Table of Contents

Streamlining Shopify Accounting with A2X in Vancouver

Vancouver’s thriving e-commerce landscape presents unique accounting hurdles for Shopify sellers. Manual data entry often leads to mismatched sales figures and errors in GST/HST calculations, complicating tax compliance for local businesses. Implementing an A2X setup for Shopify in Vancouver addresses these issues by automating reconciliation, ensuring accurate financial records in a Canadian context. This approach saves time and reduces the risk of costly mistakes for growing online stores.

A2X serves as a specialized reconciliation tool tailored for e-commerce platforms like Shopify, transforming raw transaction data into clean summaries that align with bank payouts. It integrates seamlessly with popular accounting software, including QuickBooks and Xero, making Shopify QuickBooks integration in Canada straightforward for sellers handling cross-border sales. Similarly, the A2X Xero setup for Shopify streamlines workflows by automating data feeds. As part of a broader ecosystem of ecommerce software tools, these solutions are vital for efficient bookkeeping. Transcounts, a Vancouver-based firm, guides clients through these integrations, offering expertise in automated Shopify accounting in Vancouver to support e-commerce reconciliation tools for Canadian sellers.

The primary benefits include up to 80% faster reconciliation processes, as noted in recommendations for top Shopify accounting software, along with precise tax syncing that handles GST/HST requirements effortlessly. Sellers avoid the pitfalls of manual tracking, gaining clearer insights into revenue and expenses. This automation fosters compliance and scalability for Vancouver operations facing provincial sales tax nuances.

Upcoming sections will explore detailed A2X profiles, QuickBooks and Xero integrations, providing step-by-step guidance to optimize your setup and achieve streamlined financial management.

A2X for Shopify Setup

A2X stands out as a powerful automation tool tailored for e-commerce sellers, especially those using Shopify in Vancouver. It specializes in reconciling payouts from platforms like Shopify, transforming complex sales data into clean accounting entries. For Vancouver-based stores facing high transaction volumes, A2X setup for Shopify in Vancouver simplifies the process of accurate financial tracking and ensures compliance with Canadian tax regulations, such as GST/HST remittance.

Key features of A2X make it an essential connector for seamless operations:

- Shopify Connector: Easily links to your Shopify account for automatic data import on daily payouts.

- A2x Integration Quickbooks Online Vancouver: Supports initial connections and account linking with QuickBooks, enhancing Shopify QuickBooks integration in Canada for smooth syncing.

- Tax Mapping: Customizes rules for HST mapping on local BC sales, automating Canadian tax summaries to meet provincial requirements.

- A2X Xero setup for Shopify: Integrates with Xero for automated journal entries, drawing from Shopify-Xero integration guides that boast 99% reconciliation accuracy.

- Reports and Automation Rules: Generates detailed payout summaries and sets rules for multi-channel support, including Shopify reconciliation automation in BC.

- Audit Trails: Maintains comprehensive logs for e-commerce accounting connectors for Canada, ensuring transparency in transactions.

Pricing starts with the Starter plan at $19/month for up to 100 settlements, Growth at $69/month for 500, and Pro at $199/month for unlimited, scaling with business needs.

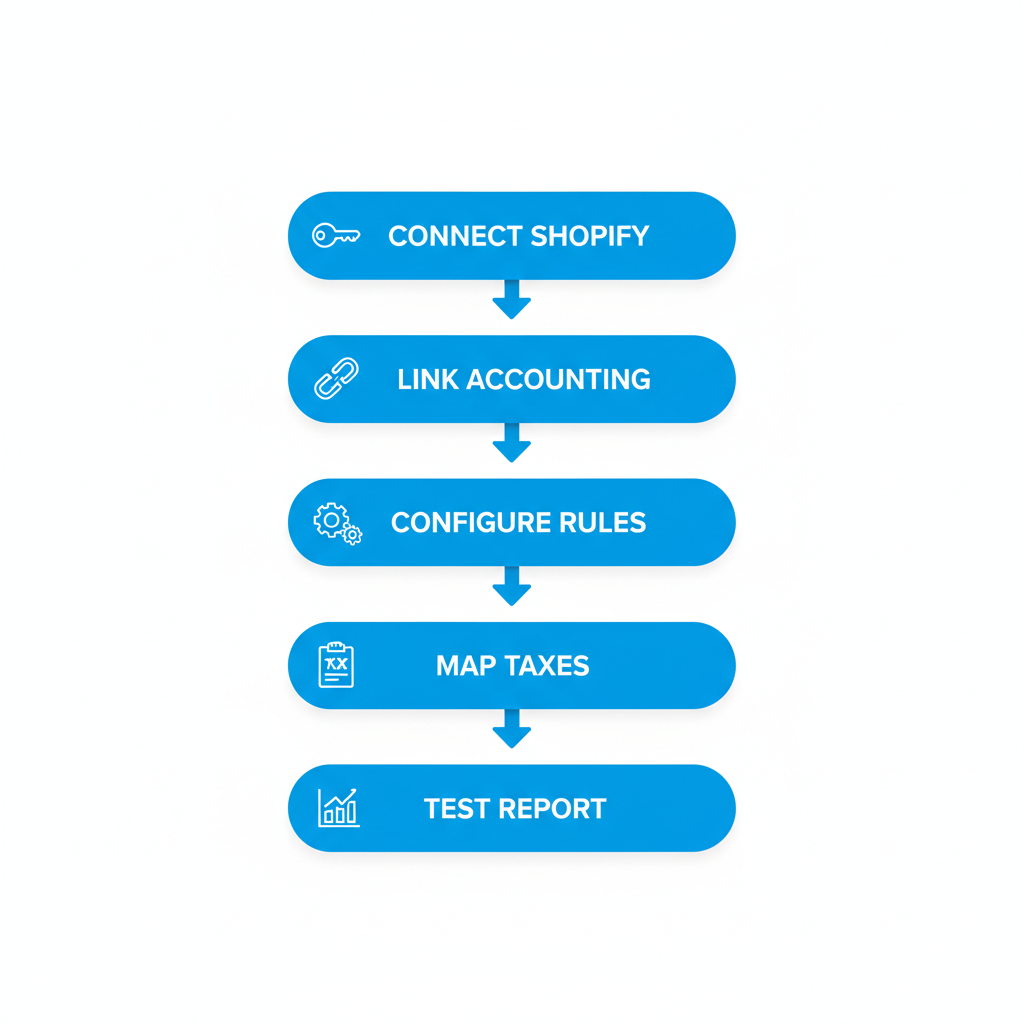

Step-by-step A2X setup process for Shopify and accounting integration

Pros

- Delivers accurate reconciliation, saving hours on manual entry.

- Easy tax and account mapping for Canadian compliance.

- Scalable for growing Vancouver stores with robust automation.

Cons

- Initial setup requires time to configure rules.

- Higher costs for Pro plan suit high-volume users only.

- Limited options for fully custom reports.

A2X is best for mid-sized Shopify sellers in Vancouver automating payouts, taxes, and reconciliations. By enhancing Shopify QuickBooks integration in Canada, it addresses common accounting challenges, paving the way for efficient QuickBooks syncing tailored to local needs.

Shopify QuickBooks Integration in Canada

QuickBooks Online plays a crucial role in Shopify accounting for Canadian e-commerce sellers, enabling seamless Shopify QuickBooks integration in Canada through automation tools like A2X. This sync automates sales data transfer from Shopify to QuickBooks, reducing manual entry and ensuring accurate financial records. For businesses handling multi-channel sales, it supports Canadian Shopify-QB syncing while addressing local compliance needs.

Key Features

- Auto-Sync for Sales Data: Automatically pulls daily Shopify sales into QuickBooks, including orders, refunds, and fees, saving hours on reconciliation.

- Sales Tax Automation: Handles GST/HST calculations per Canadian rules, applying provincial rates like those in British Columbia for accurate automated invoicing for BC stores.

- Inventory Tracking and Shopify to Quickbooks a2x Mapping Vancouver: Syncs stock levels in real-time; A2X enhances this with custom mapping rules tailored for Vancouver sellers, resolving common mismatches during setup.

- Robust Reporting and Bank Feeds: Generates CRA-compliant reports and connects bank feeds for effortless reconciliation, with A2X adding detailed summaries for better insights.

Pricing

QuickBooks Online offers tiered plans: Essentials at $30/month for basic syncing, Plus at $60/month for advanced inventory, and Advanced at $90/month for multi-entity support–ideal for scaling Canadian operations.

Pros and Cons

Pros: Comprehensive automation scales with business growth, CRA-friendly for tax filings, and reliable syncing follows ecommerce bookkeeping best practices to minimize errors. A2X integration boosts accuracy, as per Canadian tips from experts, fixing issues like duplicate entries via simple rule adjustments.

Cons: Steep learning curve for initial setup, and occasional sync delays during peak sales–troubleshoot by checking API connections or contacting support for Vancouver-specific resolutions.

Best For

This integration suits Vancouver e-commerce businesses with multi-channel operations seeking compliance. It’s particularly effective for A2X setup for Shopify in Vancouver, handling GST/HST nuances while contrasting with A2X Xero setup for Shopify for more flexible reporting needs.

A2X Xero Setup for Shopify

For Vancouver-based e-commerce sellers, Xero offers a streamlined cloud accounting solution that pairs seamlessly with Shopify through A2X. This A2X Xero setup for Shopify automates financial workflows, making it ideal for managing sales data and compliance in Canada. Unlike more complex systems like QuickBooks, Xero emphasizes simplicity, which extends naturally from Shopify QuickBooks integration in Canada by focusing on user-friendly reconciliation. Sellers can configure A2X to pull Shopify orders directly into Xero, ensuring accurate bookkeeping without manual entry.

Key Features

To begin the A2X Xero setup for Shopify in Vancouver, connect your accounts via the A2X app in Shopify’s admin panel. Follow these steps: first, authorize Xero access in A2X settings; second, map sales channels and payment methods; third, set rules for tax reconciliation for Canadian e-stores. Key features include:

- A2X Sync: Automatically summarizes payouts and deposits into Xero for easy bank reconciliation.

- GST/HST Automation: Handles Canadian sales tax mapping, reducing errors in Xero-Shopify automation in BC–users in app reviews report 95% satisfaction with this efficiency.

- Dashboards: Provides real-time overviews of revenue, expenses, and inventory synced from Shopify.

- Multi-Currency Support: Essential for cross-border sales, converting transactions accurately.

- Error Alerts: Notifies of mismatches, like unapplied taxes, with quick fix guides to avoid common setup pitfalls such as incorrect mapping.

These tools address queries on configuring A2X with Xero for Shopify stores, offering step-by-step integration benefits.

Pricing

Xero’s plans start affordably: Early at $13 per month for basic needs, Growing at $37 for expanded automation, and Established at $70 for advanced reporting–perfect for scaling Vancouver operations.

Pros and Cons

Pros include an intuitive interface that simplifies A2X Xero setup for Shopify, affordability for small businesses, and seamless tax automation praised in reviews for saving hours on reconciliation. It excels in GST/HST handling for Canadian sellers, with strong error resolution tools. Cons involve fewer third-party apps compared to competitors and basic inventory tracking, which may require add-ons for complex e-stores. Overall, it suits straightforward e-commerce finance.

Best For

Vancouver startups benefit most from A2X Xero setup for Shopify, especially those needing efficient tax reconciliation. For added support, consider ecommerce bookkeeping services that handle configurations and optimizations, ensuring compliance and growth in BC’s dynamic market.

Comparison of Shopify Accounting Tools

For Vancouver-based Shopify sellers navigating Canadian tax compliance, selecting the right accounting tool streamlines operations and ensures accurate financial reporting. This comparison evaluates A2X, QuickBooks Online, and Xero, emphasizing A2X setup for Shopify in Vancouver alongside key criteria like setup ease, GST/HST tax automation, pricing, integration depth, and suitability for e-commerce businesses. These factors address common challenges in tool comparison for BC e-commerce, helping sellers align with local regulations and growth needs.

The following table offers an accounting platform evaluation in Canada, drawing from A2X documentation, QuickBooks Canada guides, and Xero e-commerce resources to highlight integration benchmarks for Shopify users.

Comparison of A2X, QuickBooks, and Xero for Shopify Integration

This table compares key aspects of A2X, QuickBooks Online, and Xero for Vancouver Shopify sellers, focusing on setup ease, features, and Canadian compliance.

| Feature | A2X | QuickBooks Online | Xero |

|---|---|---|---|

| Setup Time | 15-30 min with Shopify connector | 30-60 min via app | 10-20 min cloud setup |

| Tax Automation (GST/HST) | Full mapping and reconciliation | Automated sales tax rules | GST/HST automation via A2X |

| Pricing Starting | $19/mo | $30/mo Essentials | $13/mo Early |

| Integration Depth | Payout-focused with accounting sync | Deep inventory and reporting | Simple invoicing and bank feeds |

| Best for Canadian Sellers | E-commerce reconciliation specialists | Robust for scaling businesses | Affordable for startups |

A2X stands out for its specialized reconciliation, ideal for A2X Xero setup for Shopify in complex sales environments. QuickBooks provides comprehensive Shopify QuickBooks integration in Canada, supporting multi-channel operations with advanced reporting for growing firms. Xero offers quick, cost-effective entry for small Vancouver stores, though it often pairs with A2X for full tax handling. Recommendations vary by business size: startups favor Xero’s affordability, while scaling e-commerce benefits from QuickBooks depth and A2X precision.

These comparisons reinforce best practices for Canadian sellers, such as prioritizing GST/HST automation to simplify reconciliations and reduce errors in monthly filings. For Vancouver operations, tools with strong Shopify connectors minimize setup disruptions, allowing focus on sales growth over administrative tasks. Visual aids like charts can further illustrate these trade-offs, aiding decision-making in a competitive market.

Comparison of key Shopify accounting tools for integration and pricing

Choosing the Right Toolkit for Shopify Accounting in Vancouver

Selecting the ideal toolkit begins with a streamlined A2X setup for Shopify in Vancouver, which automates payouts and ensures accurate financial tracking for local sellers. This foundation pairs seamlessly with robust options like QuickBooks for in-depth reporting or Xero for user-friendly management, addressing the unique demands of e-commerce operations in the region.

Key strengths emerge from these tools: A2X excels in automation, reducing manual entry errors, while QuickBooks offers analytical depth for scaling businesses. The Shopify QuickBooks integration in Canada simplifies GST/HST compliance, and A2X Xero setup for Shopify provides intuitive dashboards. Together, they deliver optimized e-commerce finance in BC, handling Canadian tax nuances effectively. User reviews highlight the ease of A2X implementation, with many Vancouver merchants praising quick onboarding and reliable performance.

For actionable steps, start with a free A2X trial to test integrations. If needed, consult experts like Transcounts for tailored support, beginning with granting accounting platform access to enable secure onboarding. This integrated accounting for Canadian stores streamlines your workflow without complexity.

Embracing these tools empowers sustainable growth, turning financial insights into strategic advantages for your Vancouver-based venture.