Table of Contents

Reliable Bookkeeping for Burnaby Small Businesses

Burnaby’s small business scene is booming, fueled by thriving tech startups and e-commerce ventures in the Lower Mainland. As local entrepreneurs scale up, the demand for a skilled bookkeeper for small businesses in Burnaby grows, ensuring financial stability amid rapid expansion.

Many face challenges like tracking high transaction volumes from online sales or preparing accurate year-end reports for BC provincial taxes. According to local financial analyses, over 70% of Burnaby SMBs struggle with manual tracking, leading to cash flow hiccups and compliance risks. Outsourced financial tracking in the Vancouver area can bridge these gaps with efficient, cloud-based solutions.

Transcounts, a Vancouver-based firm, delivers bookkeeping services burnaby through scalable, technology-driven models integrated with QuickBooks and Xero. With fixed monthly fees based on revenue or transactions, over 100 clients served across Canada and the US, and response times under 24 hours, we provide local accounting support for Burnaby SMBs. Discover how Transcounts simplifies this with Monthly Bookkeeping Services Vancouver tailored for growth.

This guide explores local options, costs, and tips for choosing the right small business bookkeeper vancouver.

Burnaby Business Landscape and Bookkeeping Needs

Burnaby’s vibrant business scene thrives as a hub for retail, tech startups, and e-commerce, with hotspots like Metrotown and Brentwood driving economic growth. Over 5,000 small businesses operate here, benefiting from proximity to Vancouver while navigating unique local challenges. The city’s diverse neighborhoods foster innovation, from e-commerce booms in Brentwood to startup density in Metrotown, where financial management for Burnaby enterprises demands agile solutions.

Small businesses in Burnaby often require robust bookkeeping services in Burnaby to handle variable revenue streams, such as bank reconciliations and inventory tracking for online sellers. A bookkeeper for small businesses in Burnaby can address key needs like GST/HST filing and provincial sales tax compliance, especially in retail-heavy areas. For instance, a Brentwood e-commerce shop might process high transaction volumes, needing year-end reporting for investor readiness. Local firms report 30% time savings with cloud tools, per bookkeeping trends, while costs start at fixed monthly fees of $200-500 based on volume. Nonprofits and contractors in Lougheed also seek payroll automation to streamline operations.

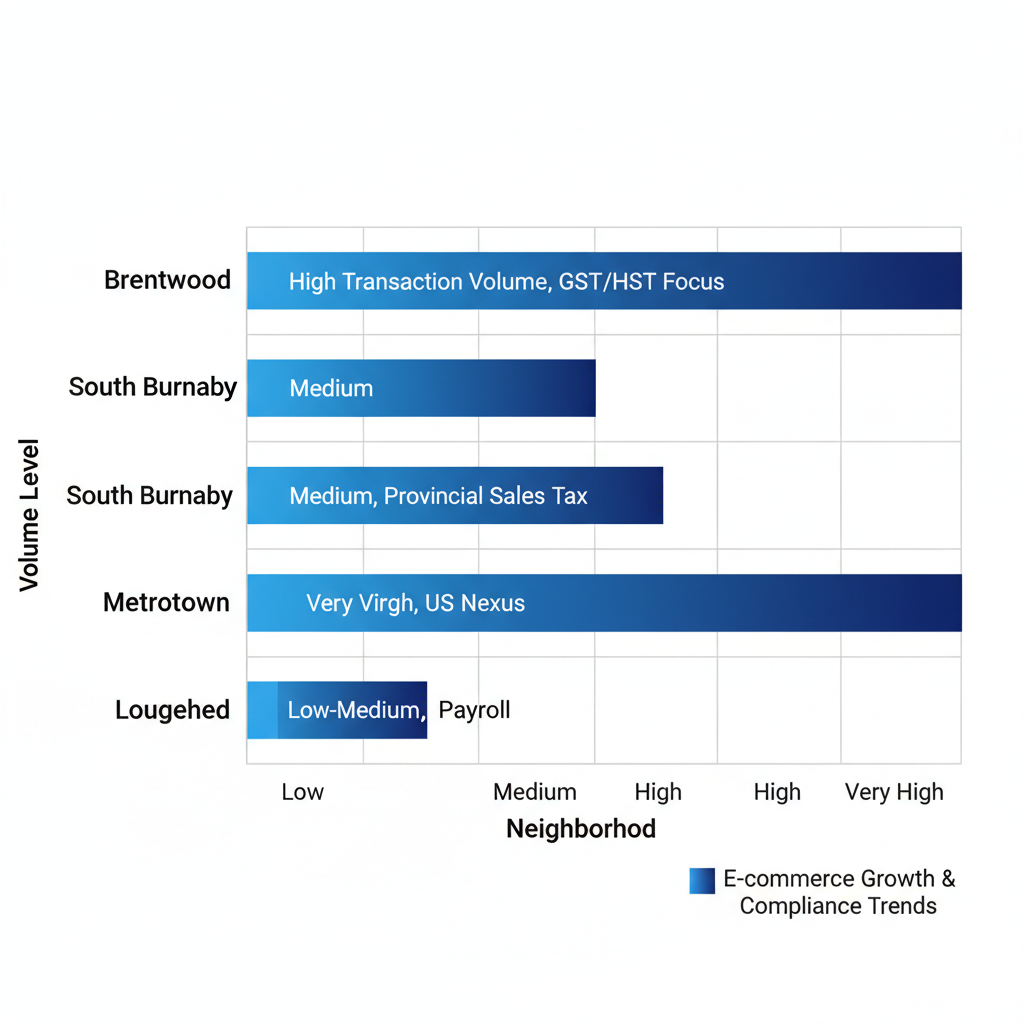

The following table compares bookkeeping needs across Burnaby neighborhoods, aiding selection based on business type and compliance focus:

| Neighborhood | Typical Transaction Volume | Key Compliance Needs | Recommended Service Type |

|---|---|---|---|

| Brentwood | High (e-commerce heavy) | GST/HST filing | Cloud-based with inventory tracking |

| South Burnaby | Medium (retail mix) | Provincial sales tax | Fixed-fee monthly reconciliation |

| Metrotown | Very High (startups) | US nexus support | Fractional CFO integration |

| Lougheed | Low-Medium (contractors) | Payroll automation | Outsourced with QuickBooks sync |

Data sourced from local reports shows 40% e-commerce growth in Brentwood, highlighting the need for scalable tools. This comparison underscores how cloud services suit high-volume areas like Metrotown, while fixed-fee options fit moderate needs in South Burnaby, guiding businesses toward efficient, tech-driven providers over traditional methods.

Transcounts aligns perfectly with these demands, offering end-to-end cloud bookkeeping via QuickBooks and Xero integrations, including A2X for sales tax automation and Plooto for payments. For regional context, options like Bookkeeping Services Surrey BC provide similar support nearby, akin to a small business bookkeeper in Vancouver. Their KPI dashboards and fractional CFO services ensure investor-ready reporting for Burnaby’s growth-oriented SMBs. Local ledger services near Vancouver emphasize outsourced finance for over 100 clients, delivering audit-ready books and faster closes.

Bookkeeping needs comparison across Burnaby business neighborhoods

Understanding these needs leads to exploring accessible solutions for your business.

Bookkeeping Service Availability in Burnaby

Small businesses in Burnaby often seek a reliable bookkeeper for small businesses in Burnaby to handle growing financial demands efficiently. With a variety of bookkeeping services burnaby now offering virtual solutions, entrepreneurs can access professional support without leaving their offices. These accessible financial services in Burnaby include everything from basic reconciliations to advanced compliance tools, tailored for local operations in neighborhoods like Brentwood or Metrotown.

Core offerings encompass end-to-end bookkeeping, which covers monthly bank reconciliations, bill payments, and detailed inventory reporting to keep finances organized. Payroll automation stands out, particularly through integrations like Wagepoint, which handles direct deposits, remittances, and employee onboarding seamlessly. For a Burnaby-based e-commerce seller, this means effortless processing of seasonal hires without manual errors. Tax support is comprehensive, addressing Canadian GST/HST filings and U.S. sales tax nexus requirements–beware of overlooking nexus taxes, as they can lead to costly penalties. Bundled accounts payable and receivable services streamline invoicing and vendor payments, ideal for online retailers expanding across borders.

Advanced features elevate these options further, such as fractional controller support for strategic insights and integrations with tools like TaxJar for automated sales tax compliance. Custom quotes accommodate complex needs, including catch-up bookkeeping with discounts for overdue records. Secure cloud infrastructure ensures data protection, while dedicated success managers provide personalized guidance.

As a Vancouver-based provider, Transcounts delivers vancouver bookkeeping services virtually to Burnaby clients, leveraging a 100% online model with 24/7 access portals–mirroring top Vancouver benchmarks for reliability. This small business bookkeeper vancouver extends expertise as Vancouver-area ledger experts, serving e-commerce and startups nationwide yet attuned to local regulations. With these services at hand, consider local factors for optimal selection.

Local Considerations for Burnaby Bookkeeping

Small businesses in Burnaby face unique regulatory demands that shape effective bookkeeping. British Columbia’s Provincial Sales Tax (PST) requires careful tracking alongside federal GST/HST remittances, due quarterly for most filers. Missing deadlines can trigger penalties, as seen in cases where e-commerce sellers overlooked multi-channel sales tracking across platforms like Shopify and Amazon, leading to audit flags from the CRA. Burnaby-specific financial compliance adds layers for nonprofits handling grants and contractors managing variable income, emphasizing accurate categorization to avoid common tax pitfalls.

When selecting a bookkeeper for small businesses in Burnaby, prioritize certified professionals who understand these nuances. Local experts recommend certified pros for PST handling to ensure seamless compliance. Key criteria include:

- Quick response times under 24 hours for queries.

- Fixed monthly pricing based on transaction volume for affordability.

- Expertise in cloud platforms like QuickBooks for secure data handling.

- Proven track record with Vancouver regional accounting tips, including e-commerce automation.

For broader advice, consider a small business bookkeeper vancouver who offers scalable solutions. Affordable bookkeeping services burnaby focus on transparent costs without hidden fees, helping owners evaluate providers against these benchmarks.

Transcounts excels here with audit-ready documentation, partnerships for automation like A2X for sales tax, and expertise in PST for e-commerce and SaaS. Their online model delivers small business accounting tips vancouver tailored to regional needs, ensuring data security on robust cloud infrastructure. Armed with these considerations, here’s how to proceed with engaging reliable support.

Getting Started with Burnaby Bookkeeping Services

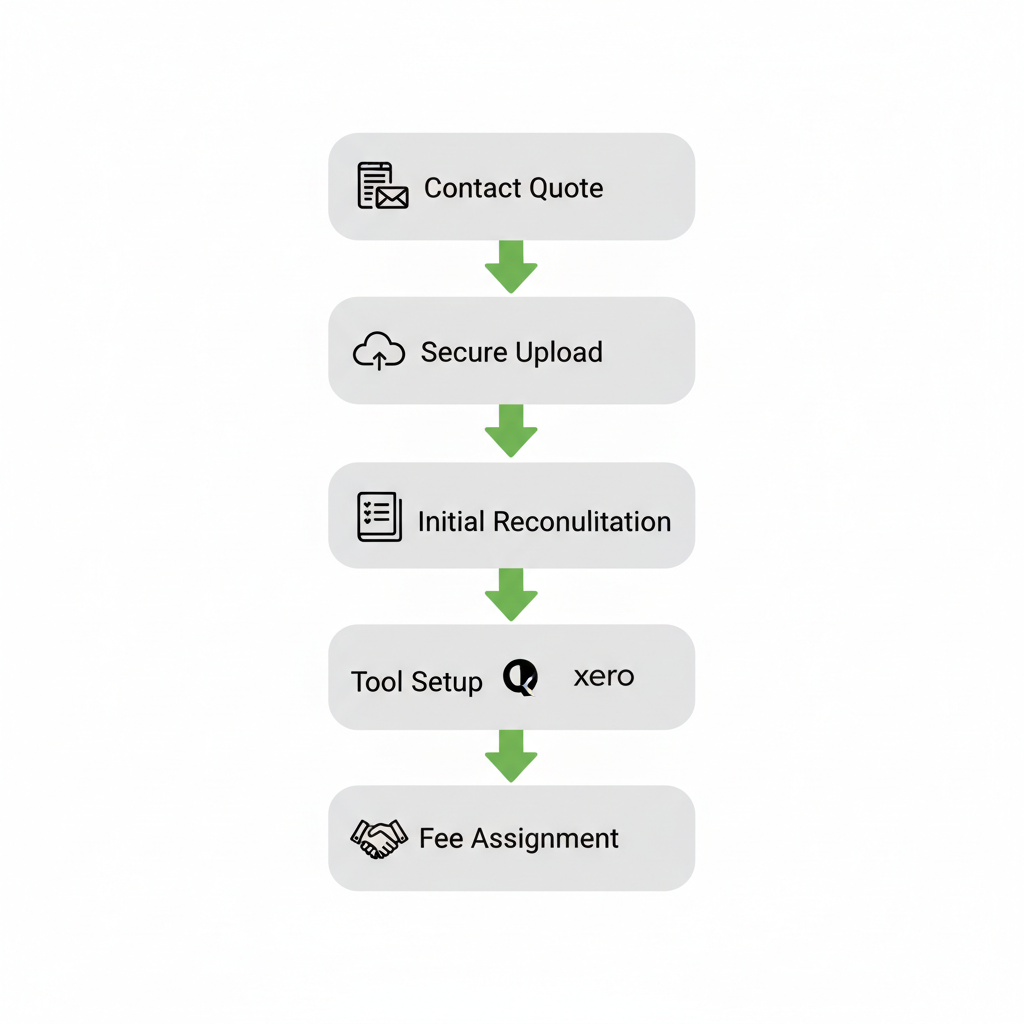

Starting your journey with a reliable bookkeeper for small businesses in Burnaby can transform financial management. Whether you’re initiating local financial partnerships in Burnaby or exploring Vancouver onboarding for SMBs, Transcounts offers a seamless path through its structured 30-day process. This includes secure data migration, custom KPI setup, and assignment of a dedicated success manager.

To begin, follow these essential steps:

- Contact for a Quote: Reach out via the Transcounts website or email to discuss your needs. Expect a response within 24 hours, with fixed monthly fees based on transaction volume or revenue.

- Secure Data Upload: During onboarding, upload financial documents safely to cloud platforms. This initial step ensures quick integration.

- Initial Reconciliation and Setup: Our team handles bank reconciliations and configures tools like QuickBooks or Xero. Efficient setups, as noted in industry best practices, reduce errors by 50%.

- Fee Confirmation and Catch-Up: Review and finalize costs, including options for catch-up bookkeeping to address past records.

For bookkeeping services in Burnaby, this process guarantees smooth transitions, even for virtual setups with a small business bookkeeper in Vancouver.

Step-by-step onboarding process for Burnaby bookkeeping services

Prepare by gathering bank statements, invoices, and receipts in digital format. Use this checklist: verify all transactions are current; organize by month; remove duplicates. Once started, enjoy streamlined finances and access to vancouver small business tax services for comprehensive support.

Streamlining Finances with Burnaby Bookkeeping

Choosing a reliable bookkeeper for small businesses in Burnaby ensures seamless financial management amid the area’s thriving economy. Transcounts delivers essential services like cloud reconciliations and tax support, with fixed-fee pricing and quick onboarding for optimized local accounting in Burnaby.

Businesses gain audit-ready books, insightful cash flow reports, and 25% efficiency boosts from modern bookkeeping. Vancouver SMB financial success starts here with our technology-driven approach. Explore a business accounting case study to see real results.

Connect today for a custom quote on bookkeeping services Burnaby and small business bookkeeper Vancouver needs.