Table of Contents

Hiring a QuickBooks Consultant in Vancouver

Vancouver businesses, especially e-commerce sellers and startups, often face challenges like navigating HST compliance and handling cross-border US sales, leading to costly errors in financial management. Hiring a QuickBooks Consultant in Vancouver can transform these pain points into streamlined operations, offering expert guidance tailored to the local Canadian market.

Engaging a Quickbooks Proadvisor Vancouver like those at Transcounts ensures certified expertise in QuickBooks setup, optimization, and integration with tools like Xero. This Vancouver-based QuickBooks expert delivers 100% online bookkeeping services, including ProAdvisor support and compliance for provincial taxes, all at fixed monthly fees based on transaction volume. Unlike in-house staff, these local QuickBooks optimization services provide cost savings, robust security protocols, and fast response times under 24 hours, positioning Transcounts as a top provider with high client satisfaction rates.

What makes a QuickBooks ProAdvisor in Vancouver essential? It addresses unique needs like BC sales tax nuances and e-commerce inventory reporting. Factors influencing pricing include transaction complexity and custom needs, with quotes ensuring affordability. As we explore the roles of these consultants next, discover how they consistently drive efficiency for SMEs in Vancouver, BC.

Understanding QuickBooks Consulting

QuickBooks consulting plays a vital role in helping Vancouver businesses streamline their accounting processes, ensuring compliance with Canadian regulations and optimizing financial operations. For small and medium-sized enterprises, especially in e-commerce and startups, professional guidance from experts like Transcounts can transform complex bookkeeping into an efficient system. This section explores the core elements of QuickBooks services, how to locate certified professionals, and seamless integrations with local tools.

Core Components of QuickBooks Services

A QuickBooks Consultant in Vancouver typically begins with an initial assessment to evaluate a business’s current accounting setup and identify pain points, such as manual data entry or outdated software. This phase involves reviewing financial records to recommend tailored solutions that align with operational needs. Following the assessment, software configuration customizes QuickBooks features like invoicing templates and expense tracking to fit the client’s workflow, ensuring accuracy for Vancouver-based firms dealing with HST filings.

Data migration comes next, where historical records are securely transferred into QuickBooks without disrupting daily operations. Training sessions empower business owners and staff with hands-on instruction on using dashboards, generating reports, and reconciling accounts. Ongoing support provides troubleshooting and monthly check-ins to maintain system efficiency, with ProAdvisors offering priority access to Intuit resources.

Key phases include:

- Initial assessment: Diagnose issues and set goals.

- Configuration and migration: Customize and import data.

- Training and support: Build skills and ensure long-term success.

QuickBooks bookkeeping in Vancouver benefits from this structured approach, reducing errors and saving time for growing companies. As an alternative to self-setup, consulting offers pros like expert compliance knowledge and faster ROI, while cons include upfront costs compared to free trials. However, for SMEs, the investment yields cleaner books and audit-ready reports, positioning firms like Transcounts as reliable partners with fixed-fee models starting at competitive rates around $500 monthly, aligning with Vancouver averages of $400-$800 as per local guides.

Finding Certified Experts in Vancouver

Locating a certified QuickBooks specialist in BC requires verifying ProAdvisor status through Intuit’s official directory, which lists professionals who have passed rigorous exams and maintain annual training credits. For Vancouver needs, search for experts with experience in Canadian tax rules, such as GST/HST reporting, to ensure local relevance. Reliable indicators include client testimonials, years in service, and affiliations with firms like Transcounts that specialize in remote yet tailored support.

To identify top options, check for endorsements from the Better Business Bureau or QuickBooks user forums, and request case studies from similar industries. Vancouver QuickBooks advisory services often highlight their ability to handle cloud-based access, allowing seamless collaboration regardless of location. Transcounts, for instance, positions itself as a leading QuickBooks ProAdvisor in Vancouver by offering 24-hour response times and expertise across e-commerce platforms.

When expanding regionally, consider Quickbooks Proadvisor Surrey for nearby support that understands Lower Mainland dynamics. Actionable steps include:

- Review Intuit certifications online.

- Schedule consultations to discuss Vancouver-specific challenges.

- Evaluate pricing against local benchmarks for value.

This process answers queries like “How to find a certified QuickBooks ProAdvisor in Vancouver BC?” by emphasizing verified credentials and proven results, helping businesses select partners that deliver strategic insights.

Integration with Local Business Tools

QuickBooks aligns effectively with Canadian payroll and tax software, enabling Vancouver firms to automate compliance-heavy tasks. For payroll, integration with Wagepoint streamlines direct deposits, remittances, and employee onboarding, ensuring adherence to provincial regulations without manual calculations. This setup reduces errors in source deductions and supports real-time reporting for small businesses.

On the tax side, connecting to TaxJar handles US sales tax nexus for e-commerce sellers, while native QuickBooks features manage HST filings for Canadian operations. Tools like Plooto automate bill payments, integrating directly to prevent duplicate entries and improve cash flow visibility.

Vancouver examples include e-commerce startups using these links to reconcile A2X data for accurate inventory and sales tracking. Benefits encompass faster month-end closes and scalable growth, with Transcounts facilitating setups through their technology-driven model.

Key integrations:

- Payroll: Wagepoint for automated remittances.

- Taxes: TaxJar for cross-border compliance.

- Payments: Plooto for secure vendor transactions.

By leveraging these, businesses gain end-to-end efficiency, hinting at the broader value of professional consulting in driving operational success and regulatory peace of mind.

Benefits of QuickBooks Consulting in Vancouver

Hiring a QuickBooks Consultant in Vancouver brings significant value to businesses navigating the complexities of financial management. Local companies, especially startups and e-commerce firms, gain from tailored Vancouver QuickBooks support benefits that enhance operations without the overhead of full-time staff. These professionals streamline processes, ensuring compliance and efficiency while integrating tools like automated reconciliations for faster workflows.

Enhanced Compliance and Efficiency

QuickBooks consulting in Vancouver ensures businesses meet stringent regulatory requirements, particularly for GST/HST filings and US sales tax obligations. Consultants handle accurate tax handling by automating reconciliations, reducing errors that could lead to penalties. For local businesses, this means quicker month-end closes, often saving up to 30% in time compared to manual processes.

Streamlined workflows come from integrating QuickBooks bookkeeping in Vancouver with cloud-based tools, enabling real-time KPI dashboards for better decision-making. Vancouver-specific perks include knowledge of regional taxes and rapid response times, minimizing disruptions. Secure cloud infrastructure protects sensitive data; according to insights on accounting firm productivity, data breaches cost firms an average of $4.45 million annually, underscoring the need for robust cybersecurity in bookkeeping. By bundling accounts payable and receivable services, consultants like those from Transcounts boost overall efficiency, allowing teams to focus on growth rather than administrative burdens.

This approach not only maintains compliance but also fosters a proactive financial environment, answering why specialized support proves essential for Vancouver enterprises.

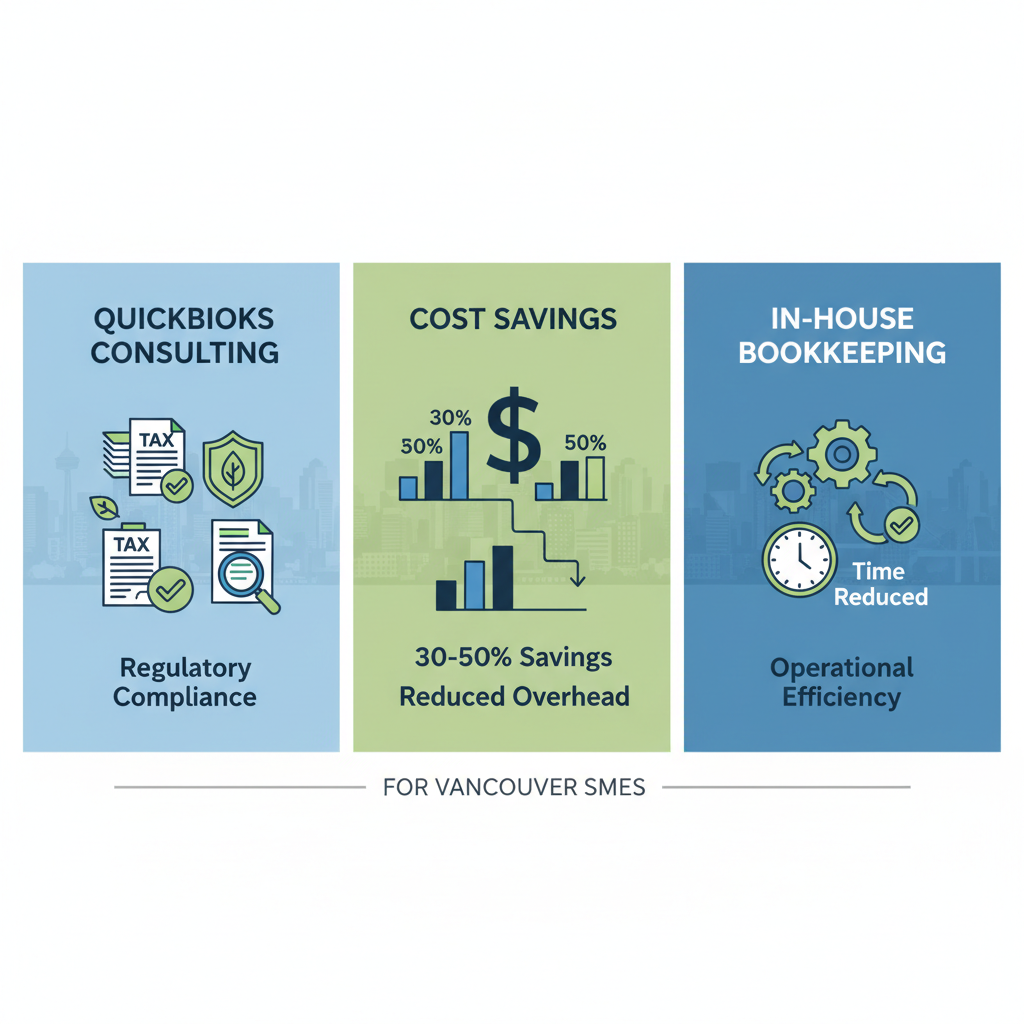

QuickBooks consulting advantages in compliance, costs, and efficiency for Vancouver businesses

The infographic highlights how these efficiencies translate into tangible productivity gains, setting the stage for exploring cost implications.

Cost Savings for Startups and SMEs

For startups and SMEs in Vancouver, engaging a quickbooks online bookkeeper vancouver offers substantial savings over in-house hires. Fixed fees typically range from $500 to $1,500 per month, based on transaction volume, compared to an annual salary exceeding $60,000 for a full-time bookkeeper, plus benefits and training costs.

This model eliminates recruitment expenses and provides scalable support without long-term commitments. Local bookkeeping advantages include customized plans for Vancouver firms, such as e-commerce sellers managing inventory and sales tax. Businesses report ROI through reduced errors and faster reporting, often recouping fees within months via improved cash flow visibility.

Tailored fixed pricing avoids surprises, with bundled services like payroll and tax compliance adding value. For tech startups, this means accessing QuickBooks ProAdvisor in Vancouver expertise at a fraction of traditional costs, enabling focus on innovation rather than finance overhead.

Access to Specialized Local Expertise

Vancouver’s dynamic e-commerce and tech sectors benefit immensely from QuickBooks ProAdvisor in Vancouver certifications, which guarantee advanced proficiency in QuickBooks Online. These experts offer industry-specific guidance, such as integrating A2X for sales tax reconciliation or TaxJar for US nexus compliance, crucial for cross-border operations.

Local consultants provide quick responses, often within 24 hours, leveraging regional knowledge of British Columbia’s tax landscape. For nonprofits and agencies, this translates to customized KPI dashboards and cash flow forecasting, supporting strategic goals. Transcounts’ ProAdvisors, for instance, deliver fractional CFO insights, helping clients prepare investor-ready reports.

Engaging such expertise ensures audit-ready books and CRA notice support, fostering trust with stakeholders. Ultimately, these local bookkeeping advantages empower Vancouver businesses to scale confidently, addressing needs for reliable QuickBooks bookkeeping services in Vancouver for startups.

How QuickBooks Consulting Works

QuickBooks consulting with Transcounts streamlines financial management for Vancouver businesses through a structured, remote workflow. This process ensures seamless integration of cloud-based accounting tools, tailored to local needs like provincial tax remittance. From initial setup to ongoing maintenance, the approach minimizes disruptions while maximizing efficiency for small and medium-sized enterprises.

Onboarding and Setup Process

The onboarding phase typically spans 30 days, designed to integrate your existing financial data smoothly into QuickBooks. It begins with a discovery call where a dedicated QuickBooks Consultant in Vancouver assesses your business operations, identifying key pain points such as outdated spreadsheets or manual invoicing. This initial consultation builds trust by aligning the setup with your specific goals, drawing from best practices in bookkeeping services.

Next, data migration transfers historical records securely into QuickBooks, ensuring accuracy for e-commerce sellers or tech startups in the area. Customization follows, where charts of accounts are tailored for Vancouver-specific requirements, like handling GST/HST remittances. Training sessions via Zoom equip your team with hands-on guidance, covering essential features to foster independence.

- Schedule discovery call (Day 1-3).

- Migrate data and customize setup (Day 4-15).

- Conduct training and testing (Day 16-30).

This structured timeline, informed by Vancouver bookkeeping guides, reduces setup time compared to in-house efforts, saving on training costs that could exceed $5,000 annually.

QuickBooks consulting workflow: five essential stages for seamless setup and compliance.

By completing onboarding efficiently, businesses experience faster month-end closes and reliable reporting from day one, setting a strong foundation for growth.

Ongoing Support and Interactions

Ongoing support maintains your QuickBooks system through proactive monthly tasks, delivered remotely for convenience. A dedicated success manager acts as your primary contact, using tools like Slack for quick queries and Zoom for deeper reviews. This Vancouver consulting workflow ensures response times under 24 hours, addressing issues like reconciliation discrepancies promptly.

Monthly activities include bank reconciliations, financial reporting, and inventory updates, all customized for local compliance. For instance, QuickBooks ProAdvisor in Vancouver expertise handles provincial sales tax filings seamlessly. Remote QuickBooks guidance via shared screens allows real-time collaboration, reducing downtime for busy SMEs.

When describing monthly tasks, Transcounts provides comprehensive bookkeeping services Vancouver, including bill payments and KPI dashboards. Compared to in-house bookkeeping, this model cuts costs by 40-60%, as it eliminates the need for full-time hires and ongoing training.

- Review and reconcile accounts (weekly check-ins).

- Generate reports and forecasts (mid-month).

- Optimize processes based on feedback (end-of-month).

These interactions foster a partnership feel, answering how remote support works effectively even from afar.

Security and Data Handling

Security forms the cornerstone of the QuickBooks consulting process, protecting sensitive financial data at every step. Transcounts adheres to SOC 2 compliance standards, ensuring rigorous controls for data privacy and availability. All interactions use end-to-end encryption, safeguarding information during migrations and remote sessions.

Data handling protocols include role-based access, where only authorized personnel view client files on secure cloud infrastructure. Regular audits and multi-factor authentication prevent breaches, aligning with Vancouver’s stringent regulatory environment. For added reassurance, backups occur daily, with recovery tested quarterly.

- Encrypt all data transmissions (AES-256 standard).

- Conduct compliance audits (bi-annually).

- Monitor access logs continuously.

This approach addresses concerns about data security when hiring remote consultants, offering peace of mind through transparent measures. By prioritizing protection, Transcounts enables businesses to focus on core operations without financial vulnerabilities.

Best Practices for QuickBooks Consulting in Vancouver

Engaging a QuickBooks Consultant in Vancouver can transform how local businesses manage their finances, especially for startups navigating e-commerce and seasonal demands. By following these best practices, companies can ensure efficient implementation and ongoing optimization tailored to British Columbia’s regulatory landscape.

Selecting the Right Provider

Choosing the right QuickBooks consulting partner in Vancouver requires careful evaluation to align with your business needs. Start by verifying their ProAdvisor certification, which guarantees expertise in QuickBooks features and updates. Look for providers with strong Google reviews, as these reflect real client experiences in the local market. Prioritize those with e-commerce experience, given Vancouver’s thriving online retail scene.

Key criteria include:

- Certifications and Experience: Confirm QuickBooks ProAdvisor status and years serving Vancouver SMEs.

- Local Knowledge: Seek firms familiar with BC tax rules and seasonal preparations, like GST/HST filings.

- Client Reviews: Analyze feedback on platforms for reliability; top-rated bookkeepers often highlight responsive service.

- Custom Fit: Ensure they offer bundled services for cost control, ideal for startups.

For instance, a Vancouver tech startup avoided costly errors by selecting a certified consultant versed in local compliance. This approach secures optimal QuickBooks practices in BC and builds long-term partnerships. (152 words)

Maximizing Value from Services

To get the most from QuickBooks bookkeeping in Vancouver, focus on proactive collaboration and strategic integrations. Schedule monthly check-ins to review financials and adjust setups, preventing small issues from escalating. Implement automation for invoicing and reconciliations, freeing time for growth-focused tasks.

Effective tips include:

- Regular Audits: Conduct quarterly reviews with your QuickBooks ProAdvisor in Vancouver to maintain accuracy.

- Custom KPI Integrations: Set up dashboards for cash flow and inventory, tailored to e-commerce needs.

- Automation Tools: Leverage integrations like A2X for sales tax, enhancing efficiency.

- small business accounting Vancouver: Adopt SME-specific strategies, such as fixed-fee models for predictable budgeting.

A local agency in Vancouver boosted profitability by delegating complex tasks to their consultant, incorporating Vancouver consulting tips like seasonal forecasting. These habits ensure scalable financial health without overwhelming internal teams. (148 words)

Common Pitfalls to Avoid

Even experienced users encounter hurdles in QuickBooks consulting; avoiding them is crucial for Vancouver businesses facing unique pressures like rapid growth or tax changes. Common mistakes include poor data migration, which can lead to inaccurate reporting and compliance risks.

Watch out for these issues:

- Ignoring Software Updates: Failing to apply patches results in vulnerabilities; always schedule timely upgrades.

- DIY Complex Tasks: Attempting advanced setups without expertise causes errors, as seen in a Kitsilano retailer’s botched inventory sync.

- Neglecting Local Compliance: Overlooking BC-specific rules, like provincial sales tax, invites penalties during audits.

- Inadequate Backups: Skipping regular data exports exposes firms to loss; use cloud integrations for security.

By delegating to professionals, a Vancouver nonprofit sidestepped migration pitfalls during expansion. Adopting a cautionary mindset promotes proactive habits, safeguarding against disruptions and fostering reliable operations in the competitive local market. (150 words)

Choosing Your QuickBooks Partner in Vancouver

Selecting the right QuickBooks Consultant in Vancouver can transform your business’s financial management, ensuring efficiency and growth in a competitive local market. As a trusted QuickBooks ProAdvisor in Vancouver, Transcounts delivers secure, scalable services tailored to Canadian businesses, from startups to established firms. Our expertise in QuickBooks bookkeeping in Vancouver emphasizes cost savings through fixed monthly fees based on transaction volume, helping you avoid hidden charges while maintaining full compliance with CRA regulations. We prioritize data security with cloud infrastructure and integrate seamlessly with your operations for real-time insights. Vancouver’s dynamic economy benefits from our scalable solutions, whether you’re an e-commerce seller or tech startup, providing the agility needed for expansion.

Success stories abound, as seen in this bookkeeping case study Vancouver, where local clients achieved streamlined accounting and predictable cash flow. Hiring a QuickBooks ProAdvisor in Vancouver like Transcounts addresses common concerns around costs–typically more affordable than traditional firms–and ensures QuickBooks online bookkeeping fits seamlessly for Canadian businesses in Vancouver, BC. Embrace a Vancouver QuickBooks partnership today for local accounting success. Contact us now for a free quote and take the first step toward empowered finances that fuel your vision.