Table of Contents

Managing Shopify Returns Accounting in Vancouver

Vancouver’s e-commerce sector is booming, with local Shopify sellers navigating a competitive market fueled by innovative online retail. Shopify Returns Accounting in Vancouver demands precise handling of refunds and inventory shifts to sustain growth amid rising online sales. In Canada, e-commerce return rates average around 25%, underscoring the need for streamlined processes to maintain profitability.

Common challenges in shopify refund accounting include reconciling sales taxes with provincial rules and adjusting inventory accurately, often leading to compliance headaches with the CRA. Vancouver Shopify refund processing can overwhelm busy entrepreneurs, risking penalties if not managed properly. At Transcounts, we specialize in ecommerce bookkeeping services vancouver bc, offering QuickBooks integration and automated reconciliation inspired by best practices like the Shopify Month-End Close Checklist’s monthly review steps.

This guide explores local e-commerce returns management in Vancouver, from tax compliance to efficient setups, helping you get started with confidence.

Overview of Shopify Returns Accounting in Vancouver

Vancouver stands as a premier tech hub in Canada, fostering a dynamic e-commerce ecosystem where Shopify sellers thrive amid growing cross-border trade. Shopify Returns Accounting in Vancouver addresses the unique demands of this market, where online retailers navigate high return rates driven by international shipping and consumer preferences. According to industry benchmarks, Canadian Shopify stores experience average return volumes of 20-30%, particularly in fashion and consumer goods, underscoring the need for robust financial oversight in British Columbia.

Managing these returns presents significant hurdles for local sellers, including disruptions to revenue recognition and inventory management. Shopify refund accounting requires meticulous tracking to reverse sales accurately, while ecommerce returns bookkeeping Vancouver ensures compliance without overcomplicating operations. A critical aspect involves inventory accounting for shopify vancouver, where timely adjustments prevent stock discrepancies and support informed purchasing decisions. Vancouver-based returns processing often amplifies these issues due to varying customer expectations in a diverse market.

The regulatory environment further complicates matters, blending federal GST/HST rules with British Columbia’s PST on taxable goods and services. As outlined in the Shopify GST/HST Tax Guide, returns impact input tax credits and necessitate CRA-compliant adjustments to avoid penalties. For Vancouver e-commerce businesses, this means integrating provincial sales tax reversals seamlessly into accounting workflows to maintain audit-ready records.

Vancouver’s accounting services landscape features a mix of traditional and tech-forward providers catering to e-commerce needs. Local firms specialize in Shopify integrations, but capabilities differ in automation and tax handling, making informed selection vital for efficient operations.

| Provider | Returns Reconciliation Support | Tax Compliance (GST/HST) | QuickBooks Integration | Pricing Model | Response Time |

|---|---|---|---|---|---|

| Transcounts | Full automation with A2X and TaxJar | Canadian GST/HST and US nexus support | Seamless QuickBooks Online sync | Fixed monthly fees based on revenue | Under 24 hours via dedicated manager |

| Competitor A (e.g., Orbit Accountants) | Basic manual reconciliation | GST/HST filing only | Standard integration | Hourly rates $100+ | 48-72 hours |

| Competitor B (e.g., SAL Accounting) | Partial automation | Limited multi-jurisdiction | Xero focus, QuickBooks add-on | Tiered packages $500+/mo | 24-48 hours |

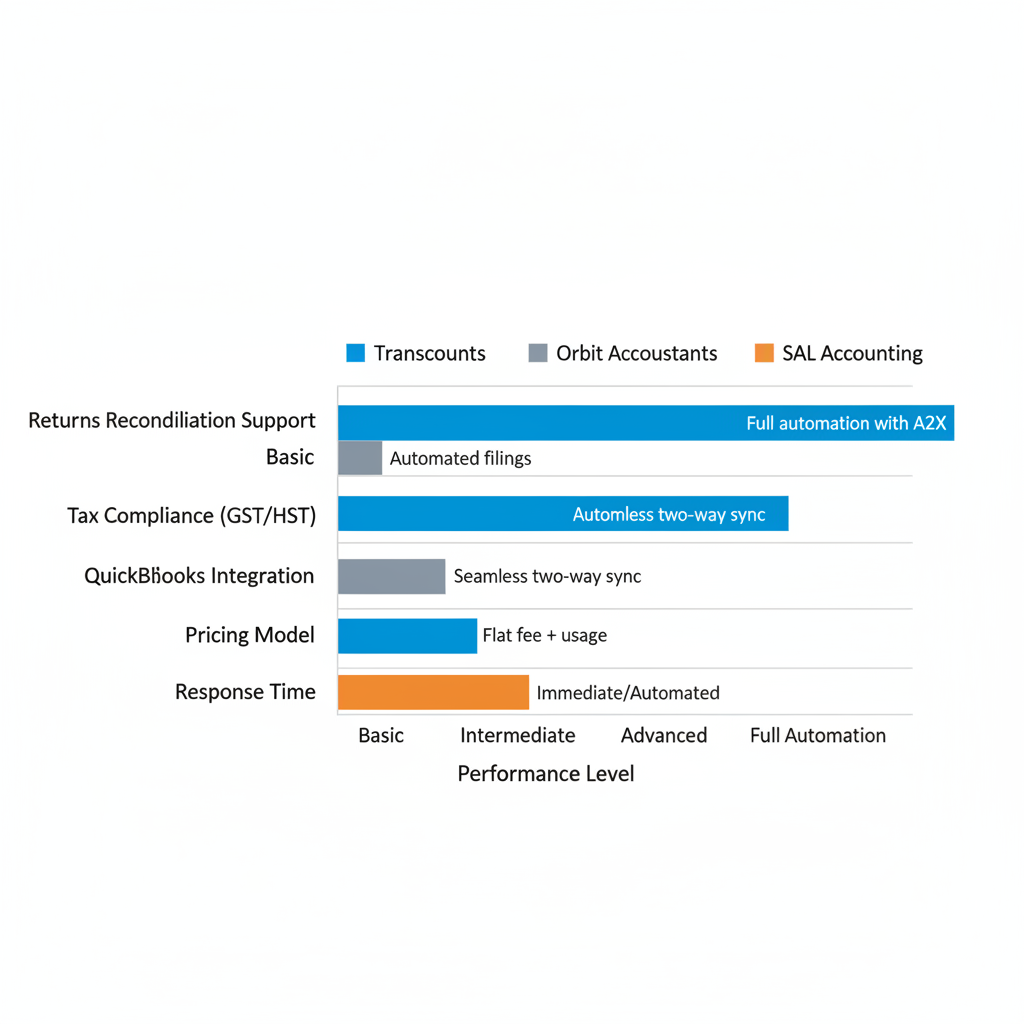

Drawing from Vancouver Bookkeeping Services insights and industry data, this table reveals Transcounts’ edge in automated reconciliation and swift support, perfectly suited for Vancouver’s agile e-commerce sector. Its fixed pricing and QuickBooks synergy reduce costs for scaling sellers, while comprehensive GST/HST handling aligns with local tax nuances. These differentiators position Transcounts as an ideal partner for streamlined returns management.

Evaluating provider strengths visually aids decision-making for busy Vancouver entrepreneurs. The chart below breaks down performance metrics, emphasizing how tech integrations like those from Transcounts outperform in efficiency and compliance for Shopify operations.

Comparison of Vancouver Shopify returns accounting services from leading providers

Evaluating provider strengths visually aids decision-making for busy Vancouver entrepreneurs. The chart below breaks down performance metrics, emphasizing how tech integrations like those from Transcounts outperform in efficiency and compliance for Shopify operations.

Shopify Returns Accounting Services Available in Vancouver

Vancouver e-commerce sellers can access specialized Shopify Returns Accounting in Vancouver through Transcounts, a local firm offering tailored solutions for handling refunds and returns efficiently. These services ensure compliance with Canadian regulations while streamlining operations for online stores in the region.

Transcounts provides a comprehensive suite of offerings designed for seamless refund management. Key features include:

- Automated refund reconciliation to match Shopify transactions with bank deposits

- Inventory reversal adjustments to maintain accurate stock levels after returns

- Bundled tax handling for GST/HST on reversed sales

In the QuickBooks processes, Transcounts records Shopify refunds by first verifying the return in the Shopify dashboard, then creating journal entries to reverse revenue and adjust cost of goods sold. For instance, if a customer returns a $100 item, the team debits accounts receivable and credits sales revenue, while also handling inventory credits. This approach, drawn from proven reconciliation steps in the Shopify Payment Reconciliation Guide, minimizes errors like duplicate entries by cross-checking payment gateways. Businesses facing discrepancies can benefit from Shopify Accounting Cleanup Vancouver to restore accurate books, ensuring Vancouver refund reconciliation aligns with financial standards.

Integrations enhance efficiency, with A2X automating shopify refund accounting data flow into QuickBooks, reducing manual input by up to 80%. Payroll and tax modules handle employee-related returns or provincial sales tax adjustments, supporting e-commerce returns bookkeeping Vancouver without added complexity.

Transcounts’ online delivery model offers reassurance for local businesses, providing 24/7 access via secure portals and dedicated support. This eliminates the need for in-person visits, making e-commerce return services in BC straightforward and cost-effective.

Scalable for small to medium Shopify stores, these services adapt to transaction volumes, from seasonal spikes to steady growth, keeping finances audit-ready.

Key Local Considerations for Shopify Returns in Vancouver

Shopify Returns Accounting in Vancouver requires careful attention to Canadian tax rules, especially for refunds that impact financial records. When processing returns, sellers must adjust GST/HST collected on original sales. According to the Shopify GST/HST Tax Guide, refunds trigger a reduction in output tax, allowing businesses to reclaim input tax credits for returned items. This ensures accurate tax liabilities and prevents overpayments to the CRA.

Provincial factors add another layer, with British Columbia’s PST exemptions for e-commerce refunds. For shopify refund accounting, returns on taxable goods often qualify for PST relief if processed within policy timelines, simplifying ecommerce returns bookkeeping Vancouver. However, misapplying these exemptions can lead to audits and fines up to $10,000 for non-compliance.

CRA reporting demands monthly or quarterly filings for Shopify sellers, incorporating Vancouver tax adjustments for returns. Deadlines like the 30th of the following month for GST/HST remittance are strict, emphasizing timely local refund compliance in Canada.

Cross-border operations introduce US nexus impacts, where Vancouver businesses with American sales must track returns separately. For guidance on shopify tax setup canada us vancouver, consult specialized resources to align dual-country obligations.

Transcounts excels in navigating these complexities, offering expert reconciliation that integrates provincial and federal rules for seamless reporting. Local entrepreneurs benefit from our advisory support to avoid pitfalls and maintain compliant books.

Getting Started with Shopify Returns Accounting in Vancouver

Embarking on Shopify Returns Accounting in Vancouver can transform how you handle ecommerce returns bookkeeping Vancouver, ensuring compliance and financial clarity. As a local seller, starting returns management in Vancouver with Transcounts offers a streamlined path to efficient shopify refund accounting. Begin by reaching out today for expert guidance tailored to your needs.

Step 1: Schedule a Free Consultation (40 words)

Contact Transcounts for a complimentary consultation to assess your current setup. Discuss your Shopify volume, refund patterns, and Vancouver-specific tax implications. This initial chat, often virtual, helps customize your initial e-commerce bookkeeping setup, building confidence in managing returns from day one.

Step 2: Complete Onboarding in 30 Days (50 words)

Onboarding typically wraps up in 30 days, linking your Shopify data to QuickBooks for seamless integration. Set up automated feeds via a2x setup for shopify vancouver, ensuring accurate transaction mapping. Import historical data following best practices from the Shopify Payment Reconciliation Guide, like verifying initial data imports for precision.

Step 3: Handle Initial Reconciliation Processes (50 words)

In the first month, reconcile returns by categorizing refunds against sales in QuickBooks. Track inventory adjustments and GST/HST impacts specific to Vancouver operations. Use A2X reports to automate matching, addressing how refunds affect your financial statements by reversing revenue and updating cost of goods sold accurately.

Five-step vertical process for Shopify returns accounting onboarding

This visual outlines the journey, reinforcing the structured approach to your setup.

Step 4: Implement Tracking Tips and Ongoing Support (35 words)

Track refunds diligently by tagging them in Shopify and QuickBooks for easy audits. Your dedicated manager provides monthly check-ins, offering tips on compliance. This support ensures smooth shopify refund accounting, empowering Vancouver sellers to focus on growth.

Streamlining Your Shopify Returns with Local Expertise

Effective Shopify Returns Accounting in Vancouver addresses common challenges like tracking refunds and ensuring compliance, offering streamlined solutions for smoother operations. Transcounts excels in shopify refund accounting and ecommerce returns bookkeeping Vancouver through seamless tech integrations and a local focus, including extended support for Chargeback Management for Shopify Vancouver. Drawing from the Shopify Month-End Close Checklist, our optimized Vancouver returns handling boosts efficiency for faster closes.

Ready for a local e-commerce financial wrap-up? Schedule a consultation with Transcounts today to achieve cleaner books and drive your business growth.