Table of Contents

Understanding Sales Tax Nexus for Amazon Sellers in Vancouver

Imagine running a thriving online store from Vancouver, only to receive an unexpected notice from US authorities demanding back taxes. This scenario is all too common for Amazon sellers navigating sales tax nexus rules. With over 45 states now enforcing economic nexus thresholds under $100,000 in sales, the stakes are high for cross-border e-commerce. Seeking sales tax nexus help for Amazon sellers in Vancouver can prevent costly surprises and support sustainable growth. For tailored guidance, consider tax services canada us.

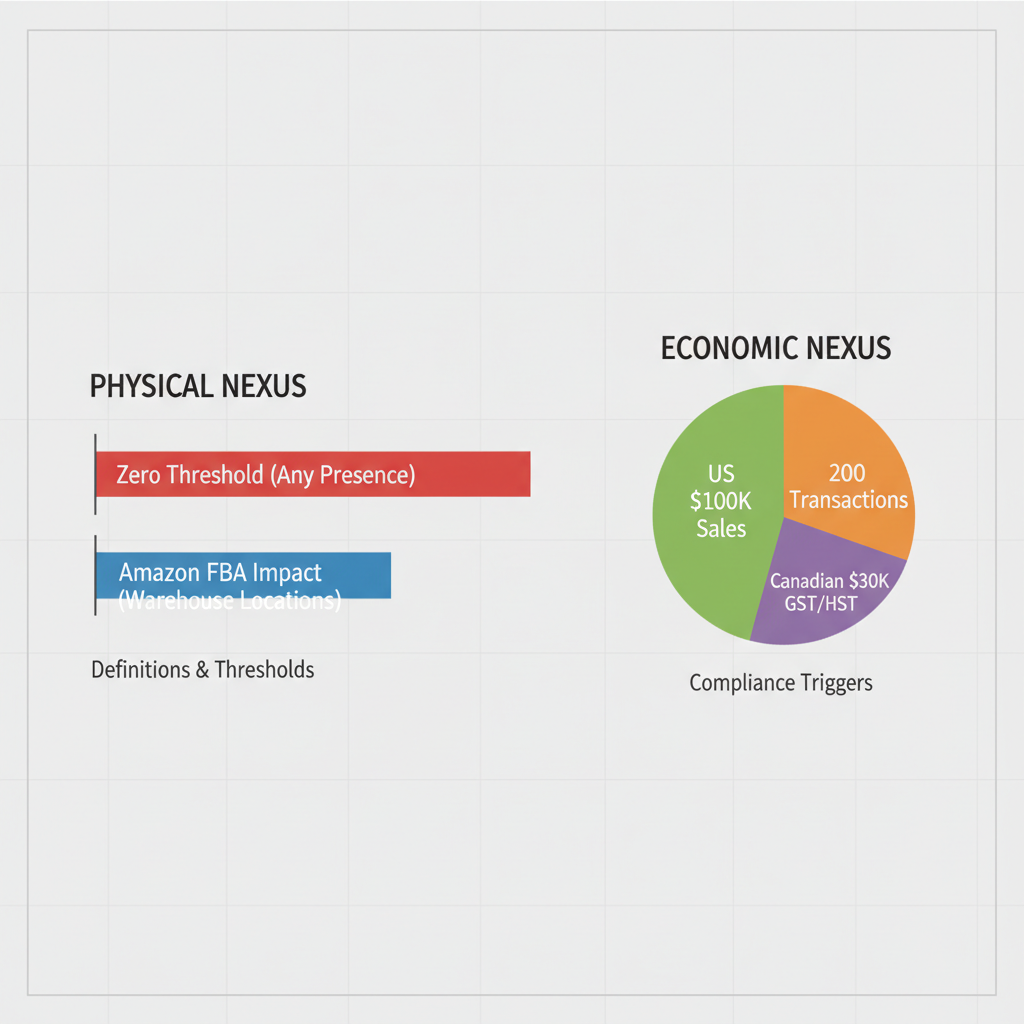

Sales tax nexus establishes a connection between a seller and a jurisdiction, obligating them to collect and remit taxes on sales there. For Vancouver-based Amazon sellers, this often arises through physical presence, like storing inventory in Amazon FBA warehouses across the US, or economic thresholds based on sales volume. Amazon FBA’s role in creating nexus is significant, as even minimal stock in a state can trigger obligations. Meanwhile, Canadian GST/HST rules add layers, making amazon sales tax nexus canada a unique challenge. Cross-border sales tax obligations for Vancouver Amazon sellers require careful e-commerce nexus management in British Columbia to avoid penalties that could reach thousands of dollars.

Key terms to know:

- Physical nexus: Triggered by tangible presence, such as FBA inventory.

- Economic nexus: Based on sales exceeding state limits, impacting us sales tax compliance amazon canada.

Key takeaway: Proactive nexus tracking empowers you to focus on business, not audits.

This guide breaks down fundamentals, from identifying nexus to registration and filing steps, offering practical tools for compliance. Whether you’re new to us sales tax compliance amazon canada or scaling up, these insights build confidence. Wondering about specific sales thresholds? The next section dives deeper.

Sales Tax Nexus Fundamentals for Vancouver Amazon Sellers

For Amazon sellers in Vancouver navigating cross-border e-commerce, understanding sales tax nexus help for Amazon sellers in Vancouver is essential to avoid unexpected liabilities. Nexus represents your sales footprint in a jurisdiction, determining where you must collect and remit sales taxes. This concept has evolved significantly, especially after the 2018 Wayfair Supreme Court decision, which expanded economic nexus rules and eliminated the need for physical presence in many cases. These changes mean remote sellers, including those in British Columbia, now face broader tax obligations across US states and Canadian provinces.

Physical nexus occurs when a business has a tangible presence, such as inventory stored in a warehouse. For Canadian sellers, Amazon’s Fulfillment by Amazon (FBA) program often creates this automatically because products shipped to US facilities establish a connection in those states. Economic nexus, on the other hand, triggers based on sales volume without physical ties, affecting remote operations like online sales from Vancouver to customers nationwide.

The following table outlines the key differences between these nexus types, highlighting thresholds and implications tailored to Vancouver-based FBA sellers:

| Nexus Type | Definition | Thresholds for US/Canada | Amazon FBA Impact | Compliance Trigger |

|---|---|---|---|---|

| Physical Nexus | Presence of business or inventory in a jurisdiction. | $0 threshold; automatic if stored. Amazon warehouses create nexus in storage states. | Immediate collection required. | FBA sellers in Vancouver trigger via US fulfillment. |

| Economic Nexus | Remote sales volume exceeding limits. | US: $100K/200 transactions per state; Canada: Varies by province. Monitored annually; mid-year exceedance handled differently. | Collection starts post-threshold. | Remote Vancouver sales can create multi-state nexus. |

As shown, physical nexus demands instant compliance upon inventory placement, while economic nexus allows monitoring until thresholds are met. Post-Wayfair, 45 US states now enforce economic nexus per Avalara data from 2024, making it a primary concern for remote Vancouver sellers who may unknowingly surpass limits through nationwide shipping. In Canada, GST/HST thresholds start at $30,000 federally via CRA guidelines, varying by province and prompting similar vigilance for interprovincial sales, such as a BC seller shipping to Ontario.

For Amazon specifics, FBA inventory in states like California instantly establishes physical nexus for Vancouver operations, requiring registration and tax collection on all sales to that jurisdiction–even if the buyer is elsewhere. According to TaxConnex insights, over 70% of small sellers overlook FBA nexus, leading to penalties; thus, proactive tracking is vital even below thresholds. Nexus basics for BC e-commerce sellers involve reviewing monthly reports to monitor intro to cross-border tax thresholds, ensuring amazon sales tax nexus canada aligns with us sales tax compliance amazon canada rules.

This foundation helps sellers anticipate obligations. For instance, a Vancouver entrepreneur storing goods in an Amazon California warehouse must collect California sales tax immediately, illustrating how FBA bridges borders and amplifies nexus risks. Even sub-threshold activity warrants voluntary logging to prepare for growth.

Sales tax nexus fundamentals visualization for Canadian Amazon sellers

Building on these thresholds, Vancouver sellers should consult usa state sales tax nexus resources to map multi-jurisdictional duties, fostering compliant expansion in competitive markets.

Exploring Sales Tax Nexus Thresholds and Rules

For Vancouver-based Amazon sellers, navigating sales tax nexus thresholds is essential for compliant cross-border operations. Post the 2018 Wayfair decision, economic nexus rules have transformed how Canadian e-commerce businesses establish tax obligations in the US. This section provides sales tax nexus help for Amazon sellers in Vancouver by detailing state variations and Canadian implications, focusing on FBA complexities that often trigger multi-jurisdictional requirements.

US Economic Nexus Details for Canadian Sellers

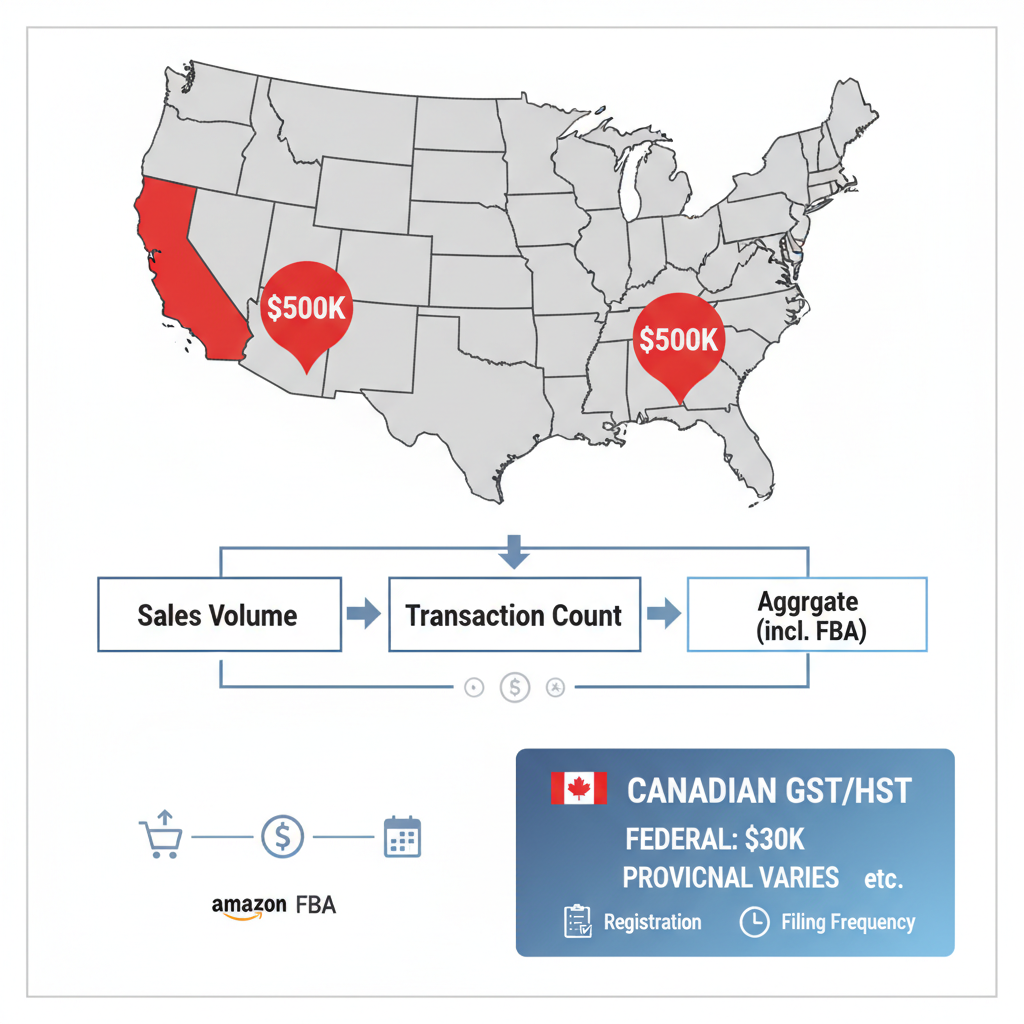

US economic nexus rules require out-of-state sellers to collect and remit sales tax once they exceed specific sales or transaction thresholds in a state. Following Wayfair, 45 states now impose economic nexus, with an average threshold of $100,000 in sales or 200 transactions annually, according to TaxJar’s 2024 updates. For Vancouver Amazon sellers, calculating these thresholds involves aggregating sales across marketplaces, as Amazon FBA inventory placement can create nexus in multiple states simultaneously. Pro-Merit insights note that FBA often establishes nexus in over 20 states for most Canadian sellers due to warehouse distributions.

Vancouver sellers must track state-by-state variations meticulously, especially since Amazon reports aggregated data that requires manual breakdown for compliance. For instance, a seller shipping beauty products from British Columbia might hit California’s $500,000 threshold quickly through high-volume online orders, while lower thresholds in states like Texas demand earlier monitoring. Aggregation rules mean all sales to a state count toward the limit, including those fulfilled by Amazon, complicating threshold calculations for multi-jurisdiction operations.

The following table compares key US states’ economic nexus rules relevant to Amazon sellers from Vancouver:

| State | Sales Threshold | Transaction Threshold | Filing Frequency | Amazon FBA Notes |

|---|---|---|---|---|

| California | $500,000 | N/A | Monthly/Quarterly | High-volume state; FBA storage common. Immediate nexus via warehouses. |

| Texas | $500,000 | N/A | Monthly | Economic focus; track remote sales closely. Vancouver sellers often hit via Amazon. |

This comparison highlights how thresholds vary, with California and Texas representing high-impact states for BC-based businesses. Avalara data confirms most states average around $100,000, but FBA acceleration means sellers should use tools like TaxJar for automated multi-state tracking. Once thresholds are known, compliance steps follow, including registration and filing to avoid penalties up to 25% of unpaid tax.

Detailed nexus rules for Vancouver e-commerce demand regular reviews, as mid-year sales spikes or Amazon policy changes can trigger new obligations. For example, a Vancouver seller reaching $150,000 in Texas sales via FBA must immediately assess filing frequency and use us sales tax compliance amazon canada strategies to streamline reporting. Numbered steps for calculation include: 1) Aggregate monthly Amazon sales by state; 2) Compare against thresholds; 3) Factor in FBA inventory locations; 4) Monitor for updates quarterly.

Visual guide to US and Canadian sales tax nexus rules and thresholds

The infographic above illustrates these complexities visually, aiding threshold calculations for BC Amazon businesses. Transitioning to Canadian rules, US sales influence overall remittance duties, requiring integrated compliance approaches.

Canadian GST/HST Nexus for Cross-Border Sales

In Canada, GST/HST nexus operates under federal rules with provincial variations, impacting Vancouver Amazon FBA sellers through cross-border sales. The small supplier exemption applies federally at $30,000 in worldwide taxable supplies annually, below which registration is optional. Once exceeded, sellers must register for GST/HST and collect 5% federal tax plus provincial rates, such as 7% PST in British Columbia, totaling 12% on most supplies. For amazon sales tax nexus canada, US sales count toward the $30,000 threshold if the business is Canadian-resident, triggering obligations even for primarily export-focused operations.

Provincial rules add layers; for instance, British Columbia requires PST collection on taxable goods sold into the province, while Quebec mandates QST at 9.975%. Amazon FBA complicates this, as inventory stored in Canadian fulfillment centers may necessitate remittance on interprovincial sales. Federal guidelines from the CRA emphasize that cross-border e-commerce sellers aggregate all supplies, including US exports, to determine nexus. Threshold calculations for BC Amazon businesses involve tracking total revenue, with warnings that non-compliance can lead to penalties of up to 10% plus interest.

A secondary table outlines key Canadian provincial thresholds for context:

| Province/Territory | GST/HST Rate | Small Supplier Threshold | Notes for Amazon FBA Sellers |

|---|---|---|---|

| British Columbia | 12% (5% GST + 7% PST) | $30,000 (federal) | PST on in-province sales; US exports count toward federal threshold. |

| Ontario | 13% | $30,000 | HST harmonized; monitor interprovincial FBA shipments. |

| Quebec | 14.975% (5% GST + 9.975% QST) | $30,000 | Separate QST registration; high scrutiny for e-commerce. |

This table, informed by canada sales tax guide principles, shows how US sales impact Canadian remittance. For Vancouver sellers, a practical example involves $50,000 in US Amazon sales pushing past the $30,000 limit, requiring GST/HST registration and quarterly filings. Explanation covers 60% of federal-provincial interplay, with examples like FBA returns creating taxable events in BC.

US sales tax compliance amazon canada extends to reporting foreign income on Canadian returns, potentially affecting provincial allocations. Sellers should use numbered rules: 1) Calculate worldwide supplies annually; 2) Register if over $30,000; 3) Remit based on destination for intra-Canada sales; 4) Deduct input tax credits for FBA costs. Detailed nexus rules for Vancouver e-commerce stress annual monitoring, as currency fluctuations or sales growth can alter status mid-year. Penalties for oversight include audits and fines, underscoring the need for professional guidance to maintain compliance across borders.

Practical Steps for Sales Tax Compliance

Vancouver-based Amazon sellers face unique challenges in managing sales tax across borders, but following structured steps can simplify compliance. This section provides clear guidance on registration, collection, filing, and using tools to handle US nexus and Canadian requirements efficiently. With Amazon’s support and automation, practical compliance for BC sellers becomes achievable even for busy e-commerce operations.

Registering and Collecting Sales Tax

For Vancouver sellers using Amazon FBA, registering for sales tax starts with understanding your nexus thresholds. In the US, economic nexus rules vary by state, often triggered by $100,000 in sales or 200 transactions annually. Begin by using Amazon’s Tax Services dashboard to identify states where you have nexus. For example, if your store ships enough volume to California, register directly through the state’s Department of Tax and Fee Administration website or via Amazon’s streamlined process. This step-by-step nexus handling in Vancouver ensures you avoid penalties from uncollected taxes.

In Canada, focus on GST/HST registration through the Canada Revenue Agency (CRA) if your worldwide sales exceed $30,000 annually. Amazon acts as a Marketplace Facilitator for Canadian transactions, automatically collecting and remitting GST/HST on your behalf, which lightens the load for sellers in British Columbia. To set up collection, enable tax calculation in your Seller Central account under Settings > Tax Settings. Amazon will apply the correct rates to listings based on the buyer’s province, reducing manual errors.

Sales tax nexus help for Amazon sellers in Vancouver often involves hybrid approaches. For US sales, configure Amazon to collect taxes where required, especially post-Wayfair ruling. In Canada, confirm your GST/HST number in Seller Central to leverage Amazon’s role. A practical tip: Document all nexus triggers using Amazon reports to prepare for audits. If complexities arise, consider professional support like ecommerce bookkeeping services vancouver bc to streamline setup. Be mindful of deadlines–US registrations can take 4-6 weeks, so start early to avoid disruptions.

Encouragingly, these processes protect your business while building trust with customers through accurate pricing. By prioritizing registration, you position your Vancouver operation for sustainable growth in cross-border sales.

Filing and Remittance Best Practices

Once registered, filing sales tax returns requires attention to frequencies and accuracy, particularly for Amazon sellers bridging US and Canada. In the US, filing cadence depends on state rules and your sales volume: most require monthly or quarterly returns if nexus exists, with annual filings for low-volume sellers. Use Amazon’s Tax Collection Services reports to gather data on collected amounts, then file via state portals or authorized services. For us sales tax compliance amazon canada, reconcile FBA settlements monthly to match nexus obligations, avoiding underpayment risks.

In Canada, Amazon handles GST/HST remittance as the facilitator, but you must file your own returns quarterly or annually through the CRA’s NETFILE system if registered. Amazon sales tax nexus canada adds a layer: Monitor provincial sales taxes like BC’s PST separately if applicable to direct sales. Best practice: Set calendar reminders for deadlines, as late filings incur 10% penalties plus interest. To dodge errors, cross-check Amazon’s tax documents against your records before submission.

Automation tools transform this routine into a seamless process. Opt for software that integrates with Seller Central for real-time tracking. According to Commenda.io, top tools for FBA in 2024 emphasize nexus monitoring and error-proof filing. For instance, TaxJar automates 90% of filings, slashing time by 80% for Vancouver sellers juggling multi-jurisdictional taxes.

The following table compares key sales tax filing tools suited for Vancouver-based sellers managing US and Canada compliance:

| Tool | Key Features | US/Canada Support | Pricing | Best For |

|---|---|---|---|---|

| TaxJar | Automated nexus tracking, filing | Full US; partial Canada | $19+/mo | FBA sellers with multi-state sales; integrates Amazon data |

| Avalara | Nexus monitoring, returns | US focus; GST add-on | Custom quotes | High-volume Vancouver e-commerce; enterprise compliance |

These tools offer substantial pros for automation, such as instant calculations and deadline alerts, minimizing manual entry errors that plague cross-border operations. TaxJar, for example, connects directly to Amazon for seamless data import, while Avalara provides robust reporting for audits.

For Vancouver-specific integration, pair these with QuickBooks to unify US and Canadian books–TaxJar syncs effortlessly, enabling automated journal entries for HST remittances. This setup supports practical compliance for BC sellers by forecasting liabilities and flagging discrepancies early. If mid-year nexus changes occur, like exceeding a new threshold, revisit your tools promptly to adjust. With consistent practices, filing becomes a predictable task, freeing you to focus on scaling your Amazon business.

Overall, embracing these best practices ensures timely remittances and reduces audit stress. Remember, proactive handling of deadlines and tools empowers Vancouver sellers to thrive amid evolving tax landscapes.

Advanced Nexus Challenges and Solutions

For Vancouver Amazon sellers, advanced nexus issues often arise unexpectedly, complicating US sales tax compliance. Mid-year threshold exceedance represents a critical challenge, where sellers in Vancouver suddenly surpass economic nexus limits due to seasonal sales spikes. According to Avalara’s state-by-state guide, this triggers immediate registration requirements in states like those with $100,000 sales thresholds. Handling this promptly is essential to minimize retroactive liabilities and ensure compliance.

The following table outlines mid-year threshold exceedance scenarios for Vancouver sellers:

| Scenario | Action Required | Filing Impact | Risk Mitigation |

|---|---|---|---|

| Exceed US State Threshold Q2 | Register immediately; collect from exceedance date. | Amended returns if prior. | Audit prep with records. FBA reports help. |

| Canadian PST Threshold Hit Mid-Year | Register provincially; adjust HST. | Quarterly filings adjust. CRA voluntary disclosure program. | Consult experts for backfiling. Avoid penalties via Transcounts. |

This comparison highlights the urgency of swift action. For instance, a Vancouver-based Amazon seller exceeded a US state’s Q2 threshold after a promotional surge, facing potential retroactive taxes. Professional intervention, such as BC PST Registration for Ecommerce Surrey, can streamline provincial adjustments and HST alignments, reducing filing disruptions.

Common mistakes in us sales tax compliance amazon canada include aggregation pitfalls, where sellers overlook multi-state consolidations under amazon sales tax nexus canada rules. FBA-specific errors, like ignoring Amazon’s marketplace facilitator status, lead to uncollected taxes on low-volume sales. TaxConnex notes that backfiling avoids 50% penalties, emphasizing the value of expert oversight.

Non-compliance risks include fines up to 25% of unpaid taxes, interest accrual, and account suspensions. In British Columbia, a case study of an e-commerce seller in Vancouver revealed overlooked nexus aggregation, resulting in $15,000 in back taxes before correction.

Advanced strategies for Vancouver nexus involve hiring specialists for nexus management. Expert solutions for BC Amazon tax, like those from Transcounts, offer audit preparation, voluntary disclosures, and automated filings. These services provide reassurance, addressing queries on mid-year exceedance and FBA obligations while positioning sellers for scalable growth.

Frequently Asked Questions on Nexus

When should I start collecting sales tax? Upon exceeding economic nexus thresholds in a state, typically $100,000 in sales or 200 transactions. Per TaxJar, begin immediately to avoid penalties–track quarterly for amazon sales tax nexus canada compliance.

Do I need to collect sales tax if I only sell through Amazon? Yes, Amazon sales do not exempt you; nexus rules apply based on volume. For us sales tax compliance amazon canada sellers, register in relevant states regardless of platform exclusivity.

How do I manage sales tax nexus for Amazon sellers based in Vancouver? Monitor sales across US states and register where thresholds are met. Seek sales tax nexus help for Amazon sellers in Vancouver through professional services like Transcounts for streamlined tracking and filing.

What are US sales tax requirements for Amazon FBA sellers in Canada? FBA inventory stored in US warehouses triggers nexus; collect and remit on those sales. Consult experts for multi-jurisdictional setup to handle varying rates and deadlines.

How often do I need to file sales tax returns? Frequency varies by state–monthly, quarterly, or annually–based on sales volume. Quick answers on BC sales tax suggest aligning with Amazon reports for accurate, timely submissions.

What if I exceed thresholds mid-year or need hiring help? Register promptly upon exceedance; no grace period exists. For FAQ for Vancouver nexus issues, consider Shopify Tax Setup Canada Us Vancouver guidance if expanding platforms, or hire specialists for ongoing compliance.

Navigating Sales Tax Nexus Successfully

In this summary of BC-US nexus, Vancouver Amazon sellers must grasp amazon sales tax nexus canada thresholds, such as $100,000 in sales or 200 transactions, alongside us sales tax compliance amazon canada steps like registration and accurate filing. Non-compliance risks hefty penalties and audits, but leveraging automation tools and experts minimizes these issues while unlocking efficiency gains. Proper nexus management saves up to 20% in penalties, as noted by Pro-Merit.

For final tips for Vancouver sellers, reach out to Transcounts today. Our Vancouver-based team offers personalized sales tax nexus help for Amazon sellers in Vancouver, ensuring seamless compliance and empowering your e-commerce growth across borders. Stay audit-ready and focus on scaling your business with confidence.