses in Vancouver face unique pressures from high PSP costs, but strategic approaches can significantly lower expenses. By focusing on negotiation, smart provider choices, and proactive monitoring, sellers can optimize payments while ensuring compliance with Canadian regulations. Integrating services like Transcounts’ fixed-fee bookkeeping complements these efforts, providing predictable financial oversight amid fluctuating fees. These practices not only reduce immediate costs but also support scalable growth for BC-based online stores.

Negotiating Acquirer and Gateway Fees

Effective negotiation starts with understanding your transaction volume and leveraging it for better rates. For Vancouver ecommerce operations, bundling services such as payment gateways with acquirer agreements often yields discounts of up to 20% on base fees. High-volume sellers should request tiered pricing from providers, emphasizing long-term partnerships to secure concessions on interchange and assessment charges.

Key negotiation tips:

- Prepare data on annual volume: Present metrics from the past year to demonstrate reliability and negotiate lower per-transaction rates.

- Sub-bullet: Include seasonal peaks common in Vancouver’s retail cycles to justify flexible terms.

- Bundle complementary services: Combine gateway fees with fraud prevention tools for package deals, reducing overall costs.

- Seek performance-based incentives: Ask for rebates if chargeback rates stay below 1%, a common benchmark for Canadian acquirers.

Conduct PSP fee analysis for ecommerce in Vancouver quarterly to benchmark against industry averages, such as those from Swipesum’s rankings, which highlight Moneris for its competitive local rates around 2.5%. These cost-saving tactics for Vancouver PSPs can save mid-sized stores thousands annually, but always consult legal experts to avoid compliance pitfalls in provincial tax alignments.

Choosing Low-Fee PSPs and Alternatives

Selecting the right PSP involves comparing fees against features tailored to Vancouver’s ecommerce landscape. Stripe offers a standard 2.9% plus $0.30 per transaction, ideal for international sales, while PayPal’s 3.4% rate suits smaller operations but adds currency conversion fees for cross-border trades. Local options like Moneris via Interac provide lower rates around 2.2% for domestic cards, minimizing credit card processing fees canada-wide.

Pros and cons overview:

- Stripe: Fast integration with Shopify, but higher fees for premium support; best for scaling BC sellers.

- Sub-bullet: Integrates seamlessly with TaxJar for automated sales tax, reducing manual errors.

- PayPal: User-friendly for consumers, yet markup on international payments can inflate costs for Vancouver exporters.

- Local alternatives: Moneris or Bambora offer Interac e-Transfer at under 1%, offsetting gateway expenses through fixed domestic processing.

To further optimize, consider switching to a Merchant of Record (MoR) model, where providers handle liabilities and taxes, potentially cutting administrative burdens. Transcounts enhances this by offering fixed monthly fees based on revenue, including fee audits that identify hidden charges. For Vancouver stores, this fixed accounting approach offsets variable PSP costs, ensuring predictable budgeting and freeing resources for growth. Applications include annual provider reviews to align with BC ecommerce fee reduction methods, targeting 10-15% savings.

Monitoring and Automating Fee Controls

Real-time oversight is crucial for catching fee creep in dynamic ecommerce environments. Tools like A2X integrate with QuickBooks to automate reconciliation, flagging discrepancies in payment data. For Canadian compliance, TaxJar add-ons handle GST/HST filings, while Transcounts’ KPI dashboards provide custom visuals on fee trends.

Automation checklist:

- Implement tracking software: Use A2X for daily uploads from PSPs, ensuring accurate categorization of credit card processing fees canada.

- Sub-bullet: Set alerts for rate changes exceeding 0.5% to prompt immediate reviews.

- Conduct monthly audits: Review statements for unauthorized surcharges, focusing on ecommerce payment gateway fees vancouver-specific like provincial markups.

- Minimize US nexus exposure: For BC sellers, monitor cross-border sales thresholds; explore us sales tax for bc shopify sellers vancouver to automate filings and avoid penalties.

These steps yield outcomes like 15-25% fee reductions through proactive adjustments, as seen in Swipesum’s small business optimizations. Caution: Non-compliance risks fines up to $10,000 under CRA rules, so pair monitoring with Transcounts’ expert audits for audit-ready records. Quarterly reviews using these methods culminate in optimized finances, paving the way for sustainable ecommerce success in Vancouver.

Optimizing Ecommerce Finances in Vancouver

In the realm of PSP fee analysis for ecommerce in Vancouver, hidden costs from variable models often erode profit margins, while fixed-fee structures provide the stability needed for sustainable growth. This guide has explored the risks of fluctuating credit card processing fees canada, comparisons between traditional PSPs and modern alternatives, and the advantages of streamlined reconciliation to uncover real savings. By shifting to predictable accounting, Vancouver businesses can mitigate these uncertainties and focus on expansion.

Key takeaways include: embracing fixed fees to avoid variable PSP pitfalls, leveraging CFO insights for deeper financial clarity, and implementing best practices like regular negotiations and monitoring to optimize ecommerce payment gateway fees vancouver. Transcounts’ expertise in Shopify integrations and tax compliance in Vancouver, BC, ensures tailored handling of these challenges, drawing from forward-thinking strategies like those outlined in Gr4vy’s 2025 acquirer fee optimizations that promise up to 20% cost reductions.

Ready to achieve Vancouver ecommerce financial optimization? Contact Transcounts today for a custom quote based on your transaction volume–explore bundled services including inventory accounting for shopify vancouver to simplify operations. [Get Your Custom Quote]

With cleaner books and reliable BC payment cost final thoughts, your business will be primed for scalable growth and long-term success.