Table of Contents

Navigating Sales Tax Reconciliation in Vancouver, British Columbia

In the bustling e-commerce scene of Vancouver, British Columbia, businesses often grapple with discrepancies in sales records, leading to headaches with tax compliance. Sales tax reconciliation in Vancouver, British Columbia ensures these mismatches are resolved efficiently, preventing costly errors for local sellers.

Sales tax reconciliation involves matching sales transactions against collected taxes to accurately report GST/HST (Goods and Services Tax/Harmonized Sales Tax) and PST (Provincial Sales Tax) liabilities. For CRA (Canada Revenue Agency) compliance, this process is vital to avoid audits, fines up to 10% of unpaid amounts, and interest penalties as outlined in British Columbia’s sales tax policies. Proper GST HST reconciliation in Vancouver, British Columbia and PST filing services in Vancouver, British Columbia maintain audit readiness amid the province’s dual tax system.

Transcounts, a trusted Vancouver provider, streamlines tax compliance processes for local businesses with automated tools like A2X and TaxJar integrations for Shopify users. Facing Shopify tax glitches? Our Gst Hst Filing Vancouver expertise handles provincial sales tax management in BC, offering fixed-fee online services for seamless filing. Discover how we support your growth in upcoming sections on the local tax landscape and getting started.

Sales Tax Landscape Overview in Vancouver, British Columbia

Vancouver businesses navigate a complex sales tax environment shaped by federal and provincial regulations, where sales tax reconciliation in Vancouver, British Columbia, becomes essential for compliance. The city’s thriving e-commerce sector, including platforms like Shopify, amplifies challenges from cross-border sales, triggering tax obligations under both GST/HST and PST. Local firms must align transactions with remittances to avoid penalties, especially as BC’s harmonized system blends federal and provincial elements.

British Columbia operates a dual tax framework that demands careful management for e-commerce sellers. Federal GST/HST, administered by the Canada Revenue Agency, applies broadly, while provincial PST targets specific tangible goods with varying exemptions. This setup heightens nexus risks for Vancouver operations handling US or interprovincial sales, underscoring the need for robust BC tax compliance strategies in local sales tax management.

The following table compares key aspects of federal GST/HST and provincial PST for Vancouver businesses, aiding in understanding reconciliation differences:

| Aspect | GST/HST | PST |

|---|---|---|

| Tax Rate | 5% GST + provincial HST (13% in BC) | N/A |

| Applicability | Federal sales on most goods/services | Provincial sales on specific goods/services, exemptions vary |

| Filing Frequency | Monthly/quarterly/annually based on revenue | Monthly/quarterly for registrants |

| Reconciliation Tools | CRA NETFILE, cloud integrations like TaxJar | BC PST portal, A2X for e-commerce |

Data sourced from BC Government PST Guide and CRA compliance resources for accuracy in Vancouver context. As per the Small Business Guide to PST, exemptions apply to items like groceries, reducing PST liability, while CRA notes audit frequencies rise for high-volume e-commerce, with over 20% of Vancouver filings scrutinized annually.

This comparison reveals GST HST reconciliation in Vancouver, British Columbia, focuses on value-added tracking via federal portals, contrasting with PST filing services in Vancouver, British Columbia, which emphasize retail-specific reporting. For e-commerce, tools like A2X streamline matching, but integrated solutions from canada sales tax services such as Transcounts offer tailored support for startups, automating dual compliance and minimizing errors. Vancouver’s Shopify stores, for instance, benefit from these to handle cross-province volumes without nexus pitfalls.

Visual comparison of federal GST/HST and provincial PST in Vancouver

Reconciliation urgency grows with BC’s evasion risks, where mismatched remittances can lead to fines up to 10% of unpaid tax. Transcounts aids nonprofits and tech firms in crafting efficient strategies, ensuring audit-ready records amid Vancouver’s dynamic market.

Available Sales Tax Reconciliation Services in Vancouver

Vancouver businesses navigating the complexities of sales taxes can rely on professional services tailored to GST/HST and PST requirements. Sales tax reconciliation in Vancouver, British Columbia, has become essential for e-commerce operators and startups seeking compliance without the hassle. Providers like Transcounts offer automated solutions that integrate seamlessly with cloud platforms, ensuring accurate filings and reducing errors for local firms.

GST HST reconciliation in Vancouver, British Columbia, focuses on federal obligations through efficient automation. Services include automated filings via integrations like TaxJar, which connects directly to platforms such as Shopify and QuickBooks for real-time transaction tracking. These GST HST reconciliation in Vancouver, British Columbia, offerings handle input tax credits, quarterly returns, and nexus monitoring for businesses selling across Canada. Professional teams address tight CRA deadlines, providing audit-ready reports and error corrections to prevent penalties. For small enterprises, custom quotes make these services accessible, with fixed fees based on transaction volume ensuring predictability.

PST filing services in Vancouver, British Columbia, streamline provincial compliance using the BC government’s online portal. Automation tools facilitate electronic remittance as required by the PST Report and Pay Guide, allowing businesses to file and pay within the standard 23-day timeline post-reporting period. PST Filing BC Vancouver stands out, offering integrations that automate calculations and submissions for accuracy. Local filing support extends to nonprofits and contractors, mitigating risks from manual errors and ensuring timely adherence to provincial rules.

Transcounts excels with its fixed-fee model, charging based on monthly transactions for comprehensive sales tax reconciliation. A Vancouver e-commerce client, for instance, reduced filing time by 70% using A2X for Shopify integrations, gaining peace of mind amid growth. Benefits include:

- Automated tax compliance aids for seamless operations

- Dedicated support for deadlines and custom needs

- Scalable solutions for startups and nonprofits alike

These services empower overwhelmed owners with reassuring, tech-driven efficiency.

Key Local Considerations for Tax Reconciliation in Vancouver

Navigating sales tax reconciliation in Vancouver, British Columbia requires attention to provincial nuances that can impact business compliance. Local enterprises face unique BC compliance hurdles, including distinct requirements for GST/HST and PST, alongside filing schedules tailored to business size.

PST filing deadlines vary by revenue: businesses with annual taxable sales over $10,000 file monthly by the 15th of the following month, while smaller ones submit quarterly. For GST/HST requirements, businesses in BC must register if sales exceed $30,000 annually, claiming input tax credits to offset costs on business purchases. These federal and provincial tax pitfalls often trip up Vancouver sellers, such as mismatched exemptions on zero-rated items or overlooking nexus rules.

Common errors in GST HST reconciliation in Vancouver, British Columbia include incorrect credit calculations during peak retail seasons, leading to CRA penalties. A Vancouver retailer, for instance, once overlooked PST on imported goods, resulting in audit complications and back taxes. Cross-border challenges like us sales tax for bc shopify sellers vancouver exacerbate these issues for e-commerce firms expanding into the US.

Transcounts’ PST filing services in Vancouver, British Columbia streamline deadlines and error-proof processes, offering CRA notice support and audit preparation to safeguard your operations with expert local guidance.

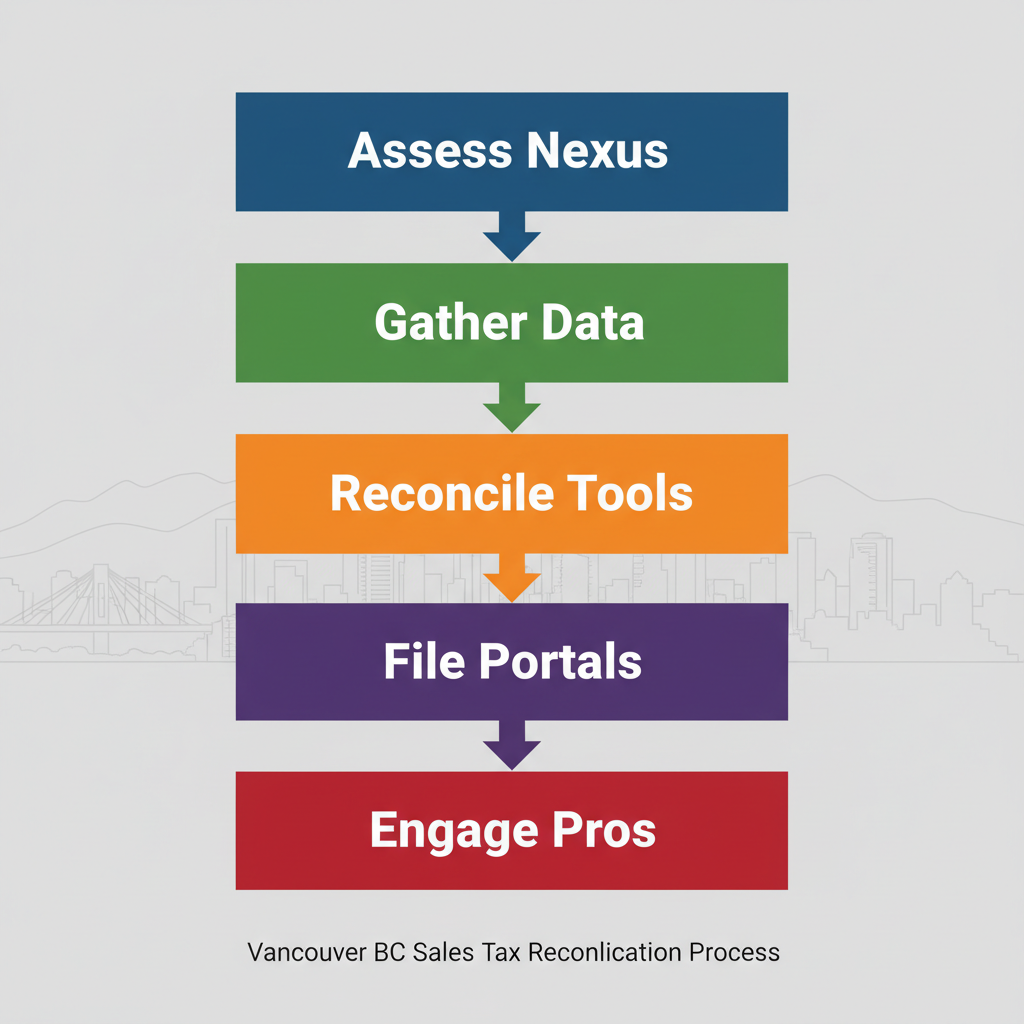

Steps to Begin Sales Tax Reconciliation in Vancouver

Starting sales tax reconciliation in Vancouver, British Columbia, ensures your business stays compliant with provincial and federal requirements from day one. This reconciliation kickoff sets a strong foundation for accurate reporting and avoids penalties. Follow these practical steps to initiate the process efficiently.

- Assess your business nexus and registration: Review your operations against British Columbia’s Sales Taxes Policy to determine if you meet PST and GST/HST registration thresholds. For initial tax setup in BC, register online via the CRA for GST/HST and the BC government’s portal for PST if your sales exceed $10,000 annually. This step is crucial for sales tax reconciliation in Vancouver, British Columbia.

- Gather transaction data: Use cloud accounting tools like QuickBooks or Xero to collect sales records, invoices, and tax details from the past quarter. Organize data by separating taxable and exempt transactions to streamline the process.

- Reconcile with automation tools: Integrate solutions like A2X for GST HST reconciliation in Vancouver, British Columbia, especially for e-commerce. For Shopify users, explore shopify tax setup canada us vancouver to automate multi-jurisdiction compliance. These tools match payouts to accounting entries, reducing errors by up to 90%.

- File returns accurately: Submit GST/HST through the CRA’s NETFILE and PST via the BC eTaxBC portal. Opt for PST filing services in Vancouver, British Columbia, if handling high volumes to ensure timely deadlines.

- Engage professionals for support: For complex needs, partner with experts like Transcounts, who offer reliable onboarding in just 30 days. Their services handle everything from automation to filings.

Steps to begin sales tax reconciliation in Vancouver

Tool tips: Start with free trials of A2X to test integrations. Best practices include monthly reconciliations. Costs for professional PST filing services in Vancouver range from $200-$500 monthly for small businesses, depending on volume–contact Transcounts for a custom quote to simplify your workflow.

Achieving Compliance Through Local Tax Expertise in Vancouver

Navigating sales tax reconciliation in Vancouver, British Columbia, demands mastery of dual GST HST reconciliation in Vancouver, British Columbia, and PST filing services in Vancouver, British Columbia. Challenges like frequent filings and accurate reporting are met with best practices: monthly reconciliations using secure portals, as outlined in the PST Report and Pay Guide for compliant submissions.

Transcounts delivers BC tax mastery through Vancouver-focused automation, integrating tools for seamless local compliance wrap-up and bundled ecommerce bookkeeping services vancouver bc. Connect with Transcounts today for custom support and sustained growth.