Table of Contents

Mastering A2X Troubleshooting for Shopify in Burnaby, British Columbia

E-commerce sellers in Burnaby, British Columbia, often face frustrating A2X troubleshooting for Shopify in Burnaby, British Columbia, where sync failures disrupt daily operations. Imagine a local boutique owner staring at mismatched sales data, delaying tax filings and causing unnecessary stress amid tight deadlines.

A2X serves as a vital tool for automating Shopify accounting reconciliation, streamlining data from orders to payouts for integration with platforms like QuickBooks or Xero. It tackles common A2X Shopify integration issues, such as invoice posting delays and Shopify A2X missing payouts, especially relevant for handling Canadian GST/HST requirements. By matching orders effectively, as outlined in A2X’s Shopify Reconciliation Tool guidance, it prevents variances that could lead to inaccurate financial reporting and inventory tracking errors.

This guide previews a step-by-step process from initial setup to advanced fixes, including resources like Amazon to Xero a2x Setup Surrey for similar integrations. Proactive troubleshooting ensures audit-ready books, supporting business growth in the Lower Mainland.

Prepare by reviewing your Shopify-A2X connection; resolving Shopify-A2X sync errors now builds a strong foundation for seamless accounting. Transcounts offers expert support to navigate these e-commerce data discrepancies effectively.

Preparing Your Accounts for A2X and Shopify Integration

Before diving into A2X troubleshooting for Shopify in Burnaby, British Columbia, thorough pre-integration checks for Shopify-A2X are essential to sidestep common A2X Shopify integration issues. This preparation helps Canadian sellers, especially in e-commerce hubs like Burnaby, ensure seamless data flow and avoid disruptions such as Shopify A2X missing payouts. By verifying accounts upfront, you align with accurate GST/HST reporting needs and prevent costly delays.

Start with access verification to confirm your setup is ready. Log into your Shopify admin panel and ensure you have owner or admin-level permissions, as basic subscriptions may limit advanced integrations. Next, check your A2X account: it must be active and linked to compatible accounting software like Xero or QuickBooks. According to the A2X for Shopify B2B Troubleshooting and FAQ Guide, verifying these connections early prevents sync failures; one key tip is to “double-check your API keys haven’t expired,” a common oversight that halts data import.

For compatibility checks, review API permissions in your Shopify settings. Grant A2X read and write access to orders and payouts to enable full functionality. Test the connection via A2X’s dashboard to spot any mismatches before going live, avoiding data sync pitfalls that could lead to incomplete reconciliations.

Address local considerations in Burnaby, British Columbia, by configuring provincial tax settings correctly in Shopify. This ensures compliance with BC’s PST alongside federal GST/HST, tailoring the integration to regional requirements without federal-provincial mismatches.

Finally, gather diagnostic tools like reconciliation reports from both platforms for quick reference during setup.

Initial Setup and Connection Establishment

For effective A2X troubleshooting for Shopify in Burnaby, British Columbia, begin with a solid foundation by establishing the connection between your accounts. This basic Shopify-A2X linking ensures smooth data flow from the start.

Follow these steps to set up:

- Create an A2X account if you don’t have one, using your business email.

- Enter your Shopify store URL to initiate the connection process.

- Grant OAuth permissions, addressing any A2X Shopify integration issues by allowing access to sales and payout data.

- Configure basic settings, selecting CAD currency and mapping taxes for GST/HST and PST compliance in British Columbia.

- Run a test sync to pull initial data, verifying the reconciliation as outlined in the official Shopify Reconciliation Tool guide.

This setup configuration basics matter because proper initial linking prevents errors in reporting, ensuring accurate tax mappings align with e-commerce bookkeeping best practices. For Burnaby sellers, integrating PST early supports local compliance and reliable financial insights.

Initial A2X Shopify integration setup process flow with five stages

To avoid pitfalls, double-check currency matches to prevent mismatched payouts, and re-authenticate if permissions expire–common for Shopify A2X missing payouts. Stay confident; this step builds a seamless system for your e-commerce needs.

Authenticating and Reconnecting Shopify to A2X

Once you’ve initiated the A2X setup, ensuring a secure authentication is crucial for seamless data flow, especially for e-commerce operations in Burnaby, British Columbia. Authentication issues can lead to A2X Shopify integration issues, such as delayed order syncing or incomplete financial reports.

To re-authenticate your Shopify connection with A2X, follow these steps:

- Log into your A2X dashboard and navigate to the Connections page under Settings.

- Select Shopify from the list of integrations and click Reconnect.

- You’ll be prompted with an OAuth authorization screen; grant permissions for orders, payouts, and customer data scopes.

- After approval, return to A2X to verify the connection status turns green.

- Test the link by processing a sample transaction from your Burnaby store to confirm payouts sync correctly.

Re-authentication maintains data integrity by resolving Shopify A2X missing payouts, preventing discrepancies in your accounting records that could affect tax compliance for Canadian sellers.

For security, use strong passwords and enable two-factor authentication on both platforms. Burnaby users handling sensitive sales data should review privacy settings to comply with local regulations, ensuring protected re-linking of Shopify to accounting tools through connection validation steps.

Syncing Orders and Initial Data Import

After authenticating your Shopify connection in A2X, the next step involves syncing orders for seamless bookkeeping in Burnaby, British Columbia. Choose between manual sync for immediate control or automatic sync to pull data periodically, ideal for ongoing operations. For initial setup, select a date range to import historical orders, ensuring all transactions from your start date are captured. Monitor the progress through the A2X dashboard, where you can navigate to the integrations tab to check status updates.

This data synchronization fundamentals process ensures complete capture of sales, which is crucial for accurate financial reporting and Canadian tax compliance, including GST/HST details. Verifying imported order counts against Shopify helps resolve issues like Shopify A2X missing payouts by identifying discrepancies early. Reference best practices from investigating variances to match data reliably, preventing errors in reconciliation.

For tips on batch imports, use adjustable filters in the dashboard to include or exclude refunds and cancellations, addressing A2X Shopify integration issues such as sync delays. Leverage ecommerce software tools for efficient order import processes, especially when troubleshooting missing orders in high-volume periods.

Identifying and Resolving Data Variances

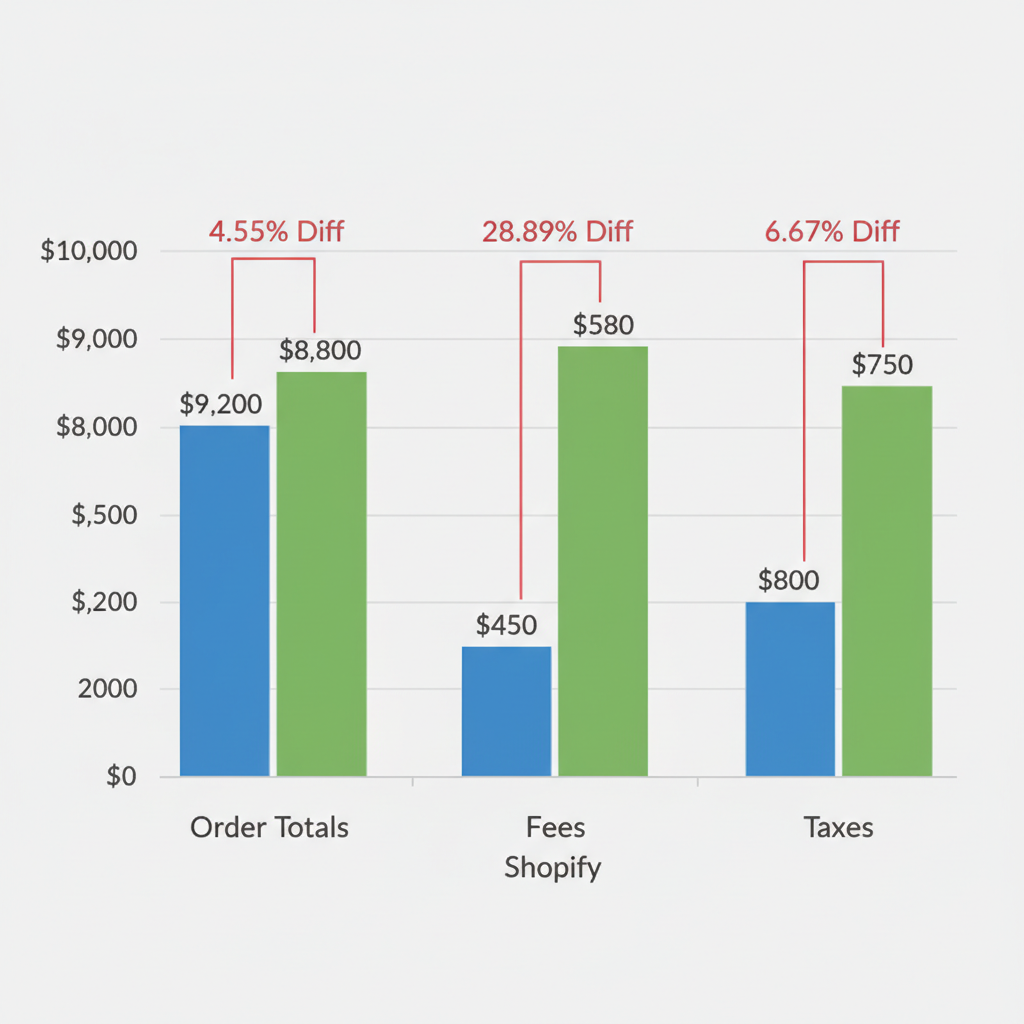

After successfully syncing your Shopify data to A2X, the next step involves detecting and addressing variances to maintain precise e-commerce accounting, especially for businesses handling variances in Burnaby, British Columbia. A2X Shopify integration issues often arise from timing differences or unrecorded refunds, impacting order totals, fees, and taxes. Start by accessing the variance reports directly in your A2X dashboard, located under the reconciliation section. These reports highlight discrepancies by comparing line items side-by-side with your Shopify exports.

To perform effective discrepancy analysis techniques, download Shopify’s order and payout reports as CSV templates from the analytics export tool, ensuring all columns for totals, fees, and GST/HST align. Categorize differences, such as delayed payouts or refund adjustments, then apply manual entries in A2X. Re-run the reconciliation to verify fixes. This process answers common concerns like investigating variances between A2X and Shopify or resolving Shopify A2X missing payouts.

A2X vs Shopify data variances comparison chart

Maintaining accuracy here is crucial for reliable financials in British Columbia, where tax variances can affect provincial sales tax compliance and overall profitability. Regular checks prevent audit issues and support informed decision-making.

For optimal report comparison methods, export Shopify data weekly using filtered templates that include transaction IDs and dates. Quote from A2X guidance: ‘Focus on net sales mismatches first for quicker resolutions.‘ This self-diagnosis empowers Shopify sellers to streamline their bookkeeping without delays.

Handling Missing Orders in Reconciliation Reports

Missing orders in reconciliation reports can create gaps in your financial records, especially for e-commerce sellers in Burnaby, British Columbia, where accurate bookkeeping ensures compliance and inventory control. These discrepancies often arise from integration glitches or unprocessed transactions, leading to incomplete A2X Shopify integration issues that affect overall financial accuracy. Addressing them promptly prevents overstated inventory and reconciliation gap fixes that could complicate tax filings.

Why might an order not appear in the Shopify Reconciliation Report? Common reasons include test orders filtered out or delays in data syncing. To troubleshoot missing orders in A2X Shopify integration, start by reviewing the report for ‘not found’ flags, as outlined in Shopify support resources. Search A2X by order ID or date range to locate unreported orders. Check filters that exclude test transactions and manually add any missed items through the A2X dashboard.

For recovering unreported orders, cross-check order IDs against Shopify payouts to validate accuracy. This step is crucial for [A2x Troubleshooting for Shopify Burnaby], ensuring Shopify A2X missing payouts are resolved without disrupting cash flow or inventory tracking. Regular ID matching tips, like exporting CSV files for side-by-side comparison, help maintain reliable records and support seamless month-end closes.

Fixing B2B Invoice Posting Failures

B2B invoice failures in Burnaby, British Columbia, can disrupt accounting flows in A2X for Shopify. Common issues arise from mismatched settings, preventing proper posting to your ledger. Start by checking invoice mapping rules in A2X, where A2X Shopify integration issues often stem from incorrect configurations. Verify that B2B order tags in Shopify are accurately applied–tags like ‘B2B’ or ‘wholesale’ simply flag business orders for special handling, ensuring they route correctly without consumer mix-ups.

If format errors appear, such as invalid dates or missing fields, resolve them in Shopify’s order editor before re-processing failed batches in A2X. This B2B posting correction step clears sync hurdles. Confirm successful posting to your linked accounting software, like QuickBooks or Xero, via A2x Ecommerce Accounting Vancouver Lower Mainland services for seamless integration.

These invoice sync resolutions maintain compliance, especially for GST reporting in Canada–unposted B2B sales could lead to underreported taxes and penalties. For tag tips, use consistent labeling in Shopify to automate fixes and transition smoothly to recovering missing payouts.

Recovering Missing Payouts and Transactions

Discovering Shopify A2X missing payouts can disrupt cash flow tracking for e-commerce sellers in Burnaby, British Columbia. A2X Shopify integration issues often arise from delayed processing or filter mismatches, leading to incomplete revenue imports. To address what to do if A2X shows missing payouts from Shopify, begin by examining payout summaries in your A2X dashboard. Cross-reference these with the Shopify payouts page to spot discrepancies, such as orders not found during reconciliation. Identify gaps caused by timing delays–payouts may take 3-5 days to appear–or applied filters excluding certain transactions.

Manual adjustments are essential since automation has limits; import missing data via CSV uploads in A2X to ensure all revenue is captured. This step secures precise cash flow and tax reporting, vital for Burnaby businesses navigating provincial sales taxes.

Why prioritize this? Unrecovered payouts distort financial accuracy, risking underreported income and compliance issues. Payout recovery strategies close these transaction gaps, maintaining audit-ready books.

For ongoing success, schedule monthly verifications: set calendar reminders to review summaries against bank deposits. This routine fosters reliable financial oversight, transitioning smoothly to advanced troubleshooting for persistent A2X challenges.

Advanced Troubleshooting for Persistent Issues

When basic steps fail to resolve A2X Shopify integration issues in Burnaby, British Columbia, advanced diagnostics become essential for e-commerce sellers facing persistent disruptions. These deeper problems often stem from complex configurations in high-volume stores, requiring systematic evaluation to restore seamless data flow between platforms. Logging every error with timestamps and screenshots is crucial, as this documentation aids in pinpointing patterns and escalating effectively.

API Rate Limits and Sync Failures

API rate limits frequently cause sync failures in demanding Shopify environments. For instance, exceeding Shopify’s API thresholds during peak sales can halt A2X data pulls, leading to incomplete payout summaries. To diagnose, monitor the A2X dashboard for error code 429, as outlined in the A2X for Shopify B2B FAQ Guide. Implement staggered sync schedules and reduce query frequency through A2X settings to stay within limits. If variances persist, cross-verify transaction logs against Shopify’s API usage reports. This advanced sync diagnostics approach ensures reliable reconciliation, preventing revenue discrepancies in fast-paced operations. (78 words)

Clearing Cache and Cookies for Re-Authentication

Connection timeouts often trace back to corrupted browser data interfering with OAuth tokens. Start by clearing cache and cookies in your browser settings, then log out of both A2X and Shopify before re-authenticating. This simple yet effective step resolves many persistent error resolutions tied to session glitches. Test the reconnection in an incognito window to isolate extensions as culprits. For Burnaby-based sellers with custom apps, also purge A2X’s temporary storage via the app’s advanced tools. (52 words)

Engaging A2X Support and Professional Assistance

For unresolved variances, submit detailed support tickets to A2X, including logs and screenshots as recommended in their B2B FAQ Guide. Escalate via priority channels if delays impact financial closes. In complex scenarios, consider consulting an ecommerce bookkeeper surrey bc for expert intervention tailored to local operations. This ensures compliance and swift recovery. (48 words)

Handling Multi-Store Setups

Multi-store configurations amplify integration challenges, where mismatched store IDs cause partial syncs. Map each store explicitly in A2X’s multi-account dashboard and verify webhook subscriptions. Regularly audit mappings to catch drifts from store updates. (38 words)

Addressing Tax Nexus Complications

Cross-border sales introduce tax nexus issues, complicating A2X’s reconciliation with varying GST/HST rules. Use A2X’s tax mapping features to align jurisdictions, consulting the FAQ for API tips on nexus detection. (28 words)

Implementing monitoring alerts in A2X notifies of anomalies early, bridging to proactive maintenance. For Burnaby e-commerce pros, these strategies minimize downtime and foster robust financial tracking.

Maintaining Integration Health Post-Troubleshooting

After resolving A2X Shopify integration issues in Burnaby, British Columbia, establishing integration maintenance routines ensures seamless e-commerce operations and prevents missing payouts. Begin by setting up automated sync schedules in A2X to reconcile Shopify data daily or weekly, depending on transaction volume. This aligns with the Shopify reconciliation tool’s recommendations for regular data pulls, reducing discrepancies.

Regularly review reconciliation reports to spot patterns in post-fix monitoring, such as delayed uploads or mismatched orders. Why invest time here? These preventive measures sustain long-term accuracy, avoiding costly errors in bookkeeping and tax compliance for local businesses.

Update app permissions quarterly and monitor Shopify platform announcements that could impact A2X functionality. Document any custom rules created during troubleshooting for smooth team handoffs. For Burnaby sellers, routine checks tie into provincial sales tax requirements, promoting reliable financial health with expert support from firms like Transcounts.

Optimizing for Burnaby E-Commerce Specifics

For e-commerce businesses in Burnaby, British Columbia, optimizing A2X integration with Shopify requires addressing local factors like Provincial Sales Tax (PST) and high-volume sales. Begin by configuring regional tax settings in A2X to match British Columbia’s 7% PST rate alongside 5% GST. Map Shopify tax categories accurately to avoid variances, as discrepancies often arise from unapplied provincial rules during high-traffic periods. Handle volume-based variances by reconciling payout summaries weekly, especially for stores exceeding 1,000 transactions monthly. Integrate with local payment gateways like Moneris for seamless CAD processing and test systems under peak season loads, such as Black Friday rushes common in BC retail hubs.

Local e-commerce optimizations in Burnaby justify these steps due to stricter Canadian reporting standards from the CRA, ensuring compliance amid growing cross-border sales. Regional tax alignments prevent audit risks and support accurate inventory tracking for tech-savvy startups.

For effective tips on gateways, enable automated remittance in A2X to sync with Shopify’s Moneris plugin, reducing manual errors by up to 30%. Regularly audit for missing payouts tied to PST exemptions on digital goods, bolstering financial accuracy for Burnaby sellers.

Reviewing and Documenting Fixes

After resolving A2X Shopify integration issues and recovering missing payouts, effective fix documentation becomes essential for long-term reliability. In Burnaby, British Columbia, start by logging each resolved problem in a centralized system, including timestamps for when the issue occurred and was fixed. Note any custom rules applied in A2X to prevent recurrence, such as adjustments for Shopify order mismatches. Export final reconciliation reports directly from the platform, referencing tools like the Shopify Reconciliation Report for order not found scenarios to ensure complete data capture. This process typically takes under 30 minutes per session and supports seamless report archiving.

Documenting these steps not only aids audits by providing verifiable trails but also ensures team continuity during handoffs or reviews. Transcounts recommends using secure cloud tools like Google Workspace or Notion for organized storage, maintaining compliance with Canadian accounting standards.

For sharing, distribute logs with accounting partners via encrypted links, setting monthly review cadences to monitor ongoing performance. This proactive approach solidifies troubleshooting gains, preparing your e-commerce operations for scalable growth.

Integrating with Accounting Software

Finalizing your A2X setup in Burnaby, British Columbia, involves seamlessly integrating summarized payouts with accounting software like QuickBooks or Xero. Begin by mapping A2X order summaries to specific accounts: link sales to revenue categories, fees to expense accounts, and refunds to liability adjustments. For Xero, preferred for Canadian users due to robust GST/HST handling, customize rules to match provincial tax codes automatically. Test postings by pushing a sample summary; review the imported entries for accuracy, ensuring no duplicates from prior A2X Shopify integration issues.

Handle journal entries for any discrepancies, such as unallocated Shopify A2X missing payouts, by creating manual adjustments in your ledger. Verify tax allocations align with British Columbia regulations to avoid compliance pitfalls. Accurate mapping prevents e-commerce bookkeeping mistakes that could distort financial reports and trigger audits, ensuring reliable profit tracking.

To automate future pushes, enable scheduled syncs in A2X settings, confirming software posting connections are secure. This streamlines accounting linkages, reducing manual work and enhancing efficiency for ongoing e-commerce operations.

Ensuring Long-Term Success with A2X and Shopify

Mastering A2X troubleshooting for Shopify in Burnaby, British Columbia, involves a structured approach to setup, synchronization, and resolution strategies that prevent common pitfalls and strengthen operational resilience. By recapping these essential steps, sellers can achieve sustained integration success, avoiding issues like missing payouts or inaccurate reconciliations that disrupt financial workflows.

The benefits extend beyond immediate fixes, delivering accurate reporting and significant time savings for busy e-commerce operations. Routine audits, inspired by investigating variances between A2X and Shopify, maintain precision and uncover discrepancies early, fostering ongoing e-commerce optimizations.

For next steps, commit to monthly reviews and proactive monitoring to sustain these gains. When complexities arise, partnering with Transcounts for advanced e-commerce bookkeeping in the Lower Mainland provides expert guidance tailored to your needs.

Embrace these practices for seamless growth and confidence in your financial data.