Table of Contents

Mastering Accounts Receivable Management in Vancouver

In the bustling Vancouver business landscape, effective Accounts Receivable Management in Vancouver plays a pivotal role in sustaining cash flow for e-commerce sellers and tech startups. These enterprises often face seasonal demands that strain finances, making timely collections essential for operational stability and growth.

Accounts receivable refers to the process of managing funds owed by customers through invoice collection processes. In Vancouver’s dynamic environment, where provincial sales taxes add complexity, optimizing this area directly impacts accounts receivable turnover and overall financial health. Common challenges, such as late payments, can disrupt small and medium-sized enterprises. According to insights on managing long payment cycles, average collection times in Canada often exceed 45 days, leading to cash crunches for local firms. Transcounts addresses these issues with its innovative online model, seamlessly integrating QuickBooks and Xero for efficient receivables management. Their bookkeeping services Vancouver combine AR optimization strategies with comprehensive financial support, featuring fixed monthly fees based on transaction volume and 24-hour response times to keep businesses agile.

Mastering these fundamentals paves the way for reduced bad debt and faster invoicing. Upcoming sections explore proven practices and benefits tailored to Vancouver’s market, empowering your business to thrive amid local economic pressures.

Fundamentals of Accounts Receivable

Defining Accounts Receivable Basics

Accounts receivable (AR) represents the money owed to a business by its customers for goods or services delivered on credit. At its core, AR consists of outstanding invoices that detail the amount due, payment terms, and due dates. For small and medium-sized enterprises (SMEs) in Vancouver, effective AR management ensures steady cash flow amid fluctuating local markets. Net AR, as defined in standard glossaries, subtracts allowances for doubtful accounts from total receivables to reflect realistic collectible amounts.

The invoicing to collection cycle begins with issuing detailed invoices post-sale, followed by tracking payments and following up on overdue amounts. This process involves customer payment tracking to monitor due dates and apply late fees if needed. For instance, a Vancouver-based e-commerce firm selling tech gadgets might issue an invoice with 30-day credit terms, expecting payment within that window. Delays here can strain operations, with Canadian businesses facing average collection periods of 45-60 days, impacting liquidity.

In Vancouver, challenges like cross-border US-Canada transactions add complexity to AR, requiring careful handling of currency conversions and GST/HST compliance. Robust accounts receivable management in Vancouver helps SMEs navigate these issues, turning potential bottlenecks into opportunities for growth. Understanding these basics lays the foundation for improved debt collection efficiency.

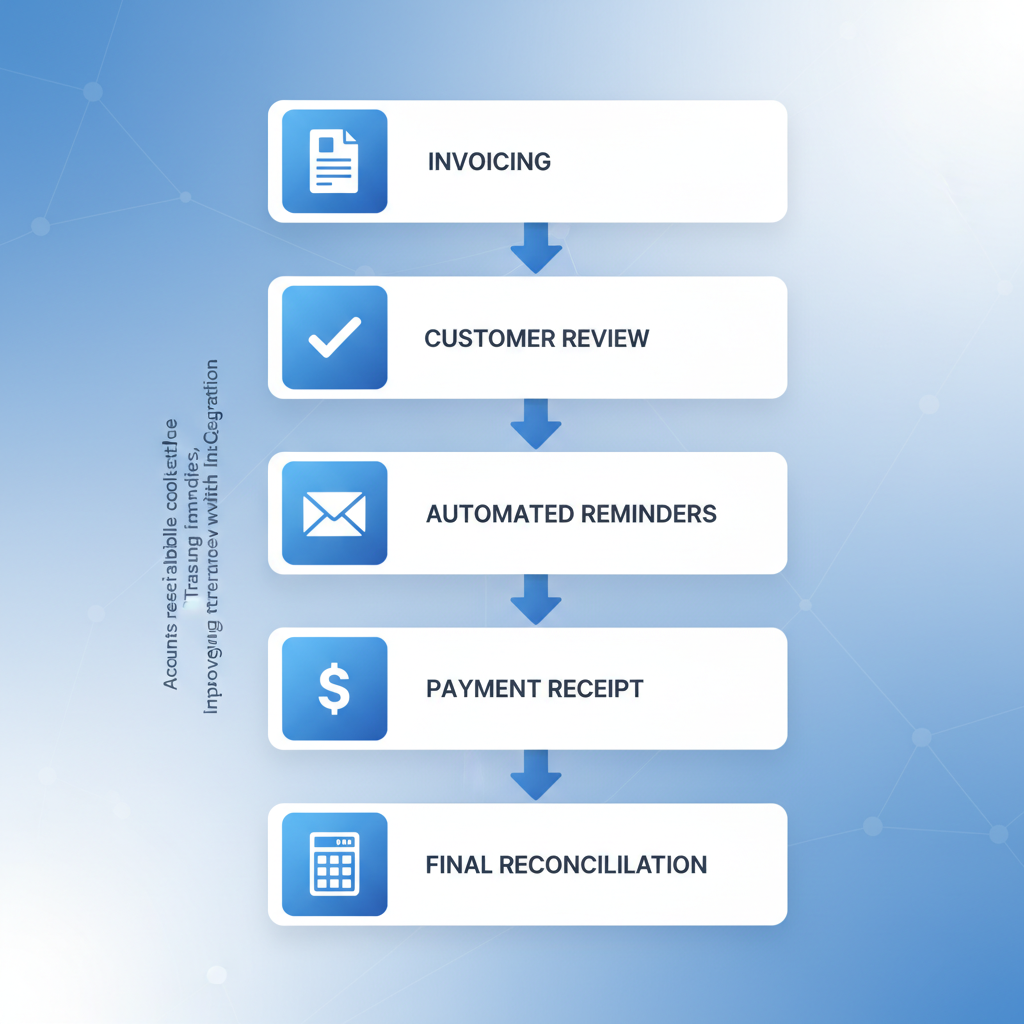

Visual guide to accounts receivable fundamentals and net receivables

This visual underscores the cyclical nature of AR, from invoicing to reconciliation, emphasizing compliance in a Canadian context. Building on this, businesses can better anticipate cash flow patterns.

Assessing Credit Worthiness Locally

Evaluating credit worthiness involves reviewing a customer’s financial health to decide on extending credit. Key methods include analyzing financial statements for liquidity ratios and obtaining credit reports from agencies like Equifax Canada. In the Vancouver market, local economic factors such as real estate volatility and tech sector growth influence assessments, as SMEs often deal with variable client stability.

Receivables management starts with thorough checks: request recent balance sheets to gauge debt levels and calculate accounts receivable turnover, which measures how quickly receivables convert to cash. A higher turnover ratio indicates efficient collection. For example, a local supplier assessing a new client might review trade references and payment history; if the client has a history of delays, credit limits could be tightened. Integrating these steps enhances overall financial security.

Vancouver’s diverse economy, with e-commerce firms facing international payments, demands tailored approaches. Here, quick credit checks for local suppliers are vital amid GST/HST nuances. For contrast, while AR focuses on inflows, accounts payable handles outflows–consider Accounts Payable Outsourcing Vancouver for streamlined vendor payments. This balance prevents overextension in credit granting.

- AR vs. AP: AR tracks customer debts for revenue; AP manages supplier obligations for expenses. AR emphasizes collection speed, AP prioritizes timely payments to avoid penalties.

Handling Credit Balances in AR

Credit balances in AR occur when a customer overpays or returns goods, resulting in a negative receivable amount owed back to them. Common causes include billing errors, such as duplicate invoices, or customer prepayments exceeding the billed amount. In Canadian businesses, these must be reconciled promptly to maintain accurate books and comply with CRA guidelines.

Resolution involves identifying the cause through transaction reviews and issuing refunds or credits. For instance, a Vancouver retailer receiving an overpayment from a US client might apply the excess to future invoices or refund via GST/HST-adjusted wire transfer. This prevents disputes and supports healthy customer relations. Tracking these balances via software ensures timely adjustments, reducing administrative burdens.

For businesses in Vancouver, credit balances can arise from complex cross-border returns in e-commerce, complicating receivables management. Addressing them efficiently ties into broader AR strategies, hinting at gains like faster cash cycles and reduced financial risks in subsequent optimization efforts.

Key Benefits of Effective Accounts Receivable Management

Effective accounts receivable management transforms financial operations for businesses in Vancouver by ensuring steady revenue streams and operational resilience. For local startups and nonprofits, this practice not only streamlines collections but also unlocks strategic advantages, allowing firms like Transcounts to provide bundled services that deliver CFO-level insights at scalable rates. By focusing on timely invoicing and follow-ups, companies can achieve the most important goals of accounts receivable management, such as maintaining liquidity and minimizing risks, ultimately fostering sustainable growth.

Improving Cash Flow and Liquidity

Optimized accounts receivable practices directly enhance cash availability, enabling Vancouver operations to meet immediate obligations without straining resources. Through payment cycle optimization, businesses reduce the time between invoicing and payment, freeing up capital for reinvestments or unexpected expenses. This liquidity boost supports smoother day-to-day functions, from payroll to supplier payments, creating a foundation of financial stability measures that empowers proactive decision-making.

Evidence from industry insights shows that faster accounts receivable turnover can cut average collection periods by up to 30%, significantly reducing long-term cash shortages as highlighted in studies on managing long payment cycles. For Canadian firms, this translates to improved working capital ratios, with many Vancouver businesses reporting 20-25% better liquidity after implementing structured AR processes. Accurate forecasting tied to these improvements allows for reliable budgeting, preventing the cash crunches that plague 40% of small enterprises during peak seasons.

Transcounts integrates these principles into its services, offering automated invoicing and real-time dashboards that accelerate month-end closes for clients in Vancouver. A local tech startup shared, “Transcounts’ AR tools turned our erratic cash flow into predictable inflows, letting us scale without loans.” This tie-in ensures nonprofits and SMEs access professional-grade tools affordably, aligning with CRA remittance rules for seamless compliance and enhanced operational agility.

Reducing Bad Debt Risks

Robust receivables management minimizes losses from unpaid invoices by incorporating proactive credit assessments and consistent follow-ups tailored to local contexts in Vancouver. By conducting thorough credit checks before extending terms, businesses can identify high-risk clients early, safeguarding assets and maintaining profitability. This risk mitigation fosters a secure financial environment where resources are allocated efficiently rather than chasing delinquent payments.

Regulatory insights from Canada’s capital adequacy requirements emphasize the importance of internal ratings-based approaches for credit risk, validating that firms using advanced bad debt strategies see write-offs drop by 15-20%. In Vancouver’s diverse market, where payment delays affect 35% of invoices due to economic variability, these measures prevent cumulative losses that could exceed 5% of annual revenue for unprepared SMEs.

Transcounts bolsters this through its fractional controller services, providing credit monitoring and automated reminders that integrate with QuickBooks or Xero. Clients benefit from bundled AP/AR offerings that include dispute resolution, ensuring compliance with Canadian regulations while reducing administrative burdens. For agencies and contractors, this means fewer surprises at year-end, with Transcounts’ expertise turning potential losses into recoverable assets and promoting long-term vendor relationships.

Enhancing Business Growth

Efficient AR management connects directly to scaling opportunities for SMEs in Vancouver by delivering predictable revenue streams that fuel expansions and innovations. With reliable cash inflows, businesses can invest in marketing, hiring, or product development without dipping into reserves, turning financial stability into a growth accelerator. This empowerment allows local firms to seize market opportunities confidently, from entering new segments to funding R&D initiatives.

Stats indicate that companies optimizing AR achieve up to 25% higher growth rates, as consistent liquidity supports strategic investments rather than survival tactics. In Vancouver’s vibrant ecosystem, where e-commerce and tech startups thrive, effective practices like timely collections enable 30% faster access to capital for scaling, per payment cycle analyses.

Transcounts facilitates this through its technology-driven model, offering KPI dashboards and cash flow forecasting that reveal growth enablers. For instance, integrating small business accounting tips Vancouver helps nonprofits diversify funding sources while maintaining audit-ready books. A Vancouver agency noted, “Our AR efficiency via Transcounts unlocked investments we couldn’t otherwise afford, doubling our client base in a year.” These services ensure bundled insights at fixed fees, positioning businesses for sustainable expansion and investor appeal.

How Accounts Receivable Management Operates

Effective accounts receivable management in Vancouver ensures steady cash flow for businesses, particularly those in e-commerce facing seasonal peaks. This section outlines the core processes, from invoicing to payment collection, highlighting how firms like Transcounts streamline operations through technology.

The AR Collection Cycle

Accounts Receivable Management in Vancouver follows a structured cycle to minimize delays and optimize collections. The process begins with accurate invoicing, where businesses generate detailed bills post-sale, including taxes like GST/HST or US sales tax nexus for cross-border transactions. Next, invoices are sent promptly via email or client portals, setting clear payment terms such as net 30 days.

Follow-up actions form the third step: automated reminders are dispatched for overdue accounts, escalating to phone calls or statements if needed. This stage addresses common disruptions, such as late payments that extend average days sales outstanding in Canada to around 45 days, impacting cash flow. Reconciliation follows, matching payments to invoices and updating records in accounting software.

The final step involves receipt and deposit: once payments arrive, they are recorded, and funds are deposited via direct deposit for efficiency. For Vancouver e-commerce sellers, this cycle handles high-volume seasonal surges, like holiday orders, ensuring timely resolutions. Transcounts automates this end-to-end, completing onboarding in 30 days to reassure new clients of quick setup.

Accounts receivable management process flow for efficient collections

This visual flowchart illustrates the cycle’s progression, emphasizing proactive steps to reduce outstanding balances and support business growth.

Calculating Turnover Ratios

Understanding accounts receivable turnover is essential for assessing collection efficiency. The accounts receivable turnover ratio measures how quickly a company collects payments, calculated using the formula: net credit sales divided by average accounts receivable. Net credit sales represent total sales on credit minus returns, while average accounts receivable is the sum of starting and ending balances divided by two.

For example, if a Vancouver business has $500,000 in net credit sales and $100,000 average accounts receivable, the turnover ratio is 5. This means the company collects receivables five times annually. To find days sales outstanding, divide 365 by the ratio, yielding 73 days here–longer than the Canadian average, signaling room for improvement.

Monitoring accounts receivable turnover trends reveals patterns, such as seasonal slowdowns in e-commerce. Regular calculation helps identify bottlenecks, like delayed invoicing, and informs strategies to shorten cycles. Businesses tracking this metric can enhance liquidity, answering key questions on formula application and its role in financial health.

Integrating Tools for Efficiency

Receivables management thrives with integrated tools tailored for Vancouver workflows. Cloud platforms like Xero enable seamless invoice tracking systems, automating notifications and reconciling bank feeds in real-time. For e-commerce, integrations with Plooto handle direct deposits, while A2X syncs sales channels to prevent errors in US sales tax nexus reporting.

Transcounts leverages these for collection workflow automation, reducing manual tasks and ensuring compliance. Clients benefit from Bill Pay Services for Small Business Vancouver, which complements receivables by streamlining outflows alongside inflows. This holistic approach cuts processing time, with features like automated aging reports to flag overdue items early.

In practice, Vancouver startups onboard within Transcounts’ 30-day window, gaining access to these tools for faster collections. By monitoring turnover through dashboard integrations, firms spot trends and adjust strategies, fostering predictable cash flow amid local market demands.

Proven Best Practices for Accounts Receivable

Effective accounts receivable management is crucial for small businesses in Vancouver, where timely cash flow can make or break growth. By adopting proven strategies, companies can minimize delays and maximize revenue. This section outlines key practices tailored to the local economy, drawing on industry standards to enhance AR performance metrics.

Implementing Efficient Strategies

Streamlining accounts receivable management in Vancouver starts with prompt invoicing and clear terms. Small businesses should issue invoices immediately upon service delivery, specifying due dates within 30 days to accelerate collections. Establishing credit policies that assess client reliability upfront prevents extended delays. For instance, a Vancouver e-commerce firm reduced outstanding receivables by 25% by automating invoice generation through integrated software.

A good accounts receivable turnover ratio, ideally 6-12 times annually, serves as a benchmark for efficiency. This metric indicates how quickly payments convert to cash, vital for maintaining liquidity in a competitive market. Payment optimization tactics like offering early payment discounts–such as 2% off for settlements within 10 days–encourage faster inflows. To implement, create a checklist: 1) Review client credit history using OSFI-inspired guidelines for risk assessment; 2) Standardize invoice formats with all essentials; 3) Track aging reports weekly. These steps empower businesses to build resilient AR processes, positioning them for sustainable expansion.

Overcoming Local Challenges

Vancouver companies face unique hurdles in receivables management, including late payments from cross-border trade with the U.S. Economic variability, influenced by seasonal tourism and tech sector fluctuations, often delays collections. For example, a local SaaS startup experienced 45-day average terms due to international clients navigating currency exchanges and regulatory differences.

To mitigate these, adopt flexible follow-up protocols. Send automated reminders at 15, 30, and 45 days past due, escalating to personalized calls for high-value accounts. Incorporate semantic variations like AR performance metrics to monitor trends, such as rising days sales outstanding in volatile periods. Reference standard definitions from accounting glossaries to ensure policies align with net receivable calculations. A practical checklist includes: 1) Segment clients by risk, prioritizing U.S. trades with stricter terms; 2) Negotiate escrow for large cross-border deals; 3) Build buffers into cash forecasts accounting for local economic shifts. By addressing these challenges head-on, Vancouver businesses can achieve more predictable cash flows and reduce bad debt risks.

Leveraging Tools and Monitoring

Optimizing receivables management requires robust tools and vigilant tracking. Recommend integrating platforms like QuickBooks or Xero for automated invoicing and real-time dashboards. For sales tax compliance in cross-border scenarios, tools such as TaxJar streamline reconciliations, freeing time for core operations.

Ongoing monitoring of accounts receivable turnover ensures alignment with benchmarks, using dashboards to flag anomalies early. Set alerts for invoices exceeding 60 days, and review monthly KPIs to refine strategies. A Vancouver nonprofit improved turnover by 20% through such integrations, enhancing overall financial health. For tailored implementation, consider accounting services Vancouver from experts like Transcounts, who offer industry-specific processes for e-commerce and SaaS, delivering audit-ready results.

A implementation checklist: 1) Select cloud-based tools compatible with your workflow; 2) Train staff on usage for prompt adoption; 3) Schedule quarterly audits of AR metrics; 4) Partner with specialists for custom KPIs. These practices not only boost efficiency but also provide CFO-level insights at scalable costs, empowering your business to thrive in Vancouver’s dynamic landscape.

Optimizing Your Accounts Receivable Strategy

Effective Accounts Receivable Management in Vancouver demands a strategic approach to streamline collections, mitigate risks, and boost cash flow for growing businesses. Throughout this guide, we’ve explored the fundamentals of receivables management, from invoicing best practices to handling long payment cycles that can tie up capital for weeks. Key benefits include accelerated accounts receivable turnover, which research shows can improve by up to 30% through automated reminders and credit checks. Operational tips emphasized timely follow-ups and integrating AP/AR processes to enhance overall financial process enhancement. For those navigating AR strategy refinement, common interview questions like “How do you prioritize collections?” or “What metrics track turnover efficiency?” prepare candidates by focusing on best practices such as setting clear terms and using dashboards for oversight.

Transcounts stands out with bundled AP/AR services and KPI dashboards tailored for Vancouver’s diverse districts, from Downtown to East Van. Our local expertise delivers quick wins, like reducing days sales outstanding by 20% for e-commerce clients. A Vancouver-based tech startup shared, “Transcounts transformed our chaotic invoicing into predictable revenue streams, freeing us to scale without financial headaches.” See real-world outcomes in this accounting case study Boxhub.

Ready to optimize your AR operations? Contact Transcounts today for a free consultation at info@transcounts.com or visit transcounts.com to schedule. Partner with us for scalable solutions that drive your business forward in Vancouver’s competitive landscape.

Resources

Accounts Receivable Management VancouverAccounts Payable Outsourcing VancouverBill Pay Services for Small Business Vancouver