Table of Contents

Navigating GST/HST Filing in Vancouver

Vancouver’s vibrant economy, from tech startups to e-commerce sellers, demands sharp attention to GST/HST filing in Vancouver. As a hub for innovative businesses, staying compliant with Canada’s Goods and Services Tax (GST) at 5% and its harmonized counterpart in other provinces is crucial. In British Columbia, businesses must also handle provincial sales tax (PST) separately, ensuring accurate GST return filing in Vancouver to claim input tax credits and avoid penalties.

Common challenges include navigating registration thresholds–mandatory when taxable supplies exceed $30,000 over four quarters, per Canada Revenue Agency guidelines–and managing complex filings for cross-border sales. Vancouver GST compliance can be daunting amid diverse sectors, but Transcounts simplifies it with a 100% online platform integrating QuickBooks and Xero for seamless provincial sales tax filing in BC. Our fixed monthly fees, scaled by transaction volume, deliver efficient BC sales tax returns without surprises.

This guide covers local deadlines, GST versus PST differences, and registration steps, including a gst registration checklist tailored for Vancouver startups. Discover how Transcounts supports your journey toward effortless compliance.

GST/HST and Sales Tax Landscape in Vancouver

Vancouver’s vibrant economy, driven by tech startups and e-commerce, navigates a complex tax environment where GST/HST filing in Vancouver requires careful attention to federal and provincial rules. Businesses here face a harmonized system blending national and local taxes, impacting operations from Downtown retail shops to online sellers on platforms like Shopify. Understanding this landscape ensures compliance and optimizes cash flow for growing enterprises.

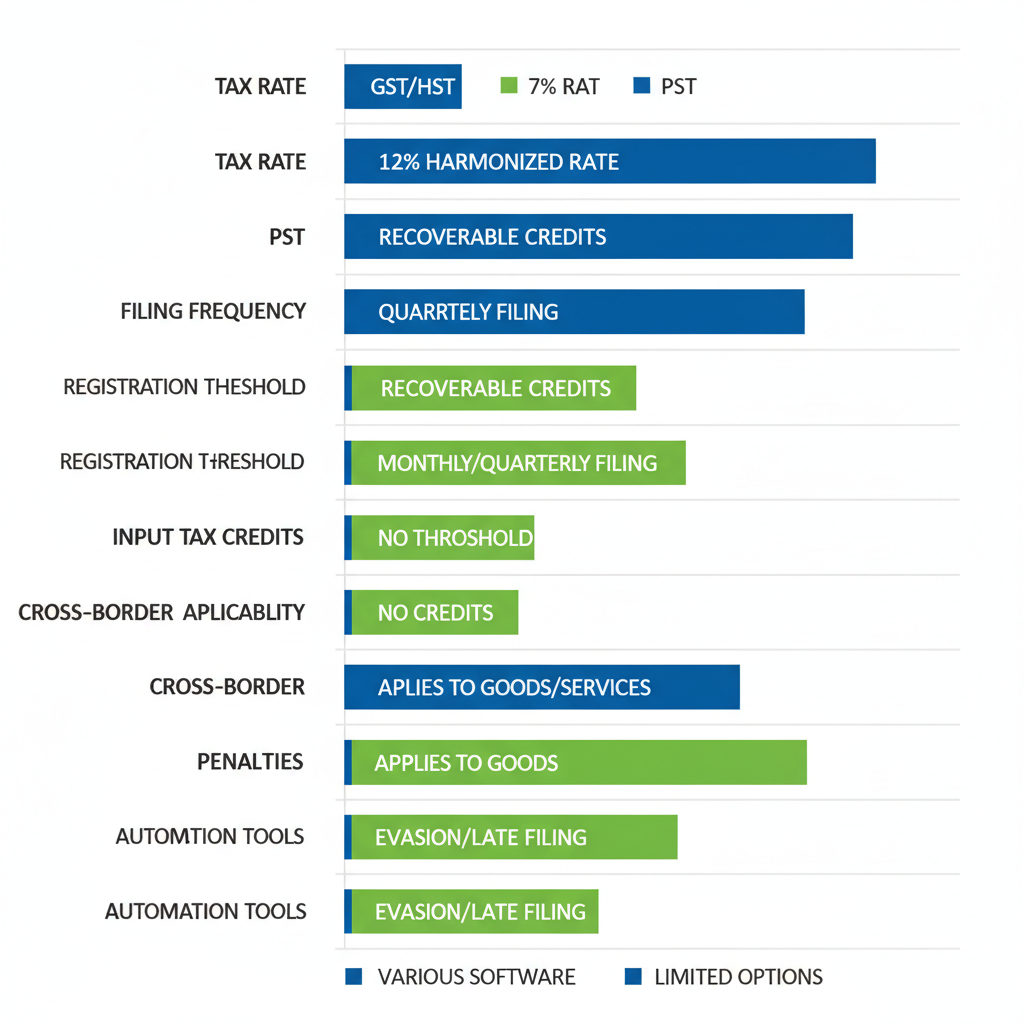

GST/HST operates as a value-added tax at a combined 12% rate in British Columbia, where the 5% federal GST merges with 7% provincial HST. This contrasts with the separate 7% provincial sales tax (PST) applied to specific goods and services without harmonization. For GST return filing in Vancouver, businesses hit a $30,000 revenue threshold over four quarters must register, with filing frequencies ranging from monthly to annual based on sales volume. Input tax credits allow registered firms to recover taxes on business inputs, a key benefit absent in provincial sales tax filing in BC, which lacks refunds and targets consumption directly. Vancouver’s e-commerce boom amplifies nexus requirements, mandating cross-border reporting for sales across Canada.

Vancouver businesses grapple with dual-tax challenges, balancing GST/HST’s federal oversight with PST’s provincial focus. This duality demands precise tracking, especially for retailers handling both harmonized and exempt items, to avoid penalties and streamline operations in a high-growth market.

| Aspect | GST/HST | PST |

|---|---|---|

| Tax Rate | 5% GST + 7% provincial (harmonized 12% in BC) | 7% on taxable goods/services in BC (no harmonization) |

| Filing Frequency | Monthly, quarterly, or annual based on revenue threshold | Monthly or quarterly; annual for small registrants |

| Registration Threshold | $30,000 in taxable supplies over 4 quarters | No threshold; voluntary for most but mandatory for retailers |

| Input Tax Credits | Recoverable on business inputs; applies federally and provincially | Not applicable; PST is a consumption tax without refunds |

| Cross-Border Applicability | Required for sales across Canada; nexus for US sellers | BC-specific; additional for US nexus via PST rules |

| Penalties for Late Filing | 5% + 2%/month interest; CRA audits common | 1% + 10%/year interest; provincial audits focus on retail |

| Automation Tools | Integrates with QuickBooks/Xero; Transcounts automates reconciliation | Plooto/A2X integration; Transcounts handles bundled filing |

Data sourced from CRA and BC Ministry of Finance guidelines for 2024; rates effective as of current fiscal year; consult Transcounts for personalized compliance.

This comparison reveals GST/HST’s broader scope and recovery options versus PST’s simpler but non-refundable structure, aiding Vancouver firms in prioritizing compliance. Transcounts excels in Vancouver tax reconciliation by bundling both taxes for e-commerce clients, leveraging cloud integrations like QuickBooks to automate BC harmonized sales tax processes. For deeper insights, explore canada sales tax resources tailored to local needs.

Key facts include quarterly deadlines for most startups and the value of early registration to claim credits. As e-commerce expands, tools from Transcounts simplify multi-jurisdictional filings, reducing errors for Shopify sellers in Vancouver.

GST/HST vs PST comparison for Vancouver business tax compliance

Professional services bridge these complexities, ensuring seamless adherence while supporting business growth in British Columbia’s dynamic market.

Accessing Professional GST/HST Filing Services in Vancouver

Navigating GST/HST filing in Vancouver can be straightforward with the right professional support, especially for small businesses in British Columbia’s dynamic market. Transcounts offers tailored solutions that streamline compliance, ensuring accurate returns without the hassle of manual processes. Local entrepreneurs often seek reliable Sales Tax Reconciliation Vancouver to handle complex tax obligations efficiently.

Transcounts specializes in GST return filing in Vancouver through secure electronic methods, such as the Canada Revenue Agency’s NETFILE or Represent a Client portal. Businesses can file monthly or quarterly based on reporting requirements, avoiding CRA penalties that reach up to $1,000 for late submissions, as outlined in official guidelines. Their fixed-fee model starts at $200 per month for low-volume filers and scales to $500 for higher transactions, providing predictability. A dedicated success manager oversees each account, responding within 24 hours to queries. For added convenience, Transcounts bundles provincial sales tax filing in BC, covering PST remittances alongside federal duties.

- Automation Integration: Seamlessly connects with Xero and QuickBooks for real-time data sync, using tools like A2X and TaxJar to automate reconciliation.

- Input Tax Credits: Identifies and claims eligible credits to maximize refunds.

- Payroll Remittances: Handles source deductions tied to HST obligations.

Vancouver clients praise the service: “Transcounts saved us hours on monthly filings,” says a local e-commerce owner. Benefits include enhanced Vancouver compliance automation through cloud-secured infrastructure and BC return processing that reduces errors. This approach not only meets deadlines but also supports growth in Vancouver’s regulated environment, transitioning seamlessly into broader local considerations for business operations.

Key Local Factors for Tax Compliance in BC

Navigating GST/HST filing in Vancouver requires understanding BC’s unique tax landscape, where provincial sales tax (PST) adds layers beyond federal rules. Local businesses, especially in the vibrant e-commerce sector, must address nexus thresholds that trigger registration, ensuring compliance to avoid penalties.

Key factors include:

- PST Exemptions vs. GST Scope: Certain services like software development may qualify for PST exemptions, unlike GST’s broader application. For provincial sales tax filing in BC, sellers must track taxable vs. exempt transactions meticulously.

- Input Tax Credits: Vancouver businesses can claim GST return filing in Vancouver for credits on local purchases, such as office supplies or marketing tools. Eligible expenses include cloud services common in tech startups, reclaiming up to 100% of GST paid per CRA guidelines.

- Cross-Border Interplay: BC sellers handling US sales face nexus risks; understanding state sales tax obligations prevents double taxation pitfalls.

- Audit Focuses: CRA and BC Ministry prioritize e-commerce audits, with stats showing 20% higher scrutiny for online platforms. Common BC compliance risks involve unclaimed Vancouver input credits or overlooked filings.

Transcounts offers audit-ready documentation and CRA notice support, empowering startups and nonprofits with bundled PST Filing BC Vancouver services. Electronic filing suffices–no paper copies needed–streamlining processes for Vancouver’s fast-paced businesses.

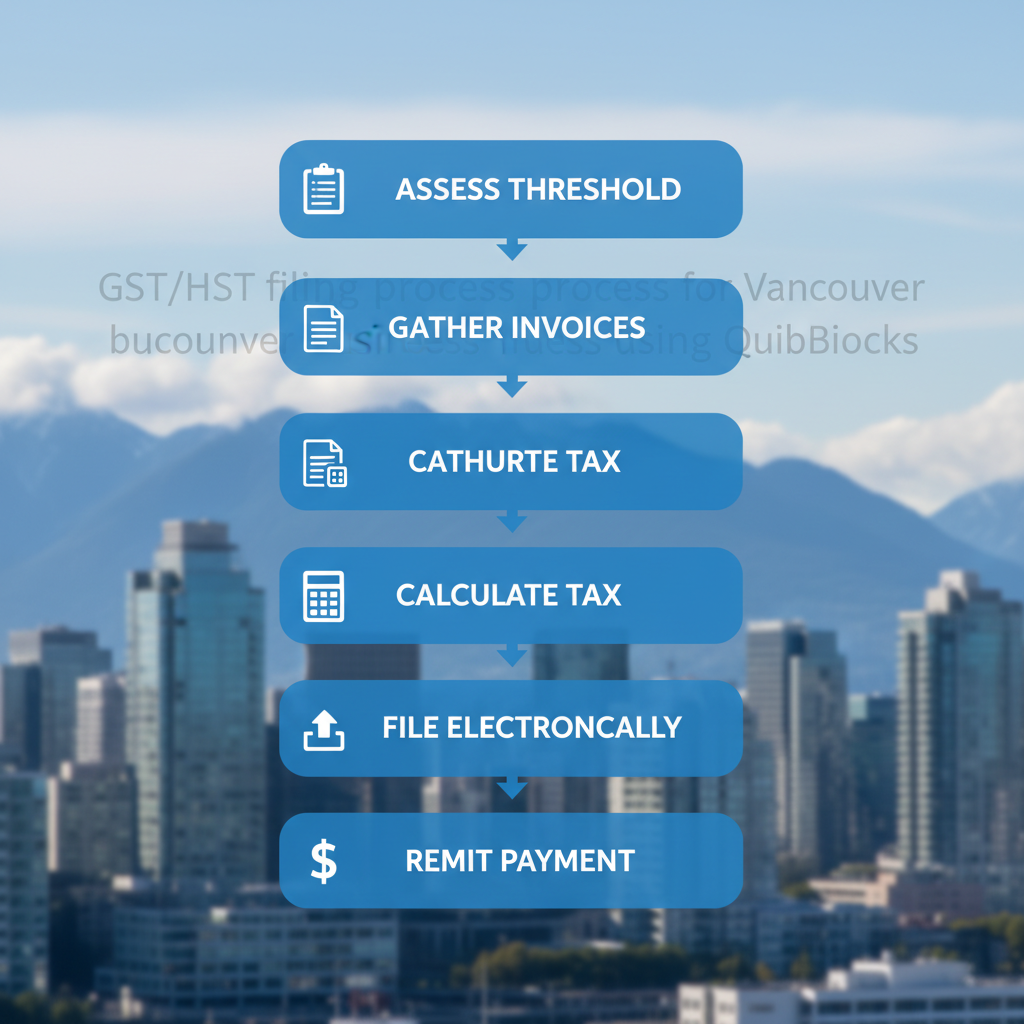

Steps to Begin Your GST/HST Filing Process

Starting GST/HST filing in Vancouver can seem daunting for small businesses, but following these structured steps ensures compliance and efficiency. For BC-based contractors and startups, the process begins with assessing your obligations under Canada Revenue Agency guidelines.

- Assess Eligibility and Register: Determine if your business exceeds the $30,000 annual threshold for taxable supplies. Complete Vancouver registration steps through the CRA Business Registration Online portal, which takes about 10 minutes and activates your GST/HST account number immediately.

- Gather and Reconcile Records: Collect all invoices, receipts, and sales data. For a Vancouver-based e-commerce startup, reconcile transactions via QuickBooks, integrating tools like shopify tax setup canada us vancouver to streamline multi-jurisdictional sales.

- Calculate Net Tax Owing: Subtract input tax credits from GST/HST collected on sales. This yields your net remittance, factoring in eligible expenses like office supplies.

- File Your Return Electronically: Submit GST return filing in Vancouver quarterly via the CRA’s NETFILE service. Deadlines include April 30 for Q1 and January 31 for Q4, with electronic filing reducing errors and speeding up processing.

- Remit or Claim Refund: Pay any balance due or request a refund if credits exceed collections, often within two weeks for direct deposits.

Step-by-step vertical flowchart for beginning GST/HST tax filing process.

Transcounts facilitates BC filing initiation with a 30-day onboarding process, handling catch-up filings and integrating provincial sales tax filing in BC for seamless compliance. This tech-driven approach saves time for busy Vancouver entrepreneurs.

Quick Tips Checklist:

- Track deadlines using CRA reminders.

- Consult professionals for complex setups.

- Bundle GST/HST with PST for efficiency.

For intricate needs, seek expert advice to avoid penalties.

Achieve Seamless Tax Compliance with Expert Support

Navigating GST/HST filing in Vancouver requires understanding registration thresholds, quarterly or annual returns, and BC-specific nuances like provincial sales tax filing in BC. Local e-commerce and startups benefit from streamlined GST return filing in Vancouver to claim input tax credits and meet deadlines without penalties.

Transcounts delivers expert, fixed-fee online support for seamless compliance, ensuring audit-ready books and clear cash flow. Our tech-driven solutions reduce errors and save time for small business tax filing vancouver. Consult CRA’s GST/HST for Businesses resources for ongoing education.

Achieve Vancouver tax success with Transcounts–contact us today for your BC compliance wrap-up.