Table of Contents

Navigating QuickBooks Payroll in Vancouver

In Vancouver’s bustling startup scene, where over 10,000 SMEs navigate British Columbia’s intricate tax rules, businesses often seek efficient tools for payroll management. QuickBooks Payroll in Vancouver, British Columbia, emerges as a vital solution, automating calculations for federal and provincial taxes while handling direct deposits and CRA remittances seamlessly.

This robust system addresses local challenges like BC provincial taxes and FINTRAC compliance, ensuring accuracy amid Canada’s complex landscape. For 2025, setup timelines range from one to three days with pricing tiers starting at $20 monthly per employee, as outlined in recent QuickBooks Canada updates.

As a Vancouver-based firm, Transcounts delivers Payroll Services Vancouver BC through 100% online integration with QuickBooks, providing end-to-end onboarding, monthly closes, and QuickBooks payroll support Canada tailored for e-commerce sellers and tech startups.

This guide explores setup, availability, and key considerations for Vancouver QuickBooks payroll solutions.

Payroll Landscape in Vancouver, BC

Vancouver’s dynamic economy, fueled by over 150,000 small and medium-sized enterprises in sectors like tech hubs in Yaletown and bustling e-commerce, has heightened demand for reliable payroll services Vancouver. Businesses here increasingly turn to QuickBooks Payroll in Vancouver, British Columbia, for streamlined operations amid rapid growth in startups and nonprofits. Certified ProAdvisors play a key role, offering QuickBooks payroll support Canada to navigate the complexities of local regulations.

Common challenges include seasonal hiring fluctuations in tourism and tech, where payroll processing must adapt to variable workforce sizes while ensuring timely remittances. Vancouver-area payroll processing often faces hurdles like integrating provincial taxes and federal deductions, compounded by the need for secure direct deposits in a remote-friendly city. These issues underscore the importance of efficient solutions tailored to BC’s business rhythm.

Selecting the right provider involves prioritizing compliance with CRA and BC-specific rules, such as EI and CPP contributions, alongside setup speed and cost predictability for small teams. The following table outlines key differences among local QuickBooks Payroll options, drawing from provider details and 2024 reports on fees for businesses under $500K revenue.

| Provider | Setup Time | Monthly Fee (Based on 10 Employees) | CRA/BC Compliance | Direct Deposit Support |

|---|---|---|---|---|

| Transcounts | 30 days or less | Fixed based on transactions | Full GST/HST, PST, FINTRAC | Automated via Wagepoint integration |

| Sense Accounting | 45-60 days | $200-400 | Basic CRA support | Manual setup |

| Minding My Books | 2-4 weeks | Custom quotes | Tax reconciliation focus | Integrated but limited |

| CPA4IT | Custom timeline | Hourly + subscription | FINTRAC expertise | Supported with add-ons |

Data sourced from provider websites and 2024 industry reports; fees approximate for small businesses with average revenue under $500K; compliance includes BC-specific payroll deductions.

Transcounts stands out with its fixed fees and robust integrations, ideal for Vancouver’s agile SMEs needing BC QuickBooks assistance without variable costs. This approach minimizes setup disruptions and ensures seamless compliance, addressing common FAQs on QuickBooks Canada hurdles like remittance timing. For enhanced efficiency, consider specialized options like Payroll Remittance Service Vancouver.

Vancouver’s payroll providers vary in scalability, but tools like Wagepoint integration provide a competitive edge for direct deposits and automation. This landscape reflects the city’s innovative spirit, where QuickBooks fits snugly into regulatory demands, supporting growth without administrative burdens.

Vancouver QuickBooks Payroll provider comparison chart

The chart visually reinforces these insights, highlighting how quicker setups correlate with integrated compliance features, aiding businesses in evaluating fits for their operational pace.

Available QuickBooks Payroll Services in Vancouver

Vancouver businesses can access robust QuickBooks Payroll in Vancouver, British Columbia, through various providers offering seamless integration with cloud accounting tools. These local QuickBooks payroll options ensure compliance with Canada Revenue Agency (CRA) requirements, streamlining operations for small and medium-sized enterprises (SMEs). While general accounting firms like Sense Accounting provide broad services, specialized payroll services Vancouver stand out by focusing on QuickBooks-specific automation and support.

Transcounts delivers comprehensive QuickBooks payroll support Canada, handling everything from initial setup to ongoing maintenance. Core services include:

- Employee onboarding with secure digital forms and automated approvals.

- Direct deposits via Wagepoint integration, answering how QuickBooks Payroll handles payments in Canada by enabling fast, secure transfers to employees’ banks.

- Tax remittances and filings processed automatically to meet provincial and federal deadlines.

- Year-end reporting, including T4 slips and ROEs, prepared with accuracy for CRA submissions.

This automation extends through Plooto for bill payments and A2X for e-commerce reconciliations, reducing manual errors. As certified QuickBooks ProAdvisors, Transcounts guarantees 24-hour response times, providing peace of mind for busy Vancouver teams. For instance, a local tech agency streamlined remittances using these tools, cutting processing time by 50%.

Add-ons like KPI dashboards offer payroll insights, visualizing costs and trends for better decision-making. Bundling with bookkeeping services creates full finance support, ideal for integrated workflows.

These Canadian payroll integration services are fully available online for Vancouver’s e-commerce firms and startups, ensuring scalability without geographical limits.

Key Considerations for Vancouver Businesses

Vancouver businesses adopting QuickBooks Payroll in Vancouver, British Columbia, must navigate unique local challenges to ensure smooth operations. From BC-specific payroll deductions to integration hurdles, these factors directly impact efficiency and compliance. Transcounts offers expert guidance, helping firms avoid common pitfalls while leveraging bookkeeping services Vancouver for seamless financial management.

Key considerations include:

- Compliance Overview: BC mandates like WorkSafeBC premiums and statutory holidays require precise calculations in QuickBooks. FINTRAC reporting ensures timely remittances for payroll taxes, with setup tips from experts emphasizing audit-ready documentation to prevent penalties. Overlooking provincial sales tax nexus can lead to unexpected liabilities, making Vancouver payroll compliance factors essential for local firms.

- Cost Structures: Pricing often bases on transaction volume or revenue, starting with fixed monthly fees for payroll services in Vancouver. High-volume e-commerce sellers may benefit from custom quotes, balancing affordability with robust features to control expenses without sacrificing accuracy.

- Integration and Troubleshooting: QuickBooks payroll support Canada addresses common issues like error-prone setups for Canadian users. Transcounts streamlines onboarding, automating remittances and direct deposits to minimize disruptions.

- Vendor Selection: Choose certified providers with local knowledge, such as Transcounts, for BC QuickBooks support essentials and tailored compliance assistance.

Steps to Implement QuickBooks Payroll Locally

Implementing QuickBooks Payroll in Vancouver, British Columbia, streamlines payroll processing for local businesses, ensuring compliance with provincial regulations. With Transcounts’ expert guidance, Vancouver payroll implementation becomes straightforward, offering reliable payroll taxes Canada management and automation. This local QuickBooks setup process typically wraps up in 30 days, empowering your team with efficient operations.

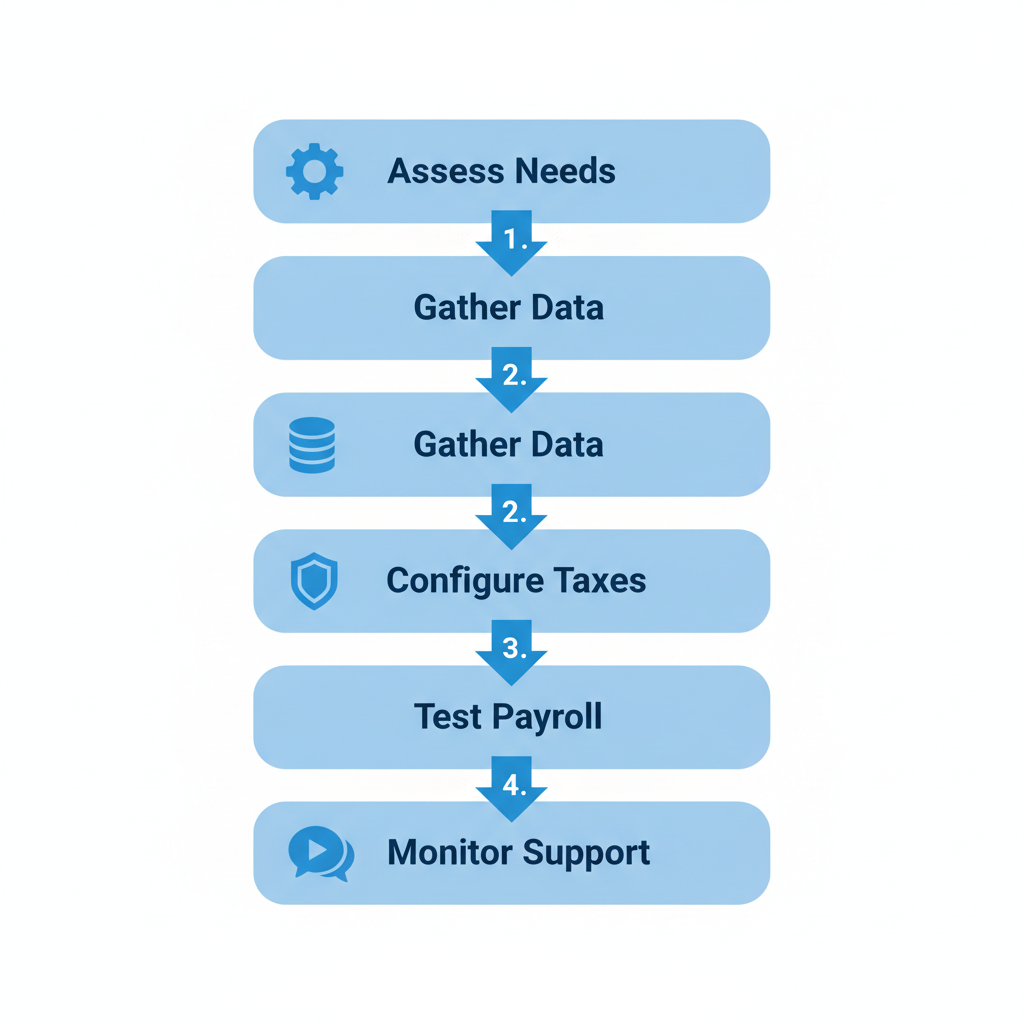

- Assess Business Needs and Choose Plan: Evaluate your employee count, payroll frequency, and compliance requirements. Select a QuickBooks Payroll plan that fits your scale, such as Core or Premium, with Transcounts advising on the best option for BC-specific needs.

- Gather Employee Data and Integrate: Collect details like SINs, addresses, and banking info. Link QuickBooks to your accounting software for seamless data flow, using Transcounts’ onboarding to import records accurately.

- Configure Taxes and Direct Deposits: Set up provincial and federal withholdings, including payroll taxes Canada, via Wagepoint integration. Enable direct deposits for timely payments, ensuring CRA remittances are automated.

- Test Run Payroll and Remittances: Process a trial payroll to verify calculations, deductions, and filings. Transcounts reviews for errors, confirming accuracy before live runs.

- Monitor with Ongoing Support: Launch full payroll and track performance using QuickBooks dashboards. Rely on QuickBooks payroll support Canada from Transcounts for adjustments, addressing queries on local setups.

Tip: Verify BC holiday pay rules during configuration to avoid compliance issues. Transcounts’ payroll services in Vancouver provide 24/7 access, boosting confidence in your implementation.

Five-step vertical process for QuickBooks Payroll implementation in Canada

Achieving Payroll Success in Vancouver

Implementing QuickBooks Payroll in Vancouver, British Columbia, transforms local businesses with seamless setup and compliance for BC taxes. Transcounts delivers expert payroll services in Vancouver, ensuring smooth integrations and reliable QuickBooks payroll support Canada-wide. Businesses enjoy faster month-end closes and significant cost savings through our scalable model, as highlighted in recent QuickBooks setups starting at affordable rates.

Explore successful Vancouver payroll strategies with our payroll case study Boxhub for real local QuickBooks outcomes. Contact Transcounts today for a consultation to empower your growth with efficient, compliant operations.