Table of Contents

Navigating Payroll Needs for Businesses in Surrey, British Columbia

Running a small business in Surrey, British Columbia, often means juggling tight deadlines and complex regulations. Payroll Services in Surrey, British Columbia, become essential when tax filing complexities, biweekly processing demands, and direct deposit expectations pile up. In fact, payroll errors impact nearly 40% of Canadian small businesses, leading to costly CRA penalties, as outlined in the Employer’s Guide on Payroll Deductions and Remittances (T4001).

Transcounts, a Vancouver-based provider, offers reliable payroll services Vancouver tailored for local needs. Their automated solutions handle CRA remittances–timely payments to the Canada Revenue Agency for taxes–with seamless QuickBooks integrations and employee onboarding. Enjoy fixed monthly fees based on transaction volume, plus benefits like error-free compliance and faster processing for small business payroll in Surrey.

This guide explores the local landscape of payroll companies in Surrey, British Columbia, key services, selection considerations, and easy implementation steps to streamline your outsourced payroll management in the region.

Payroll Landscape in Surrey, British Columbia

Surrey, British Columbia, has seen robust business growth, particularly in e-commerce and tech startups, with over 10,000 small and medium-sized enterprises (SMEs) driving demand for efficient Payroll Services in Surrey, British Columbia. These firms face unique pressures from rapid expansion and regulatory demands, making reliable payroll management essential for maintaining compliance and cash flow.

Small business payroll in Surrey presents several challenges amid this dynamic environment. Key issues include navigating British Columbia’s employment standards, such as overtime pay requirements and statutory holiday entitlements, as outlined in provincial guidelines. Businesses must also handle Canada Revenue Agency (CRA) deductions, including payroll tax increases Canada that impact financial planning. Worker compensation filings add complexity, especially for seasonal or contractor-heavy operations common in the Fraser Valley. Manual processing risks errors and delays, while rising costs strain budgets for growing SMEs. Local outsourced payroll options help mitigate these, but selecting the right provider requires careful evaluation.

Top payroll companies in Surrey, British Columbia, offer varied solutions tailored to regional needs. Providers like Transcounts stand out with technology-driven automation, integrating seamlessly with QuickBooks and Xero for biweekly processing and direct deposits. Regional payroll firms such as WIO Accounting and Clearpath CPAs provide bundled services, focusing on remittances and tax support for small businesses.

When evaluating payroll providers, consider automation levels versus cost efficiency, as Surrey firms prioritize scalability for e-commerce growth alongside affordable compliance. The following table compares key local options, including Transcounts, based on features, pricing, and support drawn from provider details and CRA guidelines.

| Provider | Key Features | Pricing Model | Compliance Support |

|---|---|---|---|

| Transcounts | Automated processing, direct deposit, CRA tax filing, QuickBooks/Xero integration | Fixed monthly fees based on transaction volume ($200-$500) | Full CRA/PD7A remittances, GST/HST support, audit-ready docs |

| WIO Accounting | Basic payroll, remittances, small business focus | Hourly or project-based ($150-$400) | Basic remittances, provincial taxes |

| Clearpath CPAs | Payroll with accounting bundle, tax services | Bundled with accounting ($300+) | CRA filing, sales tax nexus |

| Cougar Accounting | Custom payroll for contractors, compliance checks | Custom quotes ($250-$600) | BC payroll deductions, worker comp |

| Local Alternatives | Varies; often manual with limited automation | Per-payrun fees ($50-$150) | Standard CRA compliance, limited extras |

Transcounts excels in automation, offering scalability for Surrey’s growing SMEs with fixed fees that avoid surprise costs, unlike variable models from alternatives. This edge supports e-commerce and startups handling high transaction volumes while ensuring full BC and federal compliance.

These comparisons highlight how providers address Surrey’s specific business landscape, from tech-driven efficiency to bundled accounting. Businesses benefit from evaluating options based on employee count and integration needs, ensuring seamless operations in the Fraser Valley.

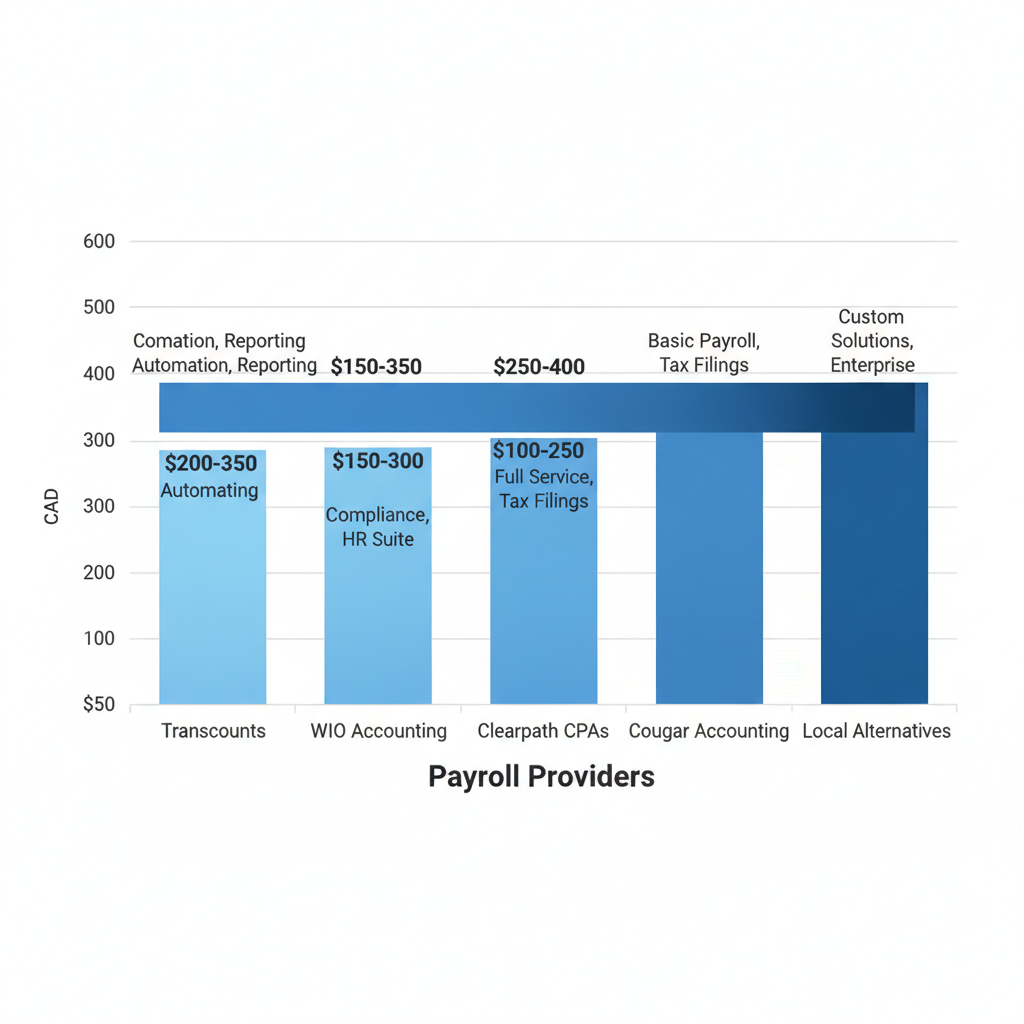

Comparison of payroll providers in Surrey, BC

Visual aids like this chart further illustrate pricing and feature disparities, aiding decision-making for local firms seeking reliable payroll support.

Available Payroll Services in the Surrey Region

Payroll Services in Surrey, British Columbia, cater to diverse business needs, from startups to established firms. These services handle essential tasks like processing employee payments, ensuring compliance with Canada Revenue Agency (CRA) requirements, and streamlining financial operations. Local providers focus on efficiency, helping businesses avoid penalties and maintain accurate records.

Core payroll services available in the region include several key features designed for operational reliability:

- Processing Frequency: Options for biweekly or monthly runs accommodate various pay cycles, with Biweekly Payroll Processing Surrey enabling timely disbursements to support cash flow management.

- Tax Filing and Remittances: Automated CRA filings and remittances reduce administrative burdens, ensuring timely source deductions for income tax, CPP, and EI.

- Direct Deposit Solutions: Regional direct deposit solutions via platforms like Wagepoint facilitate secure, instant transfers to employee accounts, minimizing check-handling costs.

- Integrations and Onboarding: Seamless syncing with QuickBooks or Xero simplifies employee onboarding, including W-4 forms and benefits setup, while integrating sales tax tools for e-commerce sellers.

Transcounts stands out for small business payroll in Surrey through its end-to-end automation tailored for e-commerce and tech startups. The service offers fixed monthly fees based on transaction volume, delivering faster month-end closes–often within days–compared to manual processes. Automated remittances and direct deposits via Wagepoint ensure compliance, with employee onboarding completed online in under a week. Payroll automation for local firms like these reduces errors by up to 90%, providing CFO-level insights at scalable prices and supporting growth in British Columbia’s dynamic market.

Local alternatives, such as payroll companies in Surrey, British Columbia, provide varied options. Clearpath CPAs bundles payroll with broader accounting for comprehensive support, ideal for firms needing integrated tax planning. Cougar Accounting excels in contractor-specific compliance, emphasizing remittance accuracy for freelancers. While these offer solid features, Transcounts’ technology-driven approach provides superior speed and scalability for SMEs, aligning with regional needs for efficient, compliant operations.

Key Compliance and Local Factors in Surrey

For businesses seeking reliable Payroll Services in Surrey, British Columbia, understanding local compliance is essential to avoid costly penalties. Non-compliance with BC payroll regulations can result in fines up to $10,000 or more, disrupting operations in the Fraser Valley. Transcounts excels in guiding clients through these requirements, ensuring seamless adherence.

British Columbia employment standards form the foundation of payroll compliance in Surrey. Key regulations include a minimum wage of $16.75 per hour as of June 2023, with overtime pay at 1.5 times the regular rate after eight hours daily. Employers must also provide statutory holidays and vacation pay at four percent of earnings. These rules protect workers while demanding accurate tracking from payroll companies in Surrey, British Columbia.

Tax obligations add another layer, particularly CRA PD7A remittances due by the 15th of the month following deductions, as outlined in the Employer’s Guide – Payroll Deductions and Remittances (T4001). Businesses with sales tax nexus must file GST/HST returns quarterly, navigating provincial variances. Worker compensation through WorkSafeBC requires premiums based on industry risk, alongside statutory deductions for CPP, EI, and income tax. Local tax compliance tools from Transcounts automate these, reducing errors in high-volume environments.

Transcounts provides audit-ready support for small business payroll in Surrey, integrating with platforms like Quickbooks Payroll Surrey for real-time remittances. Our expertise minimizes risks, empowering startups to focus on growth with confidence.

Steps to Implement Payroll Solutions in Surrey

Implementing payroll for your small business in Surrey does not have to be overwhelming. Follow these structured steps to select and onboard reliable services, ensuring compliance with local regulations while streamlining operations. Addressing common concerns like setup time, this process can complete efficiently, often within 30 days.

- Assess Your Needs: Begin by evaluating your business requirements, such as the number of employees and pay frequency. For Payroll Services in Surrey, British Columbia, consider factors like seasonal hiring common in local industries. This step helps tailor solutions to your scale.

- Compare Providers: Research payroll companies in Surrey, British Columbia, focusing on criteria like cost, direct deposit speed, and compliance support. Review options for fixed fees and integration ease to find the best fit. Explore outsourcing payroll benefits to understand long-term savings.

- Onboard the Service: Submit necessary documents, including employee records as required by BC Employment Standards, and configure the system. For small business payroll in Surrey, prioritize onboarding local payroll processes to meet provincial remittance deadlines.

- Integrate with Tools: Connect the payroll system to your accounting software for seamless data flow. Test implementations to verify accuracy in implementing regional solutions.

Transcounts offers a streamlined 30-day onboarding with fixed monthly fees based on transaction volume, dedicated support, and automation for direct deposits and remittances. Their process includes compliance checks, reducing setup hesitations.

Quick Checklist:

- Review employee docs for BC standards.

- Verify provider’s local expertise.

- Schedule integration testing.

This roadmap empowers Surrey businesses to achieve efficient, compliant payroll effortlessly.

Four key steps to implement payroll solutions in Surrey

Choosing the Right Payroll Partner in Surrey

In a Surrey business payroll summary, compliance with local regulations remains essential for smooth operations. Payroll Services in Surrey, British Columbia, offer direct deposit, automated tax filing, and expert support, making them ideal for small business payroll in Surrey. Among payroll companies in Surrey, British Columbia, Transcounts stands out with local expertise, fixed pricing, and seamless automation–unlike broader providers like WIO Accounting. Explore our payroll case study Boxhub for real results. Evaluate your needs today and contact Transcounts for a tailored quote to drive growth.