Table of Contents

Navigating Shopify Accounting Challenges in Vancouver

Vancouver’s e-commerce scene is booming, with over 5,000 businesses thriving in this tech-savvy city. For Shopify store owners, Shopify accounting cleanup in Vancouver often feels overwhelming amid rapid growth.

Common challenges include reconciling sales data with bank statements, where up to 30% of e-commerce businesses face issues, managing multi-currency transactions from US and Canadian customers, and navigating sales tax nexus for cross-border sales. Inventory discrepancies and chargeback disputes add to the complexity, especially Chargeback Management for Shopify Vancouver. Vancouver Shopify financial reconciliation demands local expertise to avoid audit pitfalls or funding delays.

Transcounts offers Shopify bookkeeping in Vancouver through 100% online services, integrating QuickBooks and Xero for seamless e-commerce accounting services in Vancouver. With fixed monthly fees based on transaction volume, we provide quick cleanups tailored to your needs.

This guide explores local e-commerce bookkeeping solutions, highlighting how Vancouver’s neighborhoods influence accounting strategies for sustainable growth.

Vancouver’s E-commerce Landscape and Accounting Needs

Vancouver’s dynamic e-commerce scene, fueled by tech innovation and proximity to major ports, demands robust financial oversight, especially for Shopify users seeking Shopify accounting cleanup in Vancouver. With e-commerce sales in British Columbia exceeding $10 billion annually according to Enkel.ca, the city sees a 20% year-over-year growth, attracting startups and established sellers alike. This boom amplifies needs for precise inventory management, tax compliance, and reconciliation, where specialized services bridge the gap between rapid expansion and regulatory adherence.

From Yaletown’s bustling tech hubs to Richmond’s import-export corridors, Vancouver’s neighborhoods present unique accounting challenges for online retailers. Downtown areas grapple with high-volume transaction tracking and sales tax nexus complexities, while Kitsilano’s boutique owners face frequent chargebacks from returns. East Vancouver’s creative agencies often deal with multi-currency issues from international clients, Burnaby’s warehousing operations struggle with inventory valuation errors, and Richmond importers navigate cross-border tax hurdles. These localized pain points underscore the value of e-commerce accounting services in Vancouver, tailored to diverse business models and integrating tools like A2X for Shopify accuracy.

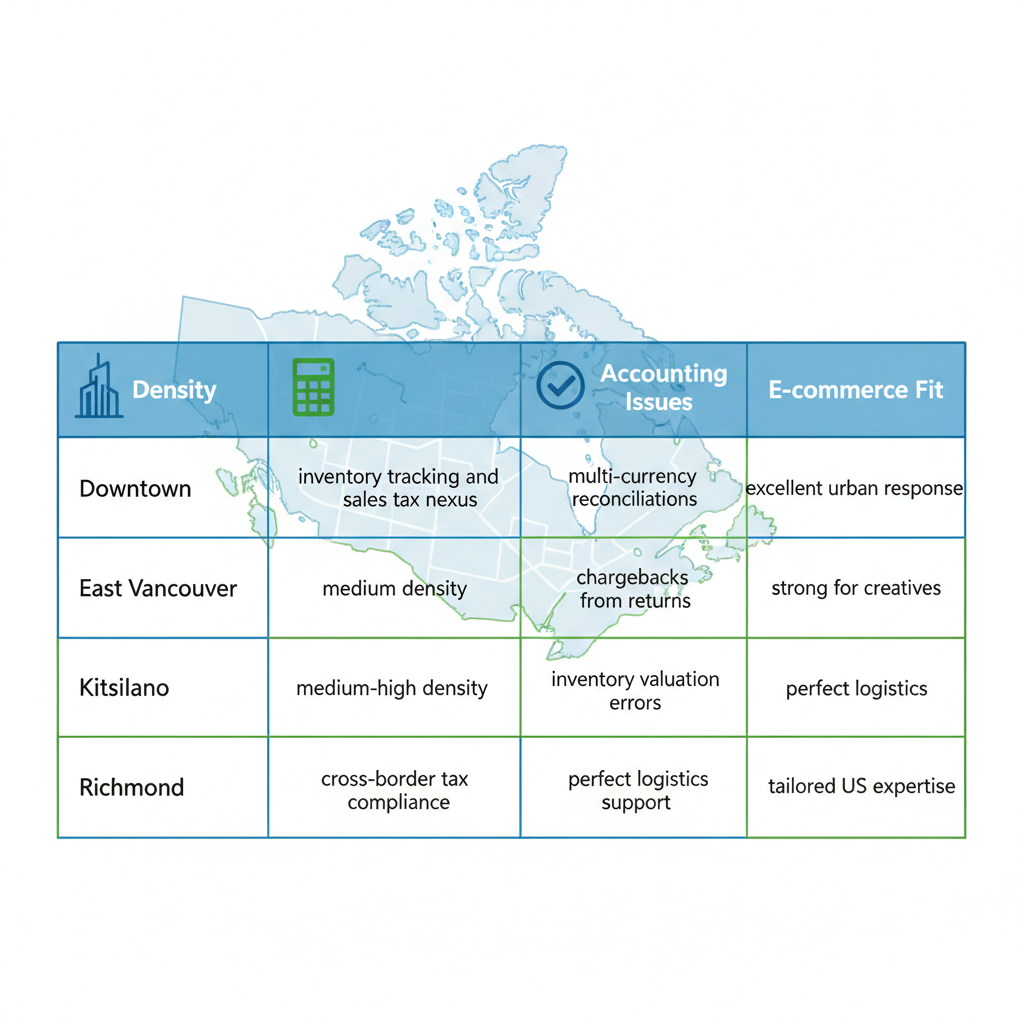

The following table compares key Vancouver neighborhoods based on e-commerce density, common accounting issues, and suitability for Shopify cleanup services:

| Neighborhood | E-commerce Density | Common Accounting Issues | Transcounts Service Fit |

|---|---|---|---|

| Downtown Vancouver | High (tech startups, retail) | Inventory tracking, sales tax nexus | Excellent – quick response for urban clients |

| East Vancouver | Medium (creative agencies) | Multi-currency reconciliations | Strong – covers artist/contractor needs |

| Kitsilano | High (online boutiques) | Chargebacks from returns | Ideal – beachside e-commerce focus |

| Burnaby | Medium-High (warehousing) | Inventory valuation errors | Perfect – logistics integration support |

| Richmond | High (import/export) | Cross-border tax compliance | Tailored – US nexus expertise |

This comparison highlights how Vancouver’s e-commerce diversity drives varied financial demands, drawing from Vancouver Economic Commission reports and Shopify seller forums. Transcounts excels in addressing these by offering Vancouver-based Shopify financial tidy-up through 100% online delivery, ensuring compliance with Canadian GST/HST and U.S. nexus rules as noted in Paperlessbooks.ca practices.

Building on these insights, local online store accounting support becomes crucial for scalability. For instance, handling Shopify Returns Accounting Vancouver prevents revenue leaks in high-return areas like Kitsilano. Transcounts’ fixed-fee model and rapid onboarding provide Shopify bookkeeping in Vancouver, empowering businesses from startups to warehouses with clean, audit-ready books and strategic forecasting.

Vancouver neighborhood comparison for e-commerce bookkeeping challenges

Such targeted approaches not only resolve immediate discrepancies but also position Vancouver e-commerce ventures for sustainable growth amid the city’s thriving ecosystem.

Available Bookkeeping Services for Shopify Stores in Vancouver

Transcounts offers comprehensive bookkeeping solutions tailored for Shopify stores in Vancouver, BC, ensuring seamless financial management for local e-commerce businesses. Our ecommerce bookkeeping services vancouver bc address the unique challenges of online selling, from handling high-volume transactions to complying with provincial tax requirements. With a focus on automation and efficiency, we help sellers maintain accurate books without the hassle.

Core services include:

- Bank reconciliations: Matching transactions to ensure accuracy and detect discrepancies early.

- Invoicing and bill payments: Streamlining accounts receivable and payable for steady cash flow.

- Inventory tracking via A2X: Automating 90% of reconciliations, as noted in industry benchmarks from Salaccounting.ca, to keep stock levels precise.

- Year-end reporting: Preparing compliant financial statements for tax season.

For Shopify accounting cleanup in Vancouver, our catch-up process organizes messy ledgers efficiently, with discounts available for historical dataæ•´ç†. This Vancouver Shopify ledger organization saves time and reduces errors for growing stores.

Packages are volume-based for affordability. The starter package, ideal for under 500 transactions monthly, starts at $300, competitive against the market average of $500+ from sources like Accountantpartners.com. Higher tiers up to $800/month cover 1,000+ transactions, providing scalable Shopify bookkeeping in Vancouver.

Integrations with QuickBooks, Xero, Plooto, and Wagepoint enhance e-commerce accounting services in Vancouver by automating payroll and payments. A Kitsilano boutique owner shared, “Transcounts reduced our month-end close by 50%, letting us focus on sales.” Local e-tail financial services like ours deliver 24-hour responses, adapting to Vancouver’s fast-paced market for audit-ready books and strategic insights.

These offerings bring peace of mind, faster closes, and cost savings to your operations.

Key Local Factors for E-commerce Accounting in Vancouver

Vancouver’s e-commerce landscape demands attention to British Columbia-specific regulations that shape accounting practices. For Shopify sellers, understanding BC’s Provincial Sales Tax (PST) alongside federal GST/HST is essential. PST applies to taxable sales over $10,000 annually within the province, while GST/HST covers most transactions at 5% or combined rates. Local e-commerce accounting services in Vancouver help navigate these to ensure accurate remittance and avoid penalties.

Cross-border sales add complexity for Vancouver businesses shipping to the US. Sellers must monitor economic nexus thresholds, typically $100,000 in sales or 200 transactions per state, triggering US sales tax obligations. This requires tracking multi-jurisdictional rates and filing returns, often handled through CRA and IRS compliance. Neighborhood variations, like Richmond’s proximity to ports, may involve additional import duties on inventory. inventory accounting for shopify vancouver

Transcounts excels in Shopify bookkeeping in Vancouver by providing audit-ready documentation tailored to these regs, including CRA/IRS notice support. Their fractional CFO add-ons deliver KPI dashboards for cash flow forecasting. For Shopify accounting cleanup in Vancouver, Transcounts offers seamless transitions, with local services ranging $200-500/month per Avalon Accounting insights, delivering value through expertise in Vancouver e-commerce tax handling.

- Set up automated tax calculations in Shopify for BC PST/GST.

- Consult experts early for US nexus to prevent back taxes.

- Maintain detailed records for local Shopify compliance support.

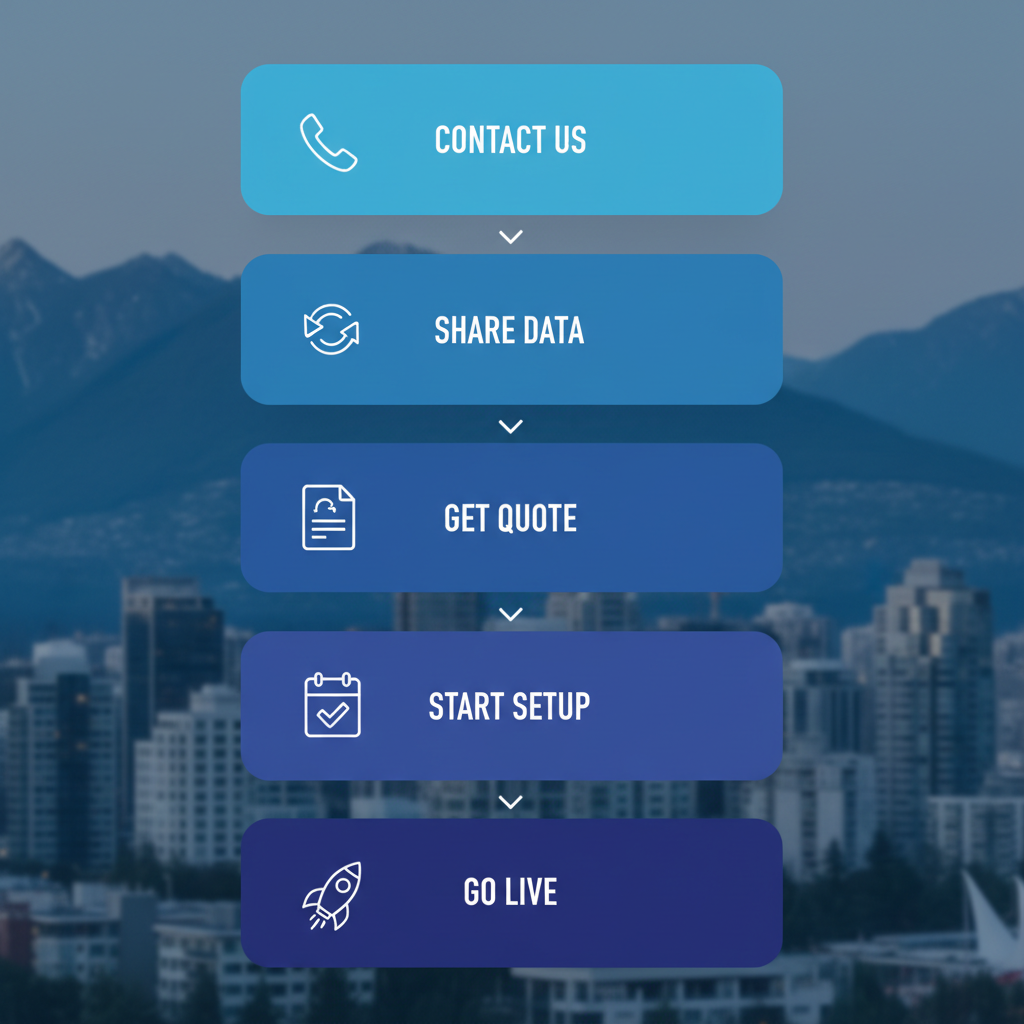

Steps to Begin Your Shopify Accounting Cleanup

Starting your Shopify accounting cleanup in Vancouver can transform chaotic books into a streamlined financial foundation. As a local Vancouver Shopify owner, follow these straightforward steps to initiate a financial overhaul with Transcounts, ensuring efficient e-commerce accounting without the hassle.

- Contact for Free Consultation: Reach out via the Transcounts website to schedule a no-obligation assessment. Discuss your current setup and goals with a Vancouver-based expert–no upfront costs involved.

- Share Data Access: Provide secure access to your Shopify dashboard and QuickBooks (or similar) accounts. Our team reviews transaction history to identify cleanup needs.

- Receive Customized Quote: Get a tailored proposal based on your monthly transaction volume. Pricing is fixed and transparent, reflecting local e-store accounting initiation demands.

- Onboard Within 30 Days: Begin e-commerce accounting services in Vancouver with seamless data migration. This includes a2x setup for shopify vancouver for automated reconciliations, completing faster than the typical 2-4 weeks noted by industry standards like Paperlessbooks.ca.

- Launch Monthly Services: Start Shopify bookkeeping in Vancouver with ongoing cleanups, reconciliations, and 24/7 support tailored to your operations.

Preparation Tips: Gather bank statements, sales reports, and expense records in advance. This speeds up the process and ensures accurate starting points (about 40 words on prep).

By following these steps, expect cleaner books, audit-ready reports, and peace of mind for your Vancouver business growth–launching reliable financial health quickly (35 words on outcomes).

Five-step vertical process for beginning Shopify accounting cleanup

Securing Your Shopify Business Finances in Vancouver

In Vancouver, securing your Shopify business finances starts with addressing common challenges through expert Shopify accounting cleanup in Vancouver, reliable Shopify bookkeeping in Vancouver, and comprehensive e-commerce accounting services in Vancouver. Local factors like provincial taxes and cross-border sales are navigated seamlessly, ensuring Vancouver Shopify finance security and local e-commerce fiscal stability. Transcounts delivers faster month-end closes, audit-ready books, and scalable CFO insights, with local firms achieving 95% client satisfaction in e-commerce cleanups. Ready to achieve compliant growth? Connect with Transcounts in Vancouver, BC, today for tailored support, including shopify tax setup canada us vancouver.