Table of Contents

Reliable Bookkeeping Solutions in Surrey, British Columbia

Surrey’s thriving economy, blending retail, tech, and service industries, has fueled a surge in demand for Bookkeeping Services in Surrey, British Columbia. Local startups and SMEs, particularly in e-commerce and technology, face mounting pressures to maintain accurate financial records amid rapid growth. Professional services offer a lifeline, providing expertise that ensures compliance and supports scalable expansion for busy owners.

Outsourcing small business bookkeeping surrey saves valuable time and minimizes errors–studies from Canadian financial resources indicate that self-managed books often contain up to 30% inaccuracies, leading to costly corrections. With online bookkeeping services surrey bc, owners gains access to specialized knowledge in local taxes like GST/HST (Goods and Services Tax/Harmonized Sales Tax) and provincial sales taxes, allowing focus on core operations while enjoying Monthly Bookkeeping Services Vancouver for reliable monthly support.

Common challenges include navigating complex tax compliance and reconciling high transaction volumes, which can overwhelm in-house efforts. Transcounts addresses these with a fixed-fee model based on transaction volume or revenue, delivering cloud-based solutions integrated with QuickBooks and Xero. Their end-to-end digital accounting support in the area includes reconciliations, reporting, and responses under 24 hours, empowering financial record-keeping for local firms to drive sustainable growth.

Overview of Bookkeeping Needs in Surrey, British Columbia

Surrey, British Columbia, boasts a vibrant business landscape with over 50,000 small and medium-sized enterprises driving the local economy. The rapid growth in e-commerce and tech startups has heightened the demand for reliable Bookkeeping Services in Surrey, British Columbia, where accurate financial records are essential for navigating provincial regulations and federal tax requirements. Businesses here, from retail shops to online sellers, rely on Bookkeeper Burnaby Small Business models that extend support to nearby areas like Surrey, addressing needs for small business bookkeeping surrey through efficient local financial tracking solutions.

This dynamic environment calls for robust bookkeeping practices tailored to high-transaction volumes. For instance, a Surrey-based e-commerce seller must track inventory meticulously to manage stock levels and sales taxes, preventing costly discrepancies that could impact cash flow.

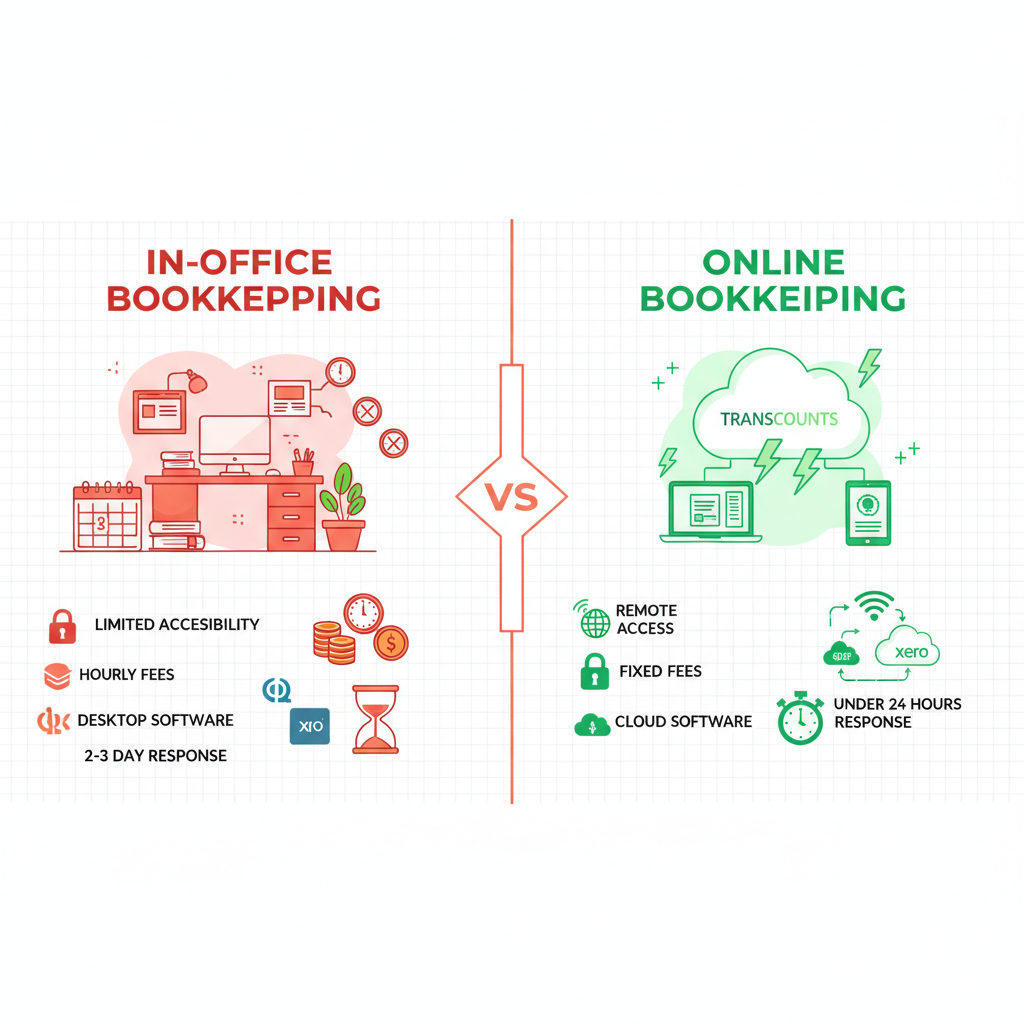

The following table compares key aspects of traditional in-office local firms versus modern online services, aiding Surrey businesses in weighing their options:

| Aspect | In-Office Local Firms | Online Services (e.g., Transcounts) |

|---|---|---|

| Accessibility | Requires physical visits to Surrey offices; limited hours. | 24/7 online portal access; work from anywhere in BC. |

| Cost Structure | Hourly or project-based fees; potential travel costs. | Fixed monthly fees based on transaction volume; no extras. |

| Technology Integration | Basic software; manual processes common. | Advanced cloud tools like QuickBooks integration; full automation. |

| Response Time | Standard business hours; may exceed 24 hours for queries. | Under 24 hours via dedicated support; instant self-service. |

In Surrey’s hybrid business scene, where many SMEs blend physical and digital operations, online options like online bookkeeping services surrey bc offer superior efficiency and scalability. Local firms provide personalized face-to-face interactions, ideal for complex audits, but often at higher costs and with slower turnaround. Online platforms emphasize cloud-based accounting in the region, reducing overhead while ensuring real-time data access, which aligns well with the area’s growth in remote-friendly enterprises.

Regular reconciliations stand out as a cornerstone for financial accuracy in Surrey businesses. By comparing bank statements against internal records monthly, companies can catch errors early, such as duplicate payments or unrecorded transactions, reducing discrepancies by up to 30% according to local service providers like Inline Accounting. This practice not only safeguards against CRA penalties but also supports informed decision-making, especially for inventory-heavy retail sectors.

Popular accounting software in Surrey includes QuickBooks and Xero, favored for their user-friendly interfaces and integration with e-commerce platforms. These tools automate reconciliations and generate compliance-ready reports, streamlining small business bookkeeping surrey without the need for extensive manual input.

Bookkeeping options comparison: in-office vs online services in Surrey, BC

Adopting these technologies helps Surrey firms stay compliant and agile, paving the way for exploring specialized service availability in the region.

Available Bookkeeping Services for Surrey Businesses

Businesses in Surrey, British Columbia, can access a wide array of Bookkeeping Services in Surrey, British Columbia, tailored to support growth and compliance. These offerings provide end-to-end financial management, from daily transactions to strategic reporting, helping local entrepreneurs streamline operations amid the area’s vibrant economy.

Core bookkeeping services vancouver extend to essential tasks that keep finances organized. Key components include:

- Bank reconciliations to match records with statements accurately.

- Bill payments processed efficiently through automated systems.

- Inventory reporting for tracking stock levels, vital for retail and e-commerce firms.

Payroll automation handles direct deposits, remittances, and employee onboarding, ensuring timely compliance. For a tech startup in Surrey, this means seamless integration with daily workflows. Tax support covers GST/HST filings and provincial sales taxes, drawing from standard practices like those outlined by local providers to maintain audit-ready books.

Integrations with platforms such as QuickBooks Online and Xero enable real-time tracking of expenses and revenues. These tools automate data entry, reducing errors and providing dashboards for cash flow insights. For small business bookkeeping surrey, this connectivity supports e-commerce sellers via A2X for sales tax reconciliation, aligning with Canadian and US nexus requirements.

Online bookkeeping services surrey bc offer remote access from anywhere, enhancing flexibility for busy owners. Automation cuts manual work, speeding up month-end closes and delivering cost savings through scalable solutions. Comprehensive financial services locally like these empower teams with secure, cloud-based remote accounting solutions.

Fixed monthly fees, based on transaction volume, start affordably and scale with needs, offering predictability without hidden costs.

Key Local Factors for Bookkeeping in Surrey

Bookkeeping Services in Surrey, British Columbia, must navigate unique local challenges like regulatory compliance and workforce mobility. For small business bookkeeping surrey owners, physical offices are unnecessary with modern online bookkeeping services surrey bc, allowing secure access from anywhere. A Surrey contractor, for instance, can handle finances remotely without unnecessary site visits, saving time and overhead.

Transcounts exemplifies this with its fully virtual model, eliminating the need for in-person meetings while ensuring area-specific financial compliance. Outsourcing bookkeeping here offers significant benefits, including up to 40% cost savings and 30% efficiency gains for BC businesses, as noted in industry analyses on outsourcing advantages.

Tax handling remains a key focus for small enterprises in the region. Providers should support GST/HST filings, provincial sales taxes, and nexus issues for cross-border sales. For e-commerce operations, an ecommerce bookkeeper surrey bc specializes in automated reconciliations to meet local compliance without hassle. This reassures businesses worried about audits or penalties.

Selecting reliable providers involves clear criteria: look for CPA certifications, response times under 24 hours, and proven experience with digital support for local enterprises. Costs vary by business size, from $300 monthly for startups to $1,000 for mid-sized firms, often including reconciliation services. To tip the scales, prioritize fixed-fee models like Transcounts for predictable budgeting and seamless integration with tools like QuickBooks, ensuring your Surrey operations stay compliant and efficient.

Steps to Begin Bookkeeping Services in Surrey

Starting Bookkeeping Services in Surrey, British Columbia, is a straightforward path to gaining control over your finances. For small businesses in the area, beginning with professional support can prevent costly errors and foster growth. Whether you’re a startup or established operation, these steps ensure a smooth transition to reliable small business bookkeeping surrey.

- Request Quotes: Contact providers to get tailored estimates based on your monthly revenue or transaction volume. Many offer fixed fees starting as low as $200 for basic needs, ideal for new ventures exploring online bookkeeping services surrey bc.

- Evaluate Providers: Look for experts in QuickBooks or Xero with strong reviews and local knowledge. Prioritize those offering remote services compatible with Surrey’s diverse business landscape, ensuring starting financial management locally aligns with your operations.

- Complete Onboarding: Set up virtually by uploading documents and linking bank accounts. Providers like Transcounts guide you through a structured 30-day integration, including initial reconciliation for catch-up work–at discounted rates to accelerate clarity. For e-commerce, see the boxhub case study bookkeeping for efficient setup examples.

- Monitor Initial Setup: Review the first month’s reconciliation to confirm accuracy in your initial accounting setup in the area.

Quick Checklist:

- Gather financial docs

- Compare 2-3 quotes

- Schedule virtual onboarding

- Track first report

Take action today–structured support brings quick financial peace for Surrey businesses (178 words).

Step-by-step process for initiating bookkeeping services in Surrey

Final Insights on Bookkeeping in Surrey, British Columbia

Bookkeeping Services in Surrey, British Columbia, thrive on efficient, tech-savvy solutions that empower local enterprises. For small business bookkeeping surrey, regular reconciliations and seamless software integrations ensure compliance and clarity, as highlighted by Green Quarter’s outsourcing advantages. Online bookkeeping services surrey bc deliver virtual bookkeeping benefits through fixed-fee models and quick onboarding, like Transcounts’ strategic support for the region’s dynamic market.

Embrace these essential local financial strategies to fuel growth–connect with reliable providers today for streamlined accounting for the region.