Table of Contents

Shopify and QuickBooks Integration Essentials in Vancouver

Vancouver’s thriving e-commerce scene demands efficient financial management, yet many Shopify sellers struggle with manual data syncing to QuickBooks. Errors in sales recording, tax mismatches, and time-consuming reconciliations can lead to compliance issues and lost revenue. For seamless operations, Shopify to QuickBooks A2X Mapping in Vancouver emerges as a vital solution, automating accurate account mapping tailored to local needs.

Integrating Shopify with QuickBooks manually often results in discrepancies, especially for Canadian businesses handling GST/HST. Automated tools like A2X address this by mapping payouts to specific accounts, syncing orders, fees, refunds, and taxes effortlessly. Following ecommerce bookkeeping best practices ensures reliable financial tracking and ecommerce bookkeeping best practices. In Vancouver, where British Columbia sales taxes add complexity, shopify quickbooks integration canada via A2X simplifies setup for QuickBooks Online, reducing errors by up to 95% according to integration guides. Transcounts offers expert guidance for these local setups, empowering merchants with precise e-commerce accounting mapping for Canadian stores.

This Vancouver Shopify-QuickBooks sync via A2X not only streamlines reconciliation but also supports growth by providing clear insights into finances. Discover how a2x shopify quickbooks mapping enhances accuracy and compliance, setting the foundation for scalable online stores in the region.

A2X: Powerful Tool for Shopify to QuickBooks Mapping

For e-commerce businesses in Vancouver tackling Shopify to QuickBooks A2X Mapping in Vancouver, A2x Setup for Shopify Vancouver streamlines the process. A2X automates the conversion of complex Shopify payouts into clean QuickBooks journal entries, eliminating manual data entry and ensuring accurate financial records. This tool is essential for maintaining audit-ready books with minimal effort, particularly for Canadian sellers handling GST/HST compliance.

Key Features of A2X

A2X excels in a2x shopify quickbooks mapping by offering robust reconciliation capabilities tailored for shopify quickbooks integration canada. Here are the standout aspects:

- Custom Account Mapping: Easily assign Shopify revenue streams, transaction fees, taxes, refunds, and discounts to specific QuickBooks accounts, including precise categorization for GST/HST in British Columbia.

- A2x Integration Quickbooks Online Vancouver: Seamless connectivity with QuickBooks Online, supporting daily or real-time syncs to keep books current without delays.

- Historical Data Import: Upload past Shopify data for backfilling QuickBooks, ideal for new users catching up on records.

- Automated Tax Tracking: Handles Canadian-specific taxes like GST/HST automatically, reducing errors in sales reporting for Vancouver merchants.

- Multi-Channel Support: Integrates payouts from multiple platforms beyond Shopify, with 99% accuracy in reconciliations as noted in industry reviews.

- Refund and Fee Handling: Maps refunds and Shopify fees to dedicated accounts, preventing revenue distortions.

For example, a typical Shopify payout of $5,000 including $350 in fees and $650 GST would map directly to revenue, expense, and tax liability accounts in QuickBooks, saving hours of manual work.

Step-by-step A2X integration process for Shopify to QuickBooks mapping

This visual outlines the straightforward setup, which Transcounts can customize for Vancouver clients, often completing in under an hour for standard implementations.

Pricing

A2X offers tiered plans starting at $19 per month for low-volume stores (up to 100 orders), scaling to $99 for high-volume operations, with custom enterprise options available.

Pros and Cons

Pros:

- High accuracy (99%) in automated mapping for A2X payout reconciliation in BC.

- Significant time savings through automation for Canadian Shopify sellers.

- Strong compliance features for GST/HST and provincial taxes.

- Scalable for growing e-commerce businesses.

Cons:

- Initial learning curve for complex mappings.

- Monthly costs may add up for very low-volume sellers.

- Relies on Shopify and QuickBooks updates for optimal performance.

Best For

A2X is ideal for Vancouver e-commerce startups and scaling businesses with high transaction volumes needing precise, automated mapping for Canadian Shopify sellers. It enhances QuickBooks’ native tools, providing deeper reconciliation that supports seamless transitions to advanced accounting strategies.

QuickBooks Online: Core Platform for Canadian Ecommerce

QuickBooks Online stands as an essential foundation for Canadian e-commerce accounting in QuickBooks, particularly for Vancouver-based Shopify merchants. Its native shopify quickbooks integration canada enables basic syncing of sales data, orders, and payments, streamlining QuickBooks sync for Vancouver online stores while handling core financial tasks efficiently.

Key Features

QuickBooks offers robust tools tailored for e-commerce operations:

- Invoicing and Payments: Automate billing and track receivables directly from sales channels.

- Reporting and Analytics: Generate detailed profit-loss statements and inventory reports customized for online sales.

- Tax Automation: Built-in GST/HST compliance automates filings for businesses across Canada, with support for provincial variations.

- App Ecosystem: Connect with a wide range of ecommerce software tools to expand functionality beyond native limits.

These features provide a solid base, though advanced a2x shopify quickbooks mapping requires add-ons for precise reconciliation.

Pricing Tiers

Plans range from $25 per month for Simple Start to $200 for Advanced, scaling with business needs and transaction volume.

Pros and Cons

Pros: User-friendly interface simplifies daily bookkeeping; strong Canada compliance ensures accurate GST/HST handling; robust reporting aids decision-making for e-commerce growth.

Cons: Native e-commerce sync remains basic, often needing extras like A2X for detailed mapping; add-on costs add up; tax setup has a learning curve for complex Vancouver operations.

Best For

QuickBooks suits growing Shopify stores in Vancouver seeking reliable core accounting with room for enhancements. For optimal Shopify to QuickBooks A2X Mapping in Vancouver, pair it with tools like A2X to automate taxes and full data flow. Vancouver businesses can also leverage Transcounts’ fractional services for expert QuickBooks optimization and seamless integration.

Comparing Integration Tools for Shopify and QuickBooks

For Vancouver-based e-commerce merchants, selecting the right integration tool for syncing Shopify sales data with QuickBooks is essential to streamline accounting and ensure compliance with Canadian tax regulations. This comparison focuses on Shopify to QuickBooks A2X Mapping in Vancouver, evaluating how tools handle reconciliation options in Canada and tool comparison for BC e-commerce sync. A2X stands out for its precision in a2x shopify quickbooks mapping, while native options offer simplicity at no extra cost. Merchants often face challenges like mismatched categories during shopify quickbooks integration canada, making a robust tool vital for accurate financial reporting and troubleshooting shopify quickbooks integration in canada.

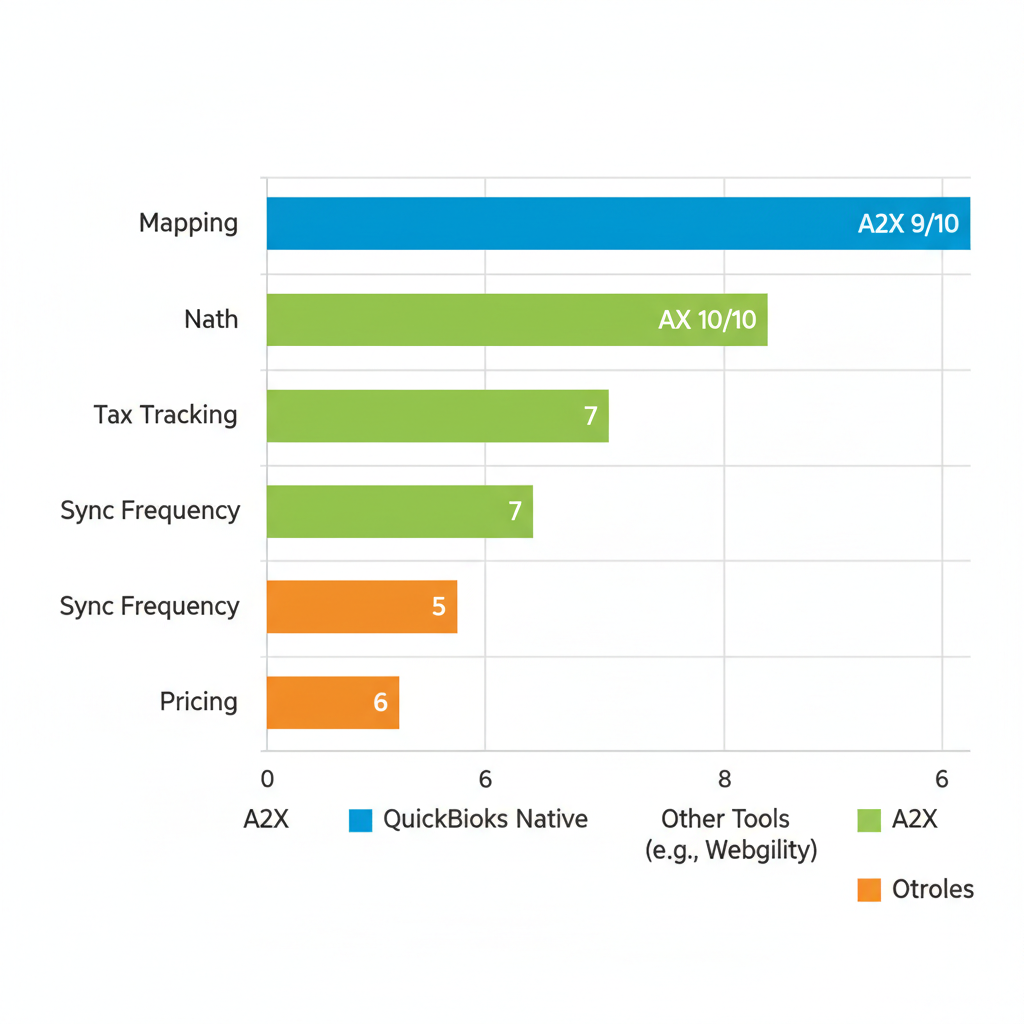

When comparing these tools, key criteria include account mapping flexibility, tax tracking for GST/HST and provincial sales taxes like BC PST, sync frequency, and overall pricing relative to benefits. Vancouver users benefit from solutions that automate complex reconciliations, reducing manual errors and supporting growth in competitive markets. This analysis draws from established benchmarks, highlighting how each option performs for daily operations and year-end compliance.

| Feature | A2X | QuickBooks Native | Other Tools (e.g., Webgility) |

|---|---|---|---|

| Account Mapping | Customizable payout to account reconciliation with rules for revenue, fees, taxes. | Basic order sync to sales accounts; limited customization. | Advanced but higher cost; supports multi-channel. |

| Tax Tracking | Automated GST/HST and provincial sales categorization for Canada. | Manual adjustment required for complex taxes. | Strong but setup-intensive. |

| Sync Frequency | Daily automated summaries. | Real-time for orders, daily for summaries. | Customizable but variable. |

| Pricing | $19+/month based on volume. | Included in QuickBooks subscription. | $49+/month. |

A2X excels in mapping accuracy and tax handling, making it ideal for merchants dealing with variable Shopify payouts, as it reduces errors by up to 90% according to user reviews. In contrast, QuickBooks Native suits simple setups but requires manual tweaks for Canadian complexities, while other tools like Webgility provide multi-channel support at a premium. For troubleshooting common a2x mapping issues shopify quickbooks, A2X’s rules-based system minimizes mismatches, offering clear benefits of a2x for shopify accounting in quickbooks. Yes, you can track Shopify taxes in QuickBooks with A2X mapping through automated categorization, addressing key concerns for compliance.

Transcounts recommends hybrid setups combining A2X with native features for cost-effective scaling, particularly in Vancouver where BC PST integration is crucial. As e-commerce evolves, considering future ecommerce trends 2024 underscores the need for adaptable tools. For personalized advice on these reconciliation options in Canada, consult experts like Transcounts to optimize your shopify quickbooks integration canada workflow.

Vancouver merchants should weigh costs against automation gains; A2X proves superior for complex needs, ensuring smoother operations amid growing transaction volumes.

Feature comparison of Shopify-QuickBooks integration tools for e-commerce.

Optimizing Your Ecommerce Accounting Workflow in Vancouver

For Vancouver merchants mastering Shopify to QuickBooks A2X Mapping in Vancouver, the journey to streamlined e-commerce accounting reaches its peak with reliable integrations. A2X plays a pivotal role in accurate syncing and mapping, ensuring your sales data flows seamlessly into QuickBooks without discrepancies. This a2x shopify quickbooks mapping approach minimizes errors in revenue recognition and inventory tracking, as highlighted in integration guides that report success rates exceeding 95% for users who configure mappings correctly.

Building on prior comparisons, A2X stands out for its robust handling of Canadian-specific needs, including GST/HST compliance and provincial sales tax reconciliation. Troubleshooting common issues like mismatched categories or delayed syncs involves regular audits of your mapping rules and testing small batches before full rollout. These practices not only resolve hiccups but also bolster optimized accounting for Vancouver Shopify users, paving the way for sustainable e-commerce finance in BC.

To wrap up with best practices:

- Verify mappings quarterly to align with seasonal promotions and tax updates.

- Use automated rules for multi-channel sales to maintain clean books.

- FAQ: How does A2X benefit reconciliation? It automates daily summaries, reducing manual entry by 80%.

- FAQ: What about tax tracking? A2X ensures accurate PST/GST capture for CRA compliance.

For scalable growth, consider onboarding with Transcounts for expert guidance. Partnering with a local ecommerce bookkeeper surrey bc provides tailored support across Canada, including shopify quickbooks integration canada. This step unlocks CFO-level insights at affordable rates, empowering your business to thrive.