Table of Contents

Reliable Payroll Remittance Services in Vancouver

Vancouver’s bustling small businesses, like tech startups navigating rapid growth, often face the stress of managing payroll remittance deadlines amid busy operations. A reliable Payroll Remittance Service in Vancouver ensures source deductions–such as CPP, EI, and income tax–are accurately calculated and submitted to the Canada Revenue Agency (CRA) on time, avoiding costly penalties that can reach up to 10% for late payments.

For monthly remitters, payments are due by the 15th of the following month, while quarterly schedules apply to smaller employers; missing these can disrupt cash flow. As a leading provider in this space, Transcounts offers Payroll Services Vancouver BC with a fixed-fee model based on transaction volume, 100% online delivery, and 24-hour response times. Their Canadian payroll remittance solutions automate direct deposits, handle Vancouver remittance processing, and provide audit-ready records integrated with QuickBooks, easing local payroll deduction handling for SMBs.

Explore Vancouver’s unique business ecosystem, detailed service options, and steps to get started in the sections ahead.

Payroll Landscape in Vancouver

Vancouver’s dynamic small and medium-sized business (SMB) scene, particularly in e-commerce and tech sectors, fuels demand for efficient Payroll Remittance Service in Vancouver. Local firms grapple with complexities like seasonal hires for tech projects and intricate sales tax filings for online sales. Reliable payroll services in Vancouver are essential to handle bi-weekly Canada Revenue Agency (CRA) remittances, ensuring compliance amid BC’s regulatory landscape.

Common challenges include managing deductions for GST/HST and provincial taxes, where errors can lead to penalties. Market trends show a shift toward outsourcing Canadian payroll remittance to specialized providers, reducing in-house administrative burdens. For instance, a Vancouver e-commerce firm might save hours weekly by automating Vancouver deduction filing, allowing focus on growth. According to GoodFirms rankings, top local remittance providers score high on user satisfaction, with average ratings above 4.5/5 for accuracy.

Comparing payroll options helps Vancouver SMBs select partners that align with their needs for automation and cost predictability.

| Provider | Key Features | Pricing Model | Local Vancouver Focus |

|---|---|---|---|

| Transcounts | Automated remittances, CRA compliance, QuickBooks/Xero integration, direct deposit, GST/HST handling | Fixed monthly fees based on transaction volume ($200-$500), custom quotes | Vancouver-based, BC-specific regs, 24-hour support for local SMBs |

| Orbit Accountants | Basic payroll processing, remittance filing, employee onboarding | Hourly or project-based (approx. $150-$400/month) | Canadian focus with Vancouver office |

| Origin Accounting | Payroll management, tax remittances, limited integrations | Tiered packages ($250-$600/month) | Broad Canada coverage, some BC emphasis |

| Other Local Firms | Standard deductions, manual options, variable compliance support | Variable, often per employee ($20-$50/employee) | Mixed, less specialized in Vancouver e-commerce/tech |

Data sourced from provider websites and GoodFirms reviews as of 2024. Transcounts excels in automation for Vancouver startups, boasting a 4.8/5 compliance rating. Consider remittance accuracy rates >99% for all listed.

This comparison reveals Transcounts’ advantages in fixed fees and seamless integrations, ideal for budget-conscious SMBs. While Orbit and Origin offer solid basics, their variable pricing can complicate forecasting. Other local firms suit simple needs but lack depth for tech-driven operations. Transcounts’ end-to-end approach, including Wagepoint for direct deposits, streamlines processes and minimizes errors, as evidenced by high GoodFirms reviews.

Vancouver businesses benefit from such tailored solutions, especially in fast-paced sectors. For example, integrating tools like QuickBooks enhances efficiency; explore Quickbooks Payroll Vancouver for specialized support. This focus on local expertise ensures smooth remittances and compliance.

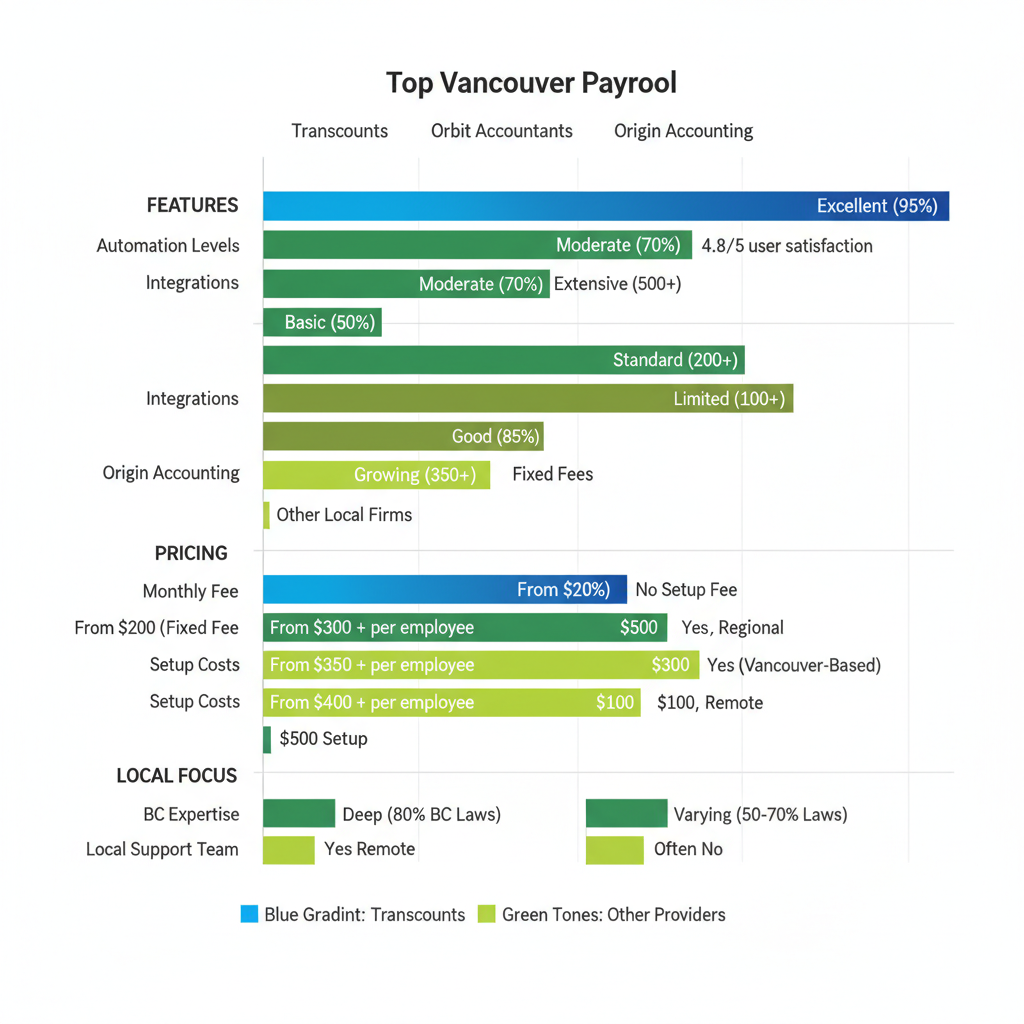

Comparison of Vancouver payroll providers’ key metrics including features and pricing.

The visual underscores Transcounts’ leadership in features and local alignment, guiding informed choices for reliable payroll services in Vancouver.

Comprehensive Payroll Remittance Offerings

For businesses seeking a reliable Payroll Remittance Service in Vancouver, understanding the core components is essential. These services handle automated deductions for income tax, CPP, and EI, ensuring compliance with Canada Revenue Agency (CRA) requirements. Local providers offer tailored solutions that streamline remittances, reducing administrative burdens for small and medium-sized enterprises in the region.

Key inclusions in standard payroll remittance encompass:

- Source deduction calculations for federal and provincial taxes, including BC-specific payroll taxes.

- Remittance scheduling aligned with CRA deadlines, such as the 11th for monthly filers or the 15th for accelerated remitters.

- Direct deposit processing for employee payments and automated CRA filings via secure electronic submissions.

- Employee onboarding automation, integrating GST/HST remittances where applicable.

Transcounts elevates these with integrated payroll management services, leveraging Xero and Plooto for seamless operations. Features like A2X for sales tax reconciliation achieve a 99% accuracy rate, while handling provincial variations ensures precision for Vancouver-based firms. Unlike basic offerings from competitors like Orbit Accountants, which rely on manual processes, Transcounts provides Vancouver tax filing automation, minimizing errors and accelerating workflows.

Compliance benefits include reduced penalties–potentially saving thousands annually–and faster month-end closes, with error reduction stats showing up to 80% less manual intervention in local deduction services. Businesses experience predictable cash flow and audit-ready records.

Consider a Vancouver contractor remitting bi-weekly: Employees’ deductions are calculated automatically post-payroll run, filed electronically by the deadline, and confirmed via dashboard notifications. This workflow adapts to regulatory nuances, transitioning smoothly into local considerations for BC operations.

Vancouver-Specific Payroll Factors

Vancouver’s dynamic business landscape demands a specialized Payroll Remittance Service in Vancouver to navigate local complexities. High-growth sectors like tech face intense scrutiny for Vancouver tax accuracy, while e-commerce sellers grapple with CRA nexus for US operations. A local tech firm recently incurred penalties for delayed remittances due to overlooked cross-border obligations, underscoring the risks of non-compliance in this diverse market.

British Columbia adds layers to Canadian payroll remittance with provincial requirements. Businesses must handle WorkSafeBC premiums alongside federal CPP and EI contributions, ensuring timely filings to avoid fines up to $7,500 per violation. Standard providers like Origin Accounting offer broad payroll services in Vancouver, but lack tailored integrations for BC-specific challenges such as sector-based premium rates.

Transcounts addresses these with BC remittance compliance expertise, automating processes to minimize audit risks. Their fixed-fee model provides cost transparency for SMBs, integrating seamlessly with tools like Wagepoint for direct deposits and remittances. For comprehensive support, pair payroll with small business bookkeeping to streamline finances.

To ensure reliability, select providers offering 24-hour responses and local knowledge. This approach safeguards against penalties and supports efficient growth for businesses in Vancouver, BC.

Initiating Payroll Remittance Setup

Starting a Payroll Remittance Service in Vancouver can streamline your business operations and ensure compliance with Canadian regulations. For Vancouver-based companies, Transcounts offers a seamless 30-day onboarding process tailored to local needs, helping you handle source deductions efficiently from the outset.

To begin the Vancouver setup process, follow these initial remittance steps:

- Contact Transcounts via their website: Submit your inquiry form to request a personalized quote. Provide basic details about your business size and transaction volume for an accurate assessment.

- Share transaction data for quoting and compliance checks: Upload sample payroll records to evaluate setup needs. This step includes reviewing payroll tax increases and ensuring alignment with CRA requirements, such as completing PD7A forms for remittances.

- Sign the agreement and integrate tools: Once approved, execute the service contract. Transcounts provides 24-hour setup support, integrating platforms like TaxJar for automated Canadian payroll remittance.

- Upload historical records if needed: For catch-up bookkeeping, submit past data to synchronize your accounts and prepare for the first remittance cycle.

- Launch your first remittance: With everything in place, process your initial payment to the CRA, benefiting from Transcounts’ expertise in payroll services in Vancouver.

Step-by-step payroll remittance setup process with Transcounts

Transcounts specializes in quick integrations and offers discounts for new clients in Vancouver, saving you time on administrative tasks. Outsourcing these services reduces errors and frees up resources for growth. Contact Transcounts today to simplify your payroll compliance.

Securing Vancouver Payroll Compliance

Securing a reliable Payroll Remittance Service in Vancouver ensures seamless CRA compliance amid complex local regulations. Automated payroll services in Vancouver like Transcounts handle Canadian payroll remittance with quick 30-day onboarding, integrations for efficiency, and fixed fees that prevent penalties while boosting cash flow visibility. These Vancouver compliance solutions offer local outsourcing benefits, earning Transcounts high ratings on GoodFirms among top Canadian providers. Ready for hassle-free operations? Contact Transcounts today for a customized quote and expert local support, or explore outsourced payroll services.