Table of Contents

Streamlining Finances with Online Bookkeeping in Vancouver, BC

Vancouver’s vibrant entrepreneurial landscape, fueled by tech innovations and e-commerce growth, sees over 50% of BC startups grappling with financial tracking challenges. From Yaletown startups to Kitsilano freelancers, manual bookkeeping often overwhelms busy owners handling high transaction volumes from online sales or invoicing. Online bookkeeping in Vancouver, BC emerges as a game-changer, automating reconciliation and generating real-time reports to keep finances accurate and accessible.

This shift to cloud-based accounting in BC tackles local hurdles like GST/HST compliance, ensuring seamless integration with daily operations. Transcounts delivers virtual bookkeeping in Vancouver through 100% remote services, leveraging QuickBooks and Xero for efficient automation. With fixed-fee pricing based on revenue or transactions and quick onboarding, we provide affordable small business bookkeeping in Vancouver tailored to your needs. Discover our bookkeeping services vancouver for secure, tech-driven support that scales with your growth.

Explore how these solutions address Vancouver’s diverse business demands in the sections ahead.

Bookkeeping Needs in Vancouver’s Business Landscape

Vancouver’s dynamic business scene demands tailored bookkeeping solutions that reflect its varied neighborhoods, from bustling tech hubs to creative enclaves. Online bookkeeping in Vancouver, BC, emerges as a flexible option for entrepreneurs navigating local regulations like BC’s PST on retail sales and startup cash flows. As the city grows, with SMEs expanding rapidly, efficient financial management becomes essential for compliance and growth.

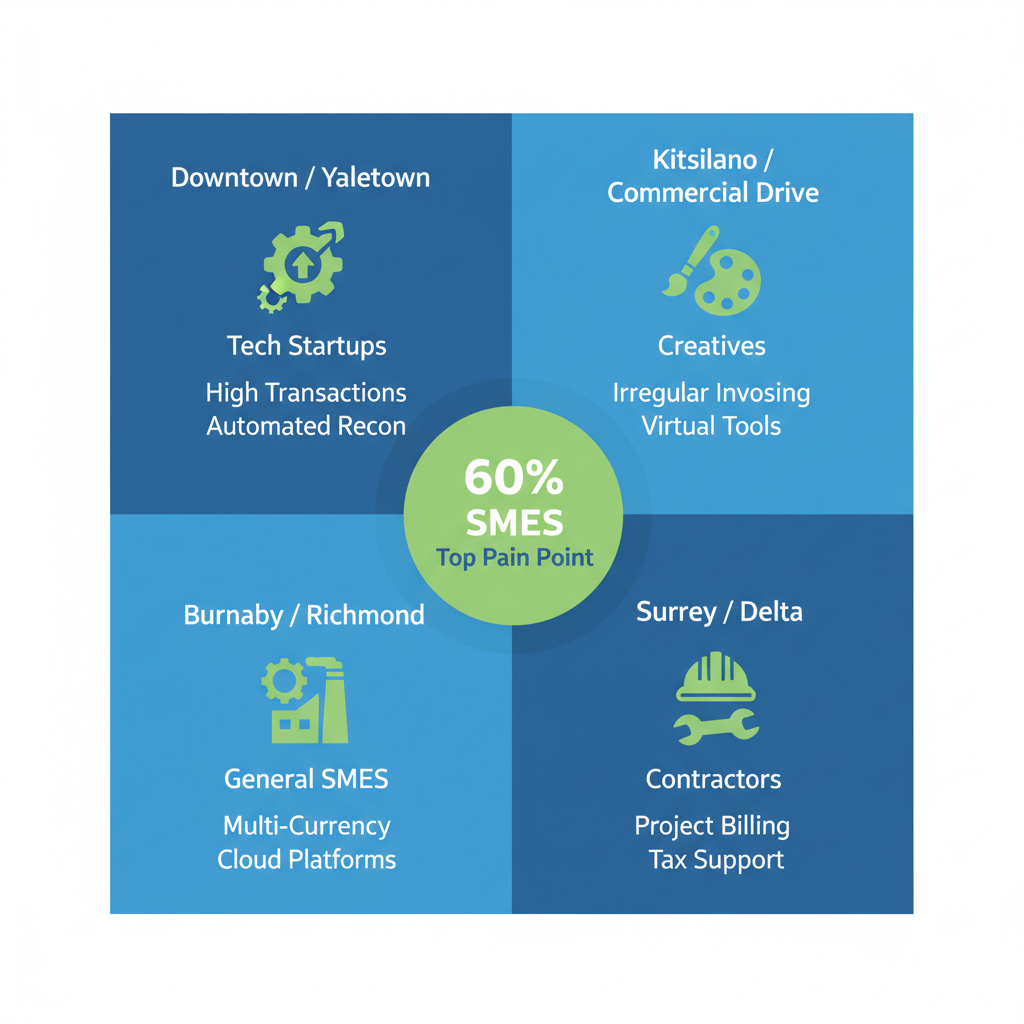

Key challenges vary by district, such as high-volume transactions for e-commerce sellers in downtown areas who juggle Amazon sales and inventory. In artistic spots, freelancers face irregular invoicing and expense categorization, while manufacturers in outer regions deal with project billing and GST/HST filings. These issues highlight the need for virtual bookkeeping in Vancouver to adapt to diverse workflows, ensuring accurate records amid provincial tax nuances.

Vancouver’s neighborhoods shape unique bookkeeping priorities, influenced by dominant industries and operational scales. The following table outlines these differences, drawing from local reports where 60% of SMEs identify bookkeeping as a top pain point.

| Neighborhood | Primary Industries | Common Bookkeeping Challenges | Recommended Service Focus |

|---|---|---|---|

| Downtown/Yaletown | Tech startups, e-commerce | High transaction volumes, inventory tracking | Automated reconciliation, sales tax compliance |

| Kitsilano/Commercial Drive | Creative agencies, freelancers | Irregular invoicing, expense categorization | Virtual invoicing tools, catch-up bookkeeping |

| Burnaby/Richmond | SMEs, nonprofits | Multi-currency handling, payroll integration | Cloud platforms like QuickBooks, fixed-fee packages |

| Surrey/Delta | Contractors, manufacturing | Project-based billing, GST/HST filings | Remote AP/AR management, tax support |

This comparison reveals how area-specific accounting support can address localized hurdles, from Yaletown’s 40% share of BC tech startups to Surrey’s construction demands. Transcounts leverages a virtual model with cloud integrations like QuickBooks to unify these needs, offering scalable small business accounting vancouver that handles everything from catch-up sessions for freelancers to multi-currency tools for nonprofits.

For small business bookkeeping in Vancouver, these adaptations provide CFO-level insights at fixed fees, streamlining digital financial management in BC locales. Consider a Kitsilano agency using remote invoicing to tame erratic cash flows–such targeted approaches foster stability across the region.

Vancouver SME bookkeeping pain points by neighborhood with 60% prevalence stat

By focusing on these tailored strategies, businesses in Vancouver’s pockets gain clearer paths to financial health, bridging geographic variances through innovative online delivery.

Accessing Online Bookkeeping Services in Vancouver

Vancouver businesses can easily access reliable online bookkeeping in Vancouver, BC, through fully remote platforms that cater to the city’s dynamic startup and e-commerce landscape. Providers like Transcounts offer virtual bookkeeping in Vancouver, ensuring seamless integration without the need for on-site visits. This model supports accessible cloud accounting in BC, with 24/7 availability and response times under 24 hours, making it ideal for firms handling provincial remittances and growth challenges.

Core services form the foundation of these offerings, addressing everyday financial needs with efficiency. Key components include:

- Invoicing and automated reminders to streamline client billing for agencies and contractors.

- Bill payments via secure tools like Plooto, reducing manual errors in accounts payable.

- Bank feeds and reconciliations that sync daily transactions, crucial for e-commerce sellers syncing Shopify sales.

- Inventory reports for tracking stock in real-time, preventing discrepancies in retail operations.

These bundled AP/AR solutions enhance cash flow visibility. Platform specifics focus on leading tools: Transcounts integrates with Quickbooks Online Bookkeeper Vancouver and Xero for automated workflows. According to Virtual Bookkeeping Canada, 90% of virtual firms leverage such cloud platforms to deliver accurate, real-time data. This setup avoids common pitfalls like unintegrated tools, which can lead to messy books–as outlined in AIS Solutions’ guide, where automation steps like feed imports resolve 80% of reconciliation delays.

Tax and payroll handling rounds out the services for compliance. Automation with Wagepoint covers direct deposits, remittances, and onboarding, while GST/HST filings and US nexus support via partnerships like A2X and TaxJar ensure Vancouver firms meet obligations effortlessly. Fixed-fee structures, based on transaction volume, keep costs predictable–typically $500 to $2,000 monthly for small business bookkeeping in Vancouver.

Transcounts differentiates with scalable remote finance solutions for Vancouver firms, offering catch-up discounts and CFO-level insights at accessible rates. This reliability reassures SMEs scaling amid BC’s regulatory demands, confirming full availability without physical presence.

Key Factors for Bookkeeping in British Columbia

Navigating bookkeeping in British Columbia involves unique local considerations that go beyond standard practices, particularly in Vancouver’s dynamic business landscape. Small enterprises here must manage provincial taxes alongside federal requirements while ensuring data security in a cloud-reliant environment. These factors influence everything from daily transactions to cross-border compliance, helping businesses avoid costly errors and stay audit-ready.

British Columbia’s sales tax system requires retailers to collect and remit PST on taxable goods and services, often alongside federal GST/HST, affecting up to 40% of Vancouver retail transactions as noted by local experts. For online bookkeeping in Vancouver, BC, this means using BC-compliant financial tools to automate filings and reduce errors. Security remains paramount for virtual bookkeeping in Vancouver, where secure remote accounting in Vancouver protects sensitive data from breaches. Key protocols include:

- Encrypted cloud storage to safeguard financial records.

- Automated handling of CRA and IRS notices for prompt compliance.

- Multi-factor authentication and regular audits to meet provincial standards.

Vancouver’s multicultural SMEs benefit from adaptable systems that handle diverse invoicing needs, supporting small business bookkeeping in Vancouver through tailored regulatory contexts.

Transcounts addresses these challenges with automated tools and secure infrastructure customized for the region. Their Xero Online Bookkeeper Vancouver integration ensures seamless PST/GST compliance and data protection. Options for catching up on messy books come with discounts, transparent fixed pricing, and audit-ready documentation, easing the compliance burden for local firms.

To incorporate these considerations, start with a compliance checklist during onboarding. Consult experts early for cross-border nuances, ensuring your bookkeeping aligns with BC regulations from day one.

Onboarding Your Bookkeeping Solution in Vancouver

Starting your journey with online bookkeeping in Vancouver, BC, is straightforward and tailored for local businesses like yours. Transcounts simplifies the process with a structured 30-day setup, ensuring clean books and seamless integration into your operations. This Vancouver onboarding for accounting focuses on efficiency, drawing from proven strategies to handle everything from initial setup to ongoing support.

Follow these numbered steps for a smooth transition to virtual bookkeeping in Vancouver:

- Schedule Your Free Consultation: Discuss your needs with a dedicated success manager, covering transaction volume and any messy backlogs. Expect custom quotes based on your specifics.

- Upload Documents Securely: Gather financial records, including BC PST returns and bank statements, using our secure portal. Reference the 5-step catch-up framework from AIS Solutions to organize messy books effectively.

- Link Accounts to QuickBooks or Xero: Connect your banks and tools for automated syncing, setting the stage for easy-start remote finance in BC.

- Meet Your Team: Get introduced to your bookkeeping specialist via video call, ensuring personalized guidance.

- Launch and Review: Complete integration within four weeks on average, as seen with services like Virtual Bookkeeping Canada, followed by your first month-end close.

For small business bookkeeping in Vancouver, pricing starts with fixed monthly fees determined by average transaction volume or revenue, with discounts for catch-up work on historical data. Prepare by compiling two years of statements and reconciling discrepancies upfront.

Step-by-step guide to onboarding bookkeeping with Transcounts in Vancouver

This approach delivers benefits like faster compliance with small business tax filing vancouver requirements and reduced stress for startups. Enjoy audit-ready books and strategic insights, empowering your growth in the BC market.

Achieving Financial Clarity with Vancouver Bookkeeping

In the dynamic landscape of online bookkeeping in Vancouver, BC, partnering with Transcounts delivers secure tax compliance, efficient onboarding, and scalable solutions for SMEs. Automation streamlines ecommerce bookkeeping services vancouver bc and startups, while local expertise ensures GST/HST mastery and cloud security. Fixed fees, reducing overhead by 30% per Save on Bookkeeping studies, provide predictability alongside catch-up services for virtual bookkeeping in Vancouver.

Embrace this local accounting partnership for small business bookkeeping in Vancouver, fostering sustained financial health in BC. Contact Transcounts today to explore tailored packages across diverse sectors and propel your growth.