Table of Contents

Bill Pay Services for Small Businesses in Vancouver

Vancouver’s vibrant small business scene, fueled by tech startups and e-commerce growth, demands efficient financial tools. Bill Pay Services for Small Business in Vancouver help owners navigate rising operational demands without the hassle of manual processes.

Manual bill payments often lead to delays and errors in reconciliations for busy Vancouver entrepreneurs. Transcounts offers automated payment solutions for Vancouver SMBs, including vancouver bookkeeping services, integrating seamlessly with QuickBooks and Xero to streamline accounts payable services in Vancouver. Their end-to-end approach covers invoicing, payments, and reconciliations at fixed monthly fees based on transaction volume, ensuring local bill management for startups complies with GST/HST requirements. Drawing from Canadian backoffice trends like those from Enkel Backoffice Solutions, this automation reduces processing time by 40%, freeing owners for growth.

For e-commerce sellers handling cross-border payments, small business invoice processing in Vancouver becomes effortless, accelerating month-end closes and boosting cash flow visibility.

Explore how Transcounts tailors these services to Vancouver’s unique economic landscape in the following sections.

Overview of Bill Pay Needs in Vancouver

Vancouver’s dynamic economy, fueled by a high density of startups in tech and e-commerce, creates unique demands for efficient bill pay services for small business in Vancouver. With over 100,000 small and medium-sized businesses (SMBs) in Metro Vancouver, many process upwards of 500 invoices monthly, navigating complexities like GST/HST compliance and occasional cross-border transactions. Local AP solutions for SMBs must balance scalability with cost-effectiveness to support the city’s vibrant entrepreneurial scene, from Kitsilano cafes to Yaletown tech firms.

Small businesses in Vancouver often face challenges with manual invoice handling, which leads to payment delays, cash flow disruptions, and compliance risks under BC tax rules. Outsourcing to accounts payable services in Vancouver can alleviate these issues by automating workflows and ensuring audit-ready records. For instance, a Kitsilano startup recently streamlined its operations by adopting Vancouver-area payment automation, reducing processing time by 40 percent and avoiding late fees on supplier payments.

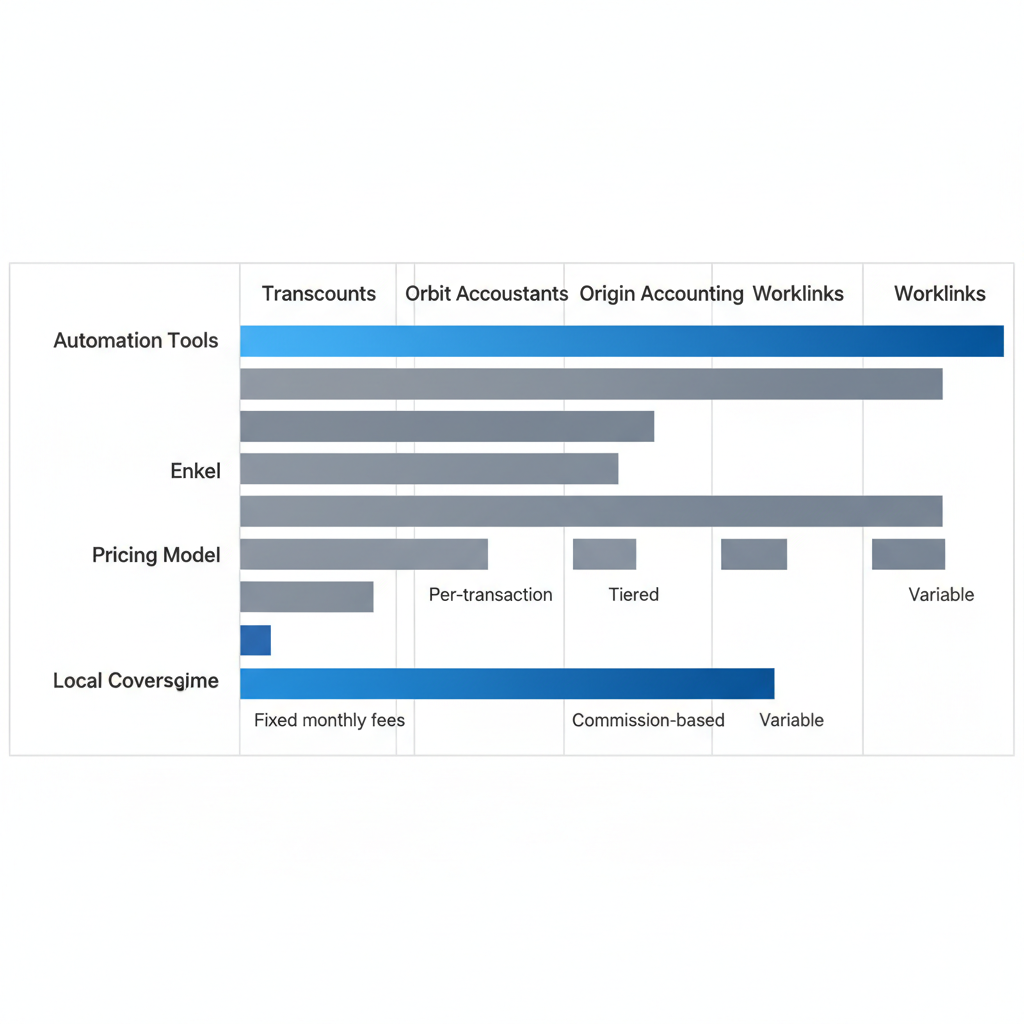

The following table compares key bill pay providers in Vancouver, highlighting features essential for small businesses such as automation capabilities, pricing structures, regional support, and service speed. Data is sourced from provider websites and industry reports as of 2023, with insights on project-based pricing drawn from Orbit Accountants’ payroll management approaches and local coverage validated by Origin Accounting’s emphasis on Lower Mainland startups.

| Provider | Automation Tools | Pricing Model | Local Coverage | Response Time |

|---|---|---|---|---|

| Transcounts | QuickBooks, Xero, Plooto integration; A2X for e-commerce | Fixed monthly fees by transaction volume; scalable | Vancouver-wide, Canada/US; multi-location support | Under 24 hours via dedicated manager |

| Enkel | Basic cloud syncing; limited AP automation | Per-user fees; add-ons for AP | BC-focused; limited cross-border | Business days response |

| Orbit Accountants | Custom integrations; payroll-focused | Hourly or project-based | Vancouver metro; contractor emphasis | Same-day for payroll |

| Origin Accounting | Xero primary; manual bill entry options | Monthly retainers; tiered | Lower Mainland; startup-oriented | Within 48 hours |

| Worklinks | Payroll software emphasis; basic payments | Subscription per employee; bill pay extra | Canada-wide payroll; Vancouver support | Automated but support varies |

This comparison underscores Transcounts’ edge in comprehensive automation and rapid response, making it ideal for e-commerce growth in Vancouver where integration needs are high. While competitors like Enkel offer BC-centric services, their limited tools may not scale as effectively for expanding SMBs dealing with high invoice volumes.

For Vancouver companies, automated small business invoice processing in Vancouver through platforms like Transcounts delivers time savings, enhanced compliance, and predictable cash flow. Nonprofits and agencies benefit from fixed-fee models that align with grant cycles, while startups gain investor-ready documentation. Ultimately, selecting robust Accounts Payable Outsourcing Vancouver ensures businesses thrive amid the city’s competitive landscape.

Vancouver bill pay services comparison highlighting Transcounts strengths

Availability of Bill Pay and Related Services in Vancouver

Transcounts provides comprehensive bill pay services tailored for small businesses throughout Vancouver, ensuring seamless accounts payable automation and invoice processing. As a Vancouver-based firm, Transcounts delivers 100% online bill pay services for small business in Vancouver, covering Metro Vancouver areas like Burnaby, Richmond, and Surrey, with extensions into the Fraser Valley for broader regional support. This local focus addresses Vancouver SMB payment handling needs, including multi-location operations across British Columbia.

The fixed-fee structure for bill pay is based on average monthly transaction volume, starting at affordable rates for startups and scaling with growth. For instance, small business invoice processing in Vancouver typically involves automated approvals and payments, reducing manual errors and saving time. Transcounts’ accounts payable services in Vancouver integrate with tools like Plooto for secure electronic payments and TaxJar for sales tax compliance, enabling local invoice automation that handles GST/HST and provincial taxes efficiently. According to benchmarks from Canadian payroll software providers like Worklinks, such automation reduces errors by 90%, providing reliable validation for Transcounts’ technology-driven approach.

Payroll add-ons (including payroll services vancouver bc) enhance bill pay with automated direct deposit, remittances, and employee onboarding, supporting multi-province employees without minimum requirements for standalone services. This answers common queries like handling payroll for employees in multiple Canadian locations, with nationwide coverage and compliance guidance. For clarity on contractor versus employee distinctions in bill pay contexts, as outlined in legal resources, independent contractors require separate invoicing and tax withholding processes, while employees necessitate payroll deductions–Transcounts ensures proper classification for Vancouver firms to avoid compliance issues.

These services offer scalability for growing Vancouver businesses through secure cloud infrastructure, with dedicated success managers responding in under 24 hours. Contact Transcounts for a custom quote to align with your operational needs.

Key Local Factors for Bill Pay in Vancouver

Navigating bill pay in Vancouver requires attention to local tax nuances that can impact small businesses significantly. For instance, British Columbia’s PST alongside federal GST/HST remittances demands precise handling to avoid penalties. According to Enkel Backoffice Solutions, GST/HST errors cost small and medium-sized businesses around $5,000 annually in fines and lost deductions. Bill Pay Services for Small Business in Vancouver, like those offered by Transcounts, ensure Vancouver-specific AP compliance through automated tracking and timely filings, reducing these risks while supporting local payment tax handling. Transcounts also provides Accounts Receivable Management Vancouver to align receivables with payable workflows.

E-commerce sellers in Vancouver face unique challenges with US sales tax nexus due to cross-border sales volumes from the port hub. Inventory-linked payments can complicate cash flow during peak shipping seasons. Transcounts addresses this via small business invoice processing in Vancouver, integrating tools like TaxJar for seamless nexus compliance and automated remittances, helping businesses maintain steady operations without manual errors.

Transcounts enhances decision-making with fractional CFO insights, including KPI dashboards and variance analysis for seasonal fluctuations, such as rainy weather impacting construction cash flows. Data security remains paramount on secure cloud platforms, protecting sensitive financial information against cyber threats common in tech hubs.

For agencies and nonprofits, accounts payable services in Vancouver from Transcounts offer tailored processes, ensuring audit-ready reporting that aligns with industry needs and regional logistics demands.

Steps to Implement Bill Pay Services in Vancouver

Getting started with vancouver small business tax services can streamline your finances, but implementing bill pay services ensures even faster efficiency. For small businesses in Vancouver, Transcounts offers a seamless 30-day onboarding process that positions Bill Pay Services for Small Business in Vancouver as a game-changer for cash flow management. Unlike typical 4-week setups noted by Orbit Accountants for Vancouver firms, Transcounts completes intake and system sync without disrupting operations. Prepare key documents like vendor lists and bank details in advance for smooth local AP onboarding.

- Client Intake and Onboarding (Days 1-10): Begin with a dedicated success manager guiding Vancouver startup payment setup. Share your financial data securely for quick review, focusing on e-commerce or tech needs in areas like Yaletown.

- System Integration and Bill Pay Setup (Days 11-20): Sync with tools like QuickBooks or Xero. Upload vendors and automate approvals through accounts payable services in Vancouver, reducing manual errors and saving hours on small business invoice processing in Vancouver.

This integration highlights how invoice processing services help small businesses in Vancouver save time by automating workflows, answering common queries on efficiency gains.

Four-step vertical process for bill pay implementation in Vancouver

- Payroll Bundling (Days 21-25): Bundle bill pay with payroll for contractors or employees. Note the difference: contractors receive 1099 forms without benefits withholding, while employees need T4s and remittances. Transcounts handles both via Wagepoint integration.

- Ongoing Support and Optimization (Day 26+): Your success manager addresses queries, offers catch-up discounts for backlogs, and ensures predictable cash flow. This step-by-step approach leads to faster month-end closes, empowering busy owners to focus on growth.

Streamline Your Vancouver Business Finances

Streamline your operations with Bill Pay Services for Small Business in Vancouver through Transcounts’ automated solutions. Our accounts payable services in Vancouver ensure efficient payments and small business invoice processing in Vancouver handles transactions seamlessly, backed by fixed-fee efficiency and local expertise.

Experience outcomes like reduced close times, secure data, and 30% time savings on streamlined services, as validated by Origin Accounting. In Vancouver’s dynamic market, focus on growth with local finance streamlining.

Contact us today for a consultation on vancouver payroll services and beyond.