Running a growing business is no easy feat, especially when it comes to making sense of financial statements, cash flow forecasts, and strategic planning. That’s where Fractional CFO services come into play. If you’ve been wondering whether your business needs a CFO, but you can’t yet afford a full-time hire, you’re dealing with a typical small business conundrum.

Consequently, this blog answers the most common questions about working with a Fractional CFO, with practical tips and helpful resources from the Transcounts team.

1. What Is a Fractional CFO?

In essence, a Fractional CFO is a part-time or contract-based Chief Financial Officer who offers high-level financial expertise without the full-time cost.

Their job description goes far beyond that of a bookkeeper or even an accountant. A fractional CFO dives deep into strategy, forecasting, capital management, and growth planning.

Moreover, they work closely with founders and leadership teams to make financial decisions that impact every single part of the business. They handle everything from pricing models and fundraising readiness to risk mitigation and long-term cash flow.

Think of them as your outsourced financial strategist, whom you reach out to only when you need them.

2. How Is a Fractional CFO Different from a Full-Time CFO?

A full-time CFO is a permanent employee, typically earning a six-figure salary plus benefits. A Fractional CFO, on the other hand, works with your business on a limited schedule, either weekly, monthly, or per project.

Small business CFO services like fractional engagements offer flexibility. Therefore, they’re ideal for startups and small businesses who:

- Need executive-level financial direction

- Aren’t ready, or willing, to commit to a full-time salary

- Want flexibility as they grow

However, for startups and small companies, a stringent budget is an ongoing issue. Thus, hiring a CFO or even choosing between DIY Bookkeeping vs. DFY Bookkeeping can be quite a challenging decision.

3. What Kind of Businesses Benefit the Most?

Almost any business can benefit from strategic financial oversight encompassed in Fractional CFO services. However, they are especially impactful for companies at pivotal stages of growth, complexity, or transition.

These include:

Startups preparing for fundraising or investor meetings

Startups aiming to secure seed or Series A funding need a solid financial foundation and compelling forecasts. Consequently, a Fractional CFO helps craft investor-ready reports, build credible models, and answer tough questions in due diligence.

Small-to-mid-size businesses scaling rapidly

When your revenue starts climbing, so does the complexity. Thus, a Fractional CFO helps cope with the growth strategically, for example, managing burn rate, hiring plans, and system upgrades.

Companies entering new markets or expanding operations

An expert CFO can help when you’re treading new waters. Maybe you’re adding a new product line, expanding to a new region, or considering an acquisition. In these situations, a CFO’s invaluable insights can reduce financial risk and improve your market-readiness.

E-commerce businesses with cash flow challenges

Furthermore, companies operating in the high-volume e-commerce sector also stand to gain a lot from a CFO’s services. E-commerce businesses tend to struggle with inventory, shipping costs, and fluctuating margins. For them, a CFO can offer support in matters such as optimizing pricing, tracking profitability per SKU, and planning for seasonal demand.

Professional services firms or agencies

Additionally, service-based businesses often face uneven revenue cycles or scope creep. Therefore, hiring a CFO can create better billing systems, improve collections, and track utilization to protect margins.

If any of these scenarios sound familiar, you may need deeper financial guidance in the running of your business. Explore Transcounts’ blog “7 Reasons Why Accounting and Bookkeeping Services Are Worth Considering.”

4. What Services Does a Fractional CFO Provide?

A Fractional CFO delivers strategic financial leadership for small businesses without getting bogged down in day-to-day bookkeeping. Unlike accountants, their services go beyond number crunching.

CFOs shape the future of the company by guiding big-picture decisions. Their core services include:

- Cash flow forecasting to ensure liquidity and plan for future needs

- Budgeting and financial modeling to guide smart decision-making

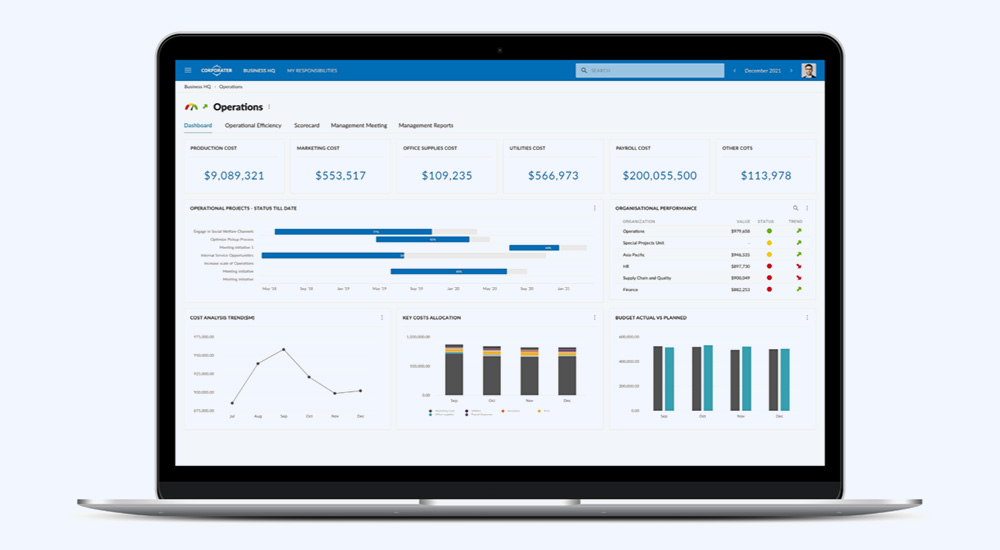

- KPI tracking and dashboard creation to monitor performance in real time

- Board and investor reporting to support capital raises and build credibility

- Profitability and cost analysis to increase margins

- Risk and compliance management to avoid penalties and keep you audit-ready

- System implementation and optimization to modernize financial workflows

Needless to say, CFOs create structure and clarity where there’s often chaos. Moreover, they also help implement efficient financial systems like QuickBooks or Xero, ensuring your operations are streamlined.

It’s important to note that they enhance, not replace, your internal team to modify existing operations.

5. Why Fractional CFO Services Are a Smart Financial Strategy for Small Businesses

Most startups and small businesses are strapped for cash, while desperately requiring the expert insights of a seasoned CFO to grow.

Therefore, fractional CFOs can provide the perfect solution. The cost of a Fractional CFO can be customized. It varies according to considerations like the location, scope, time commitment, and complexity of your financial operations. On average, their salary can range from:

- Hourly Rates: Typically, between $150–$300+

- Monthly Retainers: Commonly fall between $3,000 and $10,000+

- Project-Based Pricing: May apply for funding preparation, audits, or system overhauls

If you’re concerned about pricing, Transcounts offers transparent packages for CFO services that scale with your business needs. Visit the pricing page to explore your options.

6. How Do They Work with Existing Teams?

The ability to integrate seamlessly with your existing staff is the mark of a great CFO. Fractional CFO don’t operate in isolation. On the contrary, they are both the financial strategist and a mentor for your staff and the company at large.

Rather than disrupting your workflows, they enhance collaboration across departments and build a culture of financial accountability.

Process review and refinement

CFOs work their magic through a meticulous assessment of your current systems. They then move on to identify inefficiencies and implement smarter, scalable solutions.

Bookkeeper empowerment

CFOs are not a replacement for your in-house bookkeeper, contrary to popular belief. However, they train and support them with better tools, for example, cloud-based accounting platforms.

Financial education for non-finance roles

How are you supposed to make financially sound decisions if you don’t understand what the financial statements in front of you indicate?

Consequently, a Fractional CFO breaks down complex reports into actionable insights so that every department, including marketing to operations, understands the financial “why” behind their KPIs.

Therefore, by aligning everyone toward a shared financial strategy, a fractional or outsourced CFO helps:

- Reduce miscommunication

- Preventing budget overruns

- Promote data-driven decision-making at every level.

7. How Long Should I Expect to Work with a CFO?

The length of engagement with a Fractional CFO depends on several factors.

You have to consider factors like your business goals, the complexity of your financial landscape, and the stage of growth you’re in.

Unlike traditional hires, fractional CFOs are incredibly flexible. They can be brought in short-term for a specific project or retained long-term for ongoing strategic guidance.

Short-Term Engagement (4–8 weeks)

If you have all your metaphorical boats in a row aside from one or two urgent matters, a brief engagement may be all you need. Businesses often encounter urgent issues that require assistance, such as cash flow forecasting, budgeting for the next quarter, or preparing for a seasonal spike in expenses. These short-term projects are ideal for companies wanting quick insights without a long-term commitment.

Mid-Term Engagement (6–12 months)

Are you preparing for Series A or B fundraising? Applying for a line of credit? Restructuring your pricing model?

If you’re considering any of these, you’ll need sustained financial modeling, pitch deck support, and strategic reporting. Therefore, you might need to consider mid-term engagement as these projects typically require several months of active involvement from a veteran CFO.

Long-Term Engagement (1–3+ years)

Conversely, if your company is going through some major changes, retaining a fractional CFO long-term ensures consistent financial leadership. These changes can include anything from scaling rapidly, entering new markets, or planning for a future exit or acquisition.

In such instances, retaining a CFO for long-term engagement may be non-negotiable. They can help mature your internal processes, build strong investor relationships, and prepare your books for M&A or IPO readiness.

In many cases, businesses begin with fractional CFO services to scale responsibly without burning capital on a full-time salary. As they grow and stabilize, they may eventually transition to hiring a full-time CFO. However, starting fractional gives them access to C-suite expertise exactly when it’s needed most.

8. How Do I Know I’m Hiring the Right CFO?

Hiring a Fractional CFO is a strategic decision. This is so because you’re not just outsourcing number crunching, you’re bringing in a financial leader who will shape your company’s direction.

So, how do you know you’re choosing the right fit?

It’s key to have a detailed plan in place. Start with a structured discovery call and ask targeted questions that reveal not only their expertise but also their working style and strategic alignment with your goals. These questions might include:

Can they demonstrate ROI or tangible results from past clients?

Ask for case studies or specific metrics. A great fractional CFO will be able to show how their involvement led to improvements in areas like better cash flow management, improved margins, or successful funding rounds.

How do they prefer to communicate? Do they use dashboards, weekly meetings, or investor reports?

Alignment on communication style is key. Some founders prefer visual dashboards; others want written updates. Thus, ensure your styles match from the get-go.

What’s their experience with the financial tools or platforms you use or plan to use?

Familiarity with the key software your team relies on is crucial. Therefore, make sure the CFO is fluent in using common accountancy tools like QuickBooks, Xero, NetSuite, and Power BI.

Do they have solid references or client testimonials?

Speaking with past clients gives the hiring company an insight into the CFO's long-term value and collaborative nature.

Above all, look for someone who is transparent, proactive, and solutions-driven. The right Fractional CFO doesn’t just react to problems but anticipates them. They act as a thought partner, not just a financial technician, and are genuinely invested in helping your business grow with clarity and confidence.

Final Thoughts

The right financial guidance can make or break your business. A Fractional CFO brings the leadership and strategy you need without the long-term commitment or cost of a full-time executive.

The success of your financial decisions relies heavily on sound financial awareness. Fractional CFO services are one of the smartest investments you can make, whether you’re cleaning up your books, preparing for growth, or simply want clarity over your numbers.

Need help managing your finances with strategic insight?

Contact Transcounts to learn how their Fractional CFO solutions can help grow and safeguard your business.

Contents