Table of Contents

QuickBooks Payroll Solutions in Surrey, BC

In the bustling business landscape of Surrey, BC, where e-commerce startups and small enterprises thrive amid strict Canadian payroll regulations, managing employee payments can quickly become overwhelming. From handling provincial taxes to ensuring timely GST/HST remittances, local companies face unique challenges that demand efficient tools. This is where QuickBooks Payroll in Surrey, BC steps in as a vital solution, offering seamless integration and compliance support tailored to the Lower Mainland’s dynamic economy.

QuickBooks Online Payroll Canada addresses these needs by automating calculations for wages, deductions, and direct deposits, while simplifying ROE filings–essential records of employment for government reporting. Businesses save significant time on manual tasks, reducing errors in tax withholdings that could lead to costly audits. Local ProAdvisors provide hands-on setup and training, ensuring smooth adoption for Surrey firms. Pricing starts affordably at around $20 per month plus per-employee fees, making it accessible for SMEs navigating BC’s regulatory environment. This integration fosters Canadian QuickBooks payroll integration that keeps books audit-ready and operations streamlined.

Among top providers, Vancouver-based Transcounts stands out with its technology-driven approach, serving Surrey through bundled bookkeeping and Payroll Services Surrey BC. Other experts offer similar payroll services in Surrey, BC, focusing on Surrey-based QuickBooks payroll support for growing ventures.

QuickBooks Payroll solutions for efficient business operations in Surrey

Evaluate these options to find the right fit for your Surrey business, ensuring compliance and growth without the hassle.

Transcounts QuickBooks Payroll Services

Transcounts stands out for QuickBooks Payroll in Surrey, BC, offering seamless integration for local e-commerce and startups. This 100% online service automates processing with fixed fees based on transactions, ensuring BC payroll compliance tools like GST/HST remittances and WorkSafeBC support.

Key features of these payroll services in Surrey, BC include:

- Direct deposit and employee onboarding via Wagepoint partnership.

- QuickBooks Online syncing for real-time data.

- Local QuickBooks payroll automation with 24-hour response times.

Pricing starts at $99/month, with tiers for growing needs. Pros: Fast 30-day onboarding and secure cloud storage. Cons: Custom quotes required for complex setups. Best for Surrey SMEs bundling Vancouver payroll services with bookkeeping, leveraging proximity for efficient support in a competitive local landscape.

Wio Accounting QuickBooks Payroll

Wio Accounting stands out as a BC-focused firm offering expert QuickBooks services for small businesses. As a certified ProAdvisor, they provide tailored QuickBooks Online Payroll Canada support with emphasis on seamless integration.

Key Features

- Automated remittances and compliance filings for BC taxes.

- Year-end T4 preparation and advisory on Canadian payroll tools.

- Direct deposit setup for efficient employee payments in Surrey.

Pricing starts at competitive rates for SMEs, around $50 monthly per employee.

Pros: Personalized service builds strong client relationships; deep BC compliance knowledge ensures accuracy. Cons: Primarily serves Western Canada, limiting broader national reach; may require initial setup time.

Best for local contractors needing QuickBooks Payroll in Surrey, BC, where Surrey QuickBooks advisor services deliver hands-on support.

Hayson Accounting QuickBooks Services

Hayson Accounting’s Surrey office provides reliable payroll services in Surrey, BC, ensuring efficient QuickBooks processing and compliance for local firms.

Key features include automated remittances via QuickBooks Online Payroll Canada, seamless employee onboarding, and QuickBooks Canada setup for provincial taxes. These tools streamline local Surrey payroll for small teams.

Pricing starts at $150 monthly for small firms.

Pros: In-person consultations at the Surrey location. Cons: Higher fees compared to online-only providers.

Best for marketing agencies in the Surrey area seeking hands-on support.

Payworks QuickBooks Integration

Payworks stands as a prominent national provider of QuickBooks-compatible payroll solutions for Canadian businesses, including those in Surrey, BC. (11 words)

Key features encompass multi-province support, seamless integrations with accounting platforms, and automated compliance tools tailored for diverse operations like BC-integrated payroll systems. (18 words)

Pricing follows a scalable model based on employee count. (6 words)

Pros: Robust HR tools enhance efficiency; seamless national QuickBooks payroll handling. Cons: Primarily corporate-focused, potentially overwhelming for small teams in Surrey. (18 words)

Best suited for larger firms in Surrey, BC, needing Canada-wide reach and advanced payroll services. (10 words)

Saklas Accounting ProAdvisor Services

Saklas Accounting delivers specialized QuickBooks ProAdvisor payroll services for businesses in Surrey, Langley, and White Rock, BC. As a local expert, they focus on hands-on Biweekly Payroll Processing Surrey to streamline payroll operations.

Key features include:

- Training on QuickBooks Payroll in Surrey, BC, answering questions like “Are there QuickBooks Payroll training courses in Surrey?”

- Setup guidance for QuickBooks Online Payroll Canada, covering “How to set up QuickBooks Online Payroll in Canada?”

Pricing is project-based, with pros like personalized local training options and cons of not being full-service. Ideal for training-focused needs in Surrey ProAdvisor payroll.

Intuit QuickBooks Payroll Core

Intuit QuickBooks Payroll Core serves as an essential self-service tool for Canadian businesses, including those in Surrey, BC. This basic Canadian payroll software automates tax calculations and e-filing, ensuring straightforward compliance with local regulations.

Pricing begins at $20 per employee per month, plus a base fee. It excels in easy integration with QuickBooks Online but offers limited support. Ideal for simple setups like small teams handling routine payroll in Canada.

Wagepoint QuickBooks Sync

Wagepoint delivers seamless QuickBooks-compatible payroll integration for Canadian businesses, including those in British Columbia. This solution offers unlimited payroll runs at a flat monthly fee, prioritizing ease of use. Its simplicity suits startups well, though reporting remains basic. Ideal for payroll services in Surrey, BC, it streamlines local compliance effortlessly and provides strong local support.

Ceridian Dayforce with QuickBooks

Ceridian Dayforce offers advanced payroll integration for enterprises in Surrey, BC, seamlessly syncing with QuickBooks Online Payroll Canada. This enterprise tool features AI analytics for efficient workforce management and custom pricing tailored to business needs. Its scalability supports mid-size firms handling complex Canadian tax compliance, though the setup can be intricate. Pros include robust growth potential; it’s ideal for expanding operations requiring precise QuickBooks Payroll in Surrey, BC.

ADP QuickBooks Payroll Canada

ADP offers a robust, global-local payroll solution integrated with QuickBooks Online Payroll Canada, providing seamless support for businesses in Surrey, BC. Key features include automated compliance tools for Canadian regulations, ensuring accurate remittances and tax filings. Pricing starts at around $40 per employee monthly, plus base fees. Pros: Reliable integration and expert support; cons: Higher costs for small teams. Ideal for nonprofits switching to QuickBooks Online Payroll Canada seeking dependable payroll services in Surrey, BC.

BambooHR QuickBooks Integration

BambooHR’s integration with QuickBooks delivers a robust HR-payroll combo tailored for small businesses managing payroll processing in Surrey. This tool focuses on HR essentials, featuring seamless employee onboarding, automated payroll runs, and direct data syncing to QuickBooks Online Payroll Canada. Priced at $6 per employee per month, it offers a user-friendly interface that simplifies compliance and reporting. While pros include intuitive navigation and scalability, cons involve add-on costs for advanced analytics. Best for local agencies delivering payroll services in Surrey, BC.

Comparing QuickBooks Payroll Providers in Surrey

Choosing the right QuickBooks Payroll in Surrey, BC requires evaluating local options based on features, costs, and business needs. This Surrey provider comparison highlights top providers, helping businesses streamline payroll while ensuring compliance with British Columbia regulations. The table below details key aspects to aid decision-making for small to medium enterprises seeking efficient local QuickBooks options.

| Provider | Key Features | Pricing (Monthly Base) | Pros | Cons | Best For |

|---|---|---|---|---|---|

| Transcounts | Automated remittances, QuickBooks sync, KPI dashboards | $99+ based on volume | Fast onboarding, local expertise | Custom quotes needed | Surrey SMEs, e-com |

| Wio Accounting | Advisory, year-end filings | Competitive SME | Personalized | Western focus | Contractors |

| Hayson Accounting | In-person support, compliance | Project-based | Surrey office | Higher fees | Agencies |

| Payworks | HR tools, multi-province | Scalable per emp | Robust | Corporate | Mid-size |

| Saklas Accounting | ProAdvisor training, setup | Per service | Training | Not full-service | Training seekers |

| Intuit Core | Auto-taxes, e-filing | $20+/emp | Easy | Limited support | Simple setups |

| Wagepoint | Unlimited runs, simple | Flat fee | Simple | Basic reporting | Startups |

| Ceridian | AI analytics | Custom | Scalable | Complex | Enterprises |

| ADP | Global compliance | Per emp | Reliable | Costly | Nonprofits |

| BambooHR | HR onboarding | $6/emp + add-ons | User-friendly | Add-on costs | Teams |

Data sourced from provider sites and Intuit pricing as of 2023; focuses on Canadian compliance for Surrey, BC; recommend verifying current rates.

This comparison reveals Transcounts offers strong value for Surrey SMEs with automated features at affordable rates starting around $99 monthly, outperforming pricier options like ADP for basic needs. Local factors such as payroll taxes business impact in BC emphasize the need for seamless remittances, where providers like Intuit Core excel in e-filing but lack personalized support. Businesses should select based on size: startups favor Wagepoint’s flat fees for payroll services in Surrey, BC, while growing teams benefit from Payworks’ scalability. Next, consider contacting top picks for custom quotes to align with your operations.

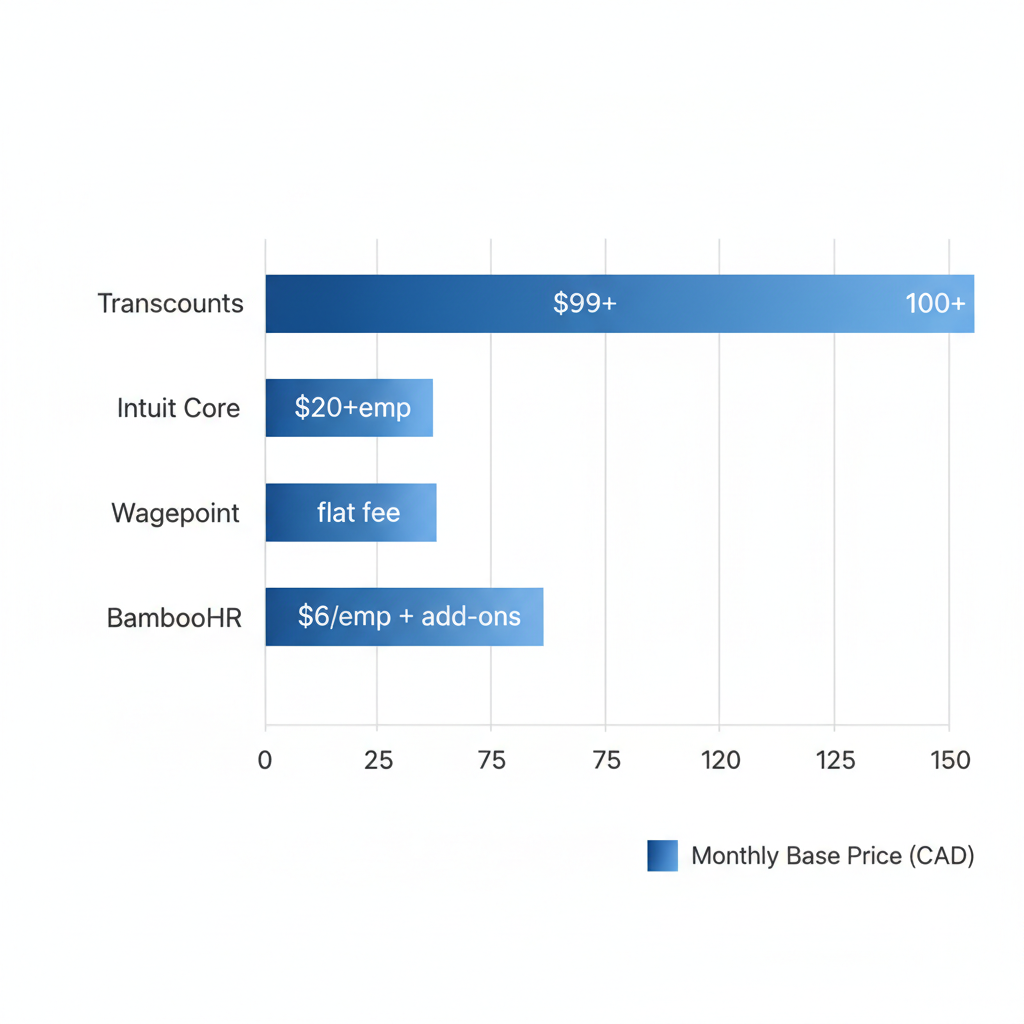

Pricing varies significantly, with per-employee models suiting variable workforces and flat fees ideal for predictability. For visual clarity on costs, review the chart below, which underscores how volume-based pricing like Transcounts’ supports e-commerce growth without excessive overhead.

QuickBooks Payroll pricing comparison for Surrey businesses

Understanding these differences ensures Surrey businesses choose payroll solutions that minimize the payroll taxes business impact while maximizing efficiency and compliance.

Additional QuickBooks Payroll Option in Surrey

Businesses in Surrey, BC, looking for reliable payroll solutions can explore QuickBooks Online Payroll Canada as an additional option. This service integrates seamlessly with accounting software, offering automated processing for direct deposits and tax remittances tailored to local needs. For comprehensive payroll services in Surrey, BC, combining it with professional support ensures compliance and efficiency.

Choosing the Right QuickBooks Payroll Provider for Your Surrey Business

Selecting the optimal Surrey payroll choice for your business means prioritizing providers that offer seamless integration with QuickBooks Payroll in Surrey, BC. Top options like Transcounts stand out for their affordability, local expertise, and proven ability to handle compliance for small to medium enterprises. By referencing the earlier comparison table, businesses can see clear cost savings, such as reduced manual errors leading to up to 30% faster processing times, alongside effortless adherence to BC regulations.

Key insights reveal how these services simplify operations through automated remittances and direct deposits, minimizing setup hassles with comprehensive training programs. Real-world examples, like the payroll case study Boxhub, demonstrate measurable benefits including month-end closes reduced from weeks to days, empowering entrepreneurs to focus on growth rather than administrative burdens. Exploring outsourcing payroll reasons further underscores why delegation enhances accuracy and scalability for local firms.

- Compliance Confidence: Stay audit-ready with automated provincial tax filings tailored for Surrey operations.

- Cost Efficiency: Fixed fees based on transaction volume keep expenses predictable.

- Scalable Support: From onboarding to ongoing advice, adapt to your business size.

Recommendations urge evaluating based on employee count and revenue: smaller teams benefit from streamlined local QuickBooks implementation, while growing firms need robust support like Transcounts’ 30-day onboarding. For personalized guidance on payroll services in Surrey, BC, reach out to Transcounts at their Vancouver hub, serving clients nationwide–contact today for a custom quote to elevate your operations.