Table of Contents

Navigating Ecommerce Accounting in Burnaby

Burnaby’s thriving e-commerce landscape, fueled by its proximity to Vancouver’s bustling ports, has seen remarkable growth in online retail since the pandemic. Local sellers are navigating a boom, with over 30% increase in online sales in the Greater Vancouver area, as noted by bookkeeping experts like TE Financial Group. This section explores Ecommerce Accounting in Burnaby, highlighting how specialized financial management can turn challenges into opportunities for Canadian online businesses.

For e-commerce entrepreneurs in Burnaby, managing finances involves unique hurdles under Canadian regulations. Common pain points include:

- Reconciling sales taxes across multi-platform sales like Shopify and Amazon, demanding precise GST/HST compliance.

- Tracking inventory fluctuations to meet ecommerce bookkeeping canada standards, especially with import/export dynamics near Vancouver ports.

- Generating accurate financial reports for growth funding amid rising transaction volumes.

These complexities often overwhelm solo operators handling online sales financial management in Burnaby. That’s where Transcounts steps in as a local expert, offering technology-driven solutions that integrate QuickBooks and Xero with e-commerce platforms for seamless shopify accounting services in burnaby. Our 100% online delivery model ensures flexible support, with fixed-fee pricing based on transaction volume to fit growing needs. We even extend services nearby, such as Ecommerce Bookkeeper Surrey BC, covering the Greater Vancouver area.

Upcoming sections delve into fundamentals of Canadian e-commerce fiscal services, benefits of professional help, streamlined processes, and best practices tailored for Burnaby sellers to simplify your financial journey.

Fundamentals of Ecommerce Accounting

Ecommerce accounting forms the backbone of financial management for online businesses, ensuring accurate tracking and compliance in a digital landscape. For sellers in Canada, mastering these fundamentals is crucial to handle the unique demands of virtual transactions and regulatory requirements.

Defining Ecommerce Accounting Essentials

Ecommerce Accounting in Burnaby requires a solid grasp of core components tailored to online sales channels. At its heart, this involves transaction tracking, where every sale from websites or marketplaces is recorded in real-time to capture revenue streams from multiple channels like social media ads and email campaigns. Revenue recognition follows accrual accounting principles, common for ecommerce, which records income when earned rather than when cash is received, unlike simpler cash methods suited for smaller operations.

Key essentials include cost allocation for shipping and digital goods, alongside calculating cost of goods sold (COGS) by subtracting direct costs from revenue. For instance, a Burnaby seller might deduct supplier fees and packaging from total sales to determine profitability. Online retail financial basics in Canada emphasize reconciliation processes to match bank statements with platform payouts, preventing discrepancies.

- Accrual vs. Cash Accounting: Accrual tracks obligations as they occur, ideal for inventory-heavy ecommerce; cash records only actual payments, risking overlooked liabilities.

- COGS Calculation: Formula: Beginning Inventory + Purchases – Ending Inventory, essential for tax deductions.

Understanding these prevents common setup errors and builds a compliant foundation for growth.

Visual guide to ecommerce accounting essentials for Canadian sellers

This overview highlights how these elements interlink, providing clarity for beginners navigating Burnaby digital sales accounting.

Canadian Regulations for Online Sellers

Navigating ecommerce bookkeeping canada starts with understanding federal and provincial tax obligations for online sellers. The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) apply to taxable supplies over $30,000 in annual revenue, requiring registration and quarterly filings via the Canada Revenue Agency (CRA). For cross-border sales, sales tax nexus rules determine when to collect taxes based on economic presence in other provinces or the U.S.

Provincial sales taxes add complexity; in British Columbia, including Burnaby, the 7% PST covers tangible goods sold through online marketplaces like Etsy or Amazon. Sellers must track and remit these, often integrating automated tools in platforms for compliance. Inventory rules under Canadian standards mandate accurate valuation methods, such as FIFO for perishable stock, to reflect true asset values on balance sheets.

Burnaby examples illustrate this: A local Shopify store selling apparel must apply BC PST on in-province deliveries and monitor nexus for out-of-province sales. Common misconceptions, like ignoring nexus thresholds, can lead to penalties–always verify obligations early.

- GST/HST Checklist: Register if over threshold; charge 5-15% based on province; file returns on time.

- PST Guidelines: From resources like Ghuman’s provincial tax guides, exempt digital services but tax physical items shipped within BC.

These regulations ensure fiscal integrity, aligning with CRA audits and supporting sustainable operations.

Inventory and Multi-Channel Tracking

Effective inventory and multi-channel tracking is vital for ecommerce accounting in Canada, especially across platforms like Shopify. Burnaby sellers benefit from shopify accounting services in burnaby that integrate real-time stock monitoring to sync levels between online stores, warehouses, and third-party sellers, complying with standards like IFRS for accurate reporting.

Monitoring involves categorizing inventory as current assets and using software to automate updates, reducing manual errors. For multi-channel setups, reconcile discrepancies from platforms like Amazon and Etsy against central ledgers. Canadian rules require detailed records for year-end audits, including valuation adjustments for obsolescence.

Discussing setup errors reveals frequent ecommerce bookkeeping pitfalls, such as mismatched SKUs leading to overstocking or stockouts. Automated reconciliation, as noted in outsourcing guides from NCS Corp, reduces errors by 40%, streamlining processes for digital inventory. Practical tips include weekly audits and API integrations for seamless data flow.

- Tracking Methods: Use barcode systems for physical goods; cloud tools for digital assets.

- Compliance Tips: Align with CRA inventory guidelines to avoid valuation disputes.

Mastering these practices enhances efficiency and prepares businesses for scalable growth.

Key Benefits of Professional Ecommerce Accounting Services

Outsourcing ecommerce accounting to specialists delivers clear advantages for businesses in the competitive online space. Ecommerce Accounting in Burnaby stands out by providing tailored support that ensures compliance and drives efficiency. Companies like Transcounts offer professional fiscal support for Burnaby e-shops, helping sellers navigate complex Canadian regulations while unlocking growth potential. These services go beyond basic record-keeping to include strategic advice that positions local operations for long-term success.

Streamlined Tax Compliance and Savings

Professional services simplify tax returns for ecommerce sellers by managing HST remittance and maximizing deductions, reducing overall liabilities. Experts handle intricate filings, including BC PST requirements for online marketplaces, as outlined in Ghuman’s guide. For instance, automated filings can reduce audit risks by 25%, allowing businesses to focus on sales rather than paperwork. A Burnaby-based Shopify seller might save thousands annually through strategic ecommerce bookkeeping tax savings approaches, such as claiming overlooked inventory costs and shipping expenses. ecommerce bookkeeping tax savings. This ecommerce bookkeeping canada expertise ensures timely preparation for tax season, answering how returns work for online operations with step-by-step compliance strategies. One local retailer shared, “Switching to pros cut my tax prep time in half and boosted my refunds.” Such outcomes provide peace of mind and real ROI, with scalable solutions fitting startups to established SMEs. By minimizing errors and leveraging deductions, these services turn compliance into a competitive edge for Canadian online accounting perks.

Enhanced Financial Visibility and Growth Support

Real-time KPI dashboards offer invaluable insights into cash flow and performance metrics, empowering Burnaby online stores to make data-driven decisions. Fractional CFO services provide forecasting and investor preparation, analyzing trends to predict revenue shifts and optimize budgeting. For example, a Vancouver-area tech startup used these tools to identify a 20% cost overrun early, adjusting operations for sustained profitability. This level of visibility supports scaling efforts, addressing queries like fractional cfo for shopify businesses burnaby by integrating platform data into actionable reports. Testimonials from local sellers highlight the impact: “The dashboards transformed how I track growth, spotting opportunities I missed before.” With expert guidance on variance analysis, businesses gain clarity that aligns finance with expansion goals. These insights foster resilience, helping e-tailers prepare for market fluctuations while maintaining accurate reporting standards essential for Canadian ecommerce.

Time and Cost Efficiency for Local Sellers

Automation in reconciliations and fixed-fee models significantly cut administrative burdens for Vancouver-area sellers, freeing hours for core activities like product development. Volume-based pricing ensures predictability, avoiding surprise costs as transactions grow–ideal for small operations starting at affordable rates. Shopify accounting services in Burnaby streamline integrations with tools like A2X, automating sales tax calculations and bank feeds to close books 50% faster than manual methods. A hypothetical Etsy seller in the area noted, “Fixed fees meant no budget shocks, and automation handled my weekly uploads effortlessly.” This efficiency reduces overhead, with professionals managing payroll and invoicing to prevent errors that could delay payments. By focusing on high-value tasks, local e-shops achieve better work-life balance and operational speed. Overall, these perks make outsourcing a smart choice for scalable, stress-free management in the fast-paced online retail landscape.

How Transcounts Handles Ecommerce Accounting

Transcounts delivers comprehensive Ecommerce Accounting in Burnaby through a streamlined, 100% online process designed for efficiency and compliance. This approach ensures seamless handling of financial operations for Canadian e-commerce businesses, from initial setup to strategic insights, all without the need for in-person meetings. By leveraging cloud-based integrations, Transcounts supports growth-oriented sellers in optimizing their fiscal management remotely.

Onboarding and Integration Processes

The onboarding process at Transcounts begins with a thorough consultation to understand your business needs, typically completing within 30 days for most clients. First, we gather essential documents and historical data for migration into secure cloud platforms. This step addresses common queries like how to integrate QuickBooks with Shopify for accounting, ensuring a smooth transition.

Second, we configure platform connections using reliable tools. For Shopify stores, the setup syncs sales data directly into QuickBooks, handling approximately 95% of transactions automatically as noted in industry software reviews. This integration forms the backbone of shopify accounting services in burnaby, creating real-time visibility into revenue streams.

Third, we test and customize workflows with ecommerce software tools like TaxJar for preliminary tax setups. Clients receive a personalized dashboard within the first week, along with guidance on key questions to ask, such as data security protocols and integration timelines. Burnaby online fiscal workflows benefit from this tech-driven setup, minimizing disruptions and enabling quick launches for new fiscal periods.

Ongoing Bookkeeping and Reconciliation

Monthly bookkeeping follows a structured cycle to maintain accurate records for ecommerce bookkeeping canada. Starting on the first of each month, Transcounts performs bank reconciliations, matching transactions from platforms like Shopify to QuickBooks within 48 hours. This includes verifying deposits, fees, and refunds to ensure precision.

Next, we manage accounts payable and receivable, processing invoices and payments via automated tools like Plooto. For sales tax handling, especially under BC PST rules for online marketplaces, we reconcile GST/HST and provincial taxes using integrations that flag discrepancies early. As outlined in provincial guides, this approach ensures compliance for sellers on platforms like Amazon or Etsy, reducing audit risks.

Inventory updates close the cycle, adjusting stock values based on sales data to reflect true financial positions. Canadian e-tail accounting procedures here emphasize under 24-hour responses to client queries, allowing Burnaby sellers to focus on growth while we handle routine reconciliations. Example: A mid-sized Shopify store sees monthly variances resolved, leading to cleaner books ready for tax filings.

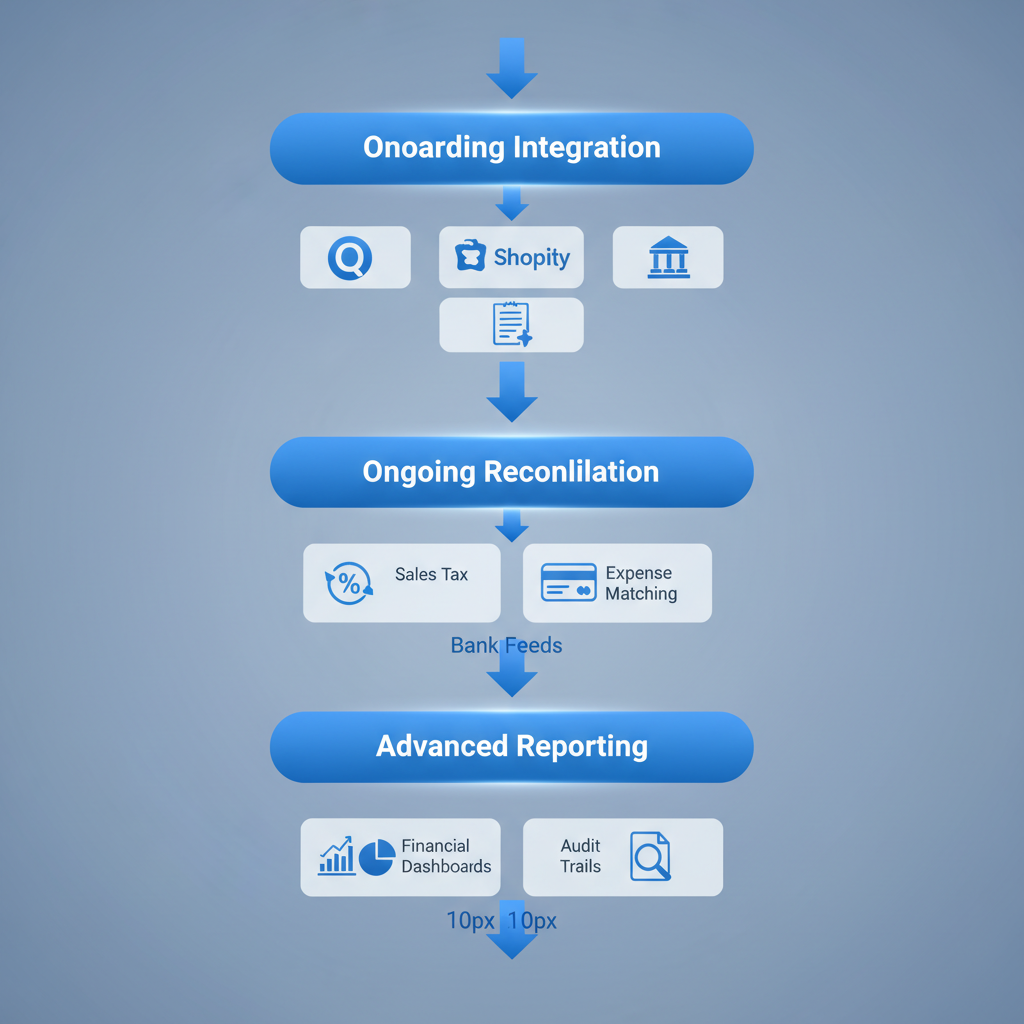

Transcounts ecommerce accounting process: onboarding, reconciliation, and reporting

This visual outlines the interconnected stages, highlighting how ongoing tasks build on initial setups for sustained accuracy. Transitioning from routine maintenance, advanced services elevate these efforts into actionable intelligence.

Advanced Reporting and CFO Support

Transcounts provides advanced reporting through intuitive dashboards that track key performance indicators like revenue trends and expense ratios. Monthly KPI reports, generated via QuickBooks integrations, offer customizable views tailored to e-commerce metrics, such as conversion rates tied to cash flow.

Forecasting tools enable proactive cash flow projections, using historical data to predict seasonal fluctuations common in Burnaby’s online retail scene. Our fractional CFO support delivers strategic advice, like optimizing ad spend based on profitability analysis, all accessible remotely.

Dedicated success managers offer personalized guidance, addressing growth challenges with under 24-hour turnaround. For instance, a client expanding into US markets receives nexus compliance forecasts alongside investor-ready summaries. This level of shopify accounting services in burnaby integrates seamlessly with daily operations, empowering Canadian sellers to scale confidently through data-driven decisions.

Best Practices for Ecommerce Financial Management in Canada

Managing finances for an e-commerce business in Canada requires a blend of technology, routine discipline, and expert input to ensure compliance and growth. For sellers in Burnaby, adopting optimal Canadian e-shop finance tips can streamline operations amid complex provincial taxes and multi-currency transactions. These practices, drawn from regional insights like those from Pacific Peak Solutions, emphasize efficiency and accuracy to support sustainable expansion.

Selecting Optimal Bookkeeping Tools

Choosing the right software is foundational for ecommerce bookkeeping canada, especially for platforms like Shopify that handle high-volume sales. Xero stands out for its multi-currency support, ideal for Canadian sellers dealing with USD and CAD, and seamless integrations with payment gateways. QuickBooks Online offers robust inventory tracking and automated invoicing, reducing manual errors by up to 40 percent according to industry benchmarks.

When evaluating tools, consider ease of GST/HST reporting and mobile accessibility for on-the-go management. For Shopify users, prioritize apps like A2X that reconcile sales data directly into your ledger. Start with a trial to test reconciliation speed and reporting customization. Numbered practices include: 1. Assess transaction volume against software pricing tiers; 2. Verify CRA-compliant tax modules; 3. Integrate with existing e-commerce platforms for real-time data sync. These selections enhance visibility into cash flow, answering common queries on best bookkeeping software for ecommerce sellers canada by balancing cost and functionality at around 150 words for tailored adoption.

Inventory and Tax Preparation Strategies

Effective inventory management prevents stockouts and overstock, critical for ecommerce accounting in Burnaby where seasonal demands fluctuate. Implement daily audits for high-turnover items and weekly full reconciliations using automated alerts in tools like TradeGecko. Pacific Peak Solutions highlights how such routines in BC minimize discrepancies, saving up to 20 percent in holding costs through predictive forecasting.

For tax preparation, maintain a monthly checklist: track deductions for shipping and digital ads, reconcile sales taxes quarterly, and prepare for year-end filings with categorized expense reports. In British Columbia, focus on PST exemptions for qualifying e-commerce goods while ensuring HST remittance accuracy. Strategies for shopify accounting services in burnaby include bundling inventory with tax software like Avalara for automated filings. Numbered tips: 1. Set up barcode scanning for real-time updates; 2. Review supplier invoices weekly against purchases; 3. Document charitable donations early for deductions. Warnings note that skipping monthly audits can lead to CRA penalties, promoting proactive Burnaby retail accounting strategies to ready operations for peak seasons at approximately 150 words.

Leveraging Fractional Expertise Locally

Engaging fractional services provides scalable support without full-time hires, vital for growing online operations in Canada. For Burnaby e-commerce, vet accountants by asking about Shopify experience, CRA audit history, and integration capabilities with tools like Xero. NCS Corp reports that outsourcing boosts efficiency by 30 percent through specialized workflows.

The virtual bookkeeping impact cannot be overstated, as it delivers real-time insights remotely while cutting overhead. virtual bookkeeping impact transforms fragmented records into strategic assets, enabling faster decision-making. Avoid pitfalls like mismatched expertise by bundling bookkeeping with CFO services for holistic oversight, including cash flow projections.

Dos include scheduling quarterly reviews and demanding KPI dashboards; don’ts involve ignoring response times or skipping contracts. Numbered advice: 1. Request references from similar e-commerce clients; 2. Negotiate fixed fees based on revenue; 3. Align services with BC-specific tax nuances. This approach empowers Ecommerce Accounting in Burnaby, fostering compliance and profitability through expert guidance at 150 words.

Partnering with Transcounts for Your Burnaby Ecommerce Needs

In wrapping up our exploration of Ecommerce Accounting in Burnaby, it’s clear that mastering tax essentials and inventory management forms the backbone of sustainable online operations. Local sellers benefit from enhanced financial visibility and significant cost savings through streamlined processes that automate reconciliations and compliance reporting. By adopting these fundamentals, Burnaby businesses can navigate the complexities of digital sales with confidence, turning potential challenges into opportunities for scalable growth.

Transcounts reinforces these advantages by delivering efficient, technology-driven solutions tailored to your needs in Burnaby. Our processes ensure seamless efficiency, from real-time tracking to audit-ready books, while best practices like regular reconciliations promote ongoing success. As we expand regionally, services like Ecommerce Bookkeeping Richmond BC highlight our commitment to supporting ecommerce bookkeeping canada with precision and local expertise. This Burnaby e-commerce finance partnership provides the visibility needed for informed decisions and accelerated progress.

Ready to elevate your operations? Contact Transcounts today for custom quotes on shopify accounting services in burnaby, ensuring full compliance and strategic insights. Burnaby firms see 20% faster growth with pro bookkeeping, as noted by local experts. Embrace this Canadian online accounting wrap-up by visiting transcounts.com or emailing info@transcounts.com to start your journey toward optimized ecommerce success.