Table of Contents

Understanding Shopify Payouts in Vancouver

For Vancouver-based e-commerce sellers scaling their online stores amid the city’s booming tech scene, managing cash flow starts with grasping Shopify Payouts in Vancouver. These automated transfers deliver net sales proceeds–total revenue minus Shopify fees and payment processor charges–directly to your linked bank account, ensuring timely access to funds for reinvestment in local inventory and growth.

Shopify handles payouts through a straightforward process: it captures sales in Canadian dollars, deducts applicable fees, and schedules deposits based on your settings, typically daily or weekly. In Vancouver, this aligns seamlessly with major Canadian banks like RBC and TD, as supported by Shopify’s Canada-specific payment infrastructure, which processes everything in CAD to avoid currency conversion hassles.

However, accurately reconciling these Vancouver Shopify payment transfers with your books is essential to track discrepancies from taxes or holds, preventing errors in local e-commerce payout management. That’s where professional help shines–firms offering ecommerce bookkeeping services vancouver bc like Transcounts integrate Shopify data with QuickBooks or Xero, simplifying Shopify accounting in Vancouver and supporting informed business decisions.

Overview of Shopify Payouts for Vancouver Businesses

Shopify Payouts in Vancouver represent a streamlined way for e-commerce sellers to receive funds from sales, directly deposited into linked bank accounts. These payouts form the financial backbone for local businesses navigating the competitive online retail scene in British Columbia. Understanding their structure is essential for maintaining cash flow and accurate bookkeeping.

A typical Shopify payout consists of several key elements:

- Gross sales: Total revenue from orders before deductions.

- Shopify fees: Transaction rates of 2.4% to 2.9% depending on the plan, plus any payment gateway charges.

- Refunds and chargebacks: Subtracted amounts for returned items or disputed transactions.

- Currency conversions: Adjustments for USD sales at prevailing exchange rates.

For a Vancouver seller with $10,000 in monthly gross sales, after 2.9% fees ($290) and a 5% refund rate ($500), the net payout might total around $9,210, arriving after processing.

Vancouver’s payout processing benefits from Pacific Time Zone alignment but can face slight delays due to local bank cutoffs at institutions like RBC or TD, typically extending deposits by one business day compared to eastern hubs. Eligible accounts receive daily payouts following a standard three-day hold, as outlined in Shopify’s Canadian guidelines, ensuring funds clear within 4-5 business days overall. This schedule addresses common queries like how long Shopify payouts take to deposit in Canada, with Vancouver examples showing efficiency for West Coast operations.

Regional banking and tax variations significantly influence payout timelines across Canada. For British Columbia sellers, factors like PST add nuances to reconciliation, making localized insights valuable for smooth financial management.

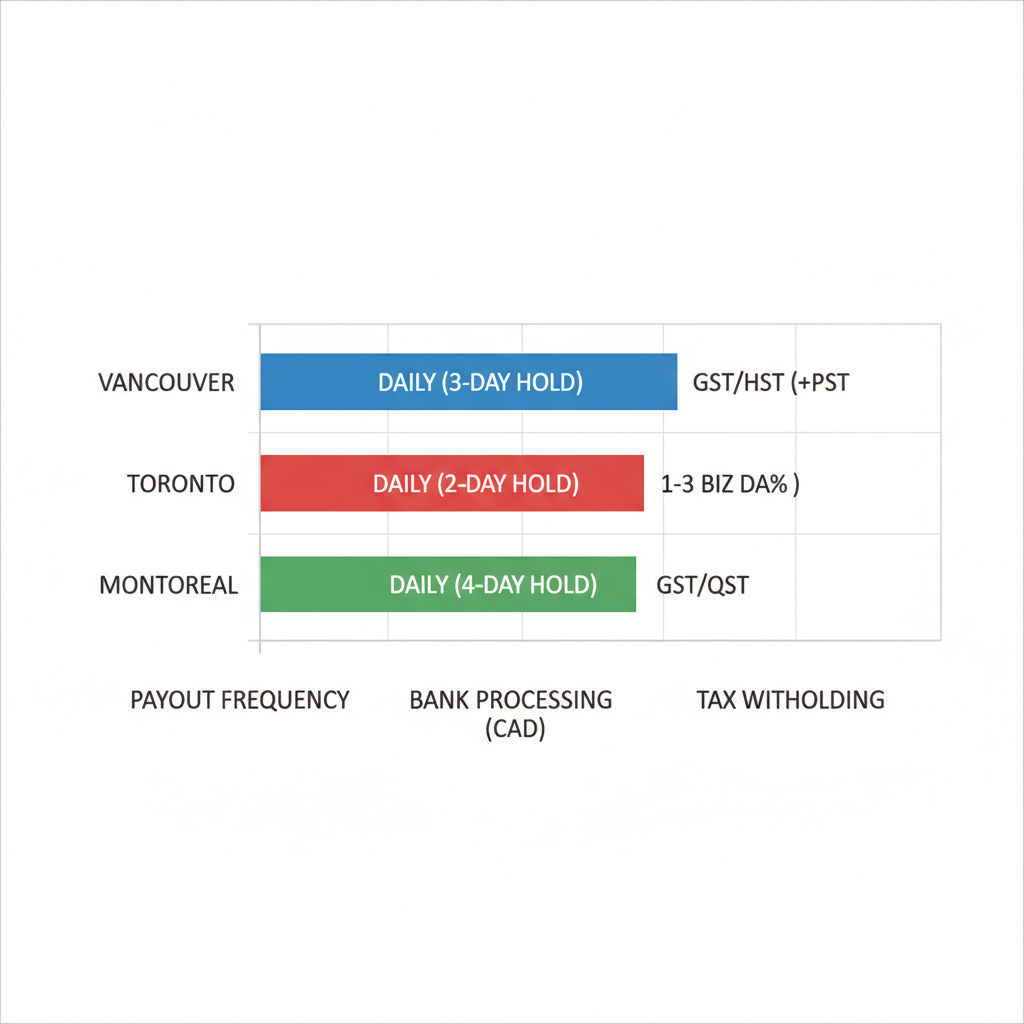

| Aspect | Vancouver | Toronto | Montreal |

|---|---|---|---|

| Standard Payout Frequency | Daily (after 3-day hold) | Daily (after 3-day hold) | Bi-weekly for some |

| Bank Processing Time (CAD) | 1-2 business days (local RBC/TD compatibility) | 1-3 business days (high volume delays) | 2-4 business days (Quebec regulations) |

| Tax Withholding Impact | GST/HST reconciliation delays PST variations | HST focus, fewer PST issues | QST adds complexity |

Vancouver stands out for its quicker processing times, leveraging West Coast banking efficiency, though PST requires careful handling during tax seasons. Data from Shopify’s Help Center confirms these Canadian-specific timings, giving local sellers a competitive edge in faster fund access over Toronto’s volume-driven lags or Montreal’s regulatory hurdles.

These differences underscore the need for precise tracking to avoid discrepancies in e-commerce deposit reconciliation. For instance, time zone shifts can misalign deposit dates, complicating monthly closes. Tools that automate this process prove invaluable for Vancouver businesses.

Transcounts excels in Shopify accounting in Vancouver by offering integrated solutions for these challenges. Their platform handles daily reconciliations, ensuring payouts match bank statements seamlessly. Specializing in e-commerce, Transcounts provides Stripe PayPal Reconciliation for Shopify Vancouver to streamline multi-gateway flows, helping sellers focus on growth while maintaining audit-ready records.

Comparison of Shopify payout schedules for major Canadian cities

By addressing how much Shopify pays in Vancouver–often $5,000 to $20,000 monthly for mid-tier stores–Transcounts empowers users to forecast cash flow accurately, turning payout complexities into strategic advantages.

Shopify Payout Services in Vancouver

Vancouver e-commerce sellers often face the challenge of managing Shopify Payouts in Vancouver, where timely reconciliation ensures smooth operations and compliance with local regulations. Services tailored for this include tools for matching deposits to bank statements and professional accounting support to handle the complexities of online sales. These options help overwhelmed entrepreneurs focus on growth rather than paperwork.

Service types range from manual to automated methods for reconciling Shopify payouts. Manual processes involve downloading payout reports from Shopify and cross-checking them against bank feeds, which can be time-consuming for high-volume stores. Automated solutions, however, streamline this by importing data directly into accounting software. For basic reconciliation, follow these steps:

- Log into your Shopify admin and export the latest payout CSV.

- Open your bank statement and note the deposit dates and amounts.

- Match line items manually, adjusting for fees and taxes.

- Record any discrepancies in a spreadsheet for review.

This approach saves hours weekly, especially for businesses scaling in the Vancouver area.

Integration details enhance efficiency for Shopify accounting in Vancouver. QuickBooks Canada allows seamless payout imports: connect via the Shopify app, authorize the link, and enable automatic syncing of sales and fees to the general ledger. As outlined in reliable guides, this setup automates bank matching, reducing errors in categorizing transactions. Xero’s Shopify connector offers real-time syncing, pulling payouts, refunds, and inventory data into invoices. Local Shopify finance tools like these ensure accurate financial reporting, with integrations cutting reconciliation time from days to minutes for BC-based sellers.

Issue resolution addresses common hurdles in payout matching in Vancouver, such as fee mismatches from currency conversions or delayed deposits due to banking holds. Automated tools flag these anomalies during import, allowing quick adjustments in QuickBooks or Xero. Professional oversight prevents compliance pitfalls with provincial sales taxes, ensuring deposits align perfectly with records.

Firms like Transcounts provide end-to-end Shopify accounting in Vancouver, including a2x setup for shopify vancouver for automated journal entries. This service handles discrepancies and scales with growing e-commerce needs, delivering time savings and peace of mind.

Local Considerations for Shopify Payouts in Vancouver

Vancouver merchants navigating Shopify Payouts in Vancouver face unique regional challenges that impact deposit timing and net earnings. British Columbia’s Provincial Sales Tax (PST) applies to digital goods, reducing payout amounts before they reach your account. Cross-border USD/CAD conversions add exchange rate volatility, while federal banking regulations require enhanced verification for international transfers. These factors demand careful planning to maintain cash flow stability.

Tax implications further complicate matters for local sellers. PST on taxable sales must be netted out, affecting final payout figures as outlined in Shopify’s Canada-specific policies. For BC-based shops selling to the US, nexus rules trigger collection obligations; explore us sales tax for bc shopify sellers vancouver to understand compliance. Under Canadian GAAP, income recognition aligns with payout receipt, ensuring accurate financial reporting.

Payout holds for fraud checks are common in Vancouver’s high-risk e-commerce scene, per Shopify’s general guidelines, potentially delaying funds by several days. Pacific Time Zone scheduling means deposits often arrive later in the business day compared to Eastern Canada.

Key considerations include:

- Reconciling Shopify payouts monthly to match taxes and avoid discrepancies.

- Monitoring exchange rates for USD sales to protect margins.

- Ensuring timely PST remittances to prevent penalties.

Transcounts provides tailored Shopify accounting in Vancouver, handling regional compliance and automated reconciliations to streamline operations.

Consider Alex, a local apparel seller, who faced unexpected PST deductions leading to cash shortages; partnering with experts resolved his issues swiftly. Non-compliance risks audits and fines, so proactive local support is essential.

Getting Started with Shopify Payouts in Vancouver

Launching your e-commerce venture in Vancouver means getting Shopify Payouts in Vancouver up and running smoothly for reliable cash flow. As a new seller, focus on these essential steps to enable payouts and gain quick financial visibility. This process, known as Vancouver payout initiation, sets the foundation for starter e-commerce accounting.

Begin by enabling Shopify Payments through your store’s Canada settings. Log into your admin dashboard, navigate to Settings > Payments, and select Shopify Payments to activate it for Canadian operations. Next, link your Vancouver bank account, such as one from RBC, by entering your routing and account details securely. Verify the connection to ensure deposits route correctly to your local branch in BC. Finally, complete identity verification with your business documents to lift any restrictions. (68 words)

Once set up, learn to reconcile Shopify payouts using tools like QuickBooks or Xero for accurate bookkeeping. Import your sales data directly into these platforms to match transactions against bank statements. This initial reconciliation step helps track income and expenses, addressing how to reconcile Shopify payouts effectively for compliance. Vancouver sellers benefit from this routine to maintain clean records from day one. (52 words)

For seamless management, onboard with Transcounts, experts in Shopify accounting in Vancouver. Their automated integration handles reconciliations and reporting, saving you time on manual entries. Start by scheduling a quick setup call to connect your Shopify feed. (34 words)

Monitor your first payouts after the standard three-day hold on sales. Check your dashboard daily for deposit notifications, typically arriving on a schedule of daily or weekly transfers. Stay proactive to celebrate your first earnings milestone. (21 words)

Step-by-step setup of Shopify Payouts in Vancouver integrated with Transcounts

To budget wisely, perform a basic Psp Fee Analysis Vancouver Ecommerce review, noting transaction costs around 2.9% plus $0.30 per sale. This empowers confident scaling in the vibrant Vancouver market.

Managing Shopify Payouts in Vancouver for Success

Effectively managing Shopify Payouts in Vancouver involves understanding bi-weekly cycles processed within 2-3 business days via local banks, ensuring compliance with Canadian regulations and proper tax configuration through the shopify tax setup canada us vancouver. Reconciliation strategies, supported by tools like QuickBooks and Xero as detailed in the Shopify QuickBooks Integration Guide, simplify tracking and accuracy.

Transcounts enhances efficiency through seamless integrations for reconciling Shopify payouts and Shopify accounting in Vancouver. Our services drive Vancouver payout optimization and local finance streamlining, delivering scalable insights for e-commerce growth–ideal for partnering with the best accountant or fractional CFO for Shopify in Vancouver.

Ready to elevate your operations? Schedule a consultation with Transcounts today for tailored support.