Table of Contents

A2X E-commerce Accounting Essentials in Vancouver Lower Mainland

Running an e-commerce business in Vancouver, Lower Mainland, brings exciting growth opportunities but also complex financial challenges like multi-channel sales tracking and Canadian tax compliance. A2X ecommerce accounting in Vancouver, Lower Mainland, emerges as a vital solution, automating reconciliation from platforms such as Shopify and Amazon directly into accounting software. This specialized approach ensures accurate financials for online sellers navigating GST/HST and provincial sales taxes.

Unlike traditional brick-and-mortar bookkeeping, which focuses on physical inventory and single-location sales, e-commerce demands robust online sales reconciliation in Lower Mainland. Key differences include real-time multi-channel integration, automated inventory adjustments for digital fulfillment, and handling deferred revenue from subscriptions or pre-orders. For growing operations, accrual accounting is recommended over cash methods, as it better matches revenues with expenses–consider a Vancouver seller accruing GST/HST on Amazon shipments to avoid cash flow distortions. According to the best e-commerce accounting software rankings, A2X boosts efficiency for Shopify users, with over 70% adoption among mid-sized Canadian sellers for seamless data syncing (Reference 1). Small business tools further highlight benefits like automated tax calculations, reducing errors in BC compliance (Reference 2).

Vancouver digital finance tools like A2X, QuickBooks, and Xero preview streamlined operations, with A2X QuickBooks integration Canada simplifying VAT handling for cross-border sales. Transcounts offers fixed-fee ecommerce bookkeeping services vancouver bc, leveraging a 100% online model for Lower Mainland convenience and expert support in ecommerce bookkeeping Vancouver.

A2X: Automated Reconciliation for Vancouver E-commerce Sellers

A2X stands out as a vital automation tool for A2X ecommerce accounting in Vancouver, Lower Mainland, where online sellers face complex sales data from platforms like Shopify and Amazon. Designed for e-commerce businesses, it streamlines the transfer of payout details directly into accounting software such as QuickBooks or Xero, ensuring compliance with Canadian tax regulations. Local firms like Transcounts leverage A2X to support Vancouver-based stores, simplifying reconciliation and reducing manual errors for efficient operations.

Key Features

A2X excels in automating essential tasks for ecommerce bookkeeping Vancouver, offering multi-channel support for platforms including Shopify, Amazon, and Etsy. It handles payout reconciliation by matching sales data to bank deposits, categorizing GST/HST accurately for BC businesses. Advanced error detection flags discrepancies in transactions, while tax mapping ensures CRA-ready reports. For seamless Amazon to Xero a2x Setup Surrey, it integrates payouts effortlessly, supporting A2X QuickBooks integration Canada with customizable rules. According to industry insights, A2X reduces reconciliation time by 80%, making it ideal for Lower Mainland sales automation tools.

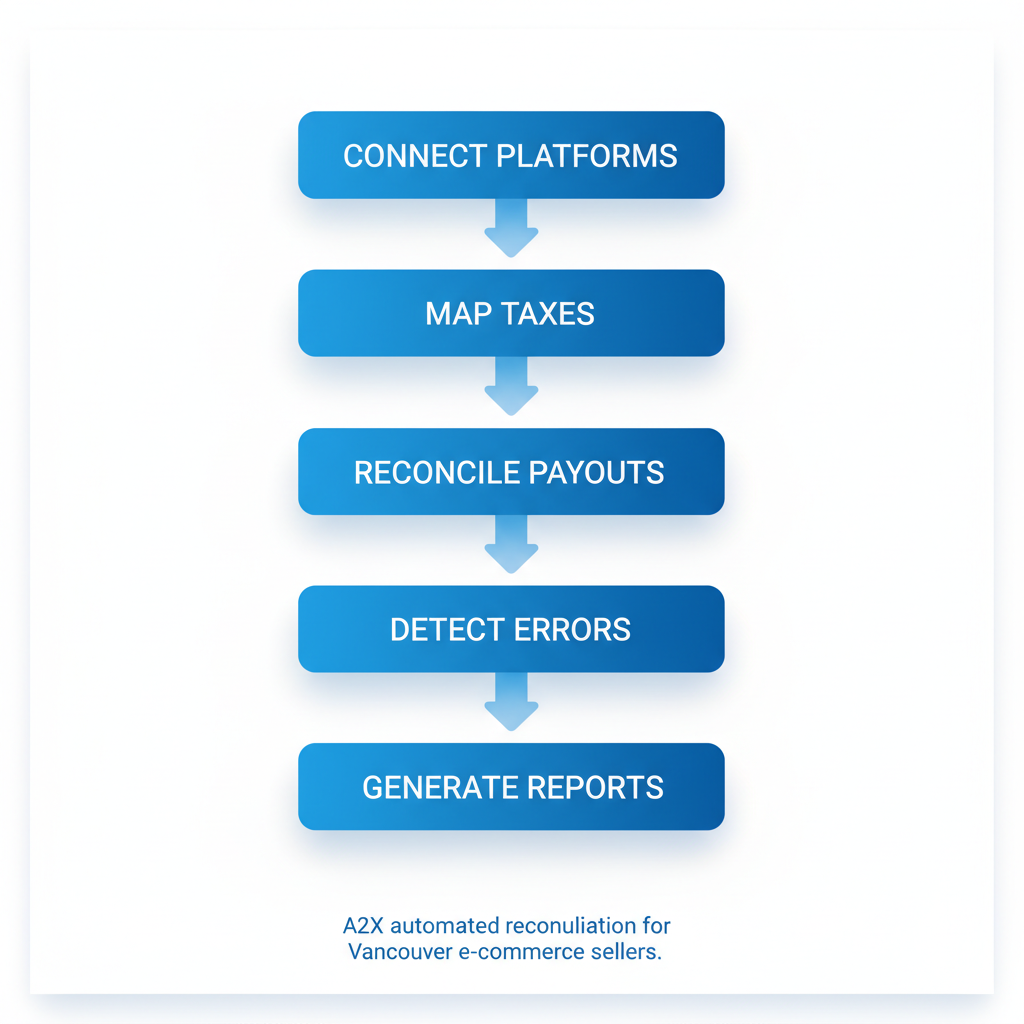

Automated A2X reconciliation process for Vancouver e-commerce sellers

This visual outlines how A2X transforms raw sales data into organized entries, benefiting sellers who manage high-volume transactions across borders.

Pricing

A2X offers tiered plans starting at $19 per month for up to 200 transactions, scaling to $99 for over 2,000, based on sales volume. This structure suits growing Vancouver e-commerce operations without excessive costs.

Pros and Cons

Pros:

- Enhances accuracy in Vancouver platform reconciliations, minimizing tax errors for GST/HST compliance.

- Saves significant time through automation, freeing sellers for business growth.

- Provides robust integration, like A2X QuickBooks integration Canada, for real-time financial visibility.

Cons:

- Initial setup involves a learning curve for custom mappings.

- Relies on accurate platform data, potentially delaying troubleshooting.

- Higher tiers may strain low-volume budgets in the Lower Mainland.

Best For

A2X is perfect for expanding Shopify and Amazon sellers in Vancouver, Lower Mainland, seeking fast, compliant reconciliations. With Transcounts’ local expertise in onboarding and A2X QuickBooks integration Canada, businesses gain CRA-aligned reports efficiently, addressing common challenges in manual processes compared to automated solutions.

QuickBooks Online Enhanced by A2X for Lower Mainland E-commerce

QuickBooks Online stands as a reliable foundation for ecommerce bookkeeping Vancouver, especially when paired with A2X for seamless automation. This combination excels in tracking online sales from platforms like Shopify, making it ideal for small businesses handling daily transactions. Transcounts, a Vancouver-based firm, offers expert setup to ensure smooth operations from day one.

Key features include robust inventory management to monitor stock levels in real-time and automated invoicing for customer billing. The A2X QuickBooks integration Canada simplifies sales data import, categorizing payouts for accurate financials. Users can choose cash or accrual accounting, with accrual recommended for e-commerce due to inventory needs, while sales tax methods handle HST remittances automatically. A2X auto-imports reconciled summaries, reducing manual entry and supporting GST/HST compliance for Canadian sellers. Transcounts provides 24-hour support for any hurdles in this process.

Pricing starts at Essentials for $30 per month, scaling to Plus at $80 monthly for advanced reporting.

Pros:

- User-friendly interface with scalable apps for growing stores.

- Robust reporting tools offering insights into cash flow and expenses.

Cons:

- Additional costs for add-ons like A2X can add up for startups.

- Learning curve for complex tax setups, though A2x Troubleshooting for Shopify Burnaby from Transcounts resolves common integration issues quickly.

This setup suits Lower Mainland startups focused on A2X ecommerce accounting in Vancouver, Lower Mainland, particularly those with Shopify stores needing Vancouver e-commerce ledger management and Lower Mainland transaction syncing. With over 60% adoption in BC small businesses, it delivers quick reconciliations at fixed fees, tying into Transcounts’ specialized services for online retail compliance.

Xero: Cloud Accounting Tailored for Vancouver Online Retail

Xero stands out in Vancouver cloud-based e-commerce finance as a robust alternative to traditional tools, offering seamless integration for online retailers in the Lower Mainland. With automated invoicing tailored to regional needs, it supports growing businesses handling multi-channel sales efficiently. This cloud platform empowers sellers with real-time financial visibility, making it ideal for tech-forward operations in British Columbia.

Key Features

Xero excels in e-commerce accounting through several core capabilities:

- Bank Feeds and Reconciliation: Automate transaction imports from multiple accounts, ensuring accurate tracking of sales and expenses without manual entry.

- Multi-Currency Support: Handle international transactions effortlessly, crucial for Vancouver exporters dealing with USD or other currencies.

- A2X Integration: Streamline A2X ecommerce accounting in Vancouver, Lower Mainland, by automating sales tax calculations and inventory reconciliation, reducing errors in provincial compliance like BC PST.

- Reporting Tools: Generate custom reports for inventory valuation and cash flow, adapting insights similar to A2X QuickBooks integration Canada but optimized for Xero’s ecosystem.

These features draw from proven automation benefits, enhancing efficiency for Canadian users as noted in local accounting guides.

Pricing Plans

Xero’s pricing starts affordably for small teams. The Early plan costs $15 per month for basic needs, while the Growing plan at $42 monthly adds advanced reporting and unlimited users, fitting scaling e-commerce operations without surprise fees.

Pros and Cons

Pros: Xero provides real-time insights into finances, enabling ecommerce bookkeeping Vancouver with mobile app access for on-the-go management. Its APIs support easy scaling and partnerships like Transcounts, which offer fixed monthly fees based on transaction volume. A testimonial from a local retailer notes, “Xero with Transcounts cut our reconciliation time by 50%, freeing us for growth.”

Cons: It has fewer native e-commerce apps compared to competitors, potentially requiring custom setups for complex inventory needs.

Best For

Xero suits tech-savvy Vancouver sellers managing multi-channel platforms, addressing queries on best ecommerce bookkeeping services in Vancouver through Transcounts’ expertise in sales tax handling. For specialized local support, consider an ecommerce bookkeeper surrey bc, ensuring 30-day onboarding for seamless A2X reconciliation near Vancouver.

Key E-commerce Accounting Tools Compared for Vancouver Businesses

Vancouver e-commerce sellers often face challenges with reconciling multi-channel sales, managing GST/HST compliance, and tracking inventory amid BC’s PST nuances. For A2X ecommerce accounting in Vancouver, Lower Mainland businesses benefit from specialized tools that streamline these processes. This section compares key ecommerce software tools like A2X, QuickBooks Online, and Xero, focusing on features vital for local online operations. These Vancouver tool comparisons for online sales help identify solutions that integrate seamlessly with Transcounts for efficient bookkeeping.

The following table outlines critical aspects for Lower Mainland finance software analysis, drawing from official features and Canadian user insights to highlight suitability for regional tax remittance and automation needs.

| Feature | A2X | QuickBooks Online | Xero |

|---|---|---|---|

| Sales Reconciliation | Automated from platforms | Add-on required | Strong via integrations |

| GST/HST Handling | Auto-mapping for Canada | Built-in for BC | Compliant remittance |

| Pricing (Starting) | $19/mo | $30/mo | $15/mo |

| Integration Ease | Seamless with QB/Xero | Core platform | API-driven |

| Local Support | Via Transcounts | Intuit partners | Vancouver experts |

| Best for Inventory | Multi-channel sync | Advanced tracking | Real-time updates |

A2X stands out for its high automation in sales reconciliation, making it ideal for scaling Vancouver e-commerce operations through A2X QuickBooks integration Canada, which reduces manual errors in multi-platform syncing. QuickBooks Online offers robust built-in BC tax handling but requires add-ons for full e-commerce depth, suiting established sellers. Xero provides affordable entry with strong remittance tools across provinces, appealing to startups. Transcounts enhances all via bundled setups, ensuring CRA compliance and PST accuracy for Lower Mainland clients. In ecommerce bookkeeping Vancouver contexts, A2X edges for automation, while Xero wins on cost–choose based on transaction volume for optimal ROI.

These insights build on prior tool profiles, guiding decisions toward compliant stacks. For personalized implementation, Transcounts offers expert onboarding to align software with your sales tax nexus.

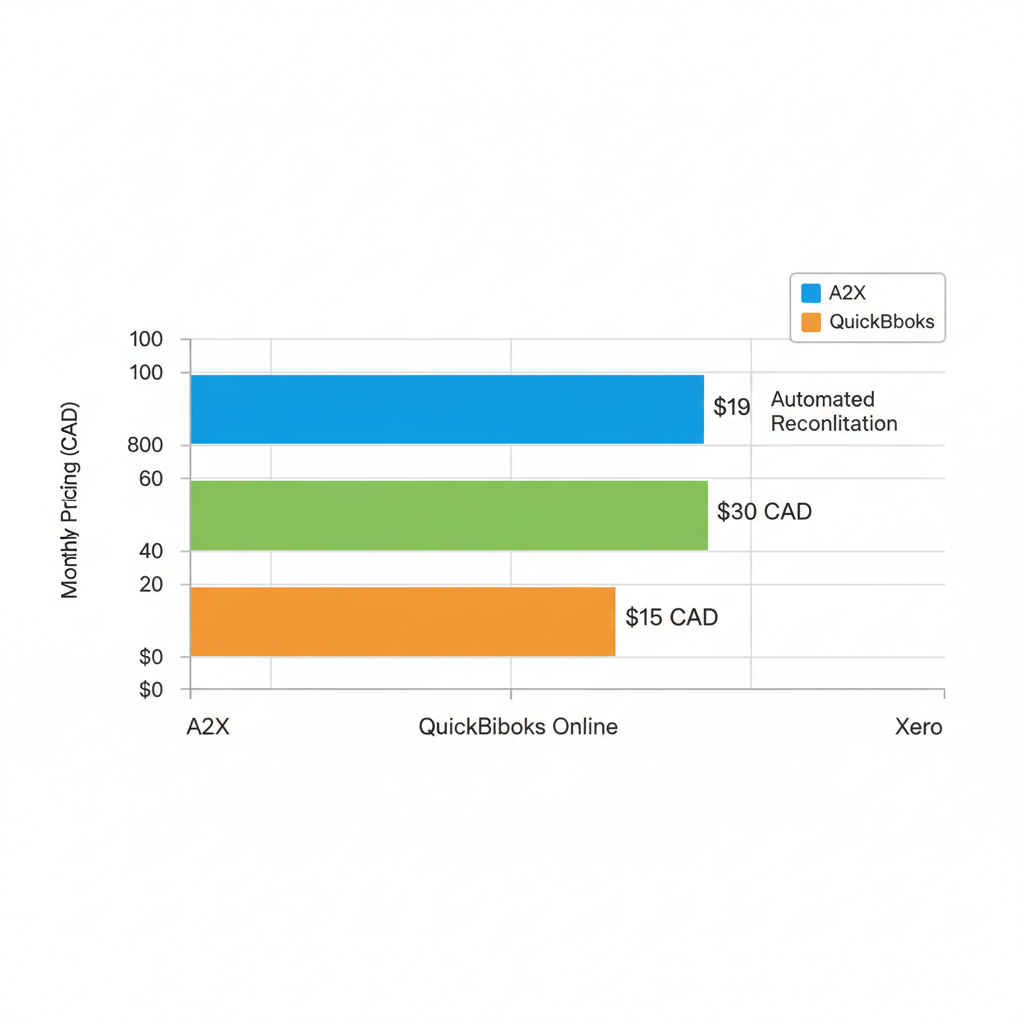

Pricing comparison of top e-commerce accounting tools for Vancouver businesses

Visualizing costs underscores Xero’s affordability for small operations in the region, yet A2X’s value shines in time savings for growing sellers. This bar chart reinforces the table’s pricing row, helping businesses weigh initial investments against long-term efficiency gains in a competitive market.

Empowering Vancouver E-commerce Growth with A2X Accounting Tools

In the dynamic world of A2X ecommerce accounting in Vancouver, Lower Mainland, businesses thrive by leveraging tools that simplify complex financials. A2X excels in automating sales reconciliations and A2X QuickBooks integration Canada, delivering accuracy and efficiency for online sellers. Transcounts enhances this with expert integrations, handling sales tax compliance and providing KPI dashboards that align with CRA requirements. With e-commerce growth in Canada surpassing 20% annually, these solutions position Vancouver-based operations for scalable success.

Ready to optimize your finances? Contact Transcounts today for ecommerce bookkeeping Vancouver tailored to your needs locally (see bookkeeping services vancouver). Our 24-hour support and fixed pricing ensure seamless transitions, with onboarding completed in just 30 days. As one Lower Mainland client shared, “Transcounts turned our chaotic books into a streamlined powerhouse, saving us hours weekly.”

Embrace Vancouver online finance optimization and Lower Mainland e-commerce compliance strategies through our proven services. Secure a free quote now to elevate your business with reliable, local expertise.